Delays to the UKŌĆÖs programme could leave us with an energy generation gap in just a few years

’╗┐Since the earthquake and tsunami in Japan on 11 March triggered a nuclear disaster at the Fukushima Daiichi power plant, a string of countries have gone back on their plans to generate energy. Germany is to close all of its 17 nuclear plants, which produce 28% of its power, in the next 11 years, new build plans have been scrapped in Switzerland and Italy and put on hold in China, where no fewer than 28 reactors are planned - or 40% of proposed plants worldwide.

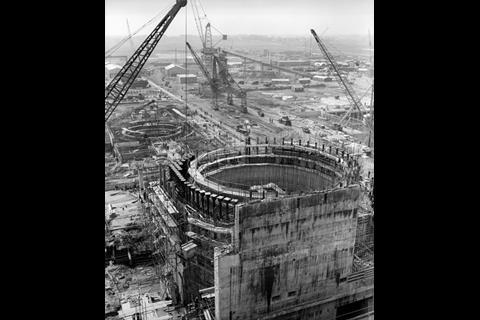

So far, however, the UK has remained committed to its two-decade pipeline of eight new power stations, worth about ┬Ż40bn. In fact, so committed has it been that two days after the accident, it was busily co-ordinating a response with multinational companies EDF Energy, Areva and Westinghouse.

Not that the government has swept safety concerns under the carpet - the day after the accident, the energy and climate change secretary, nuclear convert Chris Huhne, called on chief nuclear inspector Mike Weightman to write a report on ŌĆ£the implications of the situation in Japan and the lessons to be learnedŌĆØ.

But with the review widely expected to give the programme the go-ahead and with the government having green-lit eight sites for potential new build on 23 June, the prevailing concern is not that the UK will backtrack on its commitments but that the programme is in danger of falling behind and that the energy wonŌĆÖt be there by the time we need it.

Why nuclear?

In the words of Maja Zeremski, director of energy at Davis Langdon: ŌĆ£There is no silver bullet in terms of energy in the UK. The country is unique in that it needs a true mix of sources and it is impossible to see how it would work without nuclear playing a major role.ŌĆØ

One reason for this is that 40% of the power plants we are using now must close down in the next 15 years. This is partly because some are reaching the end of their lives. For example, all but one of the UKŌĆÖs 10 existing nuclear power stations, which provide 20% of our power, are due to come out of service by 2023, by which time they will be too old safely to continue. More alarmingly, for similar safety reasons, between now and 2016 coal and oil plants currently generating 13GW, (the UK uses 60GW per day at peak times), will have to close.

The closures are also being driven by legislation. The European Union has stipulated that its collective greenhouse gas emissions must be cut by 20% on 1990 levels by 2020 - with the UK government pushing for this to be raised to 30%. Before that the EU Energy Services Directive of 2006 will come into force in 2016/17, demanding 9% savings in energy end-use (savings when energy is sold to end-users). Another law that may lead to plants being closed is the 2009 Renewable Energy Directive, which mandates levels of renewable energy use within the European Union by 2020 - the UKŌĆÖs target is 15%. There will be huge fines for countries that fail to meet the targets.

At the same time the UKŌĆÖs energy consumption requirements are set to rise, driven mainly by the electrification of transport - and particularly the High Speed 2 rail project. Zeremski says daily consumption is rising by 1GW a year: ŌĆ£People assume we are using less electricity due to the financial downturn but this is not the case.ŌĆØ

Then thereŌĆÖs security of supply. At present almost half the UKŌĆÖs energy comes from gas (see table below) and some 80% of this is imported from the Middle East and North Africa. Zeremski says: ŌĆ£We have seen how politically unstable this region is and, taken with Russia having cut the gas supply to Belarus and Ukraine several times in recent years, there is a strong case for increasing our internal production.ŌĆØ

Part of that home-grown production will inevitably come from wind power, both on shore and off shore, and, to a lesser extent, from solar power. But neither is consistent enough to be relied on heavily. Guy Doyle is chief economist of power at Mott MacDonald, and the author of the June 2010 independent report for government, UK Electricity Generation Costs Update. He says: ŌĆ£The capacity of wind on a good site is 35% and for a solar plant in the UK it is just 10%. While these sources will become cheaper as technology improves, they are not as productive.ŌĆØ Crucially, they cannot provide the consistent ŌĆ£baseloadŌĆØ of

power required.

