Set after set of positive data means construction may finally dare to be optimistic. We look to the skies to predict what 2014 may have in store

Over the last few years, it has paid to be negative. Nobody was going to thank politicians or economic forecasters for promising green shoots before another barren season. This year may have started with stormy weather but, as far as the economy is concerned, as the sun rises on 2014 there are reasons to believe that the economic drought might actually have come to an end at last, and that being cheerful may not look entirely foolish.

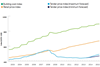

While recovery went in fits and starts last year, and depended on the sectors and regions in which you were working, from the beginning of Q2 the story the Office of National StatisticsŌĆÖ published sets of data told was largely one of ever-increasing confidence.

The mood going into the new year is therefore one of cautious optimism. Optimism because new orders and output data and several wider economic indicators are looking good.

Caution because after five years of torpor and false starts the industry is understandably - and justifiably - sceptical.

Steve Beechey, group investment director at contractor Wates, echoes the sentiments of many when he says: ŌĆ£It does look very positive, although the world economy is sensitive. Housing is driving our economy and thereŌĆÖs lots of potential in the commercial sector, in particular in the South-east. The [result] is that weŌĆÖll see more projects coming to the market.ŌĆØ

The question, then, is just how significant, widespread and sustainable the recovery will be this year - and what landmines might lie on the road ahead that could blast the return to growth off its path?

Catch some rays

Construction industry forecasters certainly seem to be positive about 2014. ExperianŌĆÖs last report was published last summer, when the organisation revised up its expectation for the year ahead, and its next set of forecasts wonŌĆÖt be published until 17 January. However, according to head of construction forecasting James Hastings, ExperianŌĆÖs report this month will predict output growth ŌĆ£north of 2%ŌĆØ this year, compared with 1% in its summer publication.

There is no doubt that the key contributor towards constructionŌĆÖs sunnier prospects this year is housing, supported massively by the early arrival of the second phase of the governmentŌĆÖs Help to Buy scheme, introduced in October. Indeed, according to the Construction Products Association (CPA), private housing starts rose 19% in 2013 and the organisation expects further rises of 15% and 10% in 2014 and 2015 respectively.

The CPAŌĆÖs economics director Noble Francis describes the growth in private housing last year as ŌĆ£startlingŌĆØ, but says that the question is what will happen when Help to Buy comes to an end. The mortgage guarantee element of the programme is finite - capped at ┬Ż12bn - and was originally intended to last until March 2016. However, Francis predicts that at current take-up rate the ┬Ż12bn will be used up in 2015 and some analysts are predicting it could be exhausted by the end of this year.

According to ExperianŌĆÖs Hastings: ŌĆ£The key question then is: has the housing market by then developed its own growth dynamic? If so, then one would hope that growth would continue after the removal of that stimulus. But if it hasnŌĆÖt, then things could turn down again in the sector - or the government could add some more money [to the programme].ŌĆØ

The key question is: has the housing market developed its own growth dynamic? If so, then that growth would continue after the removal of the stimulus

Another key story of last year was the return of commercial development, particularly the office market. According to the CPA, office development looks likely to have increased by 2% in 2013 and will increase by another 2% in 2014 followed by jumps of 10% in 2015 and 7% in 2016. ŌĆ£I think that the recovery of the commercial sector was probably the highlight of 2013,ŌĆØ says Francis. ŌĆ£Private housing recovery is great, but itŌĆÖs being boosted by government policy. Commercial is purely private sector funding.ŌĆØ

WhatŌĆÖs more, the return of the commercial market isnŌĆÖt just a London and South-east phenomenon. ŌĆ£London is obviously very strong,ŌĆØ says Hastings. ŌĆ£But weŌĆÖve seen the return of some speculative growth in some of the regional office centres as well after five years of dormancy. I think the prospects for offices this year are quite bright.ŌĆØ Indeed, the return of the regional construction markets is something that professionals at the coalface have noticed too. ŌĆ£There are encouraging signs,ŌĆØ says Richard Marchant, managing director at Capita Property and Infrastructure (formerly Capita Symonds). ŌĆ£ThatŌĆÖs particularly in London, but also in some of our regional businesses now.ŌĆØ

