Reinvention ÔÇô making obsolete buildings relevant to todayÔÇÖs market, including by conversion to more valuable uses ÔÇô is a green alternative to demolition and rebuilding. Nic di Santo, Alastair Kenyon and Rachel Coleman of Alinea balance the benefits against the risks and constraints, and detail the costs of an example scheme

01 / Why reinvent?

Retail and office vacancies have increased in the last 12 months, particularly in city centres, prompting many to declare that the pandemic is leading to the death of the high street or even the office. While it is too early to predict the full range of effects on real estate, measures put in place during the covid-19 crisis have certainly accelerated several existing trends: the shift to online shopping, the desire for an experience rather than purely transactional processes (this applies to offices as well as retail), and an appreciation for well-designed, human-scale urban spaces that inspire a sense of belonging.

The wealth of retail and office space being returned to the market presents an opportunity to reinvent empty or under-utilised units into fit-for-purpose spaces and mixed-use buildings that can better support the local community and attract people back to commercial buildings and the public realm.

There is a clear environmental benefit to reinvention. The success of decarbonising the UK economy relies on making the most of our current building stock: refurbishing and repurposing wherever possible to create new spaces that are healthy, welcoming, attractive and flexible.

Repurposing an existing asset can be a viable alternative to rebuilding, not only supporting net zero carbon and other sustainability aspirations but also offering potential efficiencies in cost, time and materials. In most instances, the existing shell can be adapted to accommodate new or multiple uses, and if the refurbishment is designed and implemented carefully it can return the space to the market quicker than a new-build project would.

Spotlight on 135 Bishopsgate

British LandÔÇÖs 135 Bishopsgate is part of a trio of buildings with a distinctly 1980s feel that make up a landscraper on the northern part of Bishopsgate and form a barrier to the eastern edge of Broadgate.

With the surrounding areas of Shoreditch, Spitalfields and the City having all undergone transformation in recent years, Broadgate also needed to change, to appeal to a broader range of occupiers and provide a better mix of uses, particularly in terms of restaurants and leisure.

The original building at 135 benefited from strong fundamentals, including good views, light levels and floor-to-floor heights, as well as long runs of space. When the developer set out to refurbish the building, it sought to play to 135ÔÇÖs existing strengths in order to appeal to new occupiers: delivering large, flexible floorplates, connected by characterful light wells and atriums with large private and communal terraces.

Another key aim was to improve permeability and address the outdated public realm. There was an opportunity to take advantage of the high seven-days-a-week footfall along Bishopsgate by refreshing the facade design at lower levels and introducing a flagship store ÔÇô this led to April seeing the opening of EatalyÔÇÖs first UK store at 135, a key part in BroadgateÔÇÖs evolution.

The project team included Fletcher Priest, Hoare Lea, Meinhaardt, M3, Alinea and Sir Robert McAlpine.

02 / Avoiding demolition

There are at least 1,300 buildings around the world that are over 200m high, yet until this year nothing above that height has ever been (peacefully) demolished. But the former Union Carbide ║├╔ź¤╚╔˙TV at 270 Park Avenue in New York is being taken down in 2021, breaking that record, as it stands at 215.5m.

The average lifespan of the tallest 100 buildings to have ever been demolished is a little over 40 years, and most are younger. This is somewhat less than the usual design life of commercial buildings, suggesting that among tall towers there is an unnecessary redundancy in design, a waste of resources and an avoidable impact on the planet.

As Edwin Heathcote wrote in the Financial Times in January, ÔÇťdemolition is architectureÔÇÖs dirty little secretÔÇŁ. Commercial buildings are too frequently demolished and replaced, at great environmental cost. Iconic or other anchor buildings are often the most difficult to demolish ÔÇô and their vast, evocative forms can support a second life through refurbishment.

The City of London is under constant renewal, usually through redevelopment. Invariably this is for good reason, replacing tired and outdated real estate with contemporary, larger assets. Sometimes deconstruction is necessary ÔÇô a complex operation undertaken by renowned specialists. But given that 60%-70% of the upfront carbon associated with the construction of a new office building is in its substructures and superstructures, it would make sense for the default first question in any project to be: Can we make a successful project by retaining at least the bones of the existing building?

