The reforms to the NHS are likely to lead to more work for private providers - and their construction teams. Mark Robinson of Aecom highlights the main design considerations for private hospitals and breaks down the costs

01 / Introduction

The transfer of NHS services to the private sector continues to grab the headlines, all the more so following the government’s recent NHS restructure through the Health and Social Care Act on 1 April 2013. A relationship between the NHS and private providers has existed for many years, but the introduction of this act will create far greater collaboration.

The strength of the UK economy has had an impact on the performance of private healthcare providers. Since the downturn these providers have been adjusting to the constrained economic outlook. Many have been diversifying their income streams and introducing new health and wellbeing services, meeting the increase in demand of consumers proactively managing their own health.

The act is seen as a welcome change of direction for the private sector as it will present more opportunities for diversification and growth in health and social care provision.

02 / Healthcare transition

Under the act, the newly established clinical commission groups (CCG) are responsible for procuring and providing healthcare services for their associated community; these were previously provided by primary care trusts.

The difference lies in two areas. The first, that the individuals who form these CCGs are now healthcare professionals and not business managers, meaning a closer tie-up of local healthcare experts with patient commissioning. The second is associated with the responsibility of the role: that the health professional will be required to manage the budget used to procure patient services. It is expected that many CCGs will seek to fill the resultant skills gap through the establishment of commissioning support units.

What is seen as the greater impact of the act is that it allows CCGs to tender and select NHS services through not just the public sector, but also the private and third sectors, based on best value.

It is known that about a quarter of independent healthcare providers’ income is from the NHS. With the current focus on trimming NHS spend and offering full NHS tender opportunities to the private sector, this proportion is likely to increase.

This is a timely change for private providers, as the number of people in the UK who hold private health insurance is at its lowest level for 20 years, at about 10% of the population. The reduction is not surprising, given both corporate and domestic cutbacks. But consumer behaviour is also changing, with the rise of “self-pay” products, which are one-off healthcare treatments offered by private providers. These products and services have grown in response to the perceived lack of availability of NHS treatments, whether as a result of budget cuts, local commissioning criteria, waiting time or patient choice.

This opportunity for private providers to play a larger role in the NHS is being eagerly taken up: from April to December 2013, £510m of contracts were awarded, with £450m given to the private sector.

For example, the NHS’ single largest appointment of a private provider to date is the 10-year contract to operate Hinchingbrooke Healthcare NHS Trust, a district general hospital in Cambridge; the NHS has invited private providers to express interest in other similar sized opportunities.

A further driver of the likely increase of private sector involvement in healthcare provision is the act’s adjustment of the rules relating to how NHS Foundation Trusts generate their own income. Trusts are now formally allowed to generate up to 49% of income from private patients. As a result, the typically smaller private patient units on existing NHS estates are bound to have a more significant presence. This is likely to result in a rise in private providers refurbishing part of the existing hospital, adding extensions, new-build facilities or even, as at Hinchingbrooke, taking on the full operation of an NHS hospital.

03 / Design issues

Brief

Within the consultation process, it is best practice to embed the principle that buildings are about people, the end users. It is not uncommon to find contract variations or a small works package being undertaken following completion of a project in tailoring to specific needs. It is therefore pivotal to continuously test and challenge the development of the brief and the design response to assist in delivering what is needed.

Understanding clinicians’ individual approaches, treatment timetables and shared service spaces will help to deliver better occupancy rates and, consequently, reduce costs. In fact, many providers are adding metering to existing accommodation in order to track and report on both occupancy and energy usage - knowledge that can be used for future developments.

Specification

The heightened focus on brand identity differentiates private from public healthcare. In selling the brand to the consumer and clinicians, private providers want to be seen as unique and offering consistent positive experiences to patients and their families, in terms of product, service and care. Given the importance of marketing, the vast majority of private healthcare providers already have the building design and specification prescribed in detail within a brand book. Whether a patient is in Bristol, Bournemouth or Bath, their built environment will not differ. The expectation then follows that neither will the service.

Marc Levinson of Murphy Philipps Architects, says: “There is a greater incentive to produce a conceptual model that can be used and adapted on future projects in order to promote a single identity”. Such well-established design criteria will reduce the consultation process.

Compliance

A private healthcare provider has relative freedom in design, as long as it meets the national quality and safety standards set by the Care Quality Commission (CQC).

Traditionally for healthcare, in order to deliver functionality of service and ease of maintenance, the response has been rather clinical and utilitarian. Through better understanding of balancing consumer preferences with patient risk, private healthcare accommodation is becoming far more flexible; indeed the current trend in design is mirroring the hotel market.

Enhanced flexibility in design will naturally make it easier to integrate innovation. This is important for private healthcare providers, which need to adapt to meet the changing demands of their clinicians and consumers.

