Many shopping centres hit by the recession need to reposition themselves to be fit for the upturn.

01 / Introduction

Retail has experienced a tough recession, but nowhere near as tough as manufacturing or other parts of the services sector. Low interest rates, a cheap pound and lower than anticipated unemployment have helped to keep the tills ringing. Sales volumes are growing at about 3.5% a year, led by growth in the clothing and other non-food sectors. Some well-placed retailers, such as John Lewis, Waitrose and Primark have gone from strength to strength. There have also been victims of the recession, and the loss of high street stalwarts such as Woolworths and Zavvi have had an impact on primary and secondary retail locations.

UK shopping centre retailing has been transformed in recent years. According to agent Cushman & Wakefield, more than 1.5 million m2 of shopping centre space opened in 2008-09, a large proportion of which is located in a big, high quality, in-town retail developments such as Liverpool 1 or Cabot Circus in Bristol. This emphasises the increasing divergence between prime and secondary retail assets. Internet shopping has also grown at an exceptional pace and online retail now accounts for 10% of sales (£38bn in 2009).

These changes have disproportionately affected high streets and secondary shopping locations, which cannot compete with the variety of goods or ease of access that the biggest malls or the web offer. As a result, the total amount of occupied retail floor space in the UK is the same as it was before the crash in 2008, but vacancy levels in secondary locations have increased. Average voids are greater than 15% and some centres have voids of more than 40%.

In effect, many high street retailers have shifted to bigger stores in new prime locations, potentially leading to a negative cycle of dwindling footfall, lower rents and low investment in previously favoured locations. In another development, retailers such as John Lewis that would have anchored schemes are developing formats suitable for out-of-town retail parks.

The solution that many secondary centres adopt is to change focus, moving from comparison retail to a convenience offer based on higher volumes of lower value transactions. Everything for a pound shops, for example, have become a major high street presence in the past two years. Other centres might pursue a niche strategy such as a specialist food retail.

Refurbishment provides the opportunity to refocus a centre around a particular segment and may also include the strengthening of other sources of income, such as leisure and food.

Retail property values increased rapidly during the boom, triggering a wave of heavily leveraged investments by private equity firms and institutions. With rents falling, increased vacancy levels and rising yields, retail capital values fell by up to 50% in the trough of the market. Low asset values have created long-term opportunities for investors with access to funding. However, many centres remain in “intensive care” and represent a considerable investment challenge.

As a result, values in the retail sector remain subdued and securing investment for the “defensive refurbishment” of an existing shopping centre is extremely challenging. However, because of the risk of a downward footfall and income spiral, timely investment is important in safeguarding existing value and in creating the basis for future success.

02 / Shopping centre performance and the potential for refurbishment

Shopping in the UK has long been a leisure activity. As people are becoming ever more connected through mobile telecoms, retail space has evolved into a “third space” between home and the office, where all manner of social and business activity takes place.

Attractive and comfortable environments that provide a good place to meet, such as shopping centres, are well placed to succeed in a competitive market if they can adapt to new sources of revenue and new customer expectations. Shopping centres at all points on the quality spectrum will thrive by enabling their clients to multitask. Investment in growing the food and leisure offer across all price points is a key refurbishment strategy to support this trend.

Shopping will of course remain the anchor and main revenue generator, but retail is also changing at a rapid pace. Pursuit of “authority of range” led many high street multiples to move into larger, more efficient units located in the largest and best shopping centres. Competition for these units drove rental and capital growth across the whole sector during the boom, inflating values for secondary centres as well as the best locations.

At the same time, a convenience offer also evolved on the high street - focused on food retail, coffee shops and so on. Speciality retail has also become important in all centres, focused on creating a more diversified and distinctive offer. This trend is increasing the attraction of smaller units that in previous cycles would have been considered unsuitable for an institutional investment.

