The UKŌĆÖs biggest contractor appears to have slipped into crisis with a profit warning, the departure of the chief executive and ┬Ż400m wiped off the firmŌĆÖs value. So, what is Balfour BeattyŌĆÖs next move?

Last weekŌĆÖs shock profit warning at the UKŌĆÖs biggest contractor saw more than ┬Ż400m wiped off the value of the firm in a matter of minutes. But it wasnŌĆÖt so much the identification of a ┬Ż30m hole in Balfour BeattyŌĆÖs predicted profits for this year, or the departure of the firmŌĆÖs chief executive Andrew McNaughton after just a year in the job that spooked investors. It was the announcement of its intention to sell its ┬Ż1.6bn professional services arm, Parsons Brinckerhoff, interpreted as a move that effectively junked the long-term strategy of the business as articulated for the previous five years.

Because Balfour Beatty has been telling the world for more than five years of its intention to become a global infrastructure business able to operate across the life cycle of built infrastructure - from designing and planning, to financing, building and maintaining. But TuesdayŌĆÖs announcement made clear the board has starkly reduced its ambition for the ┬Ż10bn turnover giant.

The vision now is of a UK and US contractor, with a supporting PPP investment business - which would at current levels turn over around ┬Ż6bn. Steve Marshall, who has stepped in as executive chair while a replacement for McNaughton is sought, told analysts last week the board had realised ŌĆ£we canŌĆÖt go on like this.ŌĆØ

He said: ŌĆ£The boardŌĆÖs general approach is that the more focused our structure is, the better that is going to be [ŌĆ”] The thoughts of any expansion plans into new market from a construction viewpoint are not on the agenda and we donŌĆÖt believe itŌĆÖs in shareholdersŌĆÖ interests that they should be.ŌĆØ

The announcement from the UKŌĆÖs bluest of blue chip builders came as the culmination of two years of woe, which began with its decision to restructure and simplify the UK business, with the loss of 400 jobs, in 2012. It also appears to mark the end of the vision of the company laid out by former chief executive, Ian Tyler, the architect of the company we know today who more than doubled turnover during his time in charge.

So where did it go so wrong for the 105 year-old firm which became the biggest global brand in UK construction? And what does the future hold for it now?

Global one-stop shop

By the time Tyler took over in 2005, Balfour Beatty had already bought regional contractor Mansell, and was embarked on a serious growth drive. But with his appointment the acquisition drive went global - adding US contractors Centex Construction and GMH Military Housing to the firmŌĆÖs widening portfolio of construction and support services businesses. The 2009 purchase of respected US engineering consultant Parsons Brinckerhoff, for $626m (┬Ż380m), was the cherry on the cake of this strategy.

This added to Balfour BeattyŌĆÖs own nascent consultancy business to create a ┬Ż1.6bn turnover professional services firm, meaning it could truly boast to be a global one-stop-shop for infrastructure clients keen to bundle up the purchase of professional services with delivery of major projects.

It said at the time its key customers were looking for suppliers to ŌĆ£get involved earlier in the project life cycleŌĆØ, and that the Parsons Brinckerhoff acquisition would ŌĆ£enhance [BalfourŌĆÖs] ability to respond to evolving procurement methods such as design and build, alliances and PPP concessionsŌĆØ.

When the credit crunch hit Balfour Beatty was initially protected from its impact by long-term framework contracts and public-sector work. But as the subsequent recession deepened it began to realise, like many other UK contractors, that it was too big in its current form. More than a decade of acquisitions had created a situation whereby the 12,000-strong UK construction business - itself responsible for just a third of Balfour BeattyŌĆÖs total turnover - contained eight different customer-facing brands within six separate operating businesses based in 75 offices.

A desire to simplify this structure led it to launch a major restructuring programme in spring 2012. The restructure was designed to create ┬Ż50m in savings through creating a single unified firm - Balfour Beatty Construction Services UK - operating in just three business streams: major projects; regional; and engineering services. The restructuring was to be completed by January 2013 and would ultimately result in the loss of 400 back-office jobs and almost 40 office closures.

No more nasty shocks?

Balfour decided to approach this change through a single mammoth consultation process with staff, which effectively put more than 1,200 staff on notice. The restructure was in itself such a major operation it had its own internal branding, ŌĆ£Realising Our VisionŌĆØ, and a central team set up to manage it from the firmŌĆÖs Wilton Road head office.

The idea was to spend three months consulting with staff, three months explaining the vision, and three months implementing it. Everyone was to get a chance to put forward their point of view. But almost immediately the review got bogged down by the sheer scale of the task, costs started to mount and it was six months before the firm settled on a way forward.

According to BalfourŌĆÖs accounts it ultimately spent ┬Ż48m on the process over two years.