03 / The real estate market post-covid

The past year or so has tested both personal and corporate standards for working, playing and learning. Enforced isolation and the narrowing of choice have recalibrated what ÔÇťgoodÔÇŁ means not only for each individual ÔÇô such as in terms of a better work-life balance ÔÇô but also for landlords and occupiers, for instance with an increased appreciation for acoustics and connectivity.

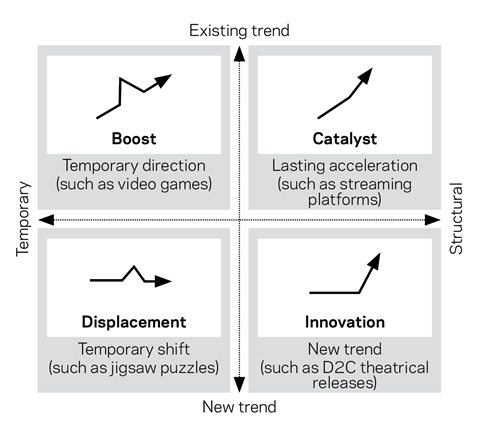

The challenge for the real estate sector is to determine which changes will stick and therefore can be used to predict future demands. While some trends are here for the long term, others are merely a temporary distraction ÔÇô the diagram shows the different types of disruption that can be identified. Understanding the context and longevity of the trends we are seeing can allow us to ensure the spaces we create are future-proofed and fit for purpose.

In the coming period we may see more human-centric buildings ÔÇô those that encourage the kind of human encounters we have been missing over the last 15 months. Offices that provide better spaces for collaboration, learning and development, innovation and creativity, while rivalling the home as a setting in which to work.

We could also see a change in the traditional daytime/night-time routine, with spaces changing from cafes serving home-workers through the day to include more restaurant services into the evening for those who no longer commute but still wish to socialise.

Retail under pressure

Clearly the pandemic has severely affected the retail and hospitality sectors. According to the Centre for Retail Research, 54 companies failed in 2020, closing 5,214 stores and affecting nearly 110,000 employees (more than double the number in 2019).

Shopping habits were already changing fast before the pandemic, and many of the large failures in 2020 were due to vast over-expansion in previous years. The closure of all non-essential stores during lockdowns has helped to speed up the shift to online retailing, which in turn is creating an oversupply of retail space and weak bottom lines when costs such as business rates, energy use and rent are factored in.

The high street is adapting from a place to do routine shopping into a destination that offers an experience, as well as somewhere to socialise. For example, customers are gravitating to emerging new models of dining, where eating is mixed with buying quality products, experimentation with new flavours, and leisure activities such as cookery schools. Other examples include SelfridgesÔÇÖ recent announcement that it has been licensed to host weddings and has created a wedding suite on its fourth floor.

Retail will need to negotiate different challenges across its many sub-sectors, with each having to promote imaginative solutions, supported by spaces that give them the opportunity to do so.

However, not all covid-generated dynamics will be permanent ÔÇô something that investors and developers will need to consider as they repurpose their assets to suit future habits.

The oversupply of retail space attracts a lot of negative press coverage, but it also presents an opportunity for reinvention. Repurposing these vacant or underperforming areas of retail parks, shopping centres or high streets can be the catalyst for levelling up in particular areas, taking advantage of the newly flexible workforce to reinvigorate districts and better support local communities.

04 / First, decide what is the invention

Any reinvention project must first identify what would drive income and viability for the scheme as well as drive value back into the local area and community.

To ensure a building suitably serves a local requirement and that the mix of tenants is appropriate, research and engagement with users is key.

Such engagement will identify the specific requirements for spaces offering community interaction, quality of life and a sense of place, convenience, entertainment and flexibility.

Identifying occupier needs

What do tenants or other end users really value in a space? Their key wants and themes will help drive the scheme, and could cover topics such as:

1. An inspiring place to work, with a focus on health and wellbeing; a destination that invites one to visit, experience, and socialise.

2. Low operating costs: net zero carbon strategies that drive performance and the highest possible EPC rating.

3. Social value initiatives that align with the occupierÔÇÖs own ESG principles such as the encouragement of local procurement and employment.

05 / Reinvention: how to get it right

There are several important factors when considering how best to repurpose any building to a new use. Every building is unique and will throw up its own individual challenges to overcome, but there are a number of common and consistent themes that should be investigated and explored. Below we consider the key commercial drivers and risk mitigation factors in design and procurement.

