UK housebuilding is still lagging despite rising 10% in a year, new figures released by the ONS show

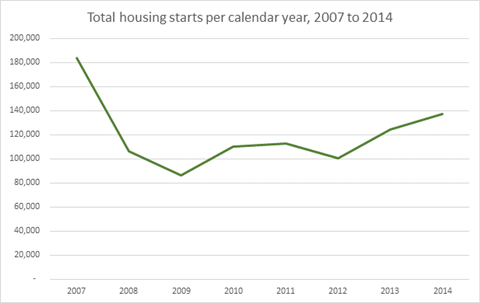

Housebuilding starts jumped 10% in 2014 to 137,010 according to figures released by government, however the rise masks a 9% drop in the final quarter of the year.

The ONS figures show housebuilding continuing to recover, with starts up 82% since the industry crashed in 2009. However despite the rise, the ONS has reported that the number of new homes built each year is still 25% below the peak in December 2007. Housing starts in the fourth quarter were 9% below the same quarter year-on-year at 29,800, while completions were 1% higher at 30,760.

Despite an 8% year-on-year rise, housing completions stood below 125,000 for the sixth year in a row at 118,760, which is 33% below the peak level of December 2007.

Speaking about the latest figures, Henry Gregg, assistant director of campaigns and communications at the National Housing Federation, said: “These figures are a damning indictment of our failure to tackle the housing crisis. With building numbers below half what is needed, we’re creating a housing shortage that will be felt for generations to come.

“Every year the country fails to build enough homes is another year that aspiring homeowners are priced out, young people are trapped in childhood bedrooms and families struggle with high rents.”

The Home Builders Federation welcomed the news, Stewart Baseley, executive chairman at the Home Builders Federation said: “We estimate that there are now over 100,000 more people employed as a result of the increase in house building, providing the country with an economic boost as well as much needed housing.”

The housebuilding figures from the ONS come as the Council of Mortgage Lenders warned of the weak pace of the mortgage market.

Mortgage lending stood at £14.3bn in January, 14% down on December’s lending total of £16.6bn and 11% lower year-on-year.

Commenting on market conditions, CML chief economist Bob Pannell said: “The softer pace of approvals through the second half of last year contributed to the relatively weak pace of mortgage lending in January. Although seasonal factors will continue to weigh on activity levels for a while longer, we expect the underlying picture to pick up over the coming months, in line with stronger earnings and employment, gentle interest rate trends and recent stamp duty changes.

“As we forecast at the end of last year, gross mortgage lending remains on course to reach an expected £222 billion this year.”

No comments yet