Patient environment

The design of healthcare facilities that promote wellness and aid healing is not a new consideration, but one that has evolved. Health studies undertaken in the 1970s and 1980s correlated patient environment with wellbeing and with shortening patient recovery. Only recently, Florence Nightingale’s notes on

nursing, advising that fresh air from an open window assists in good health, have been proven to be correct.

Now all healthcare providers are seeking to create therapeutic spaces by emphasising design criteria such as daylight, natural ventilation, views to the outside, wayfinding, quietness, social support, distraction, freedom of movement, art and music.

Integrated services

Hospitals are among the most heavily serviced types of building. Operating 24 hours a day, these facilities incur high operational and maintenance costs and although private facilities are generally less complex than their NHS equivalents, careful attention needs to be given to the planning and integration of services within the overall building.

Early focus on issues such as the optimum sizing and location of plant rooms, services zones and risers can pay real dividends. It will not only reduce construction costs but will also have a beneficial financial impact on operation and maintenance.

Similarly, the drive to create attractive surroundings for patients means that aesthetics are very important. Integrated bedhead trunking systems combining power, data, medical gases and lighting are readily available and provide a concealed solution for dealing with multiple services. More importantly, they can be cleaned easily, helping to reduce the risk of infection.

Technological advancements

It is difficult to accurately forecast future needs and the fear of technical obsolescence can lead to an overprovision of services plant and equipment.

However, designing for adaptability at the outset does not need to cost a great deal. Ensuring that plant areas are accessible, service routes are safeguarded and risers can be modified or expanded easily is vital and will make future modifications relatively straightforward.

Advances in lighting and wireless technology may in any event reduce rather than increase riser sizes and containment systems. In fact, the use of the television is starting to play a much greater role in service integration. The Smart TV has now been developed to incorporate patient controlled applications including air conditioning, lighting, blinds, patient information, nurse calls and telephones.

04 / Value drivers

Front of house

Although only equating to a small proportion of the overall building area, the entrance and reception is the public face of the provider. Patients are increasingly considered as guests or clients, so a large welcoming entrance and lobby with high-quality finishes and furnishings matching the provider’s image is an important design consideration. Those new to the market will consider a high-profile building, spending a premium through the design response, one of the factors which will drive total construction cost from a minimum benchmark of £2,150/m2 up to £3,150/m2.

Brand identity

Where there is a personal and emotional connection between a company and its customers, as there is when dealing with one’s health, the values associated with the brand (compassion, professional, responsive and so on) are of increasing importance. Integrating the provider’s desired identity and values within the design of the building will create further opportunities for increasing patient satisfaction and ultimately greater customer loyalty.

Design standards

Murphy Philipps Architects’ Levinson says: “Private healthcare design tends to be based on Department of Health guidance. While there is not the same requirement, the client team, whose background is typically in the public sector, recognise the value in the guidance literature that is available, especially in relation to space standards.” Some private providers will look to challenge these area recommendations and some may over provide.

Accommodation

A higher theatre-to-bed ratio will increase cost per square metre, given the higher cost of theatre space and greater concentration of engineering services and equipment. Typically there are 15 beds per theatre; any increase in this ratio can assist operational income, but this must be matched with the demand. A safer design solution is to ensure that there is an appropriately sized theatre recovery area.

Single beds

There has been a sustained trend for single bedrooms within healthcare. With patients paying directly for their treatment there is a heightened expectation of a quality environment. From an operational perspective, single-bedded rooms omit the need to balance accommodation according to patient gender, and evidence indicates that this can help to reduce patient stay and cross contamination / infection. The model of patient care still takes precedent - for example, where greater patient observation is required, the number of beds to a room may need to be increased.

Layout

The mean range in size of a single bedroom, including en-suite, is 18-25m2. A single corridor with bedrooms either side gives optimum area and operational efficiency. A new-build ward, typically encompassing staff base, clean-and-dirty utility space, pantry, WC and assisted bathroom, storage, access and risers, equates to 30-45m2 per bed. With the constraints in refurbishing, whether an older hospital or a building conversion, this can rise to 55m2 per bed.

Flexibility

There are numerous arrangements within a building that can offer private providers the opportunity to adapt their income stream. For instance, designing an enlarged treatment room so that it can also be used for physiotherapy, or vice versa, will mean a healthcare provider can easily change its operations. Another example is the introduction of interlocking access between bedrooms, which can allow a family member to stay in the adjacent room to the patient, removing the visiting hour constraint.

Engineering services

Hospitals are significant users of energy and are natural candidates for sustainable design. Designing for natural ventilation and daylighting are important. Where possible, services should be designed on a simple modular basis, which are easily accessible and expandable. Locating major plant close to energy-hungry areas, such as operating theatres, is also important. Ensuring reliability of supply and standby facilities is another key factor.