One senior source close to the process says: ŌĆ£Balfour was very concerned about industrial law and tried to go through the due process and do it the right way. But it should have done it faster, and maybe accepted the consequences of that.ŌĆØ

A separate senior staff member, who has since left, says: ŌĆ£A lot of people were put on notice, and told they had to re-interview for their jobs. But then as the process took longer, it was often nine months until they were interviewed, meaning they were living with that uncertainty for the whole year. It had a massive implication for staff and morale. A lot of good people just jumped ship.ŌĆØ

In public Balfour Beatty has consistently put the problems in the UK construction business down to poor market conditions exacerbated by bad commercial and risk judgements on a number of jobs. But insiders are clear that much of the blame lay with the restructure.

The senior source says: ŌĆ£Balfour simply spent too much time on the organisational review and lost the plot on the projects. There was so much focus on people, where theyŌĆÖre going, offices, and so on, that peopleŌĆÖs focus on where they earn money slipped. A lot of people should have stepped up to the plate but didnŌĆÖt.ŌĆØ

These problems may have been exacerbated by what the current UK chief executive, Nick Pollard, last week described as a ŌĆ£devolved structureŌĆØ at the firm. Rather than impose strict central controls, former chief executive Ian Tyler, who was replaced by his deputy Andrew McNaughton in March last year, had preferred to give financial autonomy to local business units and rely on his ability to quickly pick up where problems arose. Pollard said last week local businesses were ŌĆ£able to determine the price at which they bid, their view on risk, their view on inflation and their view on the contract terms they were willing to accept.ŌĆØ

Furthermore, the legacy of multiple acquisitions left the UK business operating across 11 different accounting systems - something the restructuring was supposed to address. BalfourŌĆÖs Pollard told analysts last week that ŌĆ£IŌĆÖd hate you to wander away thinking that this was all about data and systems that werenŌĆÖt functioning in some way. ItŌĆÖs not.ŌĆØ

But insiders tell a somewhat different story. The senior source close to the process said: ŌĆ£The accounting issue meant it took a certain length of time for you to find out where you were across the business. It meant the opportunity to nip problems in the bud was often lost. By the time you got the information that there was a problem, it was too late.ŌĆØ

Balfour Beatty says its move to a single accounting platform, Oracle, is due to finally complete this year.

Meanwhile the market went from bad to worse. The cancellation of the ┬Ż50bn ║├╔½Ž╚╔·TV Schools for the Future programme, on which Balfour had been successful in winning work, hit the firm hard. While some work was cancelled other jobs were delayed or, as in HertfordshireŌĆÖs BSF programme, cut down to a fraction of their previous size. This rendered prices that had won larger bids uneconomical on a vastly reduced workload.

At the same time the UK market for PFI projects collapsed following the governmentŌĆÖs decision to review and replace the PFI financing process. PFI projects had been seen as a key area where clients would adopt an integrated approach to procuring professional services and construction work. Hence the resultant collapse in PFI work reduced the hoped for opportunities for Balfour Beatty and Parsons Brinckerhoff to win work as a joint team, reducing the acquisitionŌĆÖs ŌĆ£synergiesŌĆØ.

In the recession clients also felt cheaper prices could be obtained by breaking procurement down into its component parts. The senior Balfour source says: ŌĆ£Clients wanted to cherry pick, to break jobs down, to divide and conquer. They also worry that if thereŌĆÖs a problem they canŌĆÖt get to the nub of it if theyŌĆÖre dealing with the smokescreen of one organisation.ŌĆØ

A lot of people were put on notice, and told they had to re-interview for their jobs. It had a massive implication for staff and morale. A lot of good people just jumped ship

Senior staff member

A rival contractor chief executive admits this problem wasnŌĆÖt one limited to Balfour Beatty: ŌĆ£The synergies between construction and consultancy arenŌĆÖt as great as we thought. It is fair to say we have all overestimated the appetite from clients for the combined offer.ŌĆØ

In this environment, being part of the same firm with Parsons Brinckerhoff was as likely to actually restrict Balfour winning construction work as help it, a fact tacitly admitted by Balfour BeattyŌĆÖs Pollard last week, who told analysts selling Parson Brinckerhoff would in some ways ŌĆ£remove the issue of conflict in potential customersŌĆÖ minds when they buy construction.ŌĆØ

Executive chair Marshall simply stated that synergies, estimated as just $8m (┬Ż4.7m) at the time of the merger but with a hope they would expand - had ultimately proved ŌĆ£modestŌĆØ.

It was in this market context that Ian Tyler was considering his retirement after a comparatively lengthy eight years in charge. One senior source says Tyler and the Balfour Beatty board took around a year to pinpoint McNaughton as his successor, though the company describes the process as ŌĆ£smoothŌĆØ.

