The combination of recession and increasing interest rates will result in reduced delivery of retail space over the next few years. This means food retailers must maximise existing assets, say Paul Zuccherelli and Ben McCafferty of Davis Langdon, an Aecom company

1. Introduction

As the country enters a third year of economic uncertainty, with doubts surrounding the long-term implications of the Comprehensive Spending Review and the immediate effect of a rise in VAT, both retail developers and retailers would be excused for hesitating to invest in the UK retail market.

However, early 2011 shows more positive signs emerging, with retailers posting strong trading results for the Christmas period and optimistic projections for year end. The outlook for food retailers appears particularly strong with Tesco, Sainsbury’s, Asda, Waitrose and Morrisons all embarking upon impressive expansion plans. Non-food retailers such as John Lewis, Marks & Spencer and Primark are also pressing ahead with bold expansion plans to enhance their market share.

The profile of where retailers trade also continues to change. The evolution of supermarkets as anchor tenants looks set to endure and their foray into non-food sales continues to divert footfall away from traditional high street locations. The combination of this trend and a lack of new shopping centre space has seen retailers such as Marks & Spencer, John Lewis, Next and River Island expand via out-of-town centres and retail parks, providing a complementary selection of retailers in a single location. Silverburn in Glasgow is one example where Tesco, Debenhams and Marks & Spencer jointly anchor.

A perfect world would see closer co-operation between developers and retailers to maximise existing asset values and deliver new space. Examples that can be seen in the market include a joint venture between Land Securities and Sainsbury’s called “The Harvest Partnership”, whereby the joint venture team develops the overall scheme with control over other units and mixed uses, while Sainsbury’s is the anchor tenant. This is one template that provides a vehicle for both developer and retailer to expand and is also a good example of both parties working together from the outset to deliver the end product.

Although retail trading as a whole continues to remain challenging, there are some sub-sectors that are performing well and we would expect to see supermarkets remain ahead of the game throughout the recession, being in the best position for when the economic recovery starts.

As expansion and redevelopment have not stagnated in this sub-sector, there is no oversupply of vacant retail space, meaning the recovery should be quick. A lack of readily available sales floor area will mean developers will have to revisit new build programmes.

2. Market sector report

With the retail market uncertain and spending growth likely to remain subdued due to potential interest rates increases by the Bank of England, many towns in the UK will continue to see a reduced delivery of retail space for the next two to three years. This is likely to give rise to developers and tenants wanting to optimise their existing assets for the foreseeable future.

It is reported that food retailers enjoyed a prosperous Christmas with respectable growth of 5.1% in this period, however, the next 12 months will be essential for determining the future strategy of a number of these retailers. Competition for market share is intensifying, with leading retailers striving to create growth opportunities. According to Retail Week, this January Sainsbury’s has overtaken Asda for the first time in seven years, making it the second biggest grocer by market share in the four weeks prior to Christmas. Sainsbury’s is the only top-four food retailer that increased its market share during this period from 16.3% in 2009 to 16.6% in 2010.

Kantar Worldpanel has reported that Tesco matched its market growth with its share remaining unchanged at 30.5%, with both Asda and Morrisons experiencing minor drops in market share of 0.1%. Waitrose, on the other hand, enjoyed robust growth of 9.4% over the Christmas period from 2009 to 2010.

Food retailers market share:

3. Refurbishment considerations

Clients and developers alike are being forced to consider alternative options for increasing the asset value of their retail property portfolios. This timely investment is important to safeguard existing value and create the basis for future success and growth.

Developers are looking at ways in which they can add value by investing in improving the existing portfolio. It is important to note, however, that refurbishment works should take place when a scheme is performing well, as recovery from a weak position is difficult if the existing retailers are not trading well in their current locations.

Refurbishments are potentially tax efficient and, when carefully planned, can be delivered with minimal loss of rental income and turnover for the tenants. This does, however, mean that early investment in pre-planning is critical. Ultimately, it is crucial that developers maximise the best solution for their programme to prevent or minimise disruption to trade. However, this is becoming more and more difficult with food retailers trading 24/7.

Throughout the recent economic downturn, we have seen that retailers have continued their refurbishment programmes to keep ahead of their competitors. This means that where they are operating as tenants, it is imperative that the landlords maintain the competitiveness of the property to ensure they retain the interest of their tenant. This must be done with the least disruption to the occupying retailer.