Specialist services

Early input in specialist systems design is important. For example, the experience and advice of a nurse call specialist can significantly affect the planning and location of some hospital functions. Growing sophistication in diagnostics and patient entertainment systems, as well as more local environmental control, is driving a considerable increase in IT requirements. Wireless technology is becoming more prevalent and the use of open protocols for control systems allows the operator greater choice and value from the supply chain.

05 / Refurbishment

Clients should always first consider whether it is possible to increase the use of their existing space. Capital outlay on a building is often dwarfed by the associated running costs of a typical 20-25 year building life. Whatever the sector, reconfiguring existing accommodation, an estate or a portfolio of schemes may negate the need to build new space.

The business case for refurbishment will be driven by one or more of the following needs:

- to ensure “business as usual”

- to enhance appearance

- to implement significant services, infrastructure upgrade or replacement

- to rebrand

- to align existing departments with model of care and business case

- to install, replace or upgrade diagnostic and/or theatre equipment

- to act on a compliance review such as infection control and hospital policy / audit.

The value drivers for a refurbishment project tend to focus on retaining the provision of patient services:

- Scope. A cosmetic refresh limited to decoration and replacing floor finish can be implemented by a wide variety of contractors and often accommodated with minimal decanting or disruption to the hospital. The work becomes considerably more involved when the refresh requires access to ceilings as it tends to lead to unknown additional scope and the requirement to adjust engineering services.

- Backlog issues. The opportunity to address inherent backlog issues is when a department is closed. This can include replacement of outdated secondary glazing, new internal doors and frames or whole-scale replacement of systems such as nurse call or fire alarms.

- Retrofitting. Refurbishment will allow the opportunity to tidy up the installation of systems that have been installed over various points in time, whether they be IT, data cabling, additional power, fire alarms or nurse call.

- Compliance. Depending on the age and use of the facility, the installation of medical gases should be considered. Unsightly boxed-in radiators, which are difficult to clean, could be replaced with low surface temperature radiators.

- Space. Departmental space planning alterations typically appear straightforward at first glance, but in many cases existing rooms are inappropriately sized for current use. It is therefore important to consider the cost impact on adjoining spaces in finding additional area.

- Disruption. Within the independent sector, there is a consistent wish for contractors to be neither seen nor heard. The need to clearly define working hours, access restriction, shared building engineering services and acceptable periods of noisy and dusty works are critical.

- Seasonal work. Limiting the impact on the hospital’s business operations is essential and in the case of bedroom refurbishment there are quieter times throughout the year when a larger number of rooms can be made available.

- “All or nothing”. In refurbishing patient en-suites it is often difficult to find a solution that does not involve whole-scale replacement of components and finishes. Understanding of this wider scope of works needs to be established at feasibility stage.

- Decant strategy. Phasing for a ward refurbishment is complex, and can be on a bedroom-by-bedroom basis. In the case of theatre refurbishment, the cost of a mobile solution to offer continuing revenue will need to be factored in. Works to common areas, such as the entrance, reception, lift lobbies and stairs are often undertaken out of hours, limiting disruption.

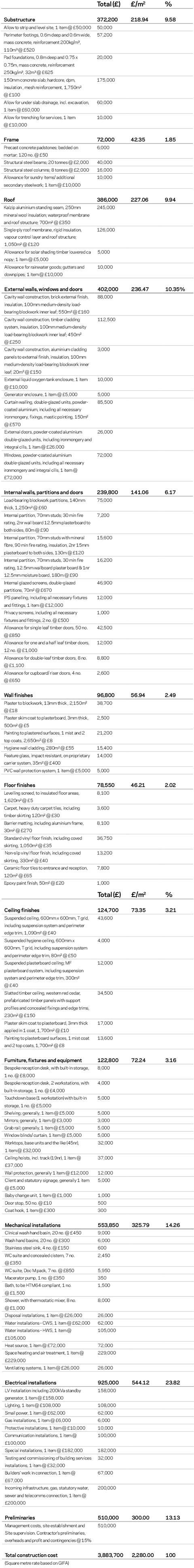

06 / Cost model

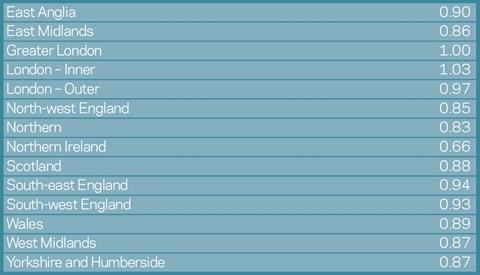

The cost model is for a standalone new-build 20-bed private patient ward unit with associated ancillary support services; both internal and external finishes to a good quality. Theatres are provided elsewhere within the hospital estate. The building contains 1,700m2 gross floor area and is in Greater London. Costs are based upon 1Q 2014 and exclude external works, professional fees, surveys, VAT and site-specific abnormals. The rates may need to be adjusted to account for specification, site conditions, procurement route and programme. For other locations, the costs may be adjusted by the following indicative multiplying factors:

Location factors

No comments yet