Growth may have slowed in the fourth quarter of 2014, but there are positive signs for the UK economy and construction elsewhere. Here are highlights of Barbour ABI’s latest monthly Economic & Construction Market Review

Economic context

The Office for National Statistics announced that the UK economy grew by 0.5% in Q4 2014, equating to yearly growth of 2.6%.

These figures confirm that growth slowed towards the end of 2014, with quarterly growth down from 0.7% in Q3 and full-year growth below the Office for Budget Responsibility estimate of 3% at the Autumn Statement in December.

Analysing growth in each of the main industrial groupings, it is notable that it is only the service sector which is above its pre-recession levels of activity, with output 7.9% above the Q1 2008 level. In contrast, construction is 7.9% below its 2008 level; manufacturing is 5.4% below and production 10.6% lower.

Despite the slowdown towards the end of 2014, the labour market maintained its recent strong performance as unemployment fell once again in the three months to November and now stands at 5.8%, which is the lowest rate since 2008.

Inflation continued to fall towards the end of 2014 and the headline rate of CPI now stands at 0.5% (as of December 2014). Much of this decline can be attributed to falling oil prices, which has lowered fuel prices. This means that consumer goods are now around 1% lower than last year, though services inflation sits at 2.3%.

Other news on the UK economy includes:

- The IMF forecast that the UK economy would grow by 2.7% this year, but cut its forecast for 2016 by 0.1% to 2.4%

- The composite purchasing managers index rose from 55.5 in December to 56.9 in January, indicating a strong start to 2015

- The UK trade deficit widened in 2014 to £34.8bn, the largest gap since 2010 when it was £37.1bn.

While the headline indicators point to a slowdown towards the end of last year in the UK economy, the IMF forecast of growth of 2.7% remains close to the long-term average. The economy appears to have maintained its strong performance at the start of 2015, but this continues to be consumption driven with export levels remaining particularly weak. The fall in oil price is expected to provide a demand side-boost to the UK economy, to offset any loss in government revenues, but the Bank of England will keep a close eye on inflation with the prospect of deflation now seeming possible. While output is growing and unemployment falling, there are still a number of fundamentals that pose longer-term problems for the economy, particularly lower productivity and slow wage growth, which will provide a drag on performance unless the rate of growth increases considerably.

It is notable that it is only the service sector which is above its pre-recession levels of activity, with output 7.9% above the Q1 2008 level

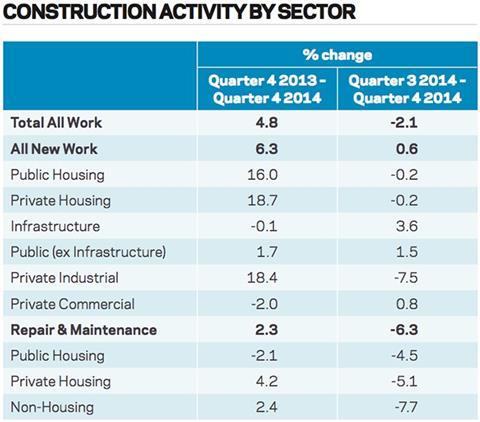

The latest figures from the ONS show that UK construction declined by 2.1% between Q3 2014 and Q4 2014. This consisted of a weak October and November with a significant improvement in December. Comparing Q4 output levels with the same period in 2013 shows an increase of 4.8%, indicating longer-term growth in output.

It is clear that it is the housing sector that is driving growth within the industry. New private housing fell slightly - 0.2% from the previous quarter, but was up 18.7% from the corresponding quarter in 2013 (see Construction activity by sector). At the same time, new public housing showed a 16% increase on the same quarter in 2013, although it saw a slight 0.2% decrease on Q3 2014. Output in the private commercial sector increased by 0.8% in Q4 2014 from Q3 2014. Infrastructure increased by 3.6% on the previous quarter but remained down 0.1% on the same period last year. This highlights that the growth patterns within the industry are reliant on housing and broader improvements are needed to ensure a robust recovery.

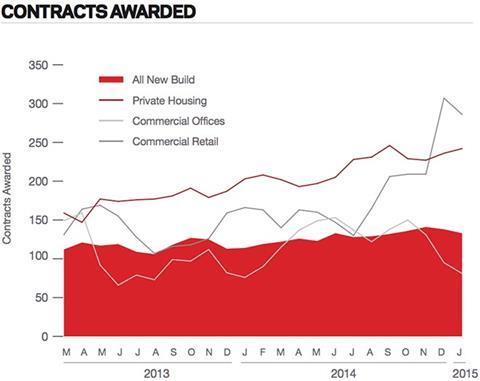

The CPA/Barbour ABI Index, which measures the level of contracts awarded using January 2010 as its base month, recorded a reading of 133 for January (see Contracts awarded). This is up 17% from this time last year and continues to support the view that overall activity in the industry remains strong. The readings for the three major sectors, private housing, commercial offices and commercial retail were all up this month on the same period in 2014. This indicates that, while output fell, the pipeline of work in the private sector remains strong.

The latest forecasts from the CPA predict that the industry will grow by 5.3% in 2015 with growth slowing to 4.2% in 2016 and 3.4% in 2017. They also forecast an increase to 3.9% in 2018 as infrastructure activity begins to reach its peak in this economic cycle.

The construction sector

According to Barbour ABI data on all contract activity, January witnessed an increase in construction levels with the value of new contracts awarded standing at £5.5bn, based on a three-month rolling average. This is a 4% increase from December but a 0.8% decrease on the value recorded in January 2014. The number of UK construction projects in January increased by 38% on December, which was a slower month, but was 8.1% lower than January 2014.

