Yorkshire based steel specialist reported a collapse in profits during 2010

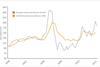

2010 was a tough year for Severfield and it reported revenues down from £349m in 2009, to £267m in 2010, a fall of 24%. Profits fared even worse as the tough market hit profit margins.

Pre-tax profits at the firm fell by 70%, ending the year at £15.3m, down from £50.8m in 2009.

Severfield also moved from a net cash position of £11.5m at the end of 2009 and ended 2010 with debts of £15m. Directors also expect the tough climate to continue in 2011, before recovering in 2012, in contrast to their earlier forecast of a recovery in 2011.

The recovery is expected to be led by the industrial, commercial and energy/power markets.

Commenting on the results, Severfield chief executive Tom Haughey said: “Twelve months ago the company had the view that 2010 would be the low point of the cycle for our industry, but UK economic conditions, the public spending review and rising steel costs are likely to prolong the relatively weak levels of activity throughout most of 2011.

“In 2010 the company saw its UK market share reach virtually double the level achieved in 2007, while significant capacity was taken out of the industry.

“Market prices in 2011 remain relatively low and are expected to continue to restrain margins, although performance is expected to improve in 2012 when the mix of project type changes.”

Despite its negative assessment of the sector at present, Severfield’s order book currently stands at £226m.

Cenkos analyst Kevin Cammack said: “[Severfield’s] final results illustrate just how tough the structural steel market has been in 2010 - and is destined to remain so in 2011 - while doing little to demonstrate just how strongly it has fared in relative terms.”

No comments yet