Cost consultant says a two-speed contracting market is emerging in the capital

A two-speed contracting market has developed in central London, with a marked slowdown in smaller projects, according to consultant Core Five.

In its latest market update for the capital, the firm said the construction industry proved more resilient than expected in the second half of last year and despite a halt in projects immediately after the EU Referendum, work quickly came back on stream.

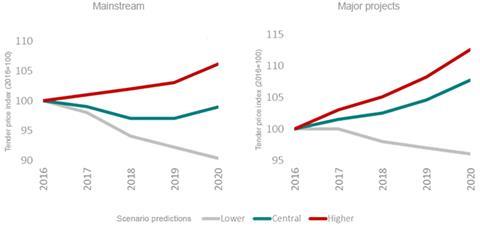

However, a split in the contracting market has emerged between major projects worth over £100m and the smaller end of the market which has slowed down.

Major projects are proceeding on the back of resilient occupier demand and overseas money taking advantage of the pound’s weakness - with only a limited number of contractors able to deliver these large projects, demand remains strong and capacity constrained.

But it’s a different story for the rest of the market, where there is more contractor capacity and a quicker turnover of projects, while developers are more cautious about committing to smaller projects after the Brexit vote.

Core Five is predicting tender price inflation of between 0-3% this year for the capital’s major projects market, while the mainstream market could see slight inflation of 1% or a fall of up to 2%.

Next year is likely to be worse for both markets with tender prices for the mainstream market potentially falling by up to 5% and for major projects by up to 2%, the consultant is forecasting.

Core Five expects the split between the two markets to become more pronounced over the next 24 months, adding that contractors’ pricing decisions are likely to become tougher as they balance pipelines against rising input costs.

In the mainstream market single stage tendering has returned and the consultant expects it to become more widespread as the year progresses.

Core Five’s forecasts come after similar updates from Turner & Townsend (T&T) and Mace last week.

T&T is forecasting tender price growth of 2.3% for the building sector across the UK as a whole this year, but nearly double that for infrastructure, at 4.3%.

Meanwhile Mace’s cost consultancy business forecasts tender price inflation of 1.5% in the capital this year, with 2.5% growth in the UK as a whole.

No comments yet