As we come to the end of the year and thoughts turn to Christmas, the latest CPA/Barbour ABI Construction index brings us more seasonal cheer

November’s overall index for construction was 141, which is 4% higher than October and 13% higher than a year earlier. Given that it measures contract awards, it is a forward looking indicator and points to 5% output growth for the year ahead. The chancellor presented his Autumn Statement at the start of the month. It is unlikely to affect the UK economy next year but he outlined the scale of public sector cuts to be implemented by 2020 if he is in the same position after the general election: £54bn of spending cuts and a fall in public sector employment of 1 million. Primarily, this would fall on current spending, particularly welfare, rather than on capital investment, which directly affects construction. However, the cuts also point towards the already hard-hit local authorities being further hit in the second half of the decade.

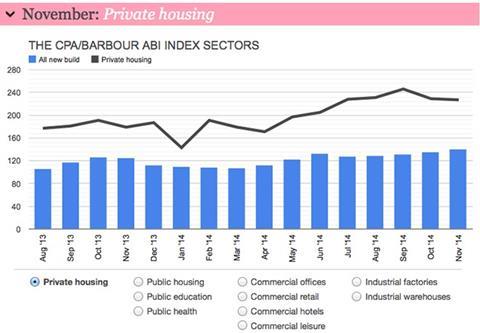

Private housing sector index

A year in review

It seems apt to end the year where we started it, looking at private housing. The CPA/Barbour ABI private housing index was 227, which is 1% lower than in October, but it was still 27% higher than one year earlier. This points towards growth of around 10-12% in private housebuilding starts in the next six months compared with a year earlier. In recent months, growth in the general housing market has slowed due to the introduction of mortgage lending constraints in an attempt to slow house price inflation. Although the chancellor’s last Autumn Statement before the election had little in it to boost the construction industry, he did alter stamp duty in an attempt to boost the housing market again. He introduced a more graduated system of stamp duty, which already operates in Scotland; 98% of home purchasers are expected to benefit. For the chancellor, it appears to be a fine balance between boosting the housing market and housebuilding but constraining house price inflation at the same time - and if the OBR’s forecasts are right, he will achieve it. House price inflation should slow from 10% to 5% in the next two years but housebuilding should also rise.

Noble Francis is economics director at the Construction Products Association

No comments yet