By the time McNaughton took over in March last year, he was already in the eye of the storm. The firm announced a ┬Ż50m profit warning following the problems in the regional construction business, which was upped to ┬Ż60m in March this year, despite Pollard promising last summer there would be ŌĆ£no more nasty shocksŌĆØ. Last weekŌĆÖs further ┬Ż30m warning showed the problem extended also to its M&E business, engineering services, and proved the nail in the coffin for McNaughtonŌĆÖs brief tenure.

Unclear future

Pollard last week again told analysts that the UK business had now ŌĆ£significantly strengthened senior teams as well as [ŌĆ”] tightening up and improving the processes that cover bidding and project controls alikeŌĆØ.

Prospects for the firmŌĆÖs regional business are now generally accepted to be good, but queries remain about the process - a previously unannounced strategic review - that came up with the plan to sell Parsons Brinckerhoff in response to all these woes.

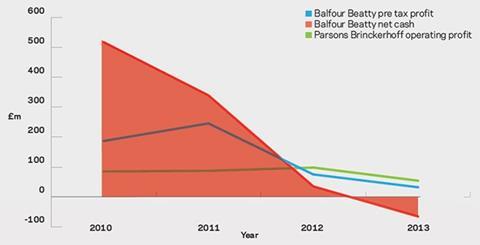

Analysts are furthermore asking a raft of wider questions about the groupŌĆÖs future, such as why it is choosing to sell a business in Parsons Brinckerhoff that, at over 5% margin, is far more profitable than the rest of the group, and, as the chart (below) shows, has shown more stable performance? Does that then spell a much more low-growth future than previously envisaged? What does the strategic review mean for the ┬Ż1.3bn turnover support services arm of Balfour Beatty? And, last but not least, is the company as a whole up for sale?

Kevin Cammack, analyst at Cenkos, downgraded the stock in response to last weekŌĆÖs announcement, and says the review leaves Balfour Beatty ŌĆ£in danger of throwing the gold out not the nickel [and] risks further long-term diminution of valueŌĆØ while giving relatively little cash back to shareholders. Despite the fact the sale of the professional services business may raise ┬Ż750m, Cammack estimates the groupŌĆÖs deepening net debt, pension liabilities and the taxman may swallow over ┬Ż450m of this, and leave a smaller and less profitable business behind - even if all of the performance issues are ironed out.

Marshall defined the future of Balfour Beatty last week by saying ŌĆ£the axis of our Anglo-American construction strength and our investments business [is] a pretty powerful way of defining Balfour Beatty as a core,ŌĆØ a vision that did not include support services. He would not be drawn on whether Balfour Beatty will look to sell this business, saying the marketing of Parsons Brinckerhoff was the boardŌĆÖs current primary focus. However, he added: ŌĆ£ThatŌĆÖs not ruling out other options going further. WeŌĆÖve got to take this step by step,ŌĆØ implying that the option remains on the table.

In addition, his comments did nothing to prevent speculation the board may be attempting to outline a simpler, more digestible idea of the company in order to attract potential buyers for Balfour Beatty as a whole. Asked directly if he was considering it, Marshall said: ŌĆ£No-one is ruling any options out. You never can do as a board because you have a fiduciary responsibility to your shareholdersŌĆ” For anybody assessing the attraction of the group to anybody else, clearly a simpler de-cluttered group is easier to assess, but our principal objective is to get the management delivering operationally.ŌĆØ

The future is, for now, unclear to say the least. Balfour Beatty is not alone in finding the current market taxing - with resurgent specialist contractors forcing up costs on cut-price jobs won in the recession - or in having overestimated, during the boom, the willingness of clients to entrust a single supplier with the whole life cycle of a project. But Balfour has been hit far more than most.

Whether the sale of Parsons Brinckerhoff is a panic measure in response to yet another profit warning, or, as claimed by Marshall, the result of a determined and considered strategic review of options for the group by the board, is impossible to say. But with the death of Ian TylerŌĆÖs long-held vision of Balfour Beatty, appears to come a lesson about the dangers of rapid acquisitive expansion without proper integration, and of underestimating how the recession changed clientsŌĆÖ needs.

Balfour Beatty: How has it performed?

The impact of the downturn and financial problems on Balfour BeattyŌĆÖs financial performance are clear to see - particularly in terms of the impact upon the businessŌĆÖs net cash. However, profits at Parsons Brinckerhoff have remained relatively stable, albeit having suffered in the last year from a ┬Ż40m hit due to the cancellation of major minerals projects in Australia. The businessŌĆÖ operating profit margin in 2012 of 5.9% compares with 1.8% in the same year for Construction Services. The comparatively stronger performance has led analysts to question why Parsons Brinckerhoff is the part of the business now set to be sold.

No comments yet