After the uplift in activity in the first half of this year and the swingeing cuts in the spending review, a long and difficult winter lies ahead, says Peter Fordham of Davis Langdon

01 / Executive summary

Tender price index

Tender prices fell again in the third quarter and the forecast is for the trend to continue at least until the end of the year.

��ɫ����TV cost index

The building cost index continues to rise, creating further pressure on contractors to absorb rising costs.

Retail prices index

The retail prices index is still rising despite the sluggish economy, although the year-on-year increase has eased to 4.6%. The consumer prices index remains stuck at 3.1%, way above the 2% target. This is expected to remain above target at least until the end of 2011.

02 / trends and forecast

Last week the government set out how and where it intends to make £83bn of spending cuts over the next four-and-a-half years. It may take rather longer to see how and where those cuts affect the construction industry.

The industry was hoping for leniency from the spending review because competition for work continues to increase and prices received in tenders in the third quarter fell again. At the beginning of the year, prices stabilised and it is now possible to see that there was actually more work around (according to the Office for National Statistics - see page 59). At the same time, materials prices were beginning to rise quite sharply.

Tender prices may have been expected to rise in the second quarter but, instead, they eased down a fraction, as reported in the last Market Forecast (23 July, pages 52-56). In the third quarter prices fell a further 0.5%, which means average prices have fallen by only 2% in the past year. So the rate of decline has slowed from the heavy falls at the end of 2008 and in 2009, but prices are 17.5% below their peak in the second quarter of 2008.

These average price reductions can hide some significant variations for particular schemes. In London and the South-east there has been a degree of optimism of late that some private sector recovery is just around the corner. In the north of the country, meanwhile, there is very little construction activity and confidence remains low. Tenders that are in the market are keenly fought over and tender returns can sometimes surprise on the low side.

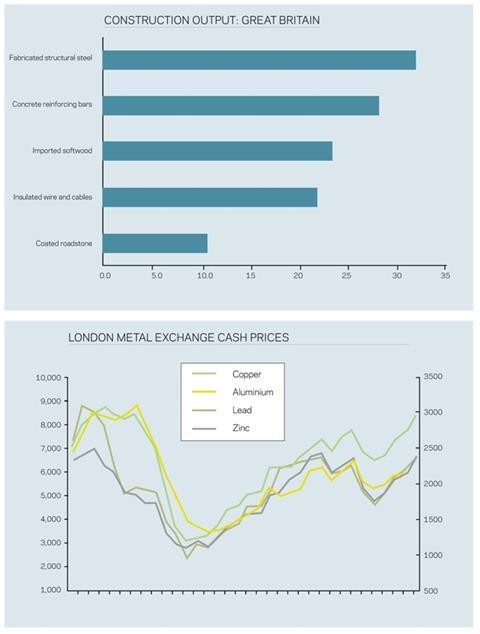

On the other hand, construction materials prices have risen sharply this year (see page 59) and, although most have been absorbed through the supply chain, the scale of some, such as structural steelwork and reinforcement, means some price rises have surfaced in tenders. Steel prices have shown the largest increases this year and the price of erected steelwork, which fell 40% between the peak in mid-2008 and the beginning of this year, rebounded by up to 20% in the second quarter to £1,300-£1,400 a tonne. European steel prices have been slipping since the second quarter and analysts do not expect further price rises in the next few months. However, the British Constructional Steelwork Association warned its members of a possible further steel price increase in the first quarter of 2011 and tenderers are refusing to submit fixed-price bids for work to be undertaken next year.

Tendered reinforcement rates also responded to a spike in material prices in the second quarter. Typical tender rates in the fourth quarter of 2009 and first quarter of 2010 were about £900 a tonne. In the second quarter these jumped to £1,000 a tonne, but in the third quarter they returned to below £900 a tonne. The material price is not expected to rise again before next spring so there should be no further pressure on tender prices in the short term from this direction.

There has been a mixed picture from the mechanical and electrical services sector. Labour cost increases and substantial materials price rises, driven by the world price of copper, have exerted upward price pressures on M&E contractors. As such, in many cases, M&E prices do not appear to have fallen as much as most building works. But in isolated cases, where contractors are finding their pipeline of work drying up, similarly competitive tenders are being returned.