Projects by region

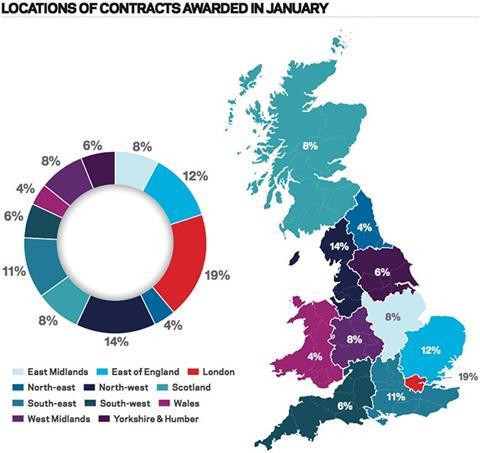

The majority of the contracts awarded in January by value were in London, accounting for 19% of the UK total (see map, right). This is followed by the North-west, with 14% of contracts awarded. Having the biggest impact on London’s figures this month was the £90m “Can of Ham” development in the City, which proposes to provide around 40,000m2 of office and retail space. The North-west also experienced a significant amount of contract activity in January.

Type of projects

Residential had the highest proportion of contracts awarded by value in January with 37% of the total. The infrastructure sector also featured prominently this month, accounting for 16% of the total value of all projects. Commercial & retail accounted for 14%. This is an indication of the continuing strength of the residential sector within construction, showing that while the top end of the residential market appears to be cooling, activity in the new-build market remains strong.

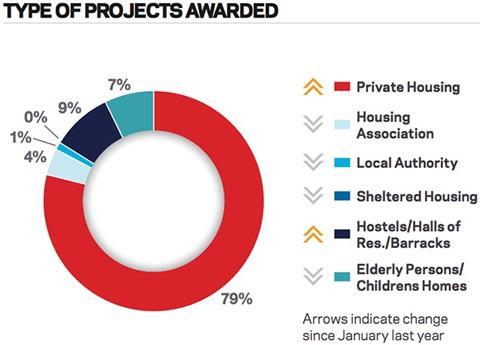

Construction performance by sector: Spotlight on residential

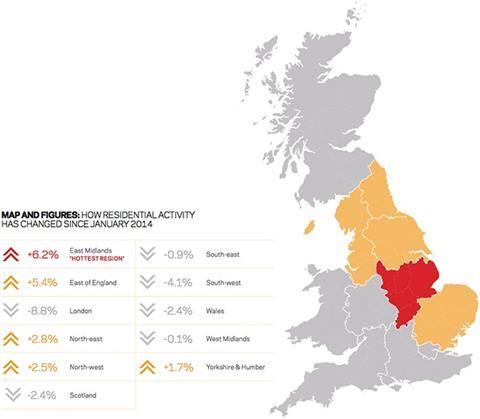

Activity in the residential sector increased in January with the total number of units awarded at 13,311, based on a three-month rolling average. This is up 4.8% compared to December and is 35.5% higher than January 2014, indicating longer-term increase in the sector. The value of projects associated with residential contracts awarded increased by 14% between December and January based on a three-month rolling average, but was 1.7% lower than this time last year, suggesting that while the number of units are increasing, actual contract values are not. This is perhaps an indication of a wider spread of projects in recent months, as opposed to a concentration in London, where values can be higher.

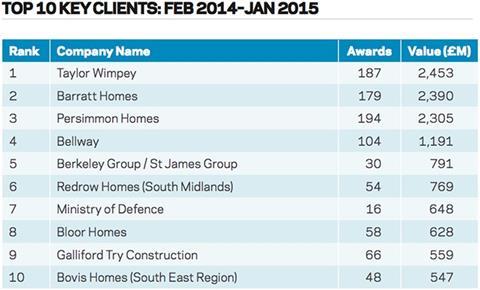

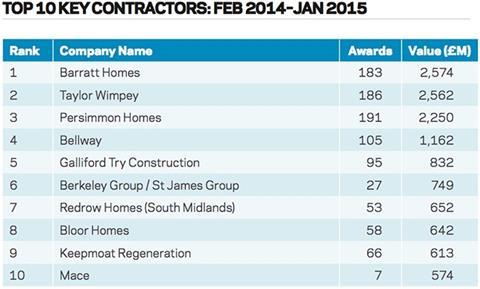

The latest house price indices for January from Nationwide showed that average house prices are rising at 6.8% annually, a slight fall from 7.2% in December. The Halifax reported rises at 8.5% in January, an increase from 7.8% in December. They also commented that the annual rate was forecast to slow to between 3% and 5% by the end of the year. Figures from the Bank of England seem to support the view that the market is rebounding after a slowdown towards the end of last year. Mortgage approvals by large lenders increased to 60,275 from 58,956 in December, the first rise in six months. The performance of housebuilders continues to be strong, however, with Redrow’s pre-tax profit increasing by 92% in the second half of 2014.

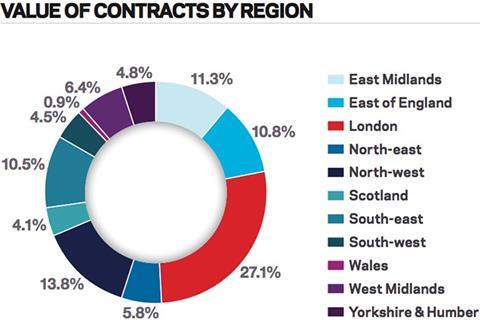

London is the main location of activity in the residential sector this month, accounting for 27.1% of the value of contracts awarded, a decrease of 8.8% from the same month last year (see Value of contracts by region).

Downloads

Economic Construction Market Review February 2015

PDF, Size 0 kb

No comments yet