Tender prices are flat, with nowhere left to fall, and output in January and February was very low. But is the housing sector showing signs of spring? By Peter Fordham of Davis Langdon, an Aecom company

01 / EXECUTIVE SUMMARY

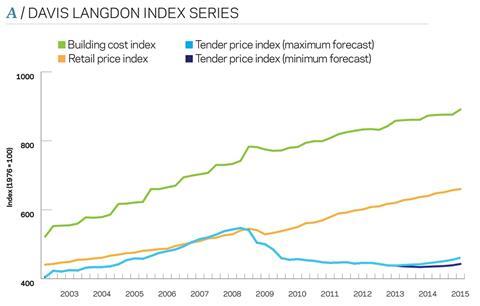

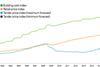

Tender price index ▶

First quarter input cost rises halt the decline in tender prices. The forecast is flat at best in London but even prices will be difficult to maintain elsewhere.

��ɫ����TV cost index ▲

Manufacturers introduce price rises at the beginning of the year and directly employed operatives secure small wage increase.

Retail prices index ▲

Retail prices rose by 1.2% between January and March led by increases in clothing and petrol costs. Inflation is now expected to remain above target until 2016.

02 / TRENDS AND FORECAST

In its Economic and Fiscal Outlook, published in March to accompany the Budget, the Office for Budget Responsibility downgraded its forecast for UK growth, predicting a rise of 0.6% in GDP in 2013, only half the rate predicted just three months ago. It is touch and go whether the UK endured a triple dip recession in the first quarter (provisional figures were due as this article went to press). Even if the country avoided that fate, construction output in January and February was very poor and there would have to have been an impossibly high surge in activity in March if a further quarterly reduction in workload was avoided.

The broadly flat economy in the first quarter reflects exactly what happened to construction prices. Although there were increases in some materials prices and in directly employed labour costs, tender prices in general remained flat as contractors continued to compete for work in a declining market. There is now a general feeling that prices have nowhere further to fall and, in some locations and sectors, they are close to rising. Contractors are no longer willing to take on unacceptable risks and are content to decline tendering opportunities if terms are deemed too burdensome. Similarly, contractors will view their rivals on proposed tender lists and opt to withdraw if they consider themselves likely to be uncompetitive.

Single-stage tenders tend to be the preferred route of many in the hope of securing the most competitive price. However some discerning clients still opt for two-stage procurement, distrusting prices that may be secured under single-stage tendering as unsustainable. Nevertheless, profit and overheads on large

two-stage tenders remain at just 2-3%.

Elsewhere, preliminaries and overheads and profit allowances may be beginning to harden and negative adjustments during tender adjudications are reducing. There are reports of some subcontract prices rising. The M&E sector has lost a number of contractors to insolvency over the last year and reduced competition may be beginning to be reflected in tender returns. Concrete frame prices may have seen small price rises in some areas; ready-mixed concrete prices have seen a small increase but reinforcement prices are at least 10% down over the year. Steel frame is unchanged over the year. One sector that may have seen a hardening of prices has been social housing, with contractors active in this sector with full order books.

Over the year ahead, materials prices are likely to be subdued. Steel is forecast to be flat, with raw materials such as iron ore in surplus supply. Other metals are generally forecast to drift downwards with the global economy still in the doldrums. Oil prices have recently fallen and the exchange rate of the pound to the euro is likely to bring the cost of imported building materials down.

Demand will be the dominant force driving construction price inflation. Public sector works in 2013 will continue to decline rapidly and the pritvate sector remains stymied by a lack of confidence in the economy and a continuing failure to secure ready finance. The housing market, however, has turned a corner, although output this year may still be only 2-3% higher than in 2012. There should be stronger growth in infrastructure, and private industrial work, too. But the important private commercial sector is set for another year of declining fortune.

With new-build activity forecast to fall by a further 3-4% this year, or 8-9% for those not involved in housing or infrastructure, competition will become even more intense. It seems inevitable that further contractor failures will occur, although so far numbers do not appear to be worsening. Contractors do appear to be shying away from suicidal bidding but survival on wafer-thin margins is precarious.

London is still the most active part of the UK, with relatively buoyant residential work, Crossrail and a fair amount of office construction. Elsewhere, activity is in further decline. Even the new growth in housing work seems likely to be disproportionately allocated to London and the South-east. Construction price inflation over the year ahead is likely to be in the -0.5% to +0.5% range in Greater London, but in most other places it is difficult to see how further small price falls can be avoided. 2014 may see the tide turn but only with stronger housing and infrastructure workflows. Contractors not involved in these sectors may have to wait until 2015 at the earliest before seeing any increase in workload.

