Activity rose for the first time in half a year in October, but winter is already extending its icy grip around the industry. Experian Marketing Information Services reports

01 / The state of play

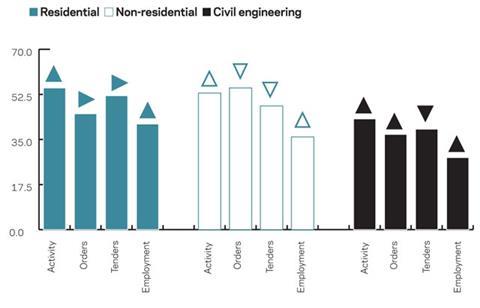

After stabilising in September, construction activity rose for the first time in six months in October. The construction activity index posted 52, two points higher than the previous month’s reading. At the sectoral level, differing trends continued to emerge, with the civil engineering activity index again signalling falling workloads at 43.

In contrast, the residential and non-residential indices, at 55 and 52, respectively, indicated that workloads rose during the month.

In October, firms reported falling tender enquiries for the first time since March, as the tender enquiries index fell three points to 48. Orders remained below normal for the time of year and the index edged down one point to 46. This was the 28th successive month that the new orders index had been in negative territory. On a sector-by-sector basis, non-residential orders remained above normal for the time of year, but this was not the case for civil engineering and residential orders.

There was little change in the outlook for construction employment during October, with firms largely anticipating a reduction in their staffing levels over the coming three months. Despite the employment prospects index edging up to a five-month high, it remained very negative at 37.

Just over half of respondents (51%) reported that insufficient demand was constraining activity in October, down from 55% in September and the lowest proportion for five months.

Meanwhile the proportion of firms reporting no constraint on activity edged down to 22%, a level not seen since February.

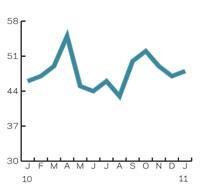

02 / Leading construction activity indicator

The Leading Construction Activity Indicator suggests that the construction industry returned to negative territory in November, highlighted by the index dropping to 49. Further declines in construction are expected into the new year.

The indicator uses a base level of 50: an index above that level indicates an increase in activity, below that level a decrease

03 / Labour costs

In October, all civil engineering firms responding to the survey indicated that labour costs had fallen over the past year. This was in contrast to 33% three months ago.

About 36% of building firms reported that labour costs had fallen over the past year, lower than the 45% of three months ago. The proportion reporting annual labour cost inflation of up to 2.5% rose to 21%, and 26% of building firms indicated that labour costs had risen by between 2.6% and 5% over the past year.

The proportion of firms in the residential and non-residential sectors reporting annual labour cost inflation of more than 7.6% increased from almost 14% in July to 18% in October.

04 / Regional perspective

Experian’s regional composite indices incorporate current activity levels, the state of order books and the number of tender enquiries received by contractors to provide a measure of the relative strength of each regional industry.

Three of the 11 regions saw their indices rise in October and two saw no change from the previous month. The strongest increase was in Wales, where the index rose from 37 to 43, its highest reading for five months. The South-west also saw a marked rise, with its index increasing by five points to 52, taking it into positive territory for the first time since June. The

one-point increase in the North-west’s index was much more modest, taking it to 41. The indices for East Anglia and Yorkshire and Humberside remained unchanged at 52 and 39, respectively.

The strongest decline was in Scotland, with its index dropping five points to reach the no-change mark of 50. The West Midlands’ index fell three points to 44, its lowest reading for seven months, while Northern Ireland saw its index decline by two points to 36, the most negative score across all the regions.

The index for the UK, which includes firms working in five or more regions, declined by five points to 52.

No comments yet