An obvious but critical starting point is to map out a clear and concise brief of what is required. Inevitably there will be options to consider in order to evaluate what can be done, but to set the project up to succeed requires clear direction in relation to end use, product, budget and programme, as well as around environmental, social and corporate governance (ESG) considerations. Those last in particular need careful evaluation, with agreed and wellÔÇĹarticulated sustainability targets.

It is vital to select a trusted team with the right blend of skills, knowledge and collaborative style to bring out the best in one another and thereby the project. Creativity is essential. Typically the intent will be to reuse as much of the existing building as possible, conserving its inherent architectural merit while at the same time unleashing its full potential.

Take the time to research the building and its component parts, whether that be the structure, fabric or MEP systems. Doing this up front will pay huge dividends later in terms of design, cost, value and risk apportionment. Being realistic with design durations and avoiding shortcuts can help prevent problems later in the programme.

Some buildings lend themselves to adaptation more than others, and inevitably when considering the art of the possible some blind alleys will be taken, but good cost advice will help identify the tipping points of what can be done with an existing asset.

Key points of focus include:

Space planning

- When reconfiguring cores, floorplates and storey heights and introducing new fire thermal and acoustics requirements, always consider the knock-on impact on the target net internal area.

Architecture

- Depending on the project brief, this could be quite a wide-ranging consideration, and will vary depending on what extent of intervention is required. Close collaboration between design team members during the design process will help mitigate surprises.

Structure and core constraints

- The extent of new interventions needs to be determined. For example, additional basement depth or size, reconfiguration of cores, creation of or filling-in of atrium spaces, additional floor loadings and terracing will affect what is viable.

- Stair and lift cores that are optimised or shared between uses can reduce costs.

Services

- Overall servicing needs to respond to all new uses, and new plant may be required, impacting design efficiencies.

- Infrastructure may need to be upgraded (for instance, a new substation).

- A food hall will require numerous drainage points, and A3 units will require fire-rated kitchen extract risers terminating at roof level, with additional maintenance access.

- There may be increased demand for foul drainage, with multiple vertical stacks and horizontal transfers.

- Utility servicing to a mix of uses will cost more than in a single building, depending on the leasing arrangement.

Vertical transportation

- An increase in uses will increase the demand for lifts and escalators. Opportunities to share these (such as through common servicing) will benefit the scheme.

- Positioning of lift and escalator pits will need to be considered for both headroom and structural implications.

Fire strategy

- There will obviously be implications for the fire strategy and smoke control.

- A change to multiple tenancy will require a new approach and may require common escape routes and fire engineered solutions.

Wider site considerations

- Noise, vibration and movement monitoring will be required if the site is located next to an underground or overground station.

- The risk of water ingress to a station or railway tunnel requires waterproofing solutions.

Using technology such as BIM can assist in clash detections, reduce waste, minimise and identify appropriate transfer of risk, and optimise the overall programme.

It is helpful to gain appropriate contractor input at the right time. If done too early, when optioneering and feasibility works are still under way, then time and cost may be wasted; but if too late then buildability, risk apportionment and programme considerations may be overlooked. As with the rest of the team, selecting the right contractor, at the right time, to undertake the works is hugely important. Rarely does lowest price equal a successful outcome.

Once the concept has been established and the team are all on board, take the time to focus on key areas of risk, identify who owns what, and put a structured plan in place. Typically the key areas of risk will include structural integrity, fire, acoustics and thermal properties. Ignore these at your peril, but if you get it right, then procurement, risk transfer and out-turn cost will be all the better for it.

Spotlight on the Bower

At the Bower on east LondonÔÇÖs Old Street roundabout, AHMM reinvented a collection of belligerent and oversized 1960s buildings that had been incongruously overclad in the 1980s, transforming them into a new workplace of discreet services and streamlined office spaces, along with groundÔÇĹfloor retail and restaurants and new public realm. The tallest building was given a new facade, and extended with two large volumes added to its sides to provide double-height zones to augment the office floorplates. The interiors were stripped back and suspended ceilings removed. At ground-floor level, a portion of the largest building is cut out to create a pedestrian link. Contractors on the project for client Helical were Sisk and Skanska.