A noticeable change in third-quarter tenders has been a further fall in allowances for preliminaries. In 2007, preliminaries accounted, typically, for a 15-16% addition to the cost of the works. At the beginning of this year, preliminaries had fallen only to 12-13% typically, albeit on a smaller base cost and therefore still representing a much reduced monetary value. A sudden further drop seems to have occurred, no doubt in part to counter increases that have occurred in some work sections because of higher materials costs. In the most recent tenders, preliminaries often amount to as little as an 8-9% addition on new work schemes.

Looking beyond the spending review, the industry must hope that private sector activity picks up to fill the void that will almost certainly appear over the next year or two (and beyond) as the public sector shrinks. Schemes that were shelved in 2008 are being dusted off, but occupiers are still thin on the ground and the banks remain uninterested in funding property investments.

Sovereign wealth money seems to be the only source of funding at present, which generally means larger prestigious schemes in London. Good-quality office space in the capital is forecast to be in short supply by 2013, so developers are undoubtedly gearing up to exploit that market. However, although rents are rising, it is still not easy to make projects inancially viable and this is not helped by other costs in the construction process, such as complying with the latest version of Part L of the ��ɫ����TV Regulations.

Confidence seems to have ebbed away in recent months and now even the London market seems less certain to proceed than seemed the case earlier in the year. That said, the high-end residential market does appear to be gathering some momentum and a number of projects are about to go to tender.

Contractors throughout the country have slimmed down their operations and are operating on minimum resources. This includes estimating departments, where staff are struggling to compile tenders on time even with the much reduced volume of tendering activity passing through their offices: requests for extensions of time are commonplace. Similarly, manufacturers have scaled back operations, actually lengthening lead times for items such as roof trusses.

There is little on the horizon to cheer about. In the late 1990s we all looked forward to the millennium and its building boom, in the late 2000s there were the Olympics to keep us buoyant. As work on the London Games passes its peak, the next best thing is Crossrail (but that has more to do with civil engineering and equipment than building work). The Severn Barrage, meanwhile, has been scrapped.

In 2011 we are likely to see a wave of insolvencies among the weaker companies faced with a higher cost base. This may be a recipe for inflation as soon as conditions permit. However, construction activity in 2011 is likely to be at or about the same level as in 2010 so construction price inflation is likely to remain restrained. The price declines that have characterised the industry are likely to come to an end by the first quarter of 2011 in London and the South-east, but elsewhere, public sector cuts may have a more severe impact and price reductions may continue further into next year.

The forecast is for tender prices over the next year in London to rise by 1-2% (although there remains the possibility of a sharper increase if a number of larger schemes all go to site at the same time). In the provinces, inflation may be zero at best.

The following year, private sector activity (commercial, housing and industrial) should by then have started to grow significantly, but the net effect on the size of the industry will still be

small.

In London, however, the increase should be enough to push construction prices higher by 3-4% (again with the possibility of higher figures if world demand causes a resurgence of variables such as steel prices). Elsewhere, prospects remain much weaker and price increases are likely to be more subdued.

03 / HOT TOPIC where in the world?

With the UK construction industry in the doldrums - and the outlook even worse - it is unsurprising that recent reports have identified a trend for architects, surveyors, engineers and even contractors to look abroad to maintain or increase their turnover. Already many have seen their percentage of income from abroad overtake their income from home, not necessarily because of their increased interest overseas, but because the level of fees from the UK has shrunk so fast.

Gulf Co-operation Council

Many are looking towards the Gulf Co-operation Council (GCC) states to provide a more likely source of workload and income. The Arab states, and Dubai in particular, have also gone through a tough period, but all have enormous programmes of construction ahead.

Credit conditions

The GCC financial markets have been relatively resilient throughout the crisis, despite a number of problems - the Dubai World debt standstill being the most high profile. Nonetheless, bank lending in the region has fallen sharply and remains largely stagnant as uncertainty about the economy has hit demand for and supply of credit. Dubai World’s announcement in September that it had reached agreement with almost all of its creditors to restructure its $24.9bn debt has been met with relief. Financial markets are hoping that the agreement will improve confidence in local assets, unlock funds and increase credit supply.

