The Celtic Tiger has roared its last and now stalks the land looking for work and a way to survive. For many in construction this means looking abroad for sustenance - and the UK is its natural prey. So how afraid should we be?

Dysfunctional, disastrous, horrendous, crushing, treacherous. Those are some of the more polite words used to describe the Irish construction market over the past two weeks. Against the backdrop of the most high-profile financial meltdown since Greece, in which the once-mighty Celtic Tiger was forced to accept a Ōé¼90bn (┬Ż75.7bn) bailout from the EU and the IMF, the countryŌĆÖs construction industry is now but a shadow of its former self.

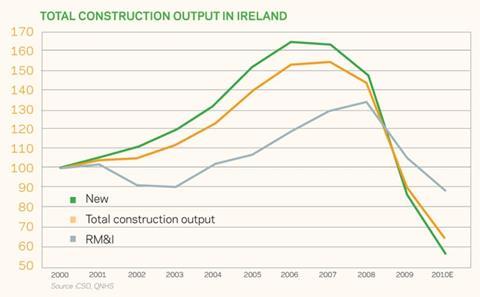

Two years ago, IrelandŌĆÖs construction output was Ōé¼38bn. This year it was Ōé¼11bn. Irish-based economic consultants DKM expect it will fall to Ōé¼9bn in 2011 - a massive 63% contraction in output between 2007 and 2011. As a result, employment in the industry is expected to fall from 376,000 in 2006 to 110,000 by the end of 2010.

And so the fate of Irish construction companies, from architects - 60% of whom are now unemployed, according to DKM - through to contractors, hangs in the balance. Construction tender prices are down, on average, by 27% since three years ago, according to DKM, and the risk of insolvency is huge: two of the countryŌĆÖs top five contractors, Pierce Contracting and McNamara, went bust this November and experts predict there will have been over 700 construction insolvencies in total in Ireland by the end of 2010. What little work remains is characterised by insanely competitive tenders and a constant risk of the main contractor, or someone further up the supply chain, going bust.

The key question though is what the knock-on effect of this will mean for the future of the already fragile UK market where competition is tough, budgets tight and work so drastically depleted? Here we investigate the effect an Irish surge could have and whether new firms should be embraced as an additional source of talent or feared as a threat to an ever-shrinking pool of work.

ŌĆ£The situation for Irish construction companies is horrific at the moment,ŌĆØ says Michael Stone, managing director of Designer, a Ōé¼45m turnover Irish M&E firm. ŌĆ£And we predict itŌĆÖs only going to get worse with more insolvencies to come. We will only work with five or six main contractors now because weŌĆÖre so concerned about the financial situation of the others.ŌĆØ

ŌĆ£Everyone is in panic mode,ŌĆØ adds Paul McGee, operations director of Irish contractor Bennett Contracting. ŌĆ£WeŌĆÖre seeing kamikaze tactics with firms putting in -15% and -20% tenders just to win work. Losing money before they even start, basically.ŌĆØ

Irish firms with any chance of survival need a strategy - and fast. Most realise they are not likely to prosper by staying put so those that can are decamping. Apart from chasing opportunities in Eastern Europe and the Middle East, firms are looking closer to home and some have already moved, or are making plans to move, to the UK. ŌĆ£There has definitely been an upsurge in Irish firms chasing opportunities in the Middle East and Eastern Europe, but the UK gets the lionŌĆÖs share of the interest because itŌĆÖs on the doorstep,ŌĆØ says a spokesman for Enterprise Ireland, the government organisation responsible for developing Irish businesses globally. ŌĆ£The UK has a similar culture and a common language. There are no firm statistics yet on how many Irish companies have moved to the UK in recent months and years but the number is rising and looks likely to continue to do so.ŌĆØ

So how did this get so bad, to the point where Irish firms have little choice but to look for work abroad.

Irish harm

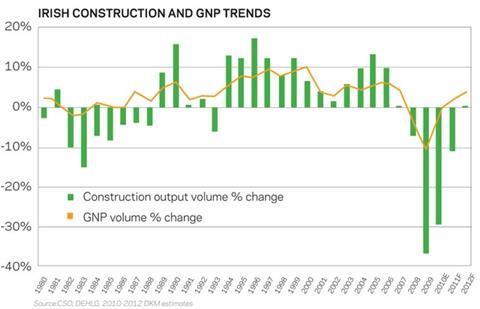

Since 2008, the Irish economy has experienced a significant contraction thanks to an overheated property market, subsequent problems in the banking sector and a rapid deterioration in public finances. In 2009, GDP contracted by 7.6% and GNP fell by 10.7% compared to 2008 - mainly as a result of a 31% decrease in investment.

