Costing Steelwork is a series from Aecom, BCSA and Steel for Life that provides guidance on costing structural steelwork. This quarter provides a market update and updates the five cost models previously featured in Costing Steelwork

For a digital edition version of this update, click here

The construction sector’s reaction to the referendum on Brexit was initially muted. After the dust settled, the industry rallied strongly, shaking off uncertainty and going on to record strong output levels over 2017 and 2018. The current situation appears to be changing, with a negative market response to Brexit and a downward business cycle emerging.

The economics of the construction sector will be influenced by most Brexit outcomes. Sourcing strategies for labour, materials and components are likely to require adjustment, as many projects currently being tendered, or coming up for tender, will have construction programmes extending beyond April 2019.

Construction sentiment has generally held up, despite the mixed economic backdrop. Tier-two contractors are still mostly confident on workload further out into 2019; however, they are talking about more uncertainty ahead, which main contractors have seen for longer.

Operational challenges remain, ranging from wage inflation, skills retention and project delivery, while maintaining staff levels to deliver current workload.

A tight labour market remains an issue for many construction sector firms. Labour input costs are still rising year-on-year, with expectations of further increases into 2019, and concerns around labour and staff resources remain a key issue for many firms. Construction industry regular pay rates continued to rise above earnings for the UK economy in Q3 2018. The “whole economy” measure recorded around a 3% year-on-year change through 2018, but construction regular pay has averaged nearer 5% over the same period.

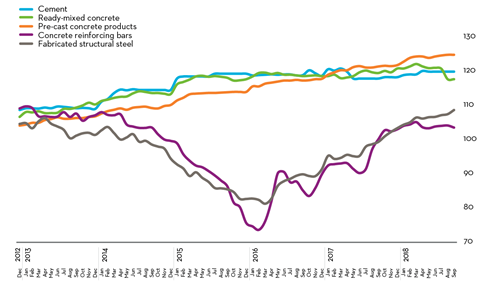

Construction materials costs increased by approximately 5% over the year to the third quarter of 2018. A broader measure of input costs for manufacturing industries, published by the Office for National Statistics, saw input costs increase by 10.3% on a yearly basis up to September 2018. This reflects a pick-up in the rate of change on a monthly and yearly basis. Crude oil was the largest single contributor to the 12-month change, up by 38% over the period, although this is a slower rate than the 41% posted in August.

Extended lead times indicate on-going pressure on resources and that overall workload is using all available market capacity. Further indicators of supply chain tightness – insolvencies data, for example – also signal the on-going difficulties to secure resources. Procurement across the supply chain will continue to be influenced by a mixture of capacity, risk apportionment and selectivity. Supply chain prices are expected to continue a positive year-on-year path as constrained capacity and market dynamics dictate the price to secure staff and labour. However, the rate of price inflation will be lower, which is reflective of a slowing level of activity.

Price inflation trends have slowed and levelled out after a number of years at above-average rates of change. Selling prices are unable to keep pace with the rate of input cost inflation though, keeping commercial pressures elevated. Although there has been some pass-through into output prices, there will remain an inability to recover all of the input cost pressures, particularly as competition increases on a weaker overall outlook on future work. Clearly, this assumes a continuation of current input cost trends.

| Forecast | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

1 |

96.3 |

104.6 |

111.2 |

114.1 |

116.8 |

119.5 |

123.2 |

|

2 |

99.0 |

106.6 |

112.2 |

115.1 |

117.3 |

120.3 |

123.9 |

|

3 |

101.4 |

108.8 |

112.9 |

115.9 |

118.3 |

121.2 |

124.9 |

|

4 |

103.4 |

110.2 |

113.9 |

116.4 |

118.8 |

122.0 |

126.4 |

Future activity is expected to be modest in comparison with recent years. Elevated input costs from tight supply-side constraints and the likelihood that sterling remains lower for longer will be key factors that support tender price inflation over the short term. Aecom’s baseline forecasts for tender price inflation then are 1.0% from Q3 2018 to Q3 2019, and 1.2% from Q3 2019 to Q3 2020.

The rate of tender price inflation over the year ahead will be influenced by: the level of risk accepted by the supply chain and how that is priced; whether discounting to current tender rates is palatable or achievable in order to secure work; further consolidation and capacity limitations of the supply chain; adverse movements in the sterling exchange rate; and damage to confidence from global economic shocks such as tariffs and political volatility. Upside risks to tender prices still exist though, from a combination of supply-side (resource constraints) and demand-side issues (sector dynamics).

Sourcing cost information

When sourcing cost information it is important to recognise that it is derived from various sources, including similar projects, market testing and benchmarking, and that relevance is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 4), highlight the existence of different market conditions in different regions.