Public investment

At a time when banks remain reluctant to lend to the private sector, the GCC governments - directly and indirectly through credit institutions and government-related entities (GRE) - have stepped in and are crucial to providing project funding.

In Saudi Arabia, the Public Investment Fund has strengthened its support for projects, while the Saudi Industrial Development Fund has also increased lending.

The Kuwaiti government plans to provide guarantees to lenders for financing its $104bn four-year economic plan.

GREs such as Industries Qatar, Sabic or Aramco have also continued with their investment plans, while sovereign wealth funds have stepped up investment in local projects.

Continued public investment is supporting the region’s construction market. MEED’s latest Gulf projects index shows that the total value of projects planned or under way in the Gulf stood at $2.937 trillion in mid-September.

In terms of project awards, Saudi Arabia now leads the region and this trend looks set to continue. The kingdom’s $385bn five-year development plan aims to address the affordable housing deficit, improve social infrastructure and increase investment in transport infrastructure, in an effort to boost the competitiveness of the Saudi Arabian economy.

The successful implementation of the plan is not only crucial to Saudi Arabia, but also to the region’s construction sector as it will result in new projects and much-needed work for all industry players.

Worldwide deflation/inflation

Construction prices may have fallen by nearly 20% in the UK, but it was not the only country to see its industry contract and prices fall. The following table shows what has happened to construction prices around the world over the past two years and Davis Langdon’s opinion about what is likely to happen to prices in 2011:

Construction price inflation

| 2009 % | 2010 % | 2011% | |

|---|---|---|---|

| UK | -10 | -2 | 1 |

| Ireland | -16 | -8 | 0 |

| UAE | -3 | 0 | 2 |

| Bahrain | -7 | -5 | 1 |

| Oman | -1 | 1 | 2 |

| Australia | 0 | 1 | 2.5 |

| New Zealand | 2 | 3.5 | 4 |

| Hong Kong | 2 | 8 | 8 |

| Philippines | 4-5 | 4-5 | 5-6 |

| Singapore | -20 | 3-5 | 5-7 |

04 / Activity indicators

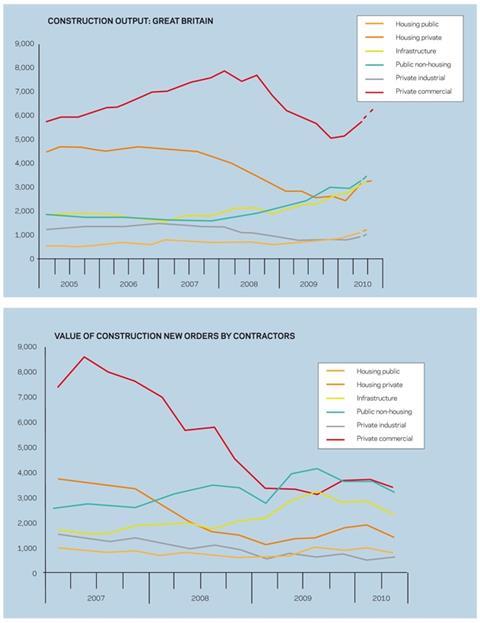

Figures released this month by the Office for National Statistics painted a remarkably rosy picture of the construction industry in the second quarter of 2010. In those three months contractors completed almost £18.5bn of new construction work throughout Great Britain which, at constant prices, represented a 14.7% increase in work over the first quarter and was just 2.9% shy of the peak quarterly workload figure recorded in the first quarter of 2008.

Perhaps equally remarkably, the figures continue to show a rising trend into July and August. This is partly explained by the bad weather at the beginning of the year, which delayed work which subsequently had to be made up; and also a push to get work onto site while the previous administration was still in power.The construction output graph, right, shows that every sector experienced an upswing in the second quarter and, with the exception of infrastructure, seems to have maintained that momentum in the third quarter.

Doubts have been expressed as to the reliability of the data since the ONS revamped, and improved, its methodology at the beginning of the year. However, other data sources support the pick-up in activity. The Markit/CIPS UK Construction Purchasing Managers’ Index has now recorded seven consecutive month-on-month increases in activity from March to September. Similarly, the Construction Products Association (CPA) has recorded strong increases in sales in both the second and third quarters, compared with the same periods in 2009, for heavy side products and light side materials.