Infrastructure output too is looking stronger after a lamentable fall of 13% in 2012. Experian expects output to have risen by 7% in 2013 and forecasts that it will increase by 9% and 4% in 2014 and 2015 respectively. The CPA concurs that output in the sector will rise by 7% this year, followed by average growth of 8.5% each year to 2017. This is in part down to the ongoing investment in the Thameslink rail service in the South-east and the fact that construction spending on Crossrail is expected to peak this year and continue to be strong in 2015. There are still some hurdles to be overcome on nuclear energy, not least that the European Commission could still decide to review the strike price the government agreed last year with EDF for Hinkley Point, but the general market expectation is that work on the plant will at least start this year.

As with private housing, the government can take some of the credit for the increased confidence in the infrastructure sector. ŌĆ£There werenŌĆÖt a lot of surprises, not a lot of new money, but obviously after the Autumn Statement weŌĆÖve got a bit more confidence about things like ongoing infrastructure investment,ŌĆØ says CapitaŌĆÖs Marchant. ŌĆ£WeŌĆÖll continue to see a bit more confidence within the infrastructure sector, with long-term spending plans on road and rail, but also utilities, power generation and energy.ŌĆØ

ŌĆ” But take a brolly

So, things are looking up, but there are of course significant dangers in the year ahead. Firstly, as has been well documented, costs are already going up and for some in the sector the spectre of cost inflation is the most significant obstacle in sight. ŌĆ£ThereŌĆÖs a risk of more cost inflation within the industry, such as labour and materials,ŌĆØ says WatesŌĆÖ Beechey. ŌĆ£It is already having an effect on housing projects in the South-east.ŌĆØ

Then there are factors that fall way outside the control of the UK government, let alone anybody in construction.While the eurozone debt crisis appears to have retreated, the issue is far from resolved. Further bad news from any Euro member would send markets into freefall, with all the negative implications for project finance in the UK that that entails. ŌĆ£ThereŌĆÖs sensitivity around funding,ŌĆØ says Beechey. ŌĆ£If you see something happen in Europe, for instance, you worry about a knee-jerk reaction - a lot of funding may be withdrawn.ŌĆØ

Longer term, of course, there is also the prospect of the election in May 2015. In the last 18 months the government has committed to schemes such as Help to Buy, which have undoubtedly provided a much-needed kick start to the construction economy. However, it is far from clear that such schemes would be extended into the next parliament, especially if a majority Conservative government were to be returned next year on the promise of ongoing austerity.

Indeed, economist Brian Green is highly sceptical about the timing of the current recovery. ŌĆ£What happens the other side of the election?ŌĆØ he says. ŌĆ£We donŌĆÖt know how much of the growth weŌĆÖre seeing is being timed because of the election and how much is underlying growth. It is strange that we were on a growth path [in 2010] and then we flat-lined for three years and now weŌĆÖre growing again. Housebuilders are filling their boots now ŌĆ” and quite rightly. But there are concerns about what happens after the election.ŌĆØ

If you see something happen in Europe, you worry about a knee-jerk reaction - a lot of funding may be withdrawn

Green also has doubts about the wider nature of the recovery - we were told that sustainable growth would be generated by increased exports and rebalancing the economy, but the majority of positive indicators once again relate to consumer data - but he admits that a lot of his pessimism is conjecture. He is right to be sceptical, of course. After all, if more economists had kept a more sceptical eye on the boom years we might not have fallen so hard. But in the last five years, construction professionals have learned to take advantage of any opportunities they identify, however short term.

And for the first time in half a decade there are opportunities waiting in the year ahead. While of course firms would be well-advised to temper their enthusiasm and avoid overstretching themselves, there are solid reasons to be cheerful, not least the burgeoning housing and commercial markets and a solid pipeline of infrastructure projects.

And for that we should, eventually, be thankful.