To use the tables:

- Identify which frame type most closely relates to the project under consideration

- Select and add the floor type under consideration

- Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£108.50 + £76.50 + £17 = £202.00

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

| Type | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

|

|

|

Steel frame to low-rise building |

98-119 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

166-188 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

188-222 |

Steelwork design based on 110kg/m2 |

|

Floors |

|

|

|

Composite floors, metal decking and lightweight concrete topping |

61-92 |

Two-way spanning deck, typical 3m span, |

|

Precast concrete composite floor with concrete topping |

98-139 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

|

|

|

Fire protection to steel columns and beams (60 minutes’ resistance) |

14-20 |

Factory-applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes’ resistance) |

16-29 |

Factory-applied intumescent coating |

|

Portal frames |

|

|

|

Large-span single-storey building with low eaves (6-8m) |

74-96 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

84-115 |

Steelwork design based on 45kg/m2 |

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

125 |

Nottingham |

106 |

|

Manchester |

101 |

Glasgow |

91 |

|

Birmingham |

97 |

Newcastle |

96 |

|

Liverpool |

96 |

Cardiff |

84 |

|

Leeds |

89 |

Dublin |

94* |

Cost comparison updates

This quarter’s Costing Steelwork provides an update of the five previously featured cost comparisons covering: offices, education, industrial, retail and mixed-use

These five projects were originally part of the Target Zero study conducted by a consortium of organisations including Tata Steel, Aecom, SCI, Cyril Sweett and the BCSA in 2010 to provide guidance on the design and construction of sustainable, low- and zero-carbon buildings in the UK. The cost models for these five projects have been reviewed and updated as part of the Costing Steelwork series. The latest cost models as of Q4 2018 are presented here.

Costing steelwork: offices update

Below is an update to the offices cost comparison originally published in the Costing Steelwork Offices feature in ��ɫ����TV magazine in April 2017.

One Kingdom Street, London, key features

- 10 storeys, with two levels of basement

- Typical clear spans of 12m x 10.5m

- Three cores – one main core with open atrium, scenic atrium bridges and lifts

- Plant at roof level

Cost comparison

Two structural options for the office building were assessed (as shown in figure 5):

- Base case – a steel frame, comprising fabricated cellular steel beams supporting a lightweight concrete slab on a profiled steel deck

- Option 1 – 350mm-thick post-tensioned concrete flat slab with a 650mm x 1,050mm perimeter beam.

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q4 2018. There has been no real cost movement from Q3 to Q4. The costs, which include preliminaries, overheads, profit and a contingency, are summarised in figure 5.

The cost of the steel composite solution is 7% lower than that for the post-tensioned concrete flat slab alternative for the frame and upper floors, and 5% lower on a total-building basis.

| Elements | Steel composite | Post-tensioned concrete flat slab |

|---|---|---|

|

Substructure |

87 |

92 |

|

Frame and upper floors |

430 |

464 |

|

Total building |

2,587 |

2,726 |

Costing steelwork: education update

Below is an update to the education cost comparison originally published in the Costing Steelwork Education feature in ��ɫ����TV magazine in July 2017.

Christ the King Centre for Learning, Merseyside, key features

- Three storeys, with no basement levels

- Typical clear spans of 9m x 9m

- 591m2 sports hall (with glulam frame), 770m2 activity area and atrium

- Plant at roof level

Cost comparison

Three structural options for the building were assessed (as shown in figure 6), which include:

- Base case – steel frame, 250mm hollowcore precast concrete planks with 75mm structural screed

- Option 1 – in situ 350mm reinforced concrete flat slab with 400mm x 400mm columns

- Option 2 – steel frame, 130mm concrete topping on structural metal deck.

The full building cost plans for each option have been updated to provide current costs at Q4 2018. The comparative costs highlight the importance of considering total building cost when selecting the structural frame material. The concrete flat slab option has a marginally lower frame and floor cost compared with the steel composite option, but on a total-building basis the steel composite option has a lower overall cost (£3,077/m2 against £3,103/m2).

This is because of lower substructure and roof costs, and lower preliminaries resulting from the shorter programme.

| Elements | Steel + precast hollow-core planks | In situ concrete flat slab | Steel composite |

|---|---|---|---|

|

Frame and upper floors |

287 |

248 |

260 |

|

Total building |

3,132 |

3,103 |

3,077 |

Costing steelwork: industrial update

Below is an update to the industrial cost comparison originally published in the Costing Steelwork Industrial feature in ��ɫ����TV magazine in October 2017.

