Overall activity levels slipped closer to the no-growth point, although repairs and maintenance were up. New orders kept on growing strongly, but new enquiries less so. Experian Economics reports

01 / State of play

The total activity index fell five points closer to the no-growth level in May, at 53. In contrast, the repairs and maintenance activity index jumped 10 points to 51, ending six months of decreases.

The residential activity index ticked up by two points and reached 58, making it the highest of the three sectors. The non-residential index plunged 17 points into negative territory for the first time since January 2017. Civil engineering also experienced a sizeable decline, of 11 points, but remained in positive territory at 54.

Both orders and tender enquiries indices remained strong despite diverging slightly. The orders index grew by three points to 70, whereas tender enquiries ticked down a point to 60.

At the sector level, residential orders gained three points to 66. Non-residential orders reached the highest value since September 2017, gaining two points to 81. Conversely, civil engineering lost three points, with a slight dip to 68.

All three sectoral indices for tender enquiries experienced a decline in May. Residential tenders ticked down a point to 55, remaining three points below its 2018 average so far. The non-residential tenders index fell by three points to 65, remaining above its 2018 average. Civil engineering recorded a sharp decline – down 17 points to 64.

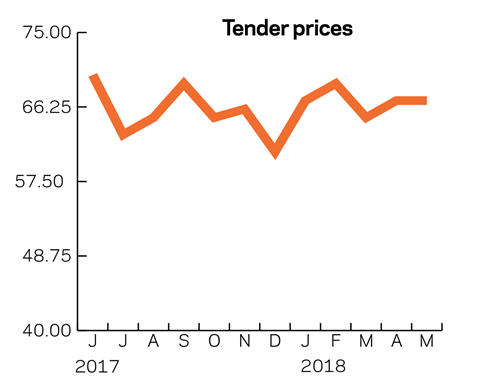

The tender prices index remained unchanged at 67, equal to its average for 2018 so far.

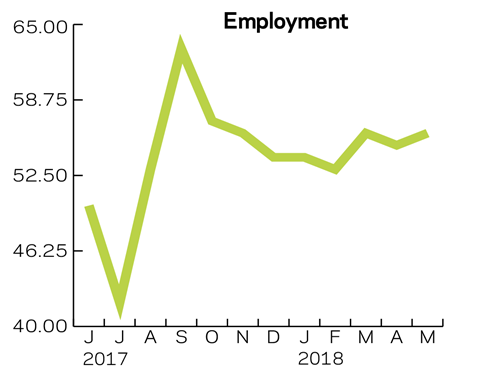

The employment prospects index ticked up by one point, slightly above its level at the end of 2017 and start of 2018, suggesting improvement.

The share of respondents facing no constraints was 41%, a 12 percentage point rise from April – mainly due to a 13 percentage point (to 6%) in those feeling financial constraints. A seven percentage point fall in those citing bad weather also contributed to the overall fall in reported constraints. Constraints due to labour shortages and material or equipment shortages rose, by eight and six percentage points, respectively.

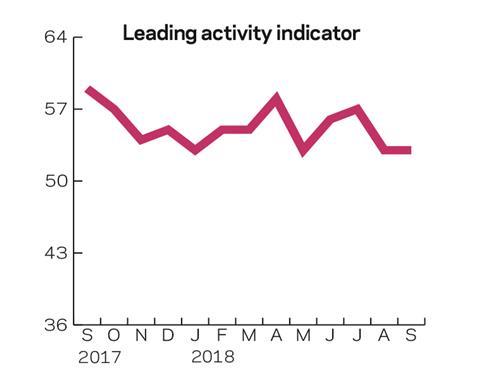

02 / Leading construction activity indicators

The activity index for May decreased by five points to 53, reverting to the level of January 2018. This is also the lowest result since January 2017. The leading activity indicator is expected to recover over the next two months, rising to 57 points by July, before settling back around 53 for the following two months.

03 / Materials costs

The latest developments in the material costs incurred by the contractors suggest that price increases have been slowing in recent months. According to the latest responses, the share of agents reporting material costs increases of between 2.6% and 5% has been expanding, at the expense of the share of respondents reporting price increases larger than 5.1%.

![]()

The share of contractors with material costs growth less than 2.5% has been also increasing. In May, 7.1% of the respondents reported a decline in material costs. This is a significant improvement over the past few quarters, as the same figure was only 2.2% in November 2017.

Similar developments were also apparent in the civil engineering sector. The main pattern is the diminishing share of respondents with material costs increases larger than 7.5%, and the simultaneous growth in the share of respondents with material costs increases smaller than 5%.

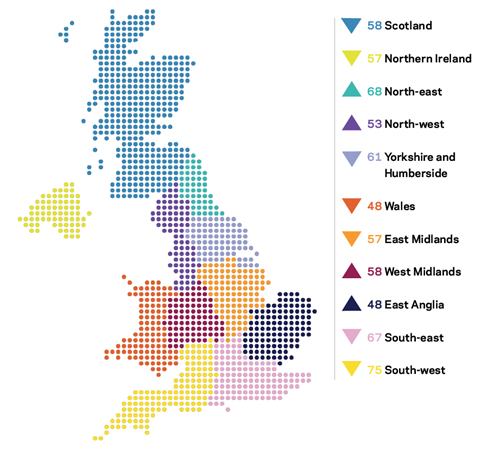

04 / Regional perspectives

Experian’s regional composite indices incorporate current activity levels, the state of order books and the level of tender enquiries received by contractors to provide a measure of the relative strength of each regional industry.

In May the regional performance as measured by the regional composite indices was disappointing, as seven out of 11 regions saw falls. Wales and the East of England were still the only two staying in negative territory (with an index of 48 for both). Wales’ index dropped a point, making this the third consecutive month of decline. The East of England grew for a fourth consecutive month, moving four points closer to positive territory in May.

On the positive side, the South-west remained the best performer, with an index of 75 – although this was six points down from April. The South-west was followed by the North-east and South-east, with indices of 68 and 67 respectively.

The North-east’s index saw a small rise of two points but for the South-east it fell by five. The West Midlands marked a strong growth of six points further into positive territory, at 58, after a long period of contraction.

The UK composite index recorded a rise of three points to 60, in its third consecutive month of growth. May was also the first month the index was above 60 since December 2017, suggesting a recovery from the slowdown seen in early 2018.

This an extract from the monthly Focus survey of construction activity undertaken by Experian Economics on behalf of the European commission as part of its suite of harmonised EU business surveys. The full survey results and further information on Experian Economics’ forecasts and services can be obtained by calling 0207-746 8217 or logging on to .

The survey is conducted monthly among 800 firms throughout the UK and the analysis is broken down by size of firm, sector of the industry and region. The results are weighted to reflect the size of respondents. As well as the results published in this extract, all of the monthly topics are available by sector, region and size of firm. In addition, quarterly questions seek information on materials costs, labour costs and work-in-hand.

No comments yet