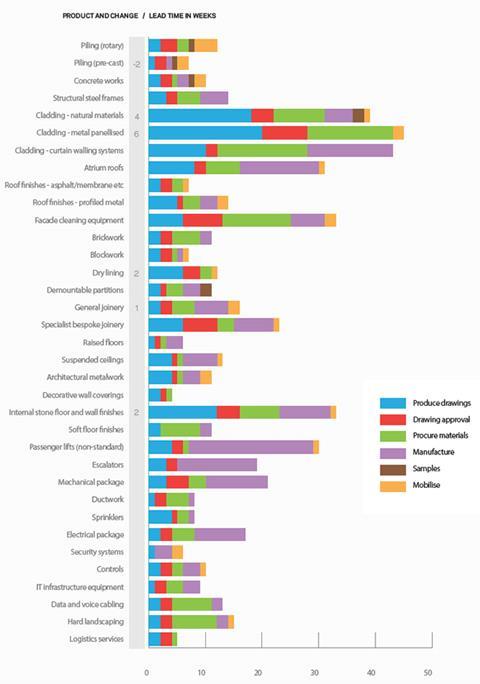

Increases to lead times continue, and many are forecast to rise in the next six months, as workload and enquiries grow. But staffing is still an issue

01 / Going up

▲ Cladding - natural materials

▲ Cladding - metal panelised

▲ Drylining

▲ General joinery

▲ Internal stone floor and wall finishes

02 / Staying level

▶ Piling (rotary)

▶ Structural steel frames

▶ Concrete works

▶ Specialist joinery

▶ Soft floor finishes

▶ Mechanical package

▶ Cladding - curtain walling systems

▶ Atrium roofs

▶ Roof finishes - asphalt/membrane

▶ Roof finishes - profiled metal

▶ Facade cleaning equipment

▶ Brickwork

▶ Blockwork

▶ Demountable partitions

▶ Raised floors

▶ Suspended ceilings

▶ Architectural metalwork

▶ Decorative wall coverings

▶ Passenger lifts (non-standard)

▶ Escalators

▶ Electrical package

▶ Ductwork

▶ Sprinklers

▶ Security systems

▶ Controls

▶ Data and voice cabling

▶ Hard landscaping

▶ Logistics services

03 / Lead times summary

▼ Piling (pre-cast)

04 / Lead times summary

Rotary piling ▶ lead times have not changed this quarter and remain at 12 weeks. Contractors anticipate lead times getting longer in the next six months. Pre-cast piling ▼ appears to be in less demand with lead times bucking the trend by reducing by two weeks to seven weeks with more reductions possible.

Concrete works ▶ No increase is anticipated for concrete works this quarter with lead times remaining at 10 weeks, but availability of concrete is a growing issue which needs careful planning.

Structural steel frames ▶ lead times remain at 14 weeks.

Cladding - natural material ▲ Increased workload and enquiries has resulted in an increase of four weeks to lead times, which are now 39 weeks, with the potential for further increases in the next six months.

Cladding - metal panelised systems ▲ have seen a six-week increase to 45 weeks, with further increases to lead times anticipated in the next six months.

Cladding - curtain walling system ▶ have remained at 43 weeks and contractors anticipate lead times increasing over the next six months.

Atrium roof ▶ lead times remain at 31 weeks and roof finishes - asphalt / membrane ▶ remain at seven weeks. Roof finish - profiled metal ▶ lead times have remained at 14 weeks for a year and no increases are anticipated in the next six months.

Facade cleaning equipment ▶ lead times remain at 33 weeks and brickwork lead times remain at 11 weeks. As availability of bricks begins to recover, labour is forecast to be in demand but no changes in lead times anticipated over the next six months.

Blockwork ▶ remains at seven weeks.

Drylining ▲ As forecast last quarter, lead times have increased by two weeks to 12 weeks with further increases anticipated in the next six months as workload and enquiries increase.

Demountable partitions ▶ lead times remain at 11 weeks.

General joinery ▲ lead times have increased again and now stand at 16 weeks, a rise of one week, and are expected to increase further.

Specialist joinery ▶ lead times remain at 23 weeks but increases in lead times are anticipated.

Raised floors ▶ lead times remain at six weeks with no changes reported.

Suspended ceiling ▶ lead times remain at 13 weeks with no increase forecast. Architectural metalwork ▶ lead times remain at 11 weeks with no increases forecast for the next six months despite an increase in the level of enquiries. Decorative wall covering ▶ lead times remain at four weeks with no change anticipated.

Internal stone floor and wall finish ▲ lead times have increased by two weeks to 33 weeks and further increases are anticipated over the next six months. Soft floor finish ▶ lead times remain at 11 weeks and are expected to rise.

Passenger lift-non standard ▶ lead times remain at 30 weeks, escalator ▶ lead times remain at 19 weeks and electrical package ▶ lead times remain at 17 weeks.

Mechanical packages ▶ Following a period of steady increase, lead times remain at 21 weeks this quarter, and the lead time for ductwork ▶ remains at eight weeks with no change forecast for the next six months.

Sprinklers ▶ lead times remain at eight weeks, contractors do not forecast an increase in lead times over the next six months. Security systems ▶ lead times remain at six weeks. Controls ▶ lead times remain at 10 weeks, and contractors anticipate that that may reduce in the next six months

IT infrastructure equipment ▶ lead times remain at nine weeks despite increases in enquiries and workload. Data and voice cabling ▶ lead times remain at 13 weeks with increases forecast due to higher levels of workload and enquiries. Availability of project managers and skilled labour is seen as a problem over the next six months.

Hard landscaping ▶ Despite increases in enquiries, as well as current and future workload, lead times remain at 15 weeks with no change forecast in the next six months.

Logistics services ▶ lead times remain at five weeks. Despite being busier with enquiries and workload, there is no change forecast in the next six months.

The trend of lead times getting longer as workload increases continues with five packages reporting longer lead times and only pre-cast piling bucking the trend and getting shorter. The majority of increases are in the early phases of drawing production due to problems of recruiting sufficient technically skilled staff.

No comments yet