Retail schemes experience a powerful “flywheel” effect. A successful scheme will draw crowds, which in turn will increase demand for space, which over time will result in rental and capital growth and further investment. Successful centres such as Bluewater in Kent or the Trafford Centre in Manchester continually re-invest to reinforce their offer to maintain this cycle. Recent development at centres such as Bluewater and Lakeside in Essex has been aimed at strengthening the leisure offer. Unfortunately, a negative cycle can take hold if vacancy levels start to increase - reducing footfall and damaging the sales of remaining units. However, defensive refurbishment must take place while a scheme is performing well, as recovery from a weak position is difficult if there is too much space of the wrong type in the wrong location.

03 / Drivers for refurbishment

Although the refurbishment of an office or school is often driven by the need to update the built asset, refurbishment in retail should ideally take place in response to changes in shoppers’ needs, retail markets and changes in the local economy. The downturn will force many of the malls developed in the eighties boom to refurbish for the first time. However, a track record of “what works and what doesn’t” based on the progressive refurbishment of centres first built in the sixties and seventies is hugely helpful to project teams as they seek to reinvigorate the existing offer in older centres.

“Principles of reinvention” developed in the US by the Urban Land Institute are useful in focusing attention on many of the main issues that face shopping centre refurbishments, including:

- Time is of the essence Refurbishment or repositioning opportunities don’t last for ever.

- Importance of the customer Local competition, demographics and customer taste will determine what can be achieved in a shopping centre rebuild.

- Knowing what works and what doesn’t A big picture analysis of performance issues is needed prior to the development and delivery of smaller incremental improvements.

- Looking beyond the centre boundaries Integration of a centre with the wider retail offer, urban setting and community uses is an important aspect of a scheme

- Rethinking the centre as a “third place” This reflects the growing importance of planning and also providing for the community and local people.

- Accessibility The continuing importance of public transport and parking

- Continual improvement The constant need to re-invent and enhance a centre throughout its life.

Unfortunately, in the current market downward pressure from retailers has meant that shopping centre owners have had to cut their service charge. This has meant that most discretionary expenditure on shopping centre repair and maintenance and improvement has been cut. As a result, the challenge for centre owners is to maintain the condition of the fabric with minimal investment. Whereas previous refurbishment programmes might have majored on substantial improvements to the mall environment and public realm, only investment which directly supports the bottom line is likely to be favoured. Consequently, although conditions remain tough, some opportunities to improve the performance of a mall may be missed.

The main drivers for refurbishment are focused on economic performance and functional obsolescence. Economic performance can be affected by a downward spiral in footfall, rental income and new tenants that can occur as a result of new competition or the loss of an anchor tenant. Refurbishment aimed at preventing economic decline is usually “defensive”. However, in the current market, the delay to large new build schemes has provided a window of opportunity for existing centres to reposition themselves. The scope of work might involve options such as:

- Developing new anchor stores and medium space user (MSU) units focused on areas of opportunity such as food or value retail. With an excess of retail space on the market, extensions are only viable if the new anchor retailer helps to reposition a shopping centre. Food retail is increasingly attractive as it pays good rents and draws in shoppers focused on regular convenience shopping rather than one-off comparison shopping.

- Reconfiguring existing units to meet tenant demand from multiple and niche retailers.

- Reorganising existing tenants to strengthen the prime retail pitch of a scheme, or to respond to the loss of a key retailer.

- Generation of additional sources of revenue including expanded merchandising programmes, which might require extended small power and data networks in public areas.

Changes introduced to improve functional performance are usually focused on the wider retail offer, and respond to customer preference. In the current market for example, the aim is to extend the frequency and duration of shopper visits. Opportunities to do this include:

- Introduction or strengthening of the food offer to consolidate a centre as a leisure and convenience destination. In many centres cafes and restaurants are being integrated into the main retail pitch rather than being hidden away in a food court. An improved food offer may require significant

back-of-house works to incorporate kitchens and kitchen building services into the existing fabric, as well as consequential expansion of the landlord’s facilities such as washrooms and WCs.

- Supporting niche retail or leisure offerings which respond to changing demographics such as the rise of the grey pound. Health and fitness centres have continued to grow membership during the recession, and shopping centre asset managers are also looking to develop smaller units to attract local and niche retailers as part of a differentiated offer.

