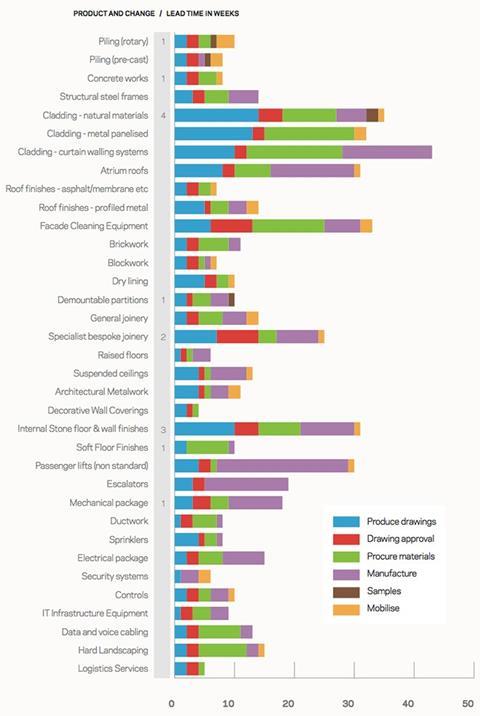

Lead times continue to increase with eight trades on the rise and no reported decreases. Some packages have increased more than once in the last 12 months

01 / Going up

▲ Rotary Piling

▲ Concrete works

▲ Cladding - Natural material

▲ Demountable partitions

▲ Specialist joinery

▲ Internal stone floor and wall finish

▲ Soft floor finish

▲ Mechanical packages

02 / Staying Level

▶ Pre-cast piling

▶ Structural steel frames

▶ Cladding - metal panellised system

▶ Cladding - curtain walling system

▶ Atrium roofs

▶ Roof finishes - asphalt / membrane

▶ Roof finish - profiled metal

▶ Facade cleaning equipment

▶ Brickwork

▶ Blockwork

▶ General joinery

▶ Specialist joinery

▶ Raised floors

▶ Suspended ceilings

▶ Architectural metalwork

▶ Decorative wall coverings

▶ Soft floor finish

▶ Passenger lifts (non standard)

▶ Escalators

▶ Electrical packages

▶ Mechanical packages

▶ Ductwork

▶ Sprinklers

▶ Security systems

▶ Controls

▶ IT infrastructure

▶ Data and voice

▶ Hard landscaping

▶ Logistics service

03 / Lead times summary

Rotary piling ▲ Lead times continue to increase as forecast, with another week added to the one week increase reported last quarter, taking the lead time to 10 weeks. This is the highest level since 2008.

Pre-cast piling ▶ Remains at eight weeks lead time for the second quarter.

Concrete works ▲ As anticipated lead times have increased by one week to eight weeks. This follows a sustained period of no movement for 12 months. The industry anticipates increases over the next six months.

Structural steel frames ▶ Lead times remain at 14 weeks, despite companies continuing to experience increased workload and enquiries. They anticipate lead times increasing in the next six months.

Cladding - Natural material ▲ Lead times have increased for the first time in 12 months. They are currently 35 weeks an increase of four weeks on last quarter. Contractors continue to report being busier with both enquiries and workload.

Cladding - metal panellised system ▶ Lead times remain at 32 weeks. Companies are continuing to report future capacity being secured through negotiation or pre-construction service agreements. Some material suppliers are also increasing their procurement periods.

Cladding - curtain walling system ▶ Lead times have remained at 43 weeks since the beginning of 2012. Workload and enquiries continue to increase and they anticipate lead times increasing over the next six months.

Atrium roof ▶ Lead times remain at 31 weeks. Firms are busier but do not anticipate an increase in the next six months.

Roof finishes - asphalt / membrane ▶ Lead times have remained at seven weeks for over a year.

Roof finish - profiled metal ▶ Lead times remain at 14 weeks for the third quarter, no further increases are anticipated.

Facade cleaning equipment ▶ Lead times remain at 33 weeks. Firms anticipate lead time remaining the same.

Brickwork ▶ Lead times remain at their extended level of 11 weeks, caused by availability of bricks and labour. Blockwork Lead times remain at seven weeks. Workload and enquiries has levelled off.

Drylining ▶ Lead times remain at 10 weeks for the second quarter. Contractors are anticipating further increases due to increased workload.

Demountable partitions ▲ As previously forecast lead times have increased by one week for the second quarter in succession to 10 weeks, the highest level since 2005.

General joinery ▶ Lead times remain at 14 weeks with no change forecast in the next six months.

Specialist joinery ▲ Lead time have increased by two weeks to 20 weeks.

Raised floors ▶ Lead times remain static at six weeks with no change since 2007. Contractors report that enquiries and workload have increased but they don’t anticipate longer lead times in the next six months.

Suspended ceiling ▶ Lead times remain at 13 weeks with no increase forecast for the next six months.

Architectural metalwork ▶ Lead times have been revised to 11 weeks.

Decorative wall covering ▶ Lead times remain at four weeks with no change anticipated.