Where property assets are getting tired and need refreshing and updating, landlords run the risk of their retail tenants terminating their lease and looking for more viable and efficient locations. Clearly, this can have a detrimental impact on an asset if the retailer is an anchor tenant. Any planned asset enhancement should have a clear sustainability target that will help to maintain and enhance the sustainable asset.

However, one of the downsides of asset refurbishment is the risk of disruption to trading. There is the disruption while the refurbishment works take place as well as the knock-on effect that this has on a retailer’s trading, especially if this coincides with peak trading around Easter or Christmas.

Procurement of the works is a major consideration in the current construction climate. To ensure the correct allocation of risk between developer and contractor, and to prevent tendering contractors underpricing submissions to secure work, the choice of procurement route and contractor is important to protect the developer and, by association, the asset.

Providing adequate information and control so that the contractor is in a position to manage the risks effectively is crucial. However, it is important to remember that the complete scope of works may only be finalised after an intrusive survey has been undertaken and the logistics of this being undertaken may be hampered if the retail unit is occupied by a trading retailer.

Life cycle considerations are increasingly more important, where previously these may not have been high on a developer’s agenda. This is especially true where it is looking to sell its asset when buildings have been completed, or where it is looking to enhance its existing asset. In this way, the refurbishment or extension works provide opportunities for incorporating sustainable solutions that can reduce energy and water consumption that might otherwise not have been possible.

4. Fiscal incentives

The real cost of a retail development can be reduced significantly when the various forms of tax relief available are taken into account. Indeed, increasing numbers of retailers and investors now measure the costs and returns on their expenditure in post-tax terms.

On a refurbishment project, elements of the works could qualify as repairs and therefore be allowable for tax purposes in full.

Where the works involve dealing with contaminants in land or hazardous substances in existing buildings, then land remediation relief could be available. This particular relief is often overlooked or not exploited to its full potential, which is a real missed opportunity as the savings realised can equate to about 40% of the costs that are incurred.

Probably the most valuable tax relief available on retail properties, however, is plant and machinery allowances. While these allowances will be minimal on a retail shell, they can cover up to 90% of the works on a retail fit out.

To encourage improvements in energy and water efficiency, enhanced levels of allowances of 100% are given on items that include lighting units, air conditioning systems and refrigeration cabinets that meet certain specified performance criteria. These can be large ticket items on which the tax savings can equate to 10%, compared with the capital cost of similar, less efficient alternatives.

In the current market, landlords often need to offer large incentives to attract prospective tenants. Again, the various forms of tax relief outlined above can be used to soften the blow with no detrimental impact on the tenant. Indeed, it is not uncommon for landlords to achieve savings of about 20% of the incentive given if it is thought about early and the terms are structured correctly.

5. Factors that influence design

The real cost of a retail development can be reduced significantly when the various forms of tax relief available are taken into account. Indeed, increasing numbers of retailers and investors now measure the costs and returns on their expenditure in post-tax terms.

On a refurbishment project, elements of the works could qualify as repairs and therefore be allowable for tax purposes in full. Where the works involve dealing with contaminants in land or hazardous substances in existing buildings, then land remediation relief could be available. This particular relief is often overlooked or not exploited to its full potential, which is a real missed opportunity as the savings realised can equate to about 40% of the costs that are incurred.

Probably the most valuable tax relief available on retail properties, however, is plant and machinery allowances. While these allowances will be minimal on a retail shell, they can cover up to 90% of the works on a retail fit out.

To encourage improvements in energy and water efficiency, enhanced levels of allowances of 100% are given on items that include lighting units, air conditioning systems and refrigeration cabinets that meet certain specified performance criteria. These can be large ticket items on which the tax savings can equate to 10%, compared with the capital cost of similar, less efficient alternatives.

In the current market, landlords often need to offer large incentives to attract prospective tenants. Again, the various forms of tax relief outlined above can be used to soften the blow with no detrimental impact on the tenant. Indeed, it is not uncommon for landlords to achieve savings of about 20% of the incentive given if it is thought about early and the terms are structured correctly.