- New facilities for enhanced customer care, such as reception desks, improved WCs, shop-mobility and so on, together with tenant care investment such as improved security.

- Developing a web presence to promote the centre and its retailers.

Improvements to the building fabric and systems may also help to reposition an otherwise tired centre and may create opportunities to improve asset value by reducing running costs and so on.

Areas of improvement to the physical fabric that are currently being prioritised include:

- Energy saving and other sustainability measures, such as low energy lighting and building controls. Minimising power use is a good opportunity to improve competitiveness as well as reduce carbon emissions.

- Environment improvements which affect footfall - these could include improvements to pedestrian flows or sight lines, fabric renewal and so on.

- Visibility of mall entrances and external branding.

Local authorities also have an interest in the performance of their shopping centres, either as owners, joint venture partners, or as beneficiaries of business rate income and promoters of the local economy. As spending in the public sector also becomes constrained, it is likely that councils will promote that introduction of public sector facilities such as drop-in centres and GP surgeries into selected retail centres as a means of expanding the user base and preserving the existing retail offer.

04 / Maximising benefits from refurbishment investments

Sustainability and value

Reducing the environmental impacts of a retail development is becoming increasingly important. Customers increasingly recognise the issue and tenants and centre owners are faced with growing costs as a result of increasing energy prices and the Carbon Reduction Commitment.

Owners will also be concerned about the possible impact of a high environmental performance certificate rating on future capital values. With 75% of energy consumption in retail being related to heating, cooling and lighting, there are opportunities to improve performance and reduce emissions, even in a relatively modest refurbishment project. The main principles in effective investment in sustainability performance are:

- Keeping the programme simple Have a small number of realistic and deliverable initiatives that are sure to improve performance.

- Keeping the solutions simple - particularly those relating to the operation and maintenance of new systems.

- Capturing the data Make sure that operations and maintenance information are useable and that performance data is collected, analysed and acted on. Sustainability guides for tenants are important to make sure that the investment delivers results.

Depending on the scope of the refurbishment, there should be plenty of scope to deliver improvements in the design of the lighting, HVAC and water supply systems; this will also help to reduce service charges.

The avoidance of any like-for-like replacement of a system is a good start in maximising the impact of a refurbishment.

As part of the sustainability programme, it is important to communicate what is being changed to shoppers as part of the refurbishment. This provides a low-cost means of optimising the overall benefit of the investment.

Owners who hold shopping centres as an investment will also be able to benefit from the 100% first-year recovery of enhanced capital allowances for many of the investments in a sustainability programme if they are properly specified.

Making the right decision

Asset management involves working with a large number of closely related players including the tenants, investors, councils and others. All are motivated to maximise the overall performance of the centre, but may have different priorities in terms of how improvement can be delivered.

One of the most important issues concerns getting the timing of a refurbishment right, and if possible ensuring that investment programmes are directed towards long-term strategic improvement rather than just short-term survival.

Key issues in the investment decision are:

- Properly understanding the sources of the problems that the refurbishment is addressing - is it the town, the shopping centre or the retailers?

- Determining the appropriate level of refurbishment, including the level of specification required to match the life of the investment, and the focus of expenditure on high impact areas.

- Putting in place a strategic plan to maximise the impact of the refurbishment - including phased, letting, marketing and transport and parking.

- Minimising the disruption caused by the site works, including phasing, temporary works and keeping the retailers on side.

Unlocking value

In the current market, demonstrating viability based on actual returns on investment is critical, but difficult to do while rents are depressed and yields relatively high. Low cost, high impact measures clearly help in the current market, as do investments that increase flexibility such as reconfigured units that give tenants the ability to expand or contract operations within the centre - helping to preserve the relationship and tenant mix. Effective means of unlocking value include:

- Aligning investment with the ability of the retailer to maximise turnover - increasing the presence of mall entrances for example, or introducing features that increase footfall or the duration of shopper visits.

- Unlocking new sources of revenue. “Commercialisation” may include the introduction of in-mall advertising, promotions or kiosk-based retailing that will generate extra earnings and is an effective way of re-animating older secondary centres.