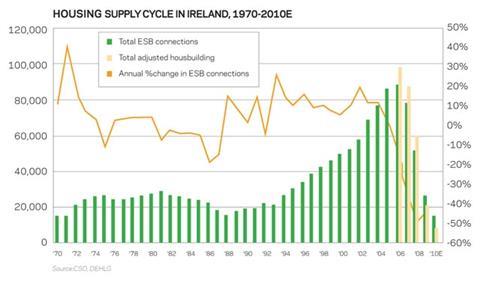

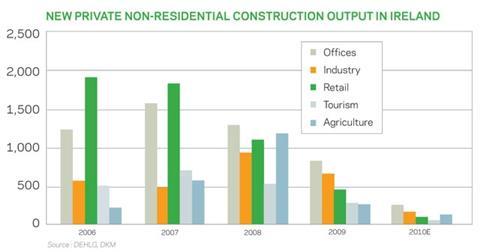

The near-decimation of the construction market in Ireland has gone hand in hand with the fall of the overall economy. Dr Peter Stafford, head of policy and public affairs at the Society of Chartered Surveyors (SCS), explains: ŌĆ£The specific developer-led stuff, residential, was the first to go. Figures show that at the peak of the market, Irish developers were building 90,000 houses a year. This year they built 10,000.

ŌĆ£Then came the commercial and industrial - and the third wave will happen now as public sector cuts loom.ŌĆØ

The cuts Stafford is referring to were announced on 24 November in a budget meant to save Ōé¼15bn over a four-year period - Ōé¼10bn to come from spending cuts, and another Ōé¼5bn from tax rises. The public was warned the savings would be ŌĆ£uncomfortably frontloaded,ŌĆØ with Ōé¼6bn savings to be made next year. It was also announced that 24,750 public sector jobs will go over the four-year period. Annette Hughes, director of economic consultant DKM, says: ŌĆ£The budget could well cut another Ōé¼1bn out of construction output in Ireland as a result of capital projects cuts - which would just be disastrous.ŌĆØ

Indeed, the future for Irish construction companies couldnŌĆÖt look much bleaker. Out of 900 firms in Ireland that went bust in the first half of 2010, construction and engineering firms made up the largest number, accounting for 40% of the corporate failures. DKM predicts that construction firms will account for over 700 insolvencies over the whole of this year. This figure is likely to rise through 2011 and beyond as the public spending cuts begin to bite and firms become increasingly aggressive in their bids for what little work is put out to tender.

ItŌĆÖs no surprise, then, that many construction firms are looking across the Irish Sea - things may be bleak here but from Ireland they appear almost buoyant. As John Stanion, chief executive of Vinci, says: ŌĆ£Any Irish firm that is still afloat will be looking to come over here.ŌĆØ

Friend ŌĆ”

So is this good news for UK construction companies, or the very last thing they need right now? For clients and main contractors looking for subcontractors in particular, an influx of Irish construction firms would not necessarily be a bad thing. Irish builders, engineers and consultants have a reputation for being very good at what they do and for having experience across a wide range of sectors.

Peter Stafford from the SCS says: ŌĆ£Irish firms are known for being extremely efficient. Some of the best and most productive in the world. During the Celtic Tiger boom years, there was a massive investment in construction in Ireland. It was immense and that is now paying dividends in terms of the skills and expertise these firms have to offer. Both private and public sector clients in the UK should bear that in mind and see it as a positive. As for UK firms seeing them as a threat - itŌĆÖs a level playing field and all part of the game.ŌĆØ

And Mark Whitby of +Whitby urges UK firms who may have reservations about the possible influx to look at the situation from a more long-term perspective: ŌĆ£This is good news,ŌĆØ he says. ŌĆ£It is an example of our market returning to normal. The British construction market has, in the past, been sustained by the strength and the knowledge of the Irish - particularly when times were good and we called on them for their skills. There is nothing wrong with quality and talent. ItŌĆÖs actually amusing that we, who trade our talent all over the world, worry when good Irish talent comes here. They have some great engineers and architects.

ŌĆ£We shouldnŌĆÖt feel threatened by the Irish but rather welcome them. I have great sympathy for them. With the pound against the euro at the moment, itŌĆÖs not like they are coming over here from a great advantageous position with a great cost base. TheyŌĆÖre coming over here to find work so they can pay the bills.ŌĆØ

Michael Stone from Irish M&E contractor Designer Group says clients have so far responded well to the additional expertise that companies like his have in sectors such as power and energy. And he has some reassurance for concerned UK competitors - in Designer GroupŌĆÖs case at least: ŌĆ£We use English staff rather than Irish,ŌĆØ he says. ŌĆ£We see ourselves as an English company that is Irish-owned rather than being an Irish firm working in England.ŌĆØ

ŌĆ” or foe?

