With government pushing the offsite agenda and a growing housing sector needing to access new capacity, how can clients position themselves to take advantage of the benefits of offsite construction? Simon Rawlinson and James Totton of Arcadis look at the opportunities

01 / Introduction

This year could mark the breakthrough for innovative construction in the UK. Following the announcement of the construction sector deal, a “Core Innovation Hub” will shortly be established to develop and commercialise digital and manufacturing technologies for construction. Meanwhile five government departments, including those for health and education, have signed up to a presumption in favour of offsite manufacture (OSM) – creating the prospect that government will shape a portion of its £20bn construction spend to pump-prime investment, based on design for manufacture and assembly (DfMA). This initiative should provide pipeline visibility and certainty of workload, which are the investment enablers for which OSM specialists have been calling for years. This in turn should lead to more investment in manufacturing capacity, a wider choice of solutions, and, in time, better value from better-performing buildings.

The potential for growth is huge: forecasts put annual growth in the sector at more than 100% – reaching £2.8bn a year for buildings alone by 2020. However, the barriers to adoption of innovative methods remain high, which has meant that even after many years of market interventions such as John Prescott’s Design for Manufacture competition in 2005, there are only seven modular manufacturers operating at scale in the UK.

Modular is not the only OSM technology available to clients in the UK. Indeed, government is actively sponsoring a platform-based approach based on standard sets of components so that programmes for schools, hospitals and other buildings can all be brought together into a single investable pipeline of work. However, modular solutions are being favoured by new entrants such as L&G as well as by established players in the housing market, including Crest Nicholson. Accordingly, getting the procurement of modular construction right, particularly in the residential sector, will go a long way towards building the skill sets that the industry needs as well as delivering better outcomes to clients.

This article focuses mostly on procurement practice for residential. Housing has immense potential for OSM, because of growth in build-to-rent and for affordable housing where the speed of delivery adds value. Many of the barriers to adoption highlighted apply across the industry.

There are five issues preventing the delivery of optimum solutions that need to be addressed:

- Planning Outline planning consents must be designed around the parameters of OSM

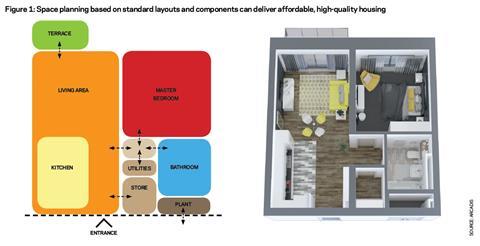

- Floor plans Residential plans need to be optimised around module or component dimensions to deliver space that meets or exceeds planning standards

- Scheme design Outline designs used in procurement must be flexible enough to accommodate solutions proposed by more than one manufacturer

- Delivery team Alternatives to a main-contractor-led model should be considered to deliver the best cost and risk management outcomes

- Delivery risk Specific steps need to be taken to manage the single point of failure risk associated with modular construction for both developers and lenders.

By explicitly addressing these challenges and aligning the needs of clients and OSM specialists more closely, other obstacles such as cost competitiveness and the attraction of new investment can also be addressed.

02 / The procurement problem – does offsite need a different approach?

The big procurement challenge for offsite manufacture is the paradox wherein clients need more confidence in the supply chain to adopt OSM, while specialists need more certainty around demand in order to be able to invest. So far, disjointed responses to this problem have held back growth in the sector. However, the success of the Education and Skills Funding Agency’s commitment to modular construction demonstrates that capacity can be grown quite quickly once clients with a pipeline of work are on board.

Despite a plethora of initiatives aimed at growing the sector, there remain many barriers to adoption, which need to be addressed by the procurement strategy route. These barriers include:

- Difficulties in retrofitting modular design solutions into conventionally designed projects

- The small balance sheets of OSM specialists, which mean they represent an unacceptable commercial risk for many clients

- Loss of cost transparency due to a lack of competition between providers

- Duplicate costs associated with main-contractor-led delivery

- Decision-making processes in client organisations.

Once these barriers are overcome, an urgent need to expand the sector will arise. The big specialist modular firms currently deliver about 7,000 units of various kinds every year – equivalent to around 3,000 homes. Changes to shift patterns in existing factories could potentially double output. Accordingly, about 40 extra factories, each producing 1,500 modules a year, will be needed to provide just 10% of total housing production targeted by the early 2020s. This will require investment of about £500m, excluding land. Investment on this scale will not be attracted by project-by-project procurement, however.

As a result, there is a need for both a short-term fix and a long-term solution. The short-term fix involves smart procurement of single projects – leveraging the skills and capability of the existing supply chain.