Internal stone floor and wall finish ▲ Lead times are on the increase with an additional three weeks taking it to 31 weeks, the highest since our records began in 1999.

Soft floor finish ▲ Lead times have increased by one week to 10 weeks. Companies forecast further increases in lead times over the next six months.

Passenger lift (non standard) ▶ Lead times remain at 30 weeks, workload and enquiries remain the same with no change in lead times forecast for the next six months.

Escalators ▶ Lead times remain at 19 weeks.

Electrical package ▶ Lead times remain at 15 weeks.

Mechanical packages ▲ Lead times have increased for the first time in a year and are now 18 weeks, an increase of one week.

Ductwork ▶ The lead time for ductwork remains at eight weeks with no change forecast for the six months.

Sprinklers ▶ Lead times remain at eight weeks.

Security systems ▶ Lead times remain at six weeks. There is no further increase anticipated in the next six months.

Controls ▶ Lead times have been revised to 10 weeks with no change forecast despite increased workload and enquiry levels.

IT infrastructure ▶ Equipment lead times remain at nine weeks with no changes anticipated.

Data and voice ▶ Cabling lead times remain at 13 weeks with no changes forecast.

Hard landscaping ▶ Lead times remain at 15 weeks. No further change is forecast in the next six months. Logistics services Lead time remains at five weeks,despite being busier with enquiries and work.

Spotlight: Bidding and design

Construction lead times show no sign of decreasing, despite a slight cooling down of the market. Could part of the reason be a shortage of technical expertise to meet demand at the design and bidding stage of projects? Brian Moone of Mace Business School reports

Despite talk of the market cooling, construction lead times continue to increase with no signs of any specialist contractors experiencing a relaxation in the market. While most people recognise shortages in labour, plant or materials as the main cause of increases in lead times, there are also the technical aspects that often need to be undertaken ahead of production where delays can occur.

Analysis of the current rise in lead times has shown that over half of the specialist trades in our survey have increased their lead times over the past 12 months. Five specialist trades are at their highest lead time in the last 10 years including brickwork, blockwork, piling, soft floor finishes and internal/external stonework with several others set to follow.

The underlying factors for these increases are often due to shortages of labour, plant or materials, for example the most notable material shortage recently has been brickwork and blockwork, with lead times at an all-time high of 11 weeks due to availability. While shortages of plant and equipment have been responsible for the long lead times for piling, particularly large or specialist rigs in and around London, labour is the most common factor and is well recognised in relation to resourcing the project.

However, underlying all of the usual factors is one which is often overlooked but affects many of the specialist contractors: the up-front bidding, technical support and expertise. With the pipeline of work on the increase, the first area of impact is at the tender stage, with the bid teams that put together prices as well as the technical solutions and methodology currently being stretched.

While the bidding process is not directly measured as a factor in the lead times, the failure of a specialist contractor to return a bid or to submit a non-compliant bid due to inadequate resourcing can lead to the tender process being delayed or repeated. This can lead to late placement of orders which can critically affect the programme and compound any lead time issues.

In the current rising market, many clients and main contractors are keen to procure the specialist contractors as early as possible to secure competitive prices as supply and demand inevitably drives up costs. This means that specialist contractors are facing the challenge of coming out of a recession and investing at bidding stages for future growth, often several months or even a year ahead of when income might be realised. Inevitably this means resources for bidding are limited and it is even more important that clients and main contractors work closely with their supply chain and give early visibility to the opportunities arising. Careful management of this will ensure that the supply chain can resource the tender process most effectively, avoiding errors in the bidding process that can be damaging to the specialist and his client and lead to project delays.

The other main underlying area of delays in lead times at present, which is often not highlighted, is around the technical submittal and approval process. Specialist contractors are increasingly required to take on the responsibility for technical design requiring them to produce technical drawings or calculations for approval by the client’s architects and engineers ahead of any work being undertaken on site. While this shift in responsibility has been introduced to utilise the expertise of the specialist contractor during design stage, little consideration is given to the additional time required within the programme to allow for this. Half of the increases in lead times reported this quarter were due to increases in design or approval stage of the lead time, and a number of other organisations reported that increases in this area were currently being absorbed in other parts of the lead time programme.

Moving the design and approval process from the client to the contractor is more likely to place the design and approval onto the critical path of the contractor’s work as it will need to be completed prior to any fabrication or construction. Delays in this area will have a direct bearing on the overall construction programme.

Many of the specialist contractors are reporting that they are experiencing difficulties in recruiting skilled people to undertake work in this area. They believe many people with these skills are opting to work for clients rather than specialist contractors. This is creating bottlenecks during the lead-in period, which contractors report is being compounded by delays in the time taken to approve designs by the client’s design teams.

Clients and main contractors need to be aware of the pressures that their supply chain are under during bidding and make appropriate arrangements to manage this. This will ensure that the requisite bids received are fully compliant and competitive, in order to avoid unnecessary delays in rebidding the works. Adequate provision also needs to be made in the programme to allow for technical design and approval. This is an area of work for the specialist that is on the increase and is proving difficult to resource, leading to inevitable increases in lead times.

No comments yet