WSP chief executive says Canada offers better opportunities than ŌĆślanguishingŌĆÖ UK economy

WSP sought a merger as it was unable to expand quickly enough as a UK-listed company, its chief executive Chris Cole has said.

Cole said the acquisition of the company by Canadian consultant Genivar would allow the combined Toronto-listed firm to expand through acquisitions, particularly in the US and Australia.

He said it made sense to align WSP - which he founded in 1969 - to the ŌĆ£powerhouseŌĆØ of the Canadian economy rather than the ŌĆ£languishingŌĆØ UK market.

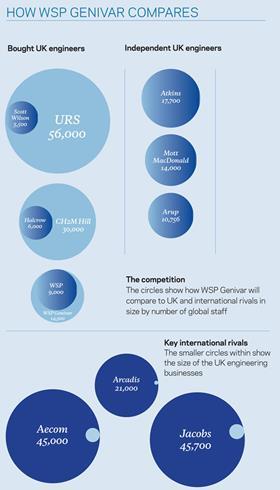

Genivar is less than two-thirds the size of WSP in terms of staff numbers and turnover but, at the time of the deal, had a market value of ┬Ż516m - more than three times that of WSP, which was valued at just ┬Ż166m.

Cole said: ŌĆ£This transaction gives us the ability to grow because weŌĆÖve got a new financial structure and new valuation. ThatŌĆÖs what the Canadians bring to the party and thatŌĆÖs what the UK hasnŌĆÖt got any more.

ŌĆ£A healthy business is a business that does a blend of organic growth and acquisitions and we havenŌĆÖt made an acquisition since the liquidity crisis of 2008.ŌĆØ

For more on the deal see assistant editor Joey GardinerŌĆÖs

While Genivar gets 95% of its ┬Ż400m revenues from Canada, WSP currently works from 200 offices in 30 different countries, with 1,000 staff in the US and 600 in Australia.

Cole said the company ŌĆ£needed to increase numbersŌĆØ in Australia. ŌĆ£We have wanted to grow these businesses in Australia and the US, and now we have that opportunity.ŌĆØ

Cole declined to say how much money the combined firm might have to spend, and added that the group would wait to let the ŌĆ£dust settleŌĆØ following the merger before embarking upon further acquisitive expansion.

He said the deal was done in the ŌĆ£spirit of a mergerŌĆØ, despite the fact that Genivar acquired WSP, and claimed that the similar sizes of the firms

would help them to integrate.

He said: ŌĆ£IŌĆÖve seen how companies get damaged [when theyŌĆÖre acquired by much larger firms] but that wonŌĆÖt happen because of the relative scales of the companies and because management remains.ŌĆØ

He said: ŌĆ£I believe WSP needed to be part of [the consolidation trend] to grow and thatŌĆÖs what weŌĆÖve achieved.ŌĆØ

Cole said there would be no job losses as there was ŌĆ£no geographical overlap whatsoeverŌĆØ between WSP and Genivar. WSP has 9,000 staff and aturnover of ┬Ż717m, whereas Genivar has just 5,500 staff.

Cole added that he had considered the emotional aspect of selling another UK consultant to an overseas buyer as he was ŌĆ£only humanŌĆØ but arguethe Genivar tie-up had provided an ŌĆ£exceptional opportunityŌĆØ.

Cole said: ŌĆ£Canada was clearly an attraction - itŌĆÖs probably the strongest economy in the Northern hemisphere. WeŌĆÖre fortunate to have another country - Sweden - as part of the group so we believe the group is now operating in the two strongest economies.ŌĆØ

When completed the deal will see Genivar pay ┬Ż278m to buy the entire issued share capital of WSP, with the combined group to be renamed WSP Genivar. Cole said the name change would come into effect ŌĆ£as soon as is practical following completion of the mergerŌĆØ.

Cole said the UK-based engineer ŌĆ£didnŌĆÖt open the door to anyone elseŌĆØ and had been talking to Genivar about a deal for a total of six months, with serious negotiation taking place within the last three months, with serious negotiation taking place within the last three months.

No comments yet