But inflation shows signs of waning as supply chain pressure eases

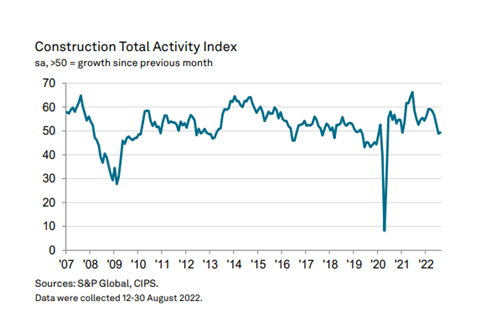

UK construction activity fell for the second successive month in August as concerns over wider economic prospects shook confidence causing purchasing activity to decline.

According to the latest PMI data, the industry posted an index reading of 49.2, marginally above the 48.9 recorded in July, but below the 50.0 no-change mark, meaning total activity still went down over the course of the month.

Andrew Harker, economics director at S&P Global Market Intelligence, which compiles the survey, said the sector was set for a “challenging period”, with a range of indicators pointing to further weakness ahead.

New orders “slowed to a crawl”, he said, increasing only marginally across the month and to the least extent since June 2020.

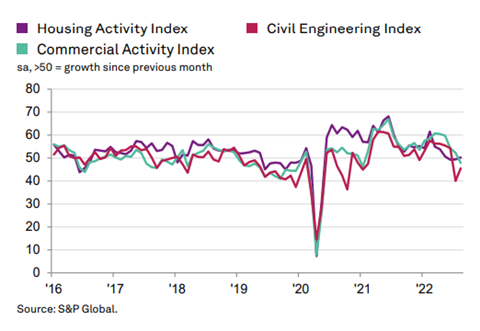

Civil engineering posted the sharpest decline of the three monitored categories, commercial activity ended an 18 month period of growth and long-time powerhouse housing only grew modestly.

Harker said the main positive from the latest survey was a “solid increase in employment”.

“That said, hiring at least in part reflects an ongoing catch-up following the pandemic. If activity continues to fall, firms will likely soon feel that their staffing capacity is sufficient and pause hiring,” he added.

Though still rising solidly, the rate of job creation in August eased to its softest since March 2021.

John Glen, chief economist at the Chartered Institute of Procurement & Supply, said there was “some consolation” for the sector, with firms scaling input buying for the first time since the initial wave of the covid-19 pandemic, putting downward pressure on supply chain costs.

“These trends could eventually help to reverse inflation, but a prolonged dip in new orders will be a bitter pill for the sector to swallow,” he added.

Mark Robinson, group chief executive at procurement body Scape, said that after another month of declining activity the sector would “looking to the new prime minister Liz Truss to tame inflation and deliver some stability for forward planning”.

“The impact of any intervention is unlikely to be immediate though, so the industry should be working now to ensure that the supply chain is shielded as much as possible from the worst effects of the upcoming recession,” he added.

>> Latest trends and prices data dashboard

Max Jones, director in Lloyds Bank’s infrastructure and construction team, said despite the contraction many larger contractors were feeling more confident than earlier in the year, with tier ones posting healthy balance sheets and strong pipelines of work.

He said: “While there has been some relief in recent weeks on the fuel price front, a cold snap this winter could prove problematic.

“All eyes will be further down the supply chain. If smaller players begin to struggle to deliver work, it will fall to the rest of the industry to ensure they are supported with prompt payments and fair practices.”

Meanwhile, information firm Glenigan released the September issue of its Construction Index, which showed a downward trend in project starts.

According to the table, which focused on the three months to the end of August, the value of underlying work commencing on site fell 35% during that period to stand 30% lower than a year ago.

No comments yet