The long-term solution relies on the pooling of demand – initially by the public sector – as well as on the adoption of “platform-based” approaches to component-based construction, which will be serviced by a much deeper pool of component manufacturers.

The potential for the public sector to provide further support for investment in OSM is an important theme, following the announcement of the government’s presumption in favour of offsite construction. How projects will be procured against this presumption is less well developed. The House of Lords’ science and technology select committee recently published its report on OSM, providing plenty of evidence of the benefits but fewer practical recommendations that individual clients can take to access the market (see “House of Lords recommendations”, left).

A common theme in these recommendations is the need to move away from project-by-project procurement for offsite. Growth strategies published by the Construction Leadership Council, in its report Demand Creation, Investment and Volume Surety, take a similar theme by focusing on pooling demand from the build-to-rent and affordable housing sectors, where developers have business models that will benefit from fast construction as well as the ability to create investable demand. However, more practical work is needed to make this model investable – considering, for example, the adoption of standard alliance contracts such as the Association of Consultant Architects’ FAC-1 as a means of making pooled pipelines of workload investable. The Infrastructure and Projects Authority has also been very active promoting DfMA – focused on a series of reports promoting the platform approach, including Bryden Wood’s recent report entitled Platforms: Bridging the Gap between Construction and Manufacturing.

One area on which few reports have so far focused is the importance of getting planning right. Many residential sites are brought forward from strategic land with an outline planning consent that maximises the sale value for the owner. If this outline design is aligned to the principles of DfMA, then it will be much easier to convert a landbank into an OSM pipeline. This illustrates that first-principles thinking is needed at every stage of the development process.

House of lords recommendations

Stated in the Lords’ science and technology committee report, Off-site Manufacture for Construction: ��ɫ����TV for Change

- Attach additional conditions to public-sector support for housing to drive the uptake of OSM

- Use Homes England as a channel to encourage adoption of OSM by local authorities and registered social landlord

- Develop business models enabling early involvement of designers/contractors/suppliers on projects or programmes

- Procure OSM using national frameworks to expand the pipeline and exchange knowledge across programmes

- Track the impact of the government presumption in favour of OSM using key performance indicators

- Adopt procurement-for-value approaches that take account of wider benefits, including waste reduction

03 / Smart single-project procurement

This scenario assumes that the client will access the existing modular supply chain to maximise pre-manufactured value. The key to smart conventional procurement is to take advantage of the complementary strengths of current modular design and competitive, single-project procurement – reversing the present situation wherein unique modular designs are shoehorned into a conventional building layout and then delivered by a team led by a main contractor.

The key opportunities to address are:

- Securing a planning consent that can be readily delivered using OSM technologies There are a few simple constraints that need to be avoided in an outline planning consent so that the potential to use OSM is retained in a scheme. Typically, floor heights and allowances for wall thicknesses need to be sized to accommodate structural zones. Similarly, elevations are best designed without multistorey fenestration, which will be difficult to deliver using a modular design approach. Planners will often want input into the refinement of the design, so starting with OSM in mind will help to manage the discussions. The project can always be built conventionally if needed.

- Using standardised layouts that make best use of combinations of modules Standard module layouts configured using BIM are the best way to accelerate design and to enable developers and residents to appreciate the quality of space and construction. With standard modules, it is easy to use digital configurators to optimise unit layout of apartments and to enable residents to select the customisable details such as finishes. Standard modules also enable early cost transparency, with specialists being able to provide early estimates based on model-based costing.

- Developing a scheme design that can be delivered by a range of module solutions Designs to be put to tender need to accommodate the structural solutions used by different specialists. For example, lightweight steel modules have a different structural zone from CLT-based solutions. If the scheme design can accommodate a range of module types, the project can be bid in genuine competition. Frameworks such as LHC can be used to identify the best participants.

- Designing the bid competition to deliver the optimum value to the client Typical competitive procurement is focused on identifying the least-cost solution. With OSM, other criteria might come into play, including manufacture and delivery programme, assured product quality, or additional floor area delivered. Requesting alternative proposals that take advantage of innovation or available slots in manufacturing schedules may open further opportunities to deliver value.

- Securing direct contractual engagement with the OSM specialist Conventional main contractor delivery is often not the optimal solution for OSM. Main contractors bring additional layers of management and cost that are often not needed on an OSM project, where much less work is done on site. Furthermore, the OSM skills base among many main contractors is quite limited. Hybrid integrator/construction management procurement routes, using a small number of packages in addition to the module contract, are a better way of securing the full benefits of modular and are widely adopted by housing specialists.

