Many factors have contributed to a slow start for the housing market – but that should change as the year progresses

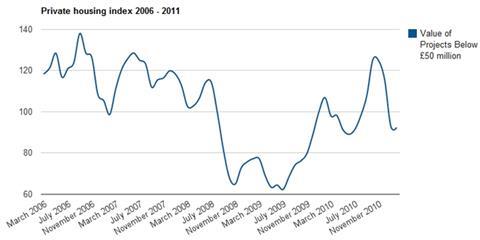

The CPA/Barbour ABI private housing index shows a subdued private housing market over the next few months. In mid-2009 the market seemed to be starting to recover. Prices started to increase and banks resumed lending, giving buyers the confidence they needed. In response, housebuilders stepped up activity from the historically low level reached in 2009. Fast-forward to early 2011 and the impetus driving the recovery has petered out. This is reflected in the CPA/Barbour ABI index, a leading indicator of work for housebuilders, which fell by 7% year-on-year in January and the rate of decline accelerated to 14% in February, after rising in 2010.

So what is going wrong? Affordability remains poor and mortgage lending criteria stringent. The average deposit paid by first-time buyers was £32,000 in 2010, 35% higher than average income. New homeowners will spend between 10% and 15% of their income on interest payments, according to the Council of Mortgage Lenders. Home ownership is a big commitment and in a market where the cost of borrowing is certain to rise, negative equity is a possibility, and a quick sale far from guaranteed, confidence about the health of the economy is key.

A combination of strong and rising inflation, modest wage settlements and unemployment, even before public sector spending cuts have an impact, is starting to take its toll. In January, the GfK NOP Consumer Confidence Index fell at the fastest pace since December 1994, to its lowest since March 2009.

A fall in the private housing index in early 2011 is concerning and suggests that the recovery in 2010 could be derailed. Household finances have suffered due to materials costs rising and VAT increasing, yet as the year goes on and after inflation peaks, pressure is likely to ease and confidence could strengthen.

For 2011 the Construction Products Association expects work to start on 105,000 private homes, 5% more than in 2010 but 40% lower than the average. The government predicts that 232,000 households will be created each year to 2015, which if our forecast is realised, means a shortfall of 400,000.

Kelly Forrest is a senior economist at the CPA

The CPA/Barbour ABI indices are an early indicator of work occurring in a construction sector based upon data of contracts awarded during that month. Depending upon the sector, these rises and falls in the index feed through into actual work with a different lag. For instance, in housing and industrial sectors, contracts awarded feed through into work within six months. However, within the commercial sector, contracts awarded can feed through into work in 12-18 months. Large projects that can bias the data on a monthly basis have been excluded from the indices and a seasonal adjustment has been applied to ensure that the data are comparable across different months.

No comments yet