Despite materials shortages and restrictions on labour as a result of the pandemic, the reductions in site activity have allowed lead times to remain remarkably resilient to change. Brian Moone of Mace reports

01 / Going up

▲ Concrete works

▲ Cladding – metal panellised

▲ Roof finishes – asphalt/membrane

▲ Electrical package

▲ Fire detection and voice alarm systems

02 / Staying level

▶ Structural steel frames

▶ Cladding – natural materials

▶ Roof finishes – profiled metal

▶ Facade cleaning equipment

▶&�Բ�����;����������ɴǰ���

▶&�Բ�����;�����dz���ɴǰ���

▶ Drylining

▶ Demountable partitions

▶ General joinery

▶ Specialist joinery

▶ Raised floors

▶ Architectural metalwork

▶ Decorative wall coverings

▶ Internal stone floor and wall finishes

▶ Soft floor finishes

▶ Passenger lifts - non-standard

▶ Mechanical package

▶&�Բ�����;�ٳܳ��ٷɴǰ���

▶&�Բ�����;���������������

▶&�Բ�����;��DzԳٰ��DZ���

▶ Logistics services

03 / Lead times summary

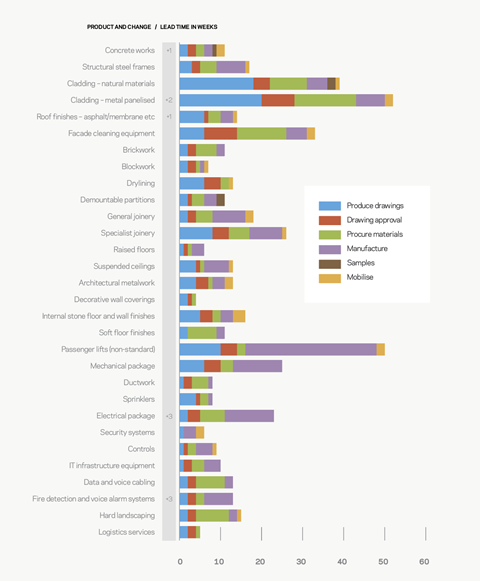

Concrete works ▲ lead times have risen one week to 11 weeks. Enquiries are up and workload down from six months ago; contractors anticipate no change in lead times over the next six months. Labour availability is an issue due to social distancing restrictions. Structural steel frames lead times remain at 17 weeks, with workload and enquiries unchanged from six months ago. No change in lead times is forecast.

Cladding – natural materials ▶ lead times remain at 39 weeks; workload is steady but enquiries are down. A rise in lead times is forecast due to closure of manufacturing facilities. There is still much uncertainty around the impact of coronavirus. Cladding – metal panelised system ▲ lead times have risen two weeks to 52 weeks and are expected to go higher due to potential labour issues and some suppliers increasing procurement periods.

Roof finishes – asphalt/membrane ▲ lead times have risen by one week to eight weeks, although enquiries and workload are down. Materials availability and restrictions on labour have been the main issues but there are signs of improvement. Contractors anticipate lead times reducing. Roof finishes – profiled metal ▶ stay at 15 weeks, despite lower workload and enquiry levels. No changes in lead times are anticipated.

Facade cleaning equipment ▶ lead times remain at 33 weeks. Contractors continue to be busier, with more enquiries than six months ago, but expect no change in lead times. Brickwork ▶ lead times stay at 11 weeks. Workload and enquiries remain steady so no change in lead times is anticipated, though there are concerns over labour availability due to Brexit and coronavirus. Blockwork ▶ lead times remain at seven weeks with no increase expected; workload and enquiries remain static. Drylining ▶ lead times remain at 13 weeks, but no further change is anticipated.

Demountable partitions ▶ lead times remain steady at 11 weeks with consistent workloads but reduced enquiry levels; no increase in lead times is forecast. General joinery ▶ remains at 18 weeks; materials and labour are not seen as issues. Specialist joinery ▶ remains at 26 weeks; workload is down but enquiries are up. No rise in lead times is anticipated. Raised floors ▶ lead times remain at six weeks; workload and enquiries remain down, but no change in lead times is forecast.

Architectural metalwork ▶ lead times remain at 13 weeks; workload and enquiries remain stable so no changes are forecast. Decorative wall coverings ▶ lead times remain at four weeks with no change anticipated. Internal stone floor and wall finishes ▶ lead times remain at 16 weeks; enquiries and workload remain consistent therefore no change in lead times is forecast despite uncertainty over the impact of coronavirus on labour and materials. Soft floor finishes ▶ lead times remain at 11 weeks.

Passenger lifts (non-standard) ▶ lead times stay at 50 weeks. Companies anticipate coronavirus could affect materials availability and push up lead times over the next six months. Mechanical package ▶ lead times remain steady at 25 weeks; workload and enquiry levels are down but no change in lead times is expected despite issues with materials availability. Ductwork ▶ lead times remain at eight weeks, with no change forecast over the next six months. Materials availability has been a problem but is resolving; there are concerns about labour and the impact of social distancing. Sprinklers ▶ lead times remain at eight weeks with no change forecast, though specialist equipment and pipework fabrication are on longer lead times due to the impact of coronavirus.

Electrical package ▲ lead times rose three weeks to 23 weeks with no further change expected despite signs of falls in workload and enquiries. Issues are reported with availability of lighting from overseas, particularly LED lights from China. Controls ▶ remain at nine weeks; workload is down but enquiries are up so no change in lead times is forecast. Fire detection and voice alarm systems ▲ lead times have risen three weeks to 13 weeks despite consistent workload, due to the availability of materials. Lead times are expected to remain higher over the next six months. Logistics services ▶ remain at five weeks with no change due.

Despite the impact of coronavirus, lead times have remained remarkably resilient to change. This has largely been due to the reduced availability of working areas balancing out materials and labour shortages. Most contractors are experiencing higher levels of enquiries but do not yet see that increasing lead times. Only five trades are reporting increases in lead times, predominantly due to materials availability.

Data capture and analysis by Mace Business School. For more details, please visit .

No comments yet