03 / THE BUDGET REVISITED

When George Osborne stood up in the House of Commons on 20 March to present his Budget statement, there were high hopes of measures to stimulate the construction industry. A number of sweeteners had been trailed such as more money for housing and infrastructure to boost economic growth. The question is, did it deliver?

The Budget was delivered against the background of a rating downgrade for the UK, continuing poor performance in the eurozone and a US economy just beginning to work through the consequences of sequestration. The chancellor remained constrained by the need to balance debt writedown with fiscal stimulus. As such, the Budget provided a sprinkling of measures aimed at growth and retaining the UK’s long-term competitiveness.

In the end, the measures announced amount to a stimulus for housebuilders but little else in the immediate future:

- The Help to Buy scheme will provide £3.5bn of equity to fund 20% of the purchase price of new homes for the next three years, supporting an estimated 74,000 home buyers. Of course, there may be an unintended consequence of driving up house prices thus perpetuating existing problems.

- A Help to Buy mortgage guarantee scheme will be introduced in January 2014 under which the government will allocate up to £12bn to provide guarantees to lenders offering mortgages with a deposit of 5-20%. This will apply to both new and second-hand properties.

- The massively oversubscribed Build to Rent programme will receive a further £1bn over the next three years to provide equity or loan finance to support the development finance stage of building new homes for private rent in England

- The existing affordable homes guarantee programme will be doubled, providing up to an additional £225m to support a further 15,000 affordable homes in England during 2014/15.

Even before these measures come into play, there is some evidence that confidence is beginning to return to the housing market. The latest RICS Housing Market Survey found that the number of homes sold during March was at a three-year high. New registrations with the NHBC in the period December to February were up 21% compared to the previous year and the number of affordable homes registered in February was 120% higher than in February 2012.

Following the Budget, Crest Nicholson, for instance, has expressed its desire to increase completions by a third over the next three years on the back of an improving mortgage market. Bellway said it wants to increase production by 50% and announced it would open two new offices.

There is also evidence that the National Planning Policy Framework (NPPF) is beginning to make it easier for developers. The number of residential planning permissions received in the last quarter of 2012 was up 62% on the previous year and was the highest figure for five years. A recent Savills report showed that appeals against planning permission were beginning to swing in favour of development. An analysis of major residential appeals in the period April 2012 to January 2013 identified only 26% proposals dismissed at appeal.

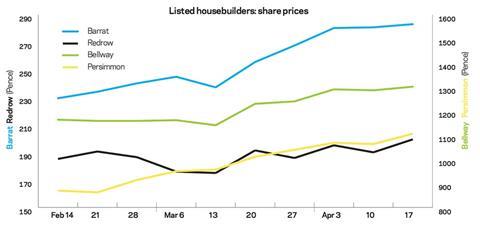

Unsurprisingly, the share prices of the major housebuilders have all leapt since the Budget announcements: Barratt Developments rose from 240p before the Budget to 291p (at 17 April), Persimmon from 890p to 1,106p and Bellway from 1,160p to 1,307p. Most housebuilders’ share prices have shown similar performance since early March.

The Budget was perhaps less inspiring in connection with the long-promised help to get infrastructure projects moving. Starting in 2015, the infrastructure sector will receive a boost of £3bn per year. The cost will be met through further cuts in departments’ spending allowances. The increased spending is welcome, albeit modest - it equates to a 5-6% increase in current expenditure. The rise is also two years away, without detail and the effects on the construction industry in the short term will be negligible or non-existent. The government’s Spending Review due in June should provide further details.

Pre-Budget, the case was once again made for a cut in VAT on repair and maintenance work as a quick and obvious way to generate an immediate uplift in work that forms a large proportion of construction activity in the UK. Once again the call went unheard.

04 / ACTIVITY INDICATORS

Construction output ▼

The volume of construction output in the UK as measured by the Office for National Statistics (ONS) goes from bad to worse. Headline figures may have reported an increase in output in February (compared to snow-hit January) but the story of the three months from December to February was an 8.9% fall in real terms on the same period the year before. New work output was down 10.7%. Last year the volume of new work was down by 11% compared to 2011 with public non-housing work down by 21%. In the latest three-month period, this has worsened to -24%.

Only the relatively small private industrial sector has shown any increase in activity, reflecting some renewed confidence in the manufacturing sector and a small step towards rebalancing the economy.

