Data from Experian Economics shows that the first quarterly rise in construction output since the second quarter of 2011 ocurred in fourth quarter of last year. However, not all the trends are positive

01 / OVERVIEW

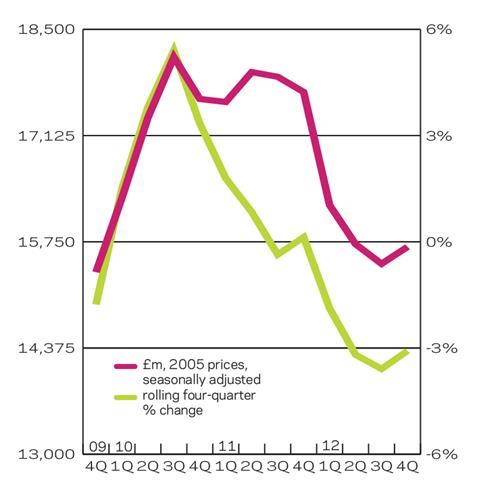

Construction output totalled £24.3bn (in 2005 prices) in the fourth quarter of 2012, up 0.8% on the third quarter. However, this was the first quarterly rise in output since the second quarter of 2011 and over 2012 as a whole the industry contracted by 8.1%.

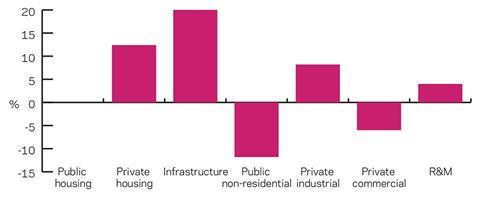

Private housing had the largest quarter-on-quarter growth of 6.3% to £3.4bn in the fourth quarter of 2012, although even with this strong fourth quarter, output in the sector fell by over 4% for the year as a whole.

The UK economy performed poorly in the fourth quarter of 2012, contracting by 0.3%. This can be partly explained by a set of unique events such as disruption to the North Sea oil supply and the conclusion of the Olympics. If these factors are removed, the economy posted a modest underlying growth figure of 0.2% quarter-on-quarter.

Public non-residential output fell by 7.2% in the three months to December 2012, the biggest sector decline in the fourth quarter. Output totalled £2.3bn, its lowest quarterly figure since the second quarter of 2009. Over the year as a whole output in this sector was down by over 21%, an inevitable consequence of public spending cuts.

Public housing has also been on a downward trend with a 1.4% drop in output between the third quarter and the fourth quarter of 2012 and an 18% fall for the year as a whole.

Infrastructure output grew by 3.5% in the final quarter of last year, taking it back over the £3bn mark. However, this has not compensated for a poor performance in the first half of the year as the latest tranche of A1 upgrades and M25 widening completed, and output for the year as a whole was down by over 12%.

The industrial and commercial sectors experienced relatively modest quarter-on-quarter rises of 2.7% and 1.4% respectively in the fourth quarter of 2012 but over the year as a whole there was a marked difference in performance, with industrial output largely stable but commercial output falling by nearly 10%.

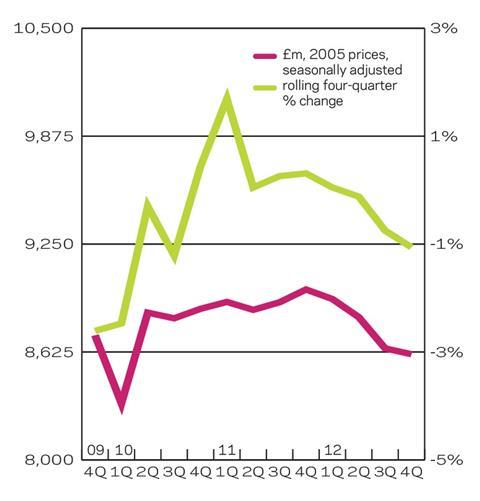

New work fared relatively better than repair and maintenance (R&M) in the final quarter of last year, the former growing by 1.4% quarter-on-quarter while the latter fell by 0.4% over the same period. However, on an annual basis the boot was on the other foot, with new work declining by over 11% but R&M falling by a much more modest 2%.

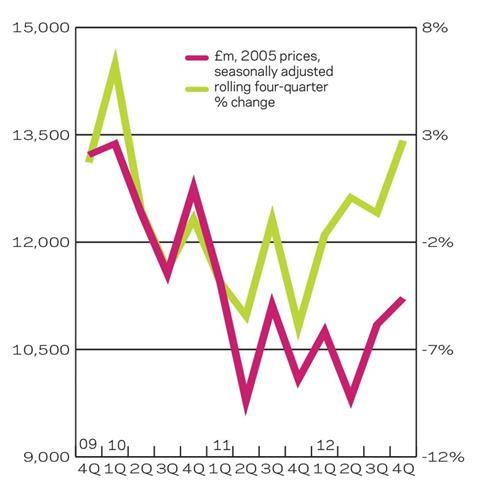

Total new work orders grew by 3.4% for the three months to December 2012, their second consecutive quarterly rise. New orders reached £11.2bn, their highest quarterly figure since the first quarter of 2011. New commercial work, industrial construction and private housing each saw quarter-on-quarter growth of around 10% in the fourth quarter of 2012, with infrastructure being the only sector to experience a decline (-15%). Over 2012, new orders rose by a marginal 0.4%, with the infrastructure and industrial sectors seeing strong growth but modest declines in most of the other sectors.

02 / NEW WORK OUTPUT

03 / R&M OUTPUT

04 / NEW WORK ORDERS

05 / 2013-15 FORECAST

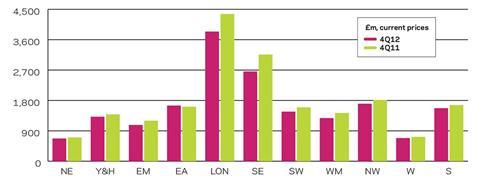

06 / REGIONAL NEW WORK OUTPUT

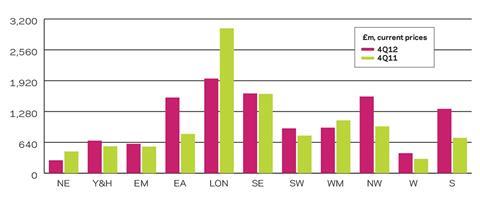

07 / REGIONAL R&M OUTPUT

08 / REGIONAL NEW WORK ORDERS

No comments yet