- Devising an exit strategy One of the biggest barriers to OSM adoption is clients’ fear of single-point failure by the OSM specialist. This is amplified by the perception that specialists’ modular solutions are unique and cannot be reproduced by third parties. The reality is production of most units could be taken over by another provider if necessary, albeit there will be delays to the programme associated with securing a manufacturing slot. Careful management of the vesting of title to the employer in materials and completed modules while in an OSM factory will also mitigate the commercial risks associated with a supplier failure.

- Planning for client approvals Setting up a project for OSM delivery will not require client commitment from the outset. Designs can if necessary be delivered conventionally. However, at some point client approval to the OSM strategy will be needed, and governance must be aligned to the procurement process.

These relatively simple incremental steps provide clients with the flexibility they need to adopt OSM in a phased way. It will avoid unnecessary cost associated with sub-optimal implementation of modular and will enable access to a wider range of suppliers, increasing competition and choice. By using an integrator model for delivery as an alternative to a lump-sum contract, this approach not only eliminates layers of duplicate cost but also enables the development of longer-term relationships between clients and suppliers.

Single-project delivery, however, is not the ideal solution for the sector. Specialists need a pipeline of work against which they can plan production and future investment. By bundling projects, the full potential for investment in offsite can potentially be realised.

04 / Bundled smart procurement

The challenge for bundled procurement is the need to balance plenty of end-user variation with sufficient assured volume that the needs of both client and supply chain can be met. Conventional frameworks such as the Delivery Partner Panel 3 established by Homes England are designed to incentivise OSM by mandating levels of adoption. However, as they do not contribute to creating volume demand around common solutions, they cannot help achieve the secondary objective of making the OSM pipeline investable.

All the disciplines described for smart single-project procurement will be needed to support a bundled approach to building an investable pipeline: planning consents that can be delivered using non-traditional methods, standard component-based solutions and the creation of a competitive market either at the level of assemblies such as modules or at a more detailed level of standard components forming the foundation for platform-based construction.

The platform approach promoted by the Infrastructure and Projects Authority will be key to this approach. Platform-based solutions will be one of the innovations scaled up through investment channelled by the Transforming Construction: Manufacturing Better ��ɫ����TVs programme, which will pool R&D expenditure by government and the private sector to accelerate the development of practical building innovation.

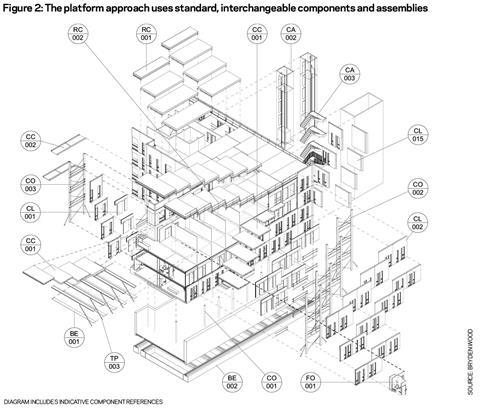

The idea behind the platform approach is to fully apply the disciplines of manufacture, including a much more developed quality and supply-chain management solution, to deliver the maximum benefits for the lowest cost, using repeatable solutions such as wall or floor panels. This big step towards component-based DfMA will help to create market volume and support continuous improvement. A platform approach will use a combination of standardised, configurable components and assemblies and common quality systems and processes to deliver mass-customised buildings. The challenges that the platform strategy will have to address will include not only the development of the product systems but also the creation of the underlying standards and new procurement routes that include marketplaces for standard components as well as contractual models for the delivery integrator.

As procuring organisations develop their plans for pooling future workload, aspects of strategy that they should consider include:

- A common approach to outline planning A bundling strategy has the potential to magnify many of the planning issues already faced by individual clients. Influential bodies such as combined authorities have a key role to play in the implementation of an area-wide approach to planning to support a manufacturing-based approach.

- Early adoption of digital design Digital tools have a critical role in enabling the optimised, computational design of component- and assembly-based buildings. A common, standards-based approach to digital must be at the heart of the delivery strategy.

- Thinking in terms of components, as well as buildings Adoption of mass-customisation thinking, potentially enabled by intelligent, computational design, will enable clients to deliver high-quality, varied and engaging buildings and places. Research commissioned by the Manufacturing Technology Centre, for example, has highlighted that the DfMA approach will attract new capacity into the sector from existing manufacturers – reducing costs and improving quality. The Greater London Authority’s development of a manufactured housing design code will help to promote this approach.