Over-commercialisation may affect relationships with tenants - so relationship management is important in delivering an optimum programme.

- Improving existing parking facilities to improve accessibility, security and so on.

Doing more with less

Refurbishments are potentially tax efficient and, when carefully planned, can be delivered with minimal loss in rental income or turnover to tenants. Both tax efficiency and minimal impact on trading rely on early investment in pre-planning.

A high proportion of the spend on shopping centre refurbishment projects has the potential to qualify for relief either as revenue expenditure or as allowable expenditure for capital allowances for plant and machinery. The total typically ranges from 40% to 70%.

- Repair and maintenance work is classified as revenue expenditure and can be fully offset against corporation tax liabilities in the current year.

- Refurbishment works related to mall finishes, furniture, signage, building fabric insulation, services and vertical transportation all qualify for capital allowances for plant and machinery.

Finishes and furniture qualify for the “main pool” that provides relief on a 20% a year reducing basis; the remainder, such as building services, qualify for the “special pool” with relief on a 10% a year reducing basis.

- Enhanced capital allowances for qualifying energy and water-efficient plant and equipment attract a 100% allowance in the first year.

Pre-planning of tax recovery can typically increase the value of allowances 20% by specifying the right design and product solutions, including all consequential work in the claim, and producing an authoritative claim. Tax efficiency can also be increased through consideration of the structure of the special purpose vehicle used to fund the redevelopment, as well as tenant incentive packages.

Maintaining trading

In the current market, with significant competition between retail centres, neither owners nor tenants can risk loss of trade during a refurbishment. Accordingly, a

well-managed refurbishment, planned around peak retail periods and weekend trading will deliver the best solution to all parties. Programme durations are typically extended 40% or more compared with unencumbered access. The critical success factors for working in a fully operational mall include:

- Active management to minimise the impact of the work on tenants and customers, including health and safety and security as well as access and so on

- Rigorous consideration of all health and safety issues and risks

- Extensive pre-planning of the sequence of work, including consideration of options, incorporation of repair and maintenance works, plans to deal with delay and disruption and avoidance of pinch points in logistics such as access to loading bays

- Investment in effective on-site liaison and communication with asset managers, tenants and customers.

Effective refurbishment relies on an investment in pre-planning and onsite management that may be difficult to secure with certainty in a competitive tender market. Use of experienced design teams, main contractors and specialists with a track record of working in operational centres is a vital starting point, as is the quality of as-built information and survey data.

Regardless of the procurement strategy, clients need to ensure that these aspects of the project are properly resourced, as limited design information, or insufficient contractor management input could result in extra costs being incurred later.

Effective on-site problem-solving and liaison inevitably relies on well-resourced design and contractor teams that are focused on delivering value to the client. Similarly the client will want to be certain that high quality subcontractors have been engaged and that full consideration of the condition of the existing building and project logistics has been included in the bid.

Accordingly, even in the a competitive market, some form of two-stage competitive tendering may be appropriate to secure the best balance between certainty of outcome and a reasonable level of competition. When appointing the main contractor, key issues to consider will include:

- The contractor’s approach to the phasing of the works and onsite health and safety.

- The contractor’s track-record of work in occupied shopping centres.

- The quality and effectiveness of health and safety and temporary works proposals.

- Proposals for resourcing on-site liaison with tenants and centre management, as well as the on-site management of the works.

- The calibre and track record of the proposed supply chain.

Although the final selection of the principal contractor may be made on the basis of the capability of the delivery team rather than lowest price, total cost discipline will be critical during the second stage if a project is to remain viable through the procurement process.

