The βcity where no-one walksβ is revolutionising transportation and land use to maximise health, income and opportunities

01 / Introduction

Los Angeles is a city of contrasts.

A luxury travel destination with significant health, education and income inequalities. A city investing in a vibrant downtown centre as well as public transit and community infrastructure.

This multicultural, young city provides a strong representation of the future of American society, with more than half of residents of Hispanic or Asian descent.

With investment in public transit and attention paid to opportunities for all, once-declining neighbourhoods in LA are now flourishing, with jobs growth and new life along the main streets.

02 / Economic and political overview

Economics

The second largest city in the US both in terms of population (nearly 4 million) and gross metropolitan product (GMP) at Β£754bn, LA is flourishing, and is expecting to see 500,000 more people by 2035.

The population is growing fast, by 1.3% in 2015, adding nearly 50,000 people. As well as new residents, the city attracts record amounts of foreign investment. LA County attracts the largest share of foreign direct investment (FDI) by foreign owned enterprises of any US county and, in 2015, China alone invested over $15bn in the LA market. The city is a world leader in entertainment, fashion, clean tech and aerospace.

However, LA faces some significant demographic and economic challenges. Rapid population growth is causing strain on infrastructure which is already in many cases at or past capacity. In addition, LA has some severe health, education and income inequalities caused partly by the design of the urban landscape, and stemming from inequality of access to hospitals, schools, open spaces and job opportunities as well as housing.

Residents in affluent neighbourhoods like Bel-Air-Beverly Crest make more than 12 times per capita income than residents of the poorest neighbourhoods like South LA, and health inequalities abound, with a Brentwood resident expecting to live 12 years longer than a resident from Watts. Similar disparities can be seen across city performance metrics, including education, access to open space, access to job opportunities, and so on.

Driven by the twin challenges faced by the city of infrastructure capacity challenges and significant inequalities, LA has embarked upon a significant programme of infrastructure investment.

Table 1: City indicators

| City-region indicator | Data (2015) |

|---|---|

| Arcadis Sustainable Cities Index | 11th |

| Profit | |

| GMP (Β£) | 754bn |

| Year-on-year economic growth (%) | 5.8% |

| Unemployment rate (%) | 5.1% (2016) |

| People | |

| Urban population | 3.97m |

| Population growth rate (annual %) | 1.3% |

| Overall crime rate per 100,000 population | 422.1 (2014) |

| Total number of tourists | 45m |

| Year-on-year tourist growth | 2.8% |

| Planet | |

| Greenhouse gas emissions (metric tons of CO2 equivalent) | 99.1m (2014) |

Politics

LA comprises of 15 city districts, each with a single member city council representative. A centralised planning department is responsible for masterplanning the city and the long term General Plan is outlined through to the year 2035. Through this plan investments will be made along transit corridors, sustainability will be invested in and the inequalities of the city will be addressed. LA uses ballots to secure funding from tax revenue for planned investments, and there are no less than 17 ballots for residents to decide upon in November, including measures on community colleges, homelessness and, most importantly, infrastructure investment.

Downtown regeneration

After a period of significant neglect from the 1970s to the mid-2000s, LA has embarked upon a massive regeneration of the downtown area. Los Angeles did not have a natural βheartβ to the city prior to the opening of the Staples Center (a sports and entertainment arena) in 1999. This created an entertainment district and gave a base for regeneration to expand around. It was essential on embarking on this programme of regeneration that any masterplanning incorporated the distinct area characteristics that define Los Angeles, such as Little Tokyo. With the investment since, downtown has become a destination within the city and is rapidly changing into a vibrant centre with a mix of large scale construction projects, high density residential and repurposing of industrial space to commercial and mixed use. By the end of 2015, Downtown LA accounted for only 1.2% of the land in the City of LA, but 5.3% of the assessed property value.

Construction activity is at a level not seen in 25 years and 20-to-25 new high rises are projected. The largest mixed use commercial development in LA, the Wilshire Grand, is ongoing in downtown LA, and when complete it will be the tallest building in the city and in the western US.

Table 2: Investment in downtown LA 1999-2014

| Sector | Β£³Ύ |

|---|---|

| Residential | 5.9 |

| Mixed-use | 4.6 |

| Civic and institutional | 2.1 |

| Figueroa Corridor/Expo Park | 1.2 |

| Arts and entertainment | 1.0 |

| Commercial | 0.8 |

| Total | 15.6 |

03 / Sustainability and resilience

Sustainability

From air pollution to housing and water shortages, LA continues to feel the adverse impact of being a densely populated, industrial metropolitan area. However, despite these challenges the city is a leader across many fields of sustainability, and is investing in solar power, water conservation, green spaces, and community infrastructure to continue to lead the US in building a sustainable city.