06 / About the cost model

This cost model looks at repurposing a commercial office building into a retail and commercial mixed-use development. While it is based upon a set of specific criteria, a typical cost range could be £230-£310/ft2 depending on the level of intervention in the existing structure, the reuse or otherwise of the external facades, the requirement to refurbish or renew existing MEP plant and distribution systems and whether additional space is created within the existing envelope or through additional floors or extension.

The scheme on which the model is based is located in central London, and all rates are based on Q2 2021. Exclusions from the cost model include professional fees, VAT, section 106/278, community infrastructure levy payments and the like.

This cost model is based on the following:

Existing building

- The existing building comprises a single-storey basement with the above-ground building arranged over nine levels, totalling a gross floor area of 35,377m┬▓.

- The primary structural frame consists of steel frame and columns wrapped in Conlit fire protection, supporting metal deck and concrete composite slabs.

- The existing facade is constructed from a strongback system which supports the granite stone and double-glazed aluminium unitised elements.

| Areas | Gross internal area (m2) | Net internal area (m2) | NIA to GIA ratio |

|---|---|---|---|

| Shared areas | 4,873 | 0 | 0% |

| Retail (A1, A3) | 3,500 | 3,466 | 99% |

| Offices | 27,004 | 20,793 | 77% |

| Total | 35,377 | 24,259 | 69% |

Proposed scheme

- The proposed scheme comprises 20,793m┬▓ of office accommodation on levels one to nine and 3,466m┬▓ of A1 and A3 retail units at basement and ground. There is also a mezzanine level between basement and ground which is dedicated to plant.

- Ownership is not split and it is assumed the plant is shared.

- All existing foundations and cores remain unmodified as they already provide the required stability.

- The existing frame does not require strengthening for the works planned.

- For layout and servicing purposes, the basement floor plant areas are reconfigured and one of the main stair cores demolished at basement to ground floor, creating additional retail space.

- A feature passenger lift is added for the retail unit, serving basement to ground.

- A dedicated retail goods lift (platform) is added, serving basement to ground.

- Mechanical refurbishment is undertaken of the existing lifts and escalators.

- Complete replacement is carried out of the facade to ground-floor level, with a mild steel stick system and double-glazed units.

- The existing facade from levels one to nine is retained, with only minor repairs and cleaning carried out.

- Roof terraces are created at levels eight and nine.

MEP

The MEP is all new and is based on the following:

- High-density polyethylene rainwater drainage, soil and vent pipework to serve toilet and shower facilities.

- Domestic hot water is produced by a water source heat pump to boost the low-temperature hot water via plate heat exchanger to a suitable domestic temperature.

- Chilled and low-temperature hot water is produced by air-source heat pumps on the roof, sized on the heating load. Air-cooled chillers provide the remaining cooling load requirements.

- Air-handling units (AHUs) are provided on-floor with intake/exhaust air taken from adjacent risers. Intake air is boosted via a supply-only AHU located on the roof.

- Ground floor and mezzanine plant and back-of-house ventilation is fire-rated where necessary.

- Toilet supply and extract systems are centralised.

- New transformers and LV switchboards/distribution/lighting/containment are provided throughout.

- Full-building back-up generation is provided along with all required switchgear upgrades and SCADA control systems.

- Dry risers and landlordÔÇÖs sprinkler system are proviced along with fire and voice alarm systems.

- A common network is installed to accommodate the lighting control, building management system, environmental management system, security systems, landlordÔÇÖs data points, landlordÔÇÖs wifi to reception, lift lobbies and cyclist facilities.

- The retail units are delivered as a shell but with the following connections: drainage, cold water, chilled and low-temperature hot-water connections to landlordÔÇÖs plant via plate heat exchangers, three fire-rated ductwork risers to roof level, electrical, gas, sprinkler, fire alarm.

Fit-outs included

- Fit-out of reception at level one, scope as described in the model overleaf.

- Fit-out of lift lobbies on levels one to nine, scope as described in the model.

- Complete strip-out and fit-out of WCs, scope as described in the model.

- Fit-out of communal clubhouse, including associated WCs on level nine.

Acknowledgments

The authors acknowledge the contribution of Steve Watts, Luke Braggins and Michael Grover from Alinea, and Alan Bunting, Gareth Roberts and Nick Phillips of British Land.

Download the cost model using the link below

Downloads

Reinvention cost model

PDF, Size 42.08 kb

No comments yet