6. Factors that influence construction

Minimising the impact on the retail trading environment is an important factor to consider for any existing development scheme. Experienced project teams will understand the potential for lost or reduced revenue both daily and weekly. This will help dictate the most cost effective method for undertaking any redevelopment works. Careful phasing of the construction works or, ultimately, introducing a temporary trading environment while the construction works are being completed, are ways to ensure minimum impact on the retailer, and the developer’s bottom line.

Programme and the logistics of being able to introduce a temporary trading facility will dictate whether this is achievable. Some retailers in key trading locations frequently use the opportunity for advertising on the temporary hoardings around the site as a means of building up a level of intrigue and enthusiasm from its customer base.

Examples of this are often seen on schemes being developed on Oxford Street and Regent Street in London. Health and safety is paramount to ensure not only construction workers are operating in a safe environment, but also for trading tenants’ customers and staff, while works take place within a live store.

The physical opening hours of a trading unit are also a factor to consider in any retail development, together with the time of year, to ensure the retailer hits either the Christmas or Easter trading periods, but also to ensure that no works are being undertaken during these times, as this would impact on potential sales figures.

7. Factors that influence operation of the asset

Retailers are looking for maximum flexibility within the shell buildings they operate and trade in. The way that people shop is continuously changing and the relentless step change being introduced by internet and IT trading initiatives is increasing both the speed and frequency of retailer churn.

This changes what is required from storage space. Retailers have become round the clock operations, and it is important to note that their service yard may require 24-hour access. This may mean enhanced security requirements such as lighting and CCTV, or even additional or improved security fencing or gates. Many of the products customers purchase in food stores are transferred directly from the delivery vehicles onto the trading floor and this also changes the requirement for large storage and back-of-house areas, and generates a good opportunity to maximise the lettable trading space. This provides a win-win situation for both tenant and developer.

For a developer that will maintain control of the asset, having a good understanding of the cleaning strategy for the building envelope is important, as retailers prioritise these matters differently. It is also important to consider life cycle costing of maintenance, repair and replacement of the building fabric. Retailers will be looking for minimum trade impact and least-cost solutions for any maintenance works that need to be undertaken, so consideration needs to be given to whether a rendered external facade really is the most cost effective material over a traditional brickwork or metal cladding system.

The physical running costs of the store are a further important factor for any developer to consider in refreshing its portfolio. With the sustainability agenda gathering pace, developers are looking for ways to run their buildings more efficiently and maximise BREEAM points in the process. This can be done through rainwater harvesting, grey water reuse, maximising daylight and introducing photovoltaic cells and natural ventilation. Due to the government’s feed-in tariff, opportunities exist for developers to sell the electricity they do not use back to the national grid, and this can become a unique selling point when looking to persuade prospective retailers.

8. Risks

The following are examples of risks associated with a typical foodstore development:

- Planning: local authorities do not necessarily want to see supermarkets built all over the place. Therefore it is important to get the building context, facade solutions and traffic planning correct during the early design stages. However, this may increase the typical base rate for the shell works

- Money may have to be spent on more sustainable building methods and materials and this could potentially have an affect on the viability of the whole scheme

- If the developer chooses new build, in lieu of refurbishment, there is a potential over-saturation of the foodstore market in the medium

- If councils want to see true mixed-use schemes, the question for the developer is whether or not the value generated by the foodstore can compensate for the relatively lower value uses such as cinemas and leisure facilities

- Upgrades may be required to surrounding highways and public spaces in the form of 278/106 contributions.

9. Food store extension cost model

The cost model included in this article is for the creation of a 3,689m2 (about 40,000ft2) extension to an existing supermarket in the East Midlands. The foodstore extension is approximately double the height (9m) of the existing building, to allow the supermarket tenant to build a trading mezzanine floor at some point in the future.

Accordingly, the foundations, ground floor slab and structural frame are designed with the flexibility to accommodate the future mezzanine in any location on the new footplate.

The cost model is based on a shell-only specification and allows for the continuous trading of a store during construction. The overall programme duration is based on 26 weeks. In addition, the model allows for the re-cladding of the existing front elevation to match the new build, and the reconfiguration and resurfacing of the existing store car parking at grade, estimated at about £3,000/space. The car parking and other external works are excluded from the cost model.

Costs are at fourth quarter 2010 and assume a lump sum, negotiated design-and-build contract. Tenant fit-out costs, external works, professional fees and VAT are excluded.