LA leads in many sustainability metrics, including:

- Most installed solar power of any city in the US

- Most water-efficient big city (population over 1m) in the US

- Projected to add more green jobs than any other American city by 2017.

In April 2015 pLAn, a sustainable city plan for LA, was released, providing a road map for transformation of the city through to 2035.

Focus initiatives include:

- Local water

- Local power source

- Energy efficient buildings

- Carbon and climate leadership

- Housing and development

- Mobility and transit

- Liveable neighbourhoods.

Resilience

Drought is a very real threat to Los Angeles and the city is headed into its fourth straight year of severe drought. 27th in the Arcadis Sustainable City Water Index, LA is only beaten by Copenhagen in water efficiency, though the years of drought have driven a poor score of 48 in resiliency.

In order to combat the threat, the city is taking what actions it can, including restrictions on use and improving water supply. LA is almost entirely reliant on importing water, with most local sources contaminated. Given the critical situation the Department for Water is decontaminating the aquifers to provide a back-up water source. Arcadis is working with the department to clean up the San Fernando Groundwater Basin aquifer, the first of these challenging projects.

LA residents live in an extreme environment. Since 1800 there have been over 90 significant earthquakes in LA, and the city lies on over 50 active/potentially active fault segments. But this precariousness also means the city is well-prepared: all new developments are built with anti-earthquake technology and only older buildings need updating.

04 / Infrastructure

LA has embarked on a programme of investment to change the way people move around the city and to develop communities around transit hubs, improving access to opportunities and critical services. Traffic continues to be a major issue despite significant investment already made and many residents face a one-and-a-half to two hour commute to work, on average wasting 64 hours in traffic each year, making LA the most traffic congested city in the US.

Metro is the major operator of bus and rail transit in Los Angeles, with 1.5 million passengers on a typical weekday. The ongoing Metro expansion, begun in 2008, was the largest public works investment in the US. Measure M, on the ballot in November, must be passed to secure a further Β£97bn from tax revenues for transportation (for the county, over 40 years).

The investments will use a transit oriented development model to ensure land usage and transit investments are meeting the needs of the community and driving growth. LA is known as a city where everyone drives: of those surveyed in 2013, only 11% used public transportation to get to work, about 37% of whom were transit dependent. It is a principle of the new approach that social equity can be improved when transit becomes a preferred option, rather than the only choice.

As part of the sustainability βpLAnβ, city government has outlined several goals to improve transit and mobility in the city:

- By 2017 establish a bike share with at least 65 stations and 1,000 bikes

- By 2025 reduce vehicle miles travelled per capita by 5%, and by 10% to 2035

- By 2025 at least 35% of all journeys to be non-car, and 50% by 2035, up from only 16% today

- Increase multimodal connections at 10 railway stations.

Investment in maintaining LAβs strong aviation position is essential: LAX is the sixth busiest airport in the world and the USβ gateway to Asia, with 75m passengers in 2015. The LA World Airport project is a massive transformation of all the airports surrounding LA joining into one system and operating as a collective. A Β£3.3bn capital improvement program is underway at LAX, generating nearly 40,000 local jobs.

Los Angeles is not just investing in transport infrastructure: with 250 days of sunshine per year the city plans to become a leader in solar energy, increasing cumulative mW of local photovoltaic power to 1,500-1,800 by 2035. There are also plans in place to install at least 1mW of solar panels on the LA Convention Center rooftop, and to increase storage capacity in the city to 1,654-1,750mW by 2025.

Table 3: Infrastructure projects 2010-2020

| Project | Completion |

|---|---|

| Phase 2a Metro Gold Line Foothill Extension (expected) | 2016 |

| Metro Crenshaw/LAX Line connecting Expo and Green Lines via LAX (expected) | 2019 |

| Regional Connector, providing one-seat ride for travel across LA County (expected) | 2020 |

| Gold Line Foothill Extension to Montclair and Ontario airport | n/a |

| Regional Bike Share Program | n/a |

| Sepulveda Pass Corridor | n/a |

| Metro Phase 1 Purple Line Extension into Westside | 2023 |

| California High Speed Rail between LA and San Francisco | n/a |

Social infrastructure

Social infrastructure is in dire need of updating, with many buildings old and not fit for purpose, as well as demand pressures due to significant growth in the population.