The Markit and CPA studies warn of changing conditions ahead, however. The Markit survey found a sharp drop in confidence regarding future business expectations and jobs being cut at a marked rate. The CPA survey suggested that heavy side sales would plateau in the fourth quarter, although light side sales were forecast to continue to rise in the short term. Its survey respondents warned that recovery was unlikely to be sustained beyond 2010.

Contractors’ new orders

If the construction output figures make it look like 2010 was a good year, the latest data for contractors’ new orders show that the industry is heading for another dip. The orders graph, below left, shows how every sector (except perhaps industrial) experienced some recovery in the level of orders at different times throughout 2009, which has been reflected in higher output in 2010. But every sector (again with the exception of industrial) has seen a fall in the value of orders in the first half of 2010 which will leave contractors’ pipelines looking thin as projects come to an end.

The sharpest falls in orders have come in infrastructure, where the value of orders in the second quarter was 20% lower than at the end of last year, and in private housing, where orders have fallen more than 20% compared with the beginning of the year as housebuilders retrench once again in response to falling demand from buyers.

Output forecasts

The surge in construction activity in the first half of the year caught most by surprise and forecasting bodies such as Experian Business Strategies and the CPA have had to review their figures for 2010. The Autumn 2010 Construction Forecasts from Experian now anticipate that new work output for this year will, in real terms, be almost 8% higher than

last year, lower than the previous five years, but higher than any year before that. The increase will be tempered by a fall in repair and maintenance work, such that the total output for 2010 will be a more moderate 3% higher than last year.

Neither Experian nor the CPA expect such growth to be maintained, but neither forecasts a drop in new build activity next year. Rather they forecast small increases of 0.6% and

0.4% respectively (albeit from different base levels of work).

Neither had the benefit of knowing exactly what was in the spending review, but both have built in hefty public expenditure cuts based on previous pronouncements affecting, in particular, public housing and non-housing work. The larger cuts are expected to fall in 2012 rather than 2011, by which time it is hoped that a tentative recovery in the private sector will have begun to take hold, maintaining a weak, but positive, overall growth for the industry.

05 / ��ɫ����TV cost index

The building cost index has continued its rise this year, despite a continued freeze on labour rates. Provisional figures for the third quarter of 2010 show an increase of 3.6% over the year, with month-on-month rises since the beginning of the year. The increase has been driven entirely by rises in materials prices.

Labour

��ɫ����TV and civil engineering operatives’ wage rates have now been frozen since the increase secured in June 2008. Unlike the builders, electricians benefited from an earlier agreement that lifted their rates of pay by 5% at the beginning of the year and heating and ventilating engineers’ rates rose by 2% at the beginning of October. This goes some way to explaining why M&E prices have fallen by a lower margin than most building work. Electricians’ anniversary pay date is January and any deal they are able to secure will set the tone for next year.

Materials

Construction materials prices as monitored and compiled by the Office for National Statistics have risen strongly throughout 2010. Month-on-month increases since the beginning of the year resulted in prices being 10% higher by midsummer than they were at the same time last year.

Rebar prices have always been closely tied to the volatile price of scrap. Steel scrap prices jumped 50% in April to about £180 a tonne and rebar prices followed suit. In a roller-coaster ride, scrap prices fell all the way back by July then, unexpectedly, rebounded to £160 a tonne in September. October figures are back down again.

Scrap prices are expected to fall further and, as demand reduces in the winter, mills may have to offer lower prices for rebar and other long products to maintain orders. Although some price recovery is predicted for the first half of 2011, the price of steel long products in summer 2011 is expected to be similar to this year.

The price of electrical materials has also surged this year, registering a year-on-year increase of 12.5% in June. A large component of this has been the price of copper. World metal prices had rebounded strongly from their collapse in the immediate aftermath of the credit crisis in 2008, before further doubts about the global recovery sent them into a mini crisis in late spring. Since June, metals prices have surged by 20-40%, partly in anticipation of world demand led, inevitably, by China, but also as investors flee the dollar and hunt for safe havens in commodities.

The price of electrical cables has risen by more than 20% in the past year; copper pipe suppliers have announced price increases of 7% to come into effect in January.

No comments yet