Elsewhere though, a flood of talent - especially talent that is traditionally well liked by clients and main contractors - is unlikely to go down well with the UK firms that will have to compete with it. Irish firmsŌĆÖ popularity, skills and willingness to fight on price is a major cause for concern for many: ŌĆ£Competition is always a threat, especially when everyone in the current market is looking for the same thing,ŌĆØ says David Hitchcock, head of building consultancy at CBRE.

ŌĆ£There are no Irish firms that we would have a head-on tussle with but it could be a problem for smaller firms,ŌĆØ adds VinciŌĆÖs John Stanion. ŌĆ£Irish firms and tradespeople are very good and this is a market they understand and one they can get to quickly.

I expect there will be more firms coming here and I would expect them to be very aggressive.ŌĆØ

Aggressive is the word. Several Irish firms confirm that one of their main selling points in the UK would be to put in extremely competitive bids - while maintaining quality - something they have had to get used to in Ireland as the situation has deteriorated.

Designer GroupŌĆÖs Stone says: ŌĆ£As to what we can offer UK clients, IŌĆÖd say a bit more value.

The fact is that business is just so bad in Ireland that people are willing to work for less in the UK.ŌĆØ

Peter Fordham from Davis Langdon explains why this could be dangerous: ŌĆ£Obviously the UK is not looking too clever in its own right and weŌĆÖre looking at further declines next year and the year after that. If Irish firms do start coming across in great numbers, this will create greater competition. There is then a risk of further deflationary conditions.ŌĆØ

Julia Evans, chief executive of the National Federation of Builders (NFB), adds: ŌĆ£UK contractors have always had to face competition from non-UK bids. However, with a shrinking base of public sector work, and the private sector challenged by the sluggish lending environment, NFB members are far more concerned that this government should be doing all it can to avoid the demise of the UK construction industry. If order books keep declining, then we are all in trouble.ŌĆØ

Irish-based commentators can see the situation from UK firmsŌĆÖ perspective: ŌĆ£I can understand their concern,ŌĆØ says DKMŌĆÖs Annette Hughes. ŌĆ£The market is already very competitive and workloads are reduced. The last thing UK firms are going to want is more competition driving the costs down further.ŌĆØ

However much of a threat to the UK the Irish construction firms might be, they have been left with little choice but to look outside their own country for work. As Michael Ankers, chief executive of the Construction Products Association, says: ŌĆ£WeŌĆÖre not 100% sure how much worse things will get in Ireland. But they sure as hell arenŌĆÖt getting better any time soon.ŌĆØ

What UK firms want

The M&E contractor is based in Ireland and, since 2008, in the UK

ŌĆ£Since moving to the UK three years ago we have done relatively well and won work including a job on the London Olympics media centre. This year, 30% of our business is based in the UK. Next year we expect to see that rise to 50%. The Irish market is treacherous at the moment and we can only see it getting worse.

ŌĆ£In terms of Irish firms flooding the market, I donŌĆÖt think there will be an increase in firms moving to the UK as itŌĆÖs difficult to do. Size is a problem because there is a lot of investment required so you really have to be over a certain size to make it sustainable. I think youŌĆÖll see more subbies coming over to supply labour.

ŌĆ£Main contractors and clients in the UK like our high levels of expertise, and as for firms that are our competitors in the UK market, we know the market here is very tight too, but firms are always looking for good contractors and we think we can offer them an edge.ŌĆØ

When one market falls away, you shift focus

Paul McGee, director, Bennett Contracting

The company has been operating in the UK for the past two years, as part of a plan to reduce its reliance on the Irish market.

ŌĆ£Our view of the Irish market at the moment is, to be perfectly honest, that it is entirely dysfunctional. We have pulled back from it. There are some kamikaze strategies out there - like putting in -15 and -20% margins. We are still running around a dozen projects in Ireland but they are much smaller than what we were doing in 07/08 and they are based on repeat business wins.

ŌĆ£We shifted our focus to the UK two years ago pre-emptively and our strategy is to run between six and eight projects and run them well to build up some repeat business. We have downsized the firm from 290 to 120 workers over the last three years and have brought 25 people to the UK where weŌĆÖre starting to build a team. We are focused on the South-east and have so far won work on the Olympic village as well as for Premier Inn, Heathrow and Gatwick airports and some leisure and residential schemes.

ŌĆ£The feedback so far from clients has been quite positive. WeŌĆÖre seen to be quite competitive which has helped. Plus, I think some clients think weŌĆÖre refreshing and we shake up the tender list a bit. I donŌĆÖt know how other contractors view us. I guess perhaps as the new kids on the block, but they have to be OK with that. We have capabilities that both UK and Irish contractors in the UK would be foolish to overlook. We have been building up expertise for years and weŌĆÖre now exporting it. When there was a boom in Ireland, we often used UK subbies and I know other Irish firms did the same. ItŌĆÖs just that now the boot is on the other foot.ŌĆØ

This article was originally published under the headline One hungry tiger

1 Readers' comment