10. Enhancements for ecostores/renewables

The need to achieve a sustainable store is becoming ever more important in order to meet the criteria/targets set by retailers and to also satisfy the planning authorities.

BREEAM’s “very good” has now almost become the minimum standard for any new food store scheme.

The real opportunities for achieving the upper echelon BREEAM ratings lie in the liaison between developer and retailer, maximising both parties’ opportunities. In terms of developers’ shell and core works, examples of how this may be achieved are as follows:

- Maximising daylight levels within the store (using solar tubes or sun pipes and glazed roof lights)

- Applying solar veil film or fritting to shopfront glazing (to reduce glare)

- Providing screening to external plant

- Specifying the building envelope to achieve an air leakage maximum of 3m3 per hour.

- Introducing roof ventilators/wind catchers.

- Constructing the building using a timber frame (as a sustainable building material), rather than a conventional structural steel or concrete frame.

The step-up to achieve BREEAM “excellent” may be achieved through:

- Introducing a travel information point (such as one that provides real time travel information at a bus stop)

- Grey water re-use for WC flushing

- Introducing low volatile organic compound materials

- Enhancing landscaping by specifying planting that requires minimal irrigation

- Maximising the use of sustainable building materials where possible

- Introducing brises soleil to the shopfront

- Introducing porous car park paving that improves drainage and minimises flooding.

The optimum BREEAM rating - “outstanding” - is being aspired to more and more stores and this may be achieved through:

- Introducing additional rooflights that can be opened

- Constructing of green walls, a biodiverse or meadow roof

- Using further sustainable building materials.

- Introducing an electric car charging points system within the car park.

The table to the right summarises likely extra over costs per ft2, based on a 70,000ft2/6,500m2 GIA retail food store (7,200mm high with no mezzanine) for achieving the BREEAM assessment ratings as highlighted above for shell works only. The base cost would be in the order of £592/m2.

In order to achieve the BREEAM assessment ratings, further enhancement works may need to be undertaken as part of the fit-out works, the cost of which will be funded by the tenant.

BREEAM assessment rating:

Very good £118/m2 to £151/m2

Excellent £226/m2 to £312/m2

Outstanding £409/m2 to £517/m2

The above figures are cumulative and should be added to the base cost for the shell works. The figures also assume main contractors preliminaries and OHP @ 16% and are at fourth quarter 2010 price levels, with a location factor of 1.00. Therefore, to achieve an “outstanding” assessment rating on a new build foodstore

shell, the cost would be between about £1,001/m2 and £1,109/m2.

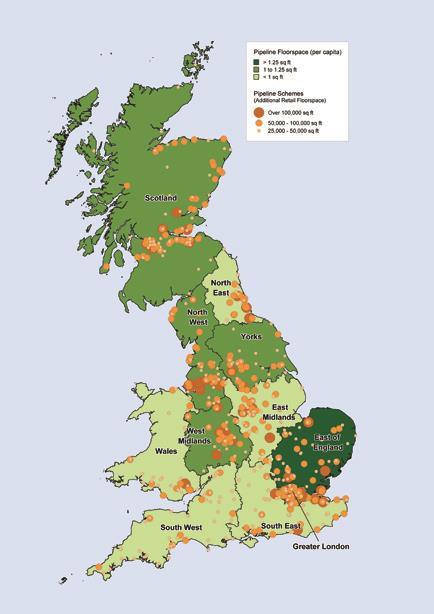

11. Planned retail work

12. Location factors

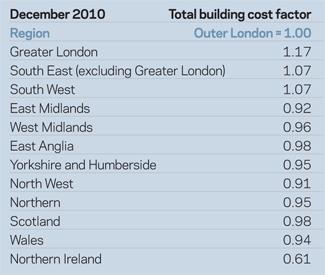

Location factors vary over time depending on regional market conditions. he cost of a building is affected by many localised variables to produce a unique cost, including market factors such as demand and supply of labour and materials, workload, taxation and grants. The physical characteristics of a particular site, its size, accessibility and topography are also contributing factors.

While all these factors are particular to a time and place, certain areas of the country tend to have different price levels to others. The location factors given in the table on the right are an attempt to identify some of these general differences.

Downloads

Cost model food retail table

Other, Size 0.16 mb

No comments yet