The community colleges measure on the ballot in November proposes Β£20-32bn of spending just on education and the Unified Schools District is incentivising the private sector to invest in LA.

Significant investment is also being made in open spaces, with Quimby funds requiring developers to invest in public spaces/facilities within their sites. However, after significant investment to bring hospitals up to seismic standards, it is likely that less investment will be seen in the health sector in the near future.

05 / Construction market

Construction jobs were up 6.9% in 2015 and construction starts spend is forecast to increase by 14% over 2016, indicating that high levels of activity are set to continue. Most local contracting firms rebounded post-recession and are achieving profit margins in excess of pre-2008 levels.

LA is the US HQ of a mix of contractors, including Aecom and Parsons Corporation and due to the growing number of large infrastructure and commercial projects in the region, various international construction and engineering firms have increased their market presence. Potential selection as the 2024 Olympic city could boost the construction market further, shoring up a pipeline for the next eight years at least.

However, activity is becoming more challenging, with resources increasingly limited and challenges around finding the right skill sets. After years of abundant labour supply keeping costs down, labour costs are creeping up, whilst material costs continue to grow. Another strain on costs is the lack of land in prime areas, causing land prices to increase by almost 85% since 2012.

Growing costs have fed into massive growth in property values over the past five years, reaching or surpassing the 2007 peak in most areas.

Table 4: Residential and commercial developments

| Project name | Units/ft2 | Estimated completion | |

|---|---|---|---|

| Residential (units) | Metropolis Phase II | 1,247 | 2018 |

| Olympic and Broadway | 686 | 2016 | |

| Circa | 648 | Q4 2017 | |

| Commercial (ft2) | The Boardwalk, Irvine | 537,224 | Q3 2017 |

| The Brickyard | 494,000 | Q4 2016 | |

| 400 Spectrum Center, Irvine | 425,044 | Q3 2017 |

06 / Residential

Housing need is currently not met and housing is not affordable, with LA the most expensive housing market in the US when comparing median rents to median incomes. Prices have reached record highs for the country, including a median home price of nearly Β£570,000. Property values have more than doubled for residential units over the past five years and some of growth was driven by the booming technology sector. Rents are also growing, by 4% to June 2016 to surpass Β£2,430 median rent for a two bedroom property, placing it among the top five highest priced rental markets in the US. Targets have been outlined by the municipality for both affordable and overall provision of housing based on what it is believed possible to supply. The city is expected to need 82,000 units through to 2021, but as outlined in the table above, the market will oversupply private and undersupply affordable housing, not meeting the housing needs of the city. pLAn outlines the aim to promote appropriate development, encourage housing around transit hubs and increase the production and preservation of affordable housing. Aims include: n By 2025 57% of all new housing units to be built within 1,500 feet of transit, and by 2035 65% n 100,000 new units by 2021, 150,000 by 2025 and 275,000 by 2035 n Boost housing investment by around Β£1.5bn over the next five years. While the volume of residential sales has been slowing since June 2016, down 30% from the previous year, foreclosures are close to an all-time low and vacant properties are only 7% of units. Continued high demand is likely to keep pressure on rental and sales values.

Table 5: Housebuilding targets

| Income category | City objective | Needed according to regional estimate | Shortfall or surplus |

|---|---|---|---|

| Affordable (for those on income <120% Area Median Income) | 11,559 | 46,000 | -34,441 (75% shortfall) |

| Market housing | 48,000 | 36,002 | +11,998 (33% surplus) |

| City objective total | 59,559 | 82,002 | -22,443 (27% shortfall) |

07 / Commercial

The commercial market in LA is booming. Rental rates increased 7% to Q2 2016, to Β£2.22 per ft2 per month and the office vacancy rate was 14.3% in Q2. The market maintains strong net absorption at 507,400ft2, nearly double the 10 year average, with West LA accounting for most of this figure.

Comprised of 303.3 million ft2 of multi-tenant office space, the LA office market is the third largest in the nation. Demand for modern office space is high, leading to high vacancy rates of older commercial properties located outside the core office locations. Despite that, major commercial transactions occurred in almost every submarket over the past year.