Another sustainable option would be carbon capture and storage (CCS), the process of catching and storing the greenhouse gas emitted by burning coal and gas before it escapes into the atmosphere. Doyle says that the problem with CCS is that it is even less tested than the equipment that would be used in new nuclear reactors. ŌĆ£The technology has yet be demonstrated at scale, so there is huge risk, plus you have to factor in fossil fuel price risk, which is considerable - prices could double in the coming decades.ŌĆØ

Costs

Clinching the argument for nuclear, though, is its long-term cost (see box, left.) Mott MacDonaldŌĆÖs report found that the upfront costs of new build are higher than other approaches. This is because the business of building a reactor, which takes the best part of five years, is just so complex. Plus, the new generation of plant is being built for the first time entirely by the private sector, which means the government is demanding extra safety precautions. However, once the

technology has been tried, tested and established, it is the cheapest way to generate energy.

The report says: ŌĆ£By the early 2020s, nuclear is projected to have a ┬Ż35-40/MWh levelised cost advantage [installation cost divided by expected lifetime energy output] vs the lowest cost fossil fuel options and it would be the least cost zero-carbon generation option among the main technologies.ŌĆØ In contrast, the comparable off-shore wind cost is ┬Ż110-125/MWh. Gas will cost ┬Ż80/MWh and coal ┬Ż104.5/MWh.

One thing could throw a spanner in the works: fears have been raised that Fukushima could push up costs if it leads to a significant increase in safety requirements. While we will not know the situation until we have the findings of the Weightman report, due in September, the interim report, published in May, has already identified 26 areas for a safety review. The nuclear industry has played this down, however. Horizon Nuclear Power, for example, one of the three developers (alongside EDF and NuGen, see box below) poised to build nuclear reactors in the UK, has said it does not expect to see a cost hike as a result of Weightman. Leon Flexman, head of communications for Horizon, says: ŌĆ£We agree with all recommendations of the interim report.ŌĆØ

Timing is everything

Less positively for the industry, the Weightman report is holding up the nuclear new build programme, which it can ill afford. This is because the report has delayed the publication of the Generic Design Assessment (GDA), the crucial assessment from the Office for Nuclear Regulation and the Environment Agency of the proposed reactors, ArevaŌĆÖs EPR and Westinghouse ElectricŌĆÖs AP1000. The GDA was supposed be published at the end of June but it will now be postponed until after the Weightman findings are published in the autumn. As understandable as this is, James Locke, director for nuclear and process engineering at Mott MacDonald, says it will add between six and nine months to the build programme.

Meanwhile, Horizon was set to make its most important appointment, that of the delivery team, this summer, but the two consortiums in the running, which include Laing OŌĆÖRourke and Balfour Beatty (see box), must also now wait until after the Weightman report. Flexman says: ŌĆ£We do understand this delay, but we are not happy about it.ŌĆØ

Some commentators have questioned whether Horizon, with listed German parent companies RWE and E.on, will be able to continue the programme at all after the German governmentŌĆÖs decision to stop nuclear power. Flexman denies this, though: ŌĆ£Our shareholders have said that the situation in Germany has no impact on the nuclear business in the UK and we intend to continue developing low-carbon energy here.ŌĆØ Indeed, the fact RWE and E.on are suing the German government over the cancellation of new build suggests they remain committed to nuclear.

