Norwich councillors feared Connaught had bid too low on a ┬Ż17.5m housing maintenance contract and have warned that a replacement will be ŌĆ£far more expensiveŌĆØ

Connaught undercut rival Morrison by ┬Ż5.5m to win the contract last December, but was prevented from taking it after Morrison persuaded a court that the bid was ŌĆ£abnormally lowŌĆØ.

The council later settled with Morrison, and the contract began in April. It has now emerged that some councillors agreed with MorrisonŌĆÖs assessment.

Judith Lubbock, the acting leader of the Liberal Democrat group, raised questions at the time about how the company could provide services on such a low budget.

Because the bid was so low, a new one will cost us a lot of money - plus retendering

Andrew Wiltshire, councillor

ŌĆ£It was raised that we were unhappy about going for such a low offer,ŌĆØ she said.

Niki George, a Conservative councillor on the working party, said he, too, was ŌĆ£worried about ConnaughtŌĆÖs very low bidŌĆØ.

Council officers, who worked with consultant Tribal Helm to evaluate the bids, said Connaught told them it could deliver at the price because personal computer systems would make repair work more efficient.

ŌĆ£They were going to use the latest hand-held technology so they wouldnŌĆÖt have to go back to a depot to get parts,ŌĆØ Lubbock said.

Commenting on this, a social housing boss said: ŌĆ£If true that is laughable - and a worrying insight into the procurement process in Norwich.ŌĆØ

Andrew Wiltshire, another Tory councillor, said social housing maintenance for Norwich would be ŌĆ£far more expensiveŌĆØ now Connaught had collapsed.

ŌĆ£Because the bid was so low, a new one will cost us a lot of money. WeŌĆÖll have retendering costs as well,ŌĆØ he said.

Morrison has said it will take on some Connaught contracts and staff, but said it was too early to say how many.

Rise and fall of Devon firm

A former employee of Connaught talks about the firmŌĆÖs rise and fall

Bob Holt, the chairman of Mears, was a rare non-believer in the Topsy that was Connaught - and he may have had the last laugh.

The firm was founded by Mark Tincknell, who was charming in a chubby, crumpled sort of way, with a refreshing self-deprecatory manner. He also had vision, and it was that that took a tiny concrete repair company from Sidmouth in Devon to flotation on the alternative investment market in 1998, and finally to the FTSE 250. This is not an everyday occurrence. But then neither is a FTSE 250 company going bust.

Mark was good at seeing opportunities others didnŌĆÖt; not only in business but in racehorses and art as well. He also realised he needed help as Connaught grew and grew. Mark hired, as he believed, the best. Mark Davies, formerly of lock maker Chubb, was to run the business and Stephen Hill from Serco was the finance director. There was a hattrick of non-executive directors, and PriceWaterhouse Coopers was the auditor.

So what went wrong? It is reported that the prime issue was the accounting treatment for long-term contracts. The rules allow companies some scope to spread upfront costs over a number of years if the investment gives them enduring benefit - which is fine if true.

In late June, the company said it had ŌĆ£identified 31 contracts within its social housing division where a proportion of the value relating to capital expenditure had been deferred. This will lower revenue by about ┬Ż80m ŌĆ”ŌĆØ

Clearly there was not, or at least not as much, benefit as was expected. In April Tincknell had said he looked forward to the future with ŌĆ£excitement and confidenceŌĆØ. Six months later it was over and the government could be contemplating action against the entire board for negligence ŌĆ”

Downloads

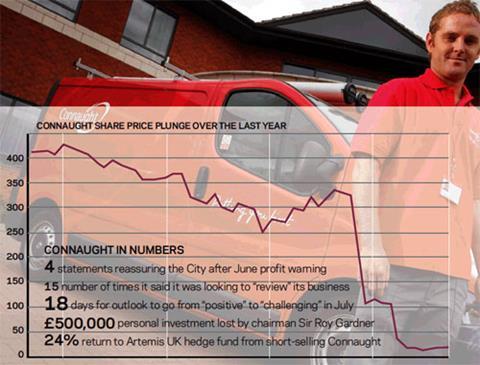

Connaught share price plunge over the last year

Other, Size 0.15 mb

1 Readers' comment