Construction giant announces it is to withdraw from bidding on ŌĆśuneconomicŌĆÖ work and switch focus to restricted markets

Balfour Beatty expects its UK construction revenue to fall by 20% this year to around ┬Ż2.55bn as the industry heavyweight withdraws from bidding on ŌĆ£uneconomicŌĆØ jobs.

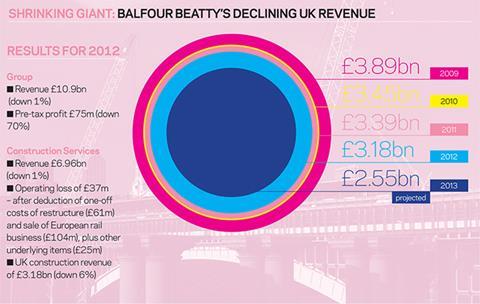

Reporting its results for the year to 31 December 2012 last week, Balfour Beatty Group posted revenue of ┬Ż10.9bn, down 1% on the previous year, with pre-tax profit falling 70% to ┬Ż75m.

The construction business reported revenue of ┬Ż6.96bn, down 1%, of which ┬Ż3.18bn was from the UK ŌĆō a drop of 6% on 2011. The firm said it had incurred a one-off cost of ┬Ż104m because of the decision to sell its European rail business, which when combined with ┬Ż61m in restructuring costs and ┬Ż25m in other underlying items meant that a profit of ┬Ż141m in 2011 fell to a loss of ┬Ż37m last year.

But the firm also said it expects its revenue for its UK construction business to fall 20% in 2013, leaving it with revenue of around ┬Ż2.55bn, down 35% on the ┬Ż3.89bn the firm posted in 2009 (see graph).

We donŌĆÖt want to be busy fools. ItŌĆÖs a strategic decision to cut back on things that are not economic

Mike Peasland, Balfour Beatty

Speaking to ║├╔½Ž╚╔·TV, Mike Peasland, Balfour Beatty UK Construction Services chief executive, said the projected fall in revenue was not simply the outcome of the shrinking market, but the result of a strategic decision to withdraw from bidding on low-margin work. He said the firm expected revenue to fall to a base of around ┬Ż2.5bn in 2013, and then grow at around 5% over the three years from 2014.

He said: ŌĆ£When we looked at our budget last year, we decided we could be at ┬Ż3.2bn [revenue in 2013] but then you look at the margins available for those kind of revenues, which would be flat compared to 2012, and thereŌĆÖs no way we want to be there.

ŌĆ£What weŌĆÖre doing is looking at what we should be focusing on. We donŌĆÖt want to be busy fools. So itŌĆÖs a question of detuning the revenue to actually improve the margin take. ItŌĆÖs a strategic decision to cut back on things that are not economic for us.

ŌĆ£WeŌĆÖll be focused on where the margins are ŌĆō if we can see markets that are growing and where we have specific competencies and we can see the margins, then obviously we will go for them more.ŌĆØ

Peasland said the business would focus less on general building work, including commercial work and social housing, and more on ŌĆ£restricted marketsŌĆØ with operating margins of 2%-3%, such as energy-from-waste projects, student accommodation, PF2 schools, and civil infrastructure.

ŌĆ£We donŌĆÖt want to be slipping down in the range of less than 1% [operating margin], where the construction markets are,ŌĆØ he said.

1 Readers' comment