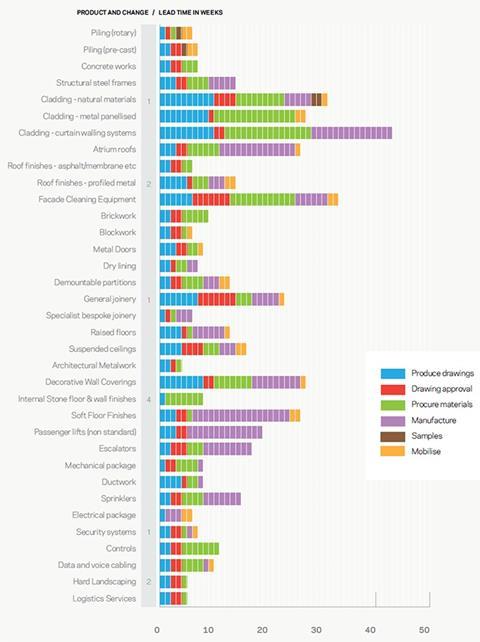

Increased enquiries and workload are now affecting most trades throughout the industry, which is showing in increasing lead times. Brian Moone of Mace Business School reports

01 / Going up

▲ Cladding - natural materials

▲ Roof finishes - profiled metal

▲ General joinery

▲ Internal stone floor and wall finishes

▲ Security systems

▲ Hard landscaping

02 / Staying Level

▶ Piling (rotary)

▶ Piling (pre-cast)

▶ Concrete works

▶ Structural steel frames

▶ Cladding - metal panellised

▶ Cladding - curtain walling systems

▶ Atrium roofs

▶ Roof finishes - asphalt/membrane

▶ Facade cleaning equipment

▶ Brickwork

▶ Blockwork

▶ Metal doors

▶ Drylining

▶ Demountable partitions

▶ Specialist joinery

▶ Raised floors

▶ Suspended ceilings

▶ Architectural metalwork

▶ Decorative wall coverings

▶ Soft floor finishes

▶ Passenger lifts (non-standard)

▶ Escalators

▶ Electrical package

▶ Mechanical package

▶ Ductwork

▶ Sprinklers

▶ Controls

▶ IT infrastructure equipment

▶ Data and voice cabling

▶ Logistics services

03 / Lead times summary

There is no change for rotary piling ▶ for the second quarter, having increased six months ago. All companies are reporting being busier but enquiries have remained the same. Pre-cast piling ▶ remained at seven weeks following the increase last quarter.

Concrete works ▶ lead times remain at seven weeks for the third quarter. Contractors anticipate that lead times will increase over the next quarter.

Lead times for structural steel frames ▶ remain at 14 weeks. Companies have more enquiries and are busier than six months ago.

Cladding - natural material ▲ lead times have been gradually extending over the past year. This quarter there has been an increase of one week to 31 weeks.

Cladding - metal panellised system ▶ lead times have remained at 27 weeks since Q1 2010 and no change is forecast. Cladding - curtain walling system ▶ lead times have remained at 43 weeks since the beginning of 2012. Workload and enquiries have increased and they anticipate lead times increasing over the next six months.

Atrium roof ▶ lead times remain at 26 weeks.

Roof finishes - asphalt / membrane ▶ lead times remain at seven weeks for the third quarter.

Roof finish - profiled metal lead times have increased for the first time since mid-2009 with no change forecast. Lead times have increased by two weeks to 14 weeks.

Facade cleaning equipment ▶ lead times remain at 33 weeks. Enquiries have picked up but companies anticipate lead time reductions due to less global activity and improved efficiencies.

Brickwork ▶ lead times have remained at nine weeks following increases for the past three quarters. This is due to contractors being busier and shortages of stock and haulage contractors able to deliver bricks.

Blockwork ▶ lead times remain at six weeks and there continues to be longer lead in from block manufacturers and haulage companies.

Drylining ▶ lead times remain stable at eight weeks.

Demountable partitions ▶ lead times remain at seven weeks, and contractors anticipate an increase in lead times over the next six months.

General joinery ▲ lead times have increased by one week to 13 weeks with no change forecast. Specialist joinery ▶ lead time remains at 23 weeks despite being busier than last quarter.

Raised floors ▶ lead times remain static at six weeks with no change since 2007. Contractors anticipate longer lead times in the next six months partly due to supply issues with timber and steel.

Suspended ceiling ▶ lead times remain at 13 weeks.

Architectural metalwork ▶ lead times remain at 16 weeks and there is no increase forecast. Decorative wall covering ▶ lead times remain at four weeks.

Internal stone floor and wall finish ▲ lead times have increased by four weeks to 28 weeks.

Soft floor finish ▶ lead times have remained at eight weeks since the end of 2010.

Passenger lift-non standard ▶ lead times remain at 26 weeks and escalator lead times remain at 19.

Electrical package ▶ lead times remain at 15 weeks for the second quarter following the first increase in over four years.

Mechanical package ▶ lead times remain at 17 weeks for the second quarter. The lead time for ductwork ▶ remains at eight weeks with no change to lead times forecast for the next six months. Lead times for sprinklers ▶ remain at eight weeks.

Security systems ▲ lead times have increased for the first time in two years. Lead times are currently six weeks, an increase of one week since last quarter.

Controls ▶ lead times remain at seven weeks, and IT infrastructure equipment lead times remain at six weeks despite being busier.

Data and voice cabling ▶ lead times remain at 11 weeks. Hard landscaping ▲ lead times have increased by two weeks to 10 weeks due to increased workload. Logistics services ▶ lead time remains at five weeks.

Contractors are reporting a healthy increase in enquiries and workload across most trades and this is showing in the increased lead times. The level of increase also appears to be more significant than previous quarters with, for example, internal stone finishes increasing by four weeks, indicating that the impact is greater than in previous quarters. The impact is across a wider spread of companies, last quarter the main increases were amongst the initial trades on site compared to this quarter where the effect of increased workload is being felt right through to internal finishes and even landscaping.

Data capture and analysis by Mace Business School. For more details on the article and the contributors please visit

No comments yet