2014: the ConsultantŌĆÖs view

Michael Thirkettle, chief executive, McBains Cooper

1. How sustainable do you believe the economic recovery to be?

You have to balance results with context; cautious optimism is alright, but just because the economy appears to be recovering it doesnŌĆÖt mean thereŌĆÖs going to be a retail or construction boom. I think this year will improve slightly, but it will still be relatively level.

2. What do you see as the biggest opportunities for your business this year? Where is growth going to come from?

Growth will primarily continue to come from Latin America and international markets; thereŌĆÖs a very high level of PPP and government work in Latin America. In the UK, if there are opportunities like the hotel, healthcare and office markets, IŌĆÖm sure that will help.

3. What do you think the greatest danger to your business will be in 2014?

The ongoing drive to undercharge for professional services, despite the rise in demand making it tough to find first-class, skilled professionals. Desperation to get income makes companies undervalue services, which is impeding growth.

4. What do you think the construction industry could do to help itself in 2014?

The industry needs to wake up and create far more mature working relationships. We need collaborative solutions, but I think the industry has defaulted back to the bad old days of each party taking its corner and having its own agendas rather than putting the client and what needs to be done first.

5. What single realistic policy change from government would make the biggest difference to your business this year?

A high-level change of direction on expenditure and investment. That would be a good change for us.

2014: the ArchitectŌĆÖs view

Peter Rogers, Lipton Rogers

1. How sustainable do you believe the economic recovery to be?

Very sustainable, and although we should be careful about talking about boom, there will be steady growth through the year. ThereŌĆÖs a lot of work already available, which will fuel growth this year, and I suspect for the year after too.

2. What do you see as the biggest opportunities for your business this year? Where is growth going to come from?

The moves in central LondonŌĆÖs office market, which is where we are mostly based. ThereŌĆÖs a lot of interest there at the moment. And also in residential - those two areas are where weŌĆÖll concentrate most.

3. What do you think the greatest danger to your business will be in 2014?

Inflating growth - if weŌĆÖre not very careful, prices will rise and panic will set in. We have an awful habit of boom and bust. We need to contain the growth this year and be sensible. Intelligent buying will be critical.

I also think if people donŌĆÖt gear up sensibly weŌĆÖll see a big influx of imports. It could be that we have to import because local resources become unavailable.

4. What do you think the construction industry could do to help itself in 2014?

We need smarter management and less bureaucracy. If you go on to any building site, the amount of management is frightening. Clearly things like BIM could help, as it reduces the resources needed on a project, giving you more resources to spread elsewhere.

5. What single realistic policy change from government would make the biggest difference to your business this year?

The government has to get to grips on environmental issues because at the moment we are wasting a huge amount of money on unnecessary measures. For example, biomass CHP is a mistake for cities.

2014: the HousebuilderŌĆÖs view

Debbie Aplin, managing director, Crest Nicholson Regeneration

1. How sustainable do you believe the economic recovery to be?

The economy is showing strong signs of improvement, and as soon as people feel comfortable about jobs and careers they will have the aspiration to buy homes. So as long as the economy stays steady and there is growth in jobs there will be a strong demand for houses, especially in the first-time buyers market. I think as suppliers see more favourable product prices they will be encouraged and begin growing too.

2. What do you see as the biggest opportunities for your business this year? Where is growth going to come from?

Release of public land. The government is pushing hard to give us some significant sites, especially in the South-east.

3. What do you think the greatest danger to your business will be in 2014?

Changes in the global economy. WeŌĆÖve already seen how banks getting into difficulty in Europe can cause major problems. A global change is out of our control, which is why itŌĆÖs always the biggest danger.

4. What do you think the construction industry could do to help itself in 2014?

I think we need to manage expectations. ThereŌĆÖs a lot of political pressure on us to produce more houses and we need to manage those expectations, ensuring weŌĆÖre still providing quality in design and production.

5. What single realistic policy change from government would make the biggest difference to your business this year?

A simplified planning system, to ensure that once planning has been gained we can get on site and start building. IŌĆÖve heard the government are talking about simplifying pre-commencement conditions, which would be a good start. We really want them to look at getting things done quickly.

Source

Additional reporting by Peter Klein

No comments yet