EDF, meanwhile, which is committed to building the first reactor of the new generation - one of two new builds at Hinkley Point, Somerset - . But many industry experts now expect this to be closer to 2020.

These delays are all the more troubling because they follow earlier hold-ups. A particular problem is the fact the industry is still waiting for the government to approve the National Policy Statements on energy infrastructure. The statements, which are based on a public consultation and identify eight sites for nuclear new build, were at last put before parliament on 23 June. They were originally meant to have been ratified by spring 2011 but were pushed back due to the change of government and a second round of consultation from October 2010 to January 2011. In total, Locke says the programme is about two years behind where the original new build plan, announced in January 2008, envisaged it would be by now.

To delay any further would cause major problems. Doyle says: ŌĆ£The closure of existing plants over the next 10 years, starting in 2015, means that in just a decade we could lose 15GW, which is a quarter of peak demand.ŌĆØ Factor in the eight to 12-year development period for a new reactor and it becomes obvious that ŌĆ£waiting another five years before starting nuclear new build would be cutting it fineŌĆØ.

The need to press ahead is compounded by a looming global bottleneck of materials. Zeremski says: ŌĆ£If you consider the extensive plans for nuclear power in China and India, and the fact that nuclear developers will be competing not just for ordinary building materials but for very special steel and concrete, you could have hyper-inflation.ŌĆØ

What now?

So what does the government need to do get the programme moving? Although the Weightman review looks set to clear the way for new build, a number of other things need to happen. The first is for the GDA report to be swiftly published after Weightman. This is the essential green light needed for the two proposed designs. It is particularly important for Horizon, which is poised to choose one of them once the GDA results are known. But EDF, although it has chosen ArevaŌĆÖs EPR, will still not commission it until it gets the official nod. Doyle says: ŌĆ£The GDA process is incredibly important; if it works smoothly, fine; if it doesnŌĆÖt, it will delay follow-ons for years.ŌĆØ

Then the industry needs the National Policy Statements to be ratified. With the summer recess looming delay looks inevitable. EDFŌĆÖs Spence says: ŌĆ£The government has been clear enough but having the process ratified by a vote in parliament will allow the planning process to take full account of the NPS.ŌĆØ

A final major piece of the puzzle is the widely anticipated Electricity Market Reform white paper. This document is fundamental to the economic viability of any future nuclear power station in the UK. It will set out a new market framework that will aim to enable the delivery of low-carbon energy, including, crucially, a guaranteed unit price feed-in tariff (FIT) for the output of low-carbon energy generators, including nuclear. The system would work like this: if the wholesale price of electricity in the UK falls below the FIT, the low-carbon generators will be paid the difference, raised through a levy on electricity consumers. But if prices rise above the FIT, the power companies must reimburse consumers the difference.

Equally vital for the nuclear industry is what the white paper will say about the price of carbon. It is expected to confirm that the government will support a steadily rising carbon price, thus reducing volatility in carbon trading and making low carbon investments more attractive. This will be done by removing the exemption for fossil fuel generators from the climate change levy and from oil duty, making carbon more expensive. The climate-change levy will be levied on different fuels at different rates, determined by their carbon content.

The white paper is due to be published before parliament breaks for summer and it wonŌĆÖt come a moment too soon. ŌĆ£We need the EMR published and then rolled out as fast as possible because nuclear developers are not going to commit to buying equipment before they know what the economics are,ŌĆØ says Doyle. After that, the legislation to implement the white paperŌĆÖs policies must be passed, which Doyle reckons could take another two years.