In 2016, a massive 4.2 million ft2 of office space was under construction in the Greater LA area, continuing high levels of activity in commercial construction.

Office demand is projected to continue to increase through 2017, which will reduce vacancy rates further, and expand lease rates 2.4% by mid-2017.

Table 6: Summary statistics for commercial market Los Angeles Q2 2016

| Class A | Class B | All classes | |

|---|---|---|---|

| Vacancy rate | 14.30% | 15.80% | 14.90% |

| Change from Q1 2016 | -0.02% | -0.01% | -0.02% |

| Net absorption (β000 ft2) | 365 | 256.8 | 687.2 |

| Construction completions (β000 ft2) | 124.5 | 0 | 124.5 |

| Under construction (β000 ft2) | 2,953.80 | 1,225.90 | 4,179.70 |

| Average asking rent (FSG) | Β£2.70 | Β£1.75 | Β£2.22 |

| Year-on-year change | 7.40% | 6.90% | 7.00% |

08 / Retail and hospitality

Sports, a prized pop up restaurant culture, the luxury travel market and, of course, Hollywood all combine to maintain LAβs position as a tourist destination. In 2015 the city achieved a record level of tourism at over 45 million visitors for the year, accounting for more than Β£16bn in direct spend for the LA economy.

Given its draw as a destination city it is no surprise that LA has the second highest number of rooms in the country, at 133,573 rooms across 915 hotels. Occupancy rates for major downtown hotels will reach 77.7% in 2016, with average daily rates of Β£178.

Table 7: Hotel developments

| Hotel | Status | Rooms |

|---|---|---|

| InterContinental Wilshire Grand | In construction | 900 |

| JW Marriott Expansion | Planning | 755 |

| Hotel Indigo Los Angeles at Metropolis | In construction | 350 |

The market continues to see a robust level of investment, with a total of 95 new construction projects and 74 ongoing renovation projects underway. Activities are densely concentrated in downtown LA and LAX areas; in downtown alone there are six upscale hotels in construction and another nine under planning. As LA competes with the luxury travel markets of the Middle East and Asia there has been investment in some iconic projects, including the One Wilshire hotel, which aims to be LAβs first six star hotel. To meet growing demand there are a total of 13 hotels in the pipeline with an additional 4,339 rooms under way.

Tourism and strong local demand have fed into the retail market experiencing one of the highest positive absorption levels of major American retail markets. Greater LA has 472 million ft2 of multi-tenant shopping centres and single tenant properties, and attracts a mix of high end and affordable retailers due to the diverse market.

Demand is high; the vacancy rate dipped to 4.5% in June 2016 and the asking rental rate grew to Β£1.83 per ft2 per month. In the LA Basin a total of 1.64 million ft2 of retail is currently under construction and the high median incomes and growing population means the area will continue to be ideal for retailers.

Table 8: Summary statistics for retail market Los Angeles Q2 2016

| Vacancy rate | 5.90% |

|---|---|

| Change from Q1 2016 | -0.04% |

| Net absorption (β000 ft2.) | 1,658 |

| Construction completions (β000 ft2) | 562.4 |

| Under construction (β000 ft2) | 1,640 |

| Average asking rent | Β£1.83 per ft2 |

| Year-on-year change | -2.50% |

09 / Conclusion

Los Angeles is a great example of how urban design can create socio-economic inequalities, as well as how it can solve them. Recognising the challenges residents face in accessing critical services and jobs, Los Angeles is transforming the city around transit hubs to maximise opportunities for all. Sustainability is at the heart of Los Angelesβ regeneration and the city will continue to lead by example.

With strong investment in regenerating areas such as downtown LA, the city will be an example of how to address urban blight sustainably. And if the βcity where no one walksβ can provide equity through public transportation, then any city in the US can too.

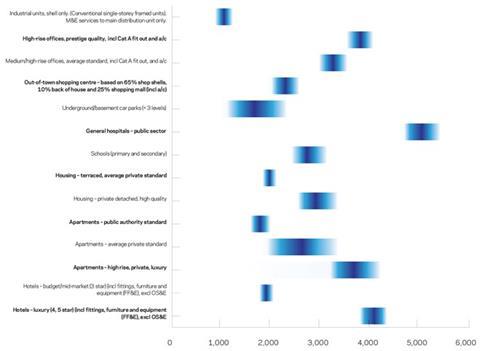

Table 9: Indicative costs (Β£ per m2) in Los Angeles

No comments yet