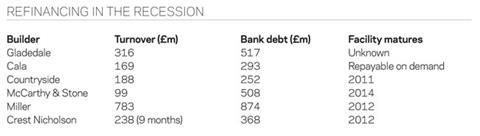

Crest Nicholson’s proposed refinancing deal could be the first of a wave of debt restructuring at the large privately held housebuilders over the next few months

Taylor Wimpey last week became the first listed housebuilder to break cover regarding a possible refinancing of its debt, but it is thought unlikely that the other public firms will follow as most already have the financial headroom they need from raising equity last year.

However, although Crest’s position of being owned by a consortium of 42 banks is uniquely complex, the situation it faces is shared by many of the housebuilders controlled by other banks such as Lloyds Banking Group and RBS.

Gladedale and Cala Homes both completed massive debt-for-equity swaps to prevent their businesses from breaching debt covenants. Others completely refinanced their debt once the banks decided that keeping them afloat was the least worst option.

However, these deals, largely completed in the darkest depths of the 2008 recession, are not necessarily suitable in the current market which, notwithstanding recent wobbles, is much healthier than it was in 2008.

Jan Crosby, an adviser to housebuilders at accountant KPMG, says: “The terms on many of these are tighter than they would want to be now. Basically the banks should be able to remove some of the handcuffs now the market looks brighter.”

Crosby’s point is that to avoid running housebuilders into the ground, the banks that saved them in 2008 will have to relax the stringent spending controls they imposed as a condition of the bailouts. This should allow them to buy more land and open sites.

He says this will lead to a second wave of refinancing. “This will be strictly a refinancing exercise though, not restructuring, and it’ll be designed to allow the housebuilders to grow. Ultimately it will allow the banks to get more of their money back.”

This view is not shared by all. Some commentators say the banks’ best option is not to throw more good money after bad. Kevin Cammack, an analyst at Cenkos Securities, says: “The most obvious thing to do with them is to run them down and sell them off. I’d have thought that unless there was a massive change of heart at the banks the best housebuilders can hope for is a neutral position - that banks stop taking money out of them.”

No comments yet