With the UKŌĆÖs energy gap looming, it is clear that we must act fast to prevent the lights going off. The arguments for filling the gap with nuclear power are controversial but compelling. And in light of the large amounts of money and time it takes to build a nuclear reactor, it is clear that the new build programme must get going soon. Zeremski says: ŌĆ£The thing that the nuclear programme really cannot afford is a serious delay - even after earthquakes and tsunamis.ŌĆØ

’╗┐UK energy mix

Coal 25.8%

Natural gas 47.7%

Nuclear 18.0%

Renewables 6.6%

Other 1.9%

Source: Department of Energy and Climate Change, March 2010

’╗┐Cost comparison

Costs per unit of electricity in megawatt hours after technology is established, taking into account reliability

Nuclear: ┬Ż35-40/MWh

CCGT (combined gas turbines) running on gas: ┬Ż80/MWh*

Advanced super critical coal: ┬Ż104.5/MWh*

Off-shore wind: ┬Ż110-125/MWh

* This excludes the government requirement for CCS capacity to be installed on new coal and gas-fired plant, which will substantially raise the costs, by ┬Ż32-38/MWh in the near term. The carbon penalty on coal and CCGT without CCS is projected to be ┬Ż40/MWh.

Source: UK Electricity Generation Costs Update, June 2010

’╗┐Where theyŌĆÖre at

Three developers have announced plans to build a third generation of nuclear plants in the UK and between them they will build eight new power stations, worth a total of at least ┬Ż40bn. Here is where they are at:

NuGen

NuGen aims to build two plants in Sellafield in Cumbria, which would generate 3,600MW. Construction to start mid-2016 with the first new power station to be operating around 2023. No construction consultants or contractors are understood to have been appointed so far.

EDF Energy

EDFwants to build four sites, two at Hinkley Point, Somerset and two at Sizewell in Suffolk which together will generate 64,000MW. It is about to submit the final submission for the first ┬Ż4.5bn project, Hinkley Point C, to Infrastructure Planning Commission. Main construction of all plants is scheduled for 2013-2020 with the first plant due to start producing power in 2017.

Contracts awarded: Faithful + Gould was chosen in 2010 for procurement and contract management services worth ┬Ż3m over an initial period of three years. Kier and Bam Nuttall won the first contract for the plant, thought to be worth about ┬Ż3m, to build fencing and prepare the site. Nuclear specialist architect YRM is working on the planning and design of the four power stations and AMEC had been awarded the contract to support the architect engineer. Mace is managing the submission of planning and consultation documents and helping with logistics and training.

Contracts coming up: The programme will see EDF let over 150 contacts, worth several billions. EDF is understood to be currently negotiating the big one - the ┬Ż1.2bn main civils contract - with three contractor consortiums. They are: Balfour Beatty/Vinci, Laing OŌĆÖRourke/Bouygues, and Costain/Sir Robert McAlpine. EDF is unlikely to be able to let the main civils contract until planning permission is given, which is expected towards the end of 2012. Some contracts to train the future workforce, build batching plants and some detailed engineering design work might be let before this, however. EDF is also in the pre-qualification stage for mechanical and electrical erection contracts.

Horizon

This is a British nuclear partnership formed in January 2009 between German utilities E.on and RWE. Both operate in the UK, with E.ON in the gas market and building renewable plants and RWE investing ┬Ż1bn in the UK over ten years in modern gas-fired generation and off-shore wind.

Plans: Horizon wants to build two reactors generating 6,000MW at sites in Wylfa on Anglesey and Oldbury near Bristol, with the first reactor expected to start generating power around 2020. It is to pick a reactor design by year end and is choosing between ArevaŌĆÖs EPR and WestinghouseŌĆÖs AP1000. It expects to submit its final planning application in early 2013.

Horizon has contracted a number of companies to conduct assist with the development process. These include early works contracts with the two consortia bidding to be on the delivery team: Areva NP (comprising Areva, Balfour Beatty Vinci and Siemens) and Nuclear Power Delivery UK

(Westinghouse, Toshiba, Shaw Group and Laing OŌĆÖRouke). Horizon has also worked with Fugro Seacore, Structural Soils and Halcrow on ground

investigation activity, Jacobs on marine ecology studies and with Arup and Risktec on seismic assessments. The work has also involved a

number of local subcontractors from North Wales.

No comments yet