05 / Cost model

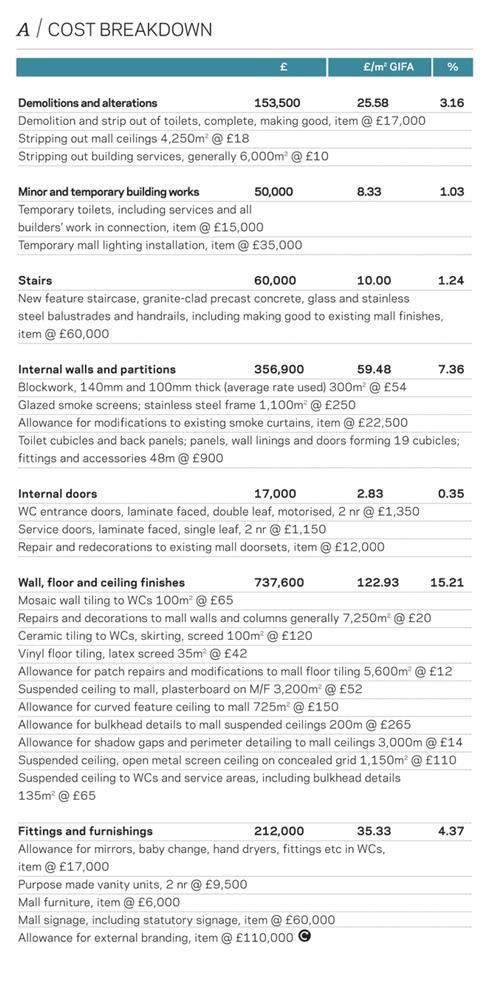

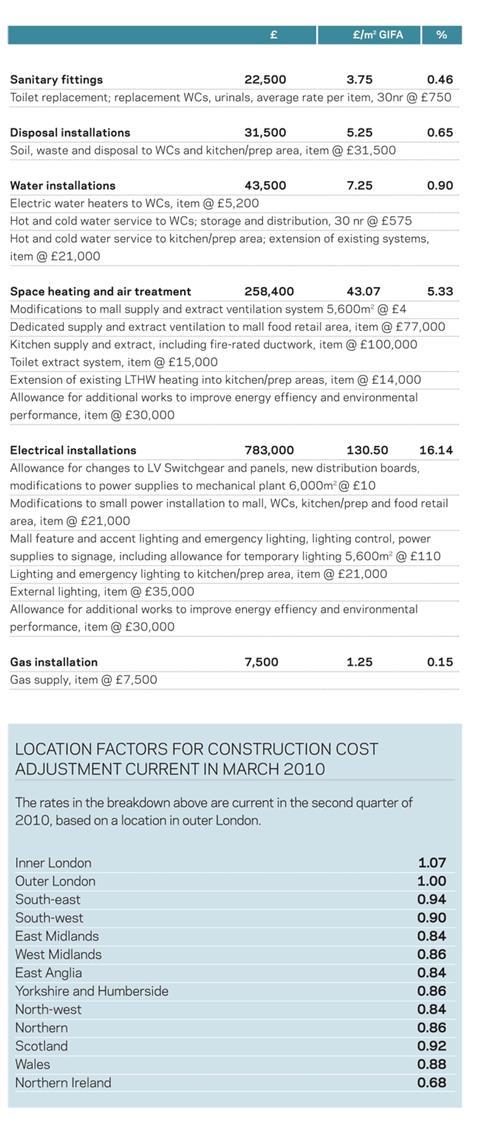

The cost model breakdown is for the refurbishment of the mall areas of a high quality town centre shopping centre with a total affected floor area of 6,000m2. The scope of work includes full replacement of ceilings, lighting and signage to update the look and feel of the centre. Works to improve circulation, including replacement lifts and a new stair are also included, as are kitchen and preparation areas needed to support an expanded food offering. The model illustrates how investment can be focused to maximise benefit with a limited budget.

On the current regulations, the value of work qualifying for capital allowances on plant and machinery is likely to total £2.9-3.25m - equivalent to a net present value tax saving of 12.5% of project cost.

Demolitions, and all costs associated with phasing and working in a trading environment are included. External works, professional fees and VAT are excluded as are tenants’ fit-out costs in the mall and kitchen/prep areas.

A / Cost breakdown

Source

Richard Taylor and Simon Rawlinson work at Davis Langdon

No comments yet