Distribution warehouse in ProLogis Park, Stoke-on-Trent, key features

- Warehouse: four-span, steel portal frame, with a net internal floor area of 34,000m2

- Office: 1,400m2, two-storey office wing with a braced steel frame with columns

Cost comparison

Three frame options were considered:

- Base option – a steel portal frame with a simple roof solution

- Option 1 – a hybrid option: precast concrete column and glulam beams with timber rafters

- Option 2 – a steel portal frame with a northlight roof solution.

The full building cost plans for each option have been updated to provide costs at Q4 2018. The steel portal frame provides optimum build value at £674/m2; glulam is least cost-efficient. This is primarily due to the cost premium for the structural members necessary to provide the required spans, which are otherwise efficiently catered for in the steelwork solution. With a hybrid, the elements are from different suppliers, which raises the cost. The northlights option is directly comparable with the portal frame in relation to the warehouse and office frame. The variance is in the roof framing as the northlights need more. Other additional costs relate to the glazing of the northlights.

| Elements | Steel portal frame | Glulam beams + purlins + concrete columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Warehouse |

70 |

139 |

81 |

|

Office |

126 |

168 |

126 |

|

Total frame |

72 |

140 |

84 |

|

Total building |

674 |

754 |

723 |

Costing steelwork: retail update

Below is an update to the retail cost comparison originally published in the Costing Steelwork retail feature in ��ɫ����TV magazine in January 2018.

Asda food store, Stockton-on-Tees, key features

- Total floor area of 9,393m2

- Retail area based on 12m x 12m structural grid

Cost comparison

Three frame options were considered (as shown in figure 8) to establish the optimum solution for the building, as follows:

- Base option – a steel portal frame on CFA piles

- Option 1 – glulam timber rafters and columns on CFA piles

- Option 2 – a steel portal frame with a northlight roof solution on driven steel piles.

The full building cost plans for each option have been updated to provide costs at Q4 2018. The steel portal frame provides the optimum build value at £2,561/m2, with the glulam option the least cost-efficient. The greater cost is due to the direct comparison of the steel frame solution against the glulam columns and beams/rafters. A significant proportion of the building cost is in the M&E services and fit-out elements, which reduce the impact of the structural changes. The northlights option is directly comparable to the portal frame in relation to the main supermarket; the variance is in the roof framing as the northlights require more. Additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area.

| Elements | Steel portal frame | Glulam timber rafters + columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Structural unit cost |

140 |

172 |

158 |

|

Total building unit cost |

2,561 |

2,601 |

2,571 |

Costing steelwork: mixed-use update

Below is an update to the mixed-use cost comparison originally published in the Costing Steelwork mixed-use focus feature in ��ɫ����TV magazine in April 2018.

Holiday Inn tower, MediaCityUK, Manchester

- 17-storey tower

- 7,153m2 of open-plan office space on five floors (floors two to six)

- 9,265m2 of hotel space on eight floors (floors eight to 15)

The gross internal floor area of the building is 18,625m2. The 67m-high building is rectilinear with approximate dimensions of 74m x 15.3m.

Cost comparison

Three frame options were considered to establish the optimum solution for the building:

- Base option – steel frame with Slimdek floors

- Option 1 – concrete flat slab

- Option 2 – composite deck on cellular beams (offices) and UCs used as beams (hotel).

The full building cost plans for each option have been updated to provide costs at Q4 2018. The steel frame with composite deck continues to provide the optimum build value with the overall building cost at £2,533/m2.

Options 1 and 2 are arguably more typical for this building type. The base case structure is an unusual solution due to a decision to change the residential accommodation to office floors at a very late stage; time constraints precluded redesign of the tower block and hence the original Slimdek design was constructed.

| Elements | Slimdek | Concrete flat slab | Composite deck on cellular beams (offices) and UCs used as beams (hotel) |

|---|---|---|---|

|

Structural unit cost |

504 |

421 |

345 |

|

Total building unit cost |

2,737 |

2,636 |

2,533 |

This Costing Steelwork article produced by Patrick McNamara (director) and Michael Hubbard (associate) of Aecom is available at .

The data and rates contained in this article have been produced for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the article contents.

Steel for Life sponsors:

Headline

ArcelorMittal | Barratt Steel Limited | British Steel | Jamestown

Gold

Ficep UK Ltd | National Tube Stockholders and Cleveland Steel & Tubes | Peddinghaus Corporation | voestalpine Metsec plc | Wedge Group Galvanizing Ltd

Silver

Jack Tighe Ltd | Kaltenbach Ltd | Tata Steel | Trimble Solutions (UK) Ltd

No comments yet