Volume of construction output (constant prices)

| 2012 compared with 2011 (% change) | Dec 2012-Feb 2013 compared with year before (% change) | |

|---|---|---|

| Housing - public | -18.0 | -14.4 |

| Housing - private | -4.2 | -7.0 |

| Infrastructure | -13.2 | -7.6 |

| Public non-housing | -21.3 | -23.7 |

| Private industrial | 0.9 | 3.1 |

| Private commericial | -9.9 | -9.8 |

| All new work | -11.4 | -10.7 |

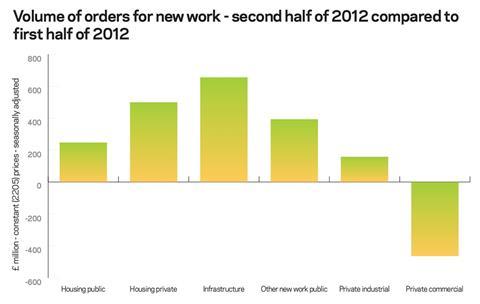

Orders for new construction ▲

The latest volume of orders for new construction statistics published by the ONS have generally been revised upwards since the third quarter 2011 but still remain fairly bleak. The last two quarters of 2012 now show an upward trend and the fourth quarter figure exceeds the previous six seasonally adjusted quarterly figures.

New orders in the infrastructure sector came through strongly last year (up 28%) after a poor 2011 though they are yet to show in growth in on-site activity (see table above). In fact there was an increase in new orders in every sector (including public non-housing) in the second half of last year except for private commercial work, the sleeping giant that the industry awaits to waken.

05 / BUILDING COST INDEX

Provisional figures for the first quarter 2013 show that the ��ɫ����TV Cost Index rose by 3.1% compared to the first quarter 2012. Two-thirds of this increase was attributable to rises in labour costs.

Over the year ahead, the rise in the index is forecast to fall back to about 1.7% as both labour and material cost increases remain restrained.

| Actual | Forecast | |

|---|---|---|

| 1Q12-1Q13 | 1Q13-1Q14 | |

| Labour | +4.4% | +1.5% |

| Materials | +1.5% | +2.0% |

Labour

The increase in labour costs over the last year noted in the table above was due to:

- the withdrawal of National Insurance concession on holiday with pay schemes from 1 November

- a 2% increase in basic wage rates from 7 January under the national wage agreement.

Wage rates for heating and ventilating operatives rose by 1.5% from 1 April 2013. Only electricians and steelworkers have agreements in place for 2014, the former’s basic rates increasing by 2% and the latter’s by 2.3%, both from the beginning of January next year.

Materials

2013 began with the usual flurry of price increases. Figures from the Department for Business, Innovation and Skills (BIS) show that construction material prices in the first two months of the year rose by 1.6%. This compares with an increase of just 0.5% in the first two months of 2012. The biggest increases recorded by the BIS figures so far are for paints (aqueous up 4.4%, non-aqueous up 2.6%), coated roadstone (up 2.7%) and ready-mixed concrete (up 1.9%). The influence of the relatively elevated oil price of the last two years (generally around $110-115 a barrel) may be in evidence here but the latest oil price trend is down. Prices dropped below $100 on 15 April, the lowest price since a brief foray below that marker in June last year.

The UK, however, will not have fully benefited from the fall in the price of oil as it will have been partially neutralised by the fall in the value of the pound against the US dollar since the turn of the year. The pound fell below $1.50 on 8 March for the first time since June 2010, and has also weakened steadily against the euro since last Summer, falling from 1.28 last July to 1.15 in March. Although, over the short term, that has made imported construction materials more expensive, the exchange rate is only back to where it was in November 2011 and at its average level since bottoming out at 1.02 in December 2008.

Looking forward, the pound is expected to continue to weaken against the dollar as the US continues its economic recovery while the UK treads water: this may have the effect of making dollar-denominated commodities such as oil and metals more expensive, keeping general inflation high and placing further pressure on construction inflation.

Against the euro, the pound is generally expected to return to a growth trajectory as the eurozone remains far from settled and the economy is on a downward path: this should reverse any recent price increases in imported materials and provide a period of favourable price movement over the next couple of years for European-sourced construction materials and components.

In line with oil, other commodity prices have also taken a tumble as the result of global growth fears. Copper prices have fallen to their lowest level for eighteen months. LME steel billet prices have been falling steadily since August 2011 including a 50% drop since the turn of the year.

No comments yet