Build UK’s update the industry amid the covid-19 outbreak

The (BBLS) opens for applications today.

- Businesses can borrow between £2,000 and £50,000, capped at 25% of turnover, with no fee to access the scheme

- The Government will guarantee 100% of the loan and there will not be any fees or interest to pay for the first 12 months

- Loan terms will be up to 6 years and no repayments will be due during the first 12 months

- Interest rates will be capped at 2.5% per annum

- Lenders are not permitted to take personal guarantees or recovery action over a borrower’s personal assets (such as their main home or personal vehicle).

To be eligible for the scheme, a business must be based in the UK, have been negatively affected by coronavirus, have been trading on 1 March 1 2020, and not have been an ‘undertaking in difficultly’ as of 31 December 2019.

To apply, companies should approach a via its website and fill in the short online application form to self-certify that they are eligible for a loan. You cannot apply if you’re already claiming under the (CBILS); however, if you would like to transfer your CBILS loan into the BBLS, you can arrange this with your lender until 4 November 2020.

Build UK has teamed up with KPMG to provide introduced by HMRC in response to coronavirus, including Time to Pay, business rates and property-related grants, income tax deferral, VAT, and corporate tax.

Working in partnership with , Build UK has reviewed contracts awarded and tender opportunities in light of the uncertainty caused by coronavirus.

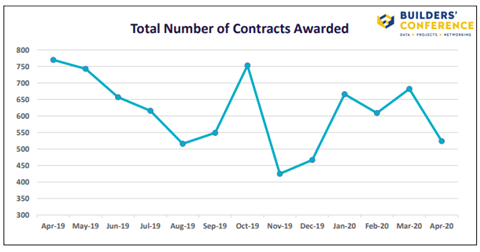

The last 12 months have been dominated by political events, including Brexit, the Conservative leadership contest and the General Election, resulting in peaks and troughs in the number of contracts being awarded. Between April 2019 and March 2020, an average of 621 contracts was awarded each month; however, this fell to 524 contracts in April 2020. This is 16% below the average and a decrease of 23% compared to March 2020 and 32% compared to April 2019.

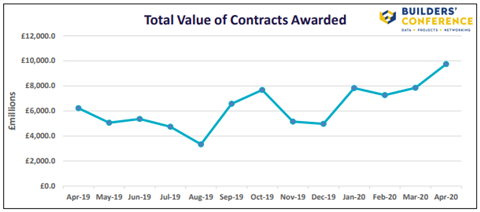

Whilst the number of contracts awarded fell in April 2020, the value of contracts increased to £9.7 billion. This was 62% higher than the monthly average of £6 billion awarded between April 2019 and March 2020; however, it included two significant infrastructure contracts with a combined value of £3.7bn.

In total, £4.3bn (44%) covered just 27 rail and road projects, £3.2bn (33%) was made up of 279 housing projects, and the final £2.2bn (23%) was spread across 218 other projects.

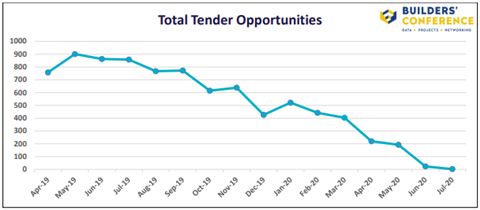

Although the number of tender opportunities has been steadily decreasing over the last year, companies could still tender for an average of 664 projects a month between April 2019 and March 2020. However, in April 2020 there were just 220 projects open for tender, which was 67% below the average and a reduction of 45% compared to March 2020 and 71% compared to April 2019.

At present, there are just 217 tender opportunities available until July 2020 according to Builders’ Conference.

Minister for Business and Industry Nadhim Zahawi confirmed on last week’s industry conference call that the Government will be looking to accelerate public sector construction projects as part of the coronavirus recovery plan. The news that HS2 Ltd has issued its ‘’, together with confirmation from Highways England of £27.4bn investment in the road network, reinforces that commitment to investing in infrastructure across the UK.

There are two webinars taking on place on Thursday 7 May at 11:00am:

- BEIS is hosting one on managing your business during coronavirus, including tax, filing reports and accounts, and right to work checks. You will need to and questions can be submitted via email to sed@beis.gov.uk until tomorrow.

- Build UK partner, Willis Towers Watson, is running one on remobilising construction sites from an insurance perspective and again you will need to .

Businesses should continue to follow the most up-to-date and for the latest updates please follow Build UK on and . If you have any construction-specific queries or feedback on what is happening within the industry, please contact Build UK.

No comments yet