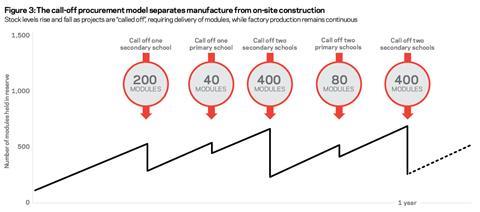

- New delivery models Conventional procurement approaches including existing frameworks are unlikely to deliver the desired outcomes. New contract models based on alliances of specialist suppliers brought together by integrators will be needed to maximise savings that can be achieved by eliminating waste and duplication. Features of these contracts are likely to include a project call-off system (see figure 3), transparent management of risk and reward, and the much wider sharing of data both to manage the project and to measure successful outcomes.

- Delivery as a programme The pooling of workload should be treated as a programme, with consortium-wide objectives, a wide range of workstreams including enabling activities, technical standards, key performance indicators and change management. The range of changes in practice and behaviours demanded by a bundling project demands the co-ordinated, enterprise approach delivered through an outcome-led programme rather than the looser arrangement that previous OSM consortiums have adopted.

05 / Case study

The Education Skills and Funding Agency (ESFA) has been prominent among clients in driving OSM solutions and opening their market for school-building to OSM suppliers. Their standardisation of design, specification and procurement for schools has been a significant factor in creating a high-quality OSM product that is equivalent in cost to traditional build solutions. The ESFA has challenged its suppliers to drive down OSM delivery costs further. Arcadis has worked with suppliers to identify how they can do this, by creating more efficiency in the manufacturing and delivery process.

Taking benefit from the standardisation innovations the ESFA has driven, it is now possible to specify a fixed annual output of standard module types in advance of having identified the locations or even the exact school design.

If an order is placed with one manufacture for a mixed bag of 1,000 modules (enough to build 25 primary schools or five secondary schools), the manufacturer can plan this output for maximum manufacturing efficiency, smoothing labour, materials ordering and manufacture. Savings will come from a variety of sources including procurement, labour efficiency, and other process innovations.

The procurement model separates manufacture from delivery by separating detailed school design and delivery from the manufacture of the modules. Once a site has been identified, separate procurement activities will initiate design and pre-construction activity, including local stakeholder management and the appointment of the construction team – comprising the OSM specialist and several trades contracts working with an integrator. Where required, specialist one-off modules will be delivered by a dedicated provider.

The elimination of bid and procurement costs and the achievement of production efficiencies from continuous utilisation of the factory delivers savings of 17%. This excludes further potential savings associated with the rationalisation of the site construction process.

This procurement strategy is wholly dependent on the achievement of predictable demand for a narrow range of common assemblies – typically these are modules, but potentially could be simpler assemblies including panels and service cupboards. By separating the assembly of the units from the manufacture process, the opportunity to spread demand across a range of clients increases – improving the likelihood that demand levels will be sustained over the five years needed to ensure that the factory investment is viable.

06 / Conclusion

It is widely recognised that OSM has a key role to play in improving the performance of the UK construction industry. However, more thought needs to go into developing the end-to-end delivery model that gets the best out of technologies such as modular – this starts with planning and relies on a design and procurement approach that enables competition throughout the supply chain. While this single-project approach will not provide the visibility of long-term pipeline that OSM businesses seek, it should enable more clients to secure better value from OSM solutions.

Pooled procurement has a long and occasionally troubled history in the housing sector. The problems faced by the Amphion consortium in 2005 highlight the complex interdependencies between client organisations and suppliers and the wider impacts of mergers and acquisitions and other business changes. For bundling to work, the lessons from Amphion are, first, that clients need to provide volume and, second, that there needs to be a diverse range of solutions available to the consortium – in terms of providers as well as technologies. The brokerage model proposed by the Construction Leadership Council will go a long way towards meeting this need.

The platform approach promoted by the Infrastructure and Projects Authority – the government’s programme delivery body – is likely in time to deliver the best results, with multiple suppliers producing the range of assemblies and components needed to deliver high quality and best value. As the construction sector deal supports the development of technical solutions, clients will need to adapt their procurement approaches to ensure that they can take full advantage of innovations delivered by the supply chain.

Acknowledgements: We would like to thank Matt Howell-Jones and James Knight of Arcadis, Jaimie Johnston of Bryden Wood, David Mosey of King’s College London and Trudi Sully of Manufacturing Technology Centre for their contributions to this article

No comments yet