Overall activity remains strong, but those working on non-residential and civil engineering projects are starting to experience a fall in work in hand.Overall activity levels slipped closer to the no-growth point, although repairs and maintenance were up. New orders kept on growing strongly, but new enquiries less so.

01 / State of play

The total activity index gained four points over May’s figure to stand at 58, the same as in April. But the R&M index remained flat at 51 points.

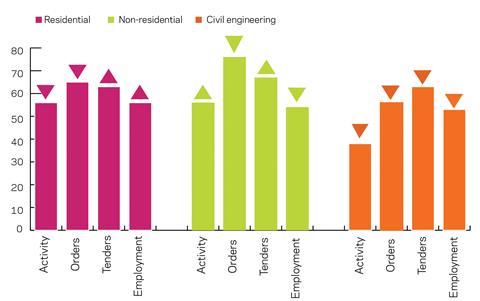

At the sector level, the non-residential activity index was the only one to increase, rising 10 points to 56. The residential index held up fairly well, but lost two points to also rest at 56. Civil engineering activity remained volatile, with June’s index hitting a four-month low of 38.

Orders and tender enquiries stayed strong, despite diverging again. The orders index dropped three points to return to its April figure of 67, while the tender enquiries index recovered by two points to 62, the same as in March.

On a sectoral basis, orders indices remained strong, despite losing some momentum. The residential orders index fell by one point to 65. The non-residential orders index lost five points but remained above the no-growth boundary, at 76. Orders index for civil engineering recorded a much bigger drop of 13 points to 56.

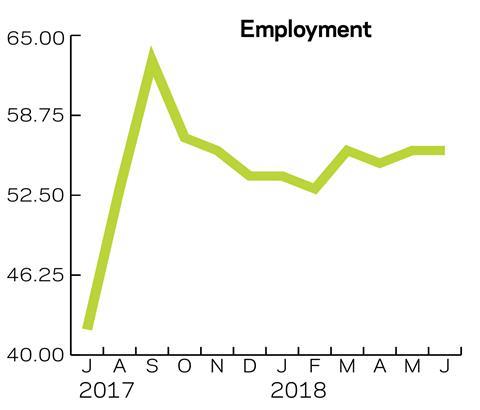

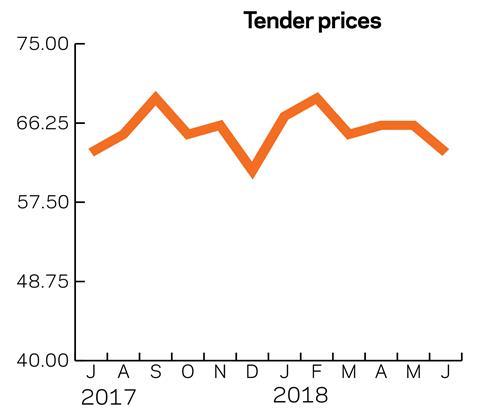

At the sector level, the residential and non‑residential tender enquiries indices showed improvement, gaining eight and two points respectively, to stand at 63 and 67. The index for civil engineering tenders fell by one point to 63. After remaining flat in May, the tender prices index dropped three points, marking a deceleration. The three-month average was down a point to 65. Employment prospects remained positive for the 11th month, as the index remained flat at its May level of 56 points.

In June, the share of respondents facing no constraints fell to 38% from 41% in May. None reported weather condition limitations or materials/equipment shortages. Those facing insufficient demand fell nine percentage points to 14%. Labour shortages became a bigger problem, rising 10 points to 26%. Financial limitations rose from 6% in May to 14%. Miscellaneous constraints rose from 2% to 7%.

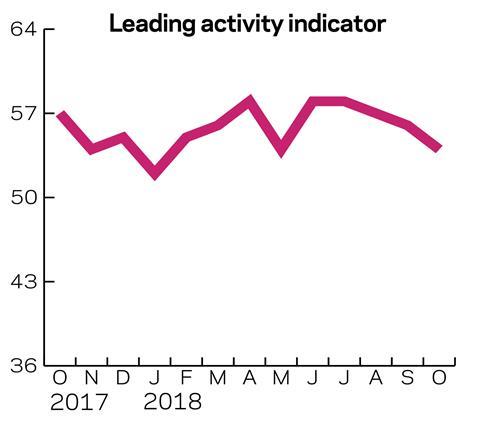

02 / Leading construction activity indicators

The contractors’ activity index for June gained four points over last month’s figure to return to its level in April at 58 points. The leading activity indicator is expected to continue moving in positive territory but gradually lose momentum in the next few months.

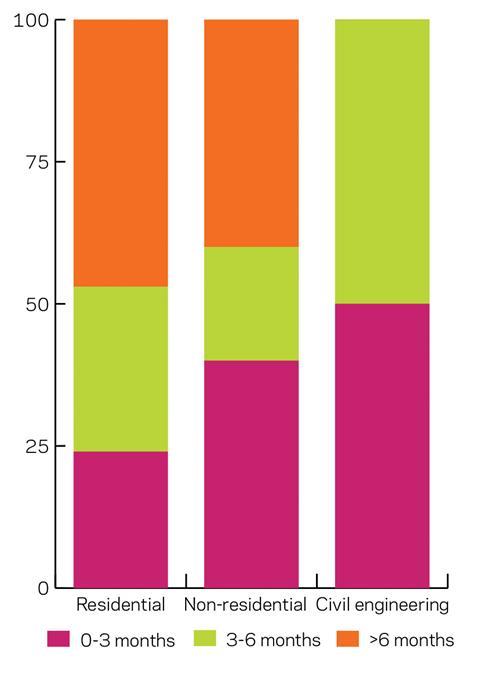

03 / Work in hand

The amount of work in hand in the residential sector in June was almost unchanged compared with March, with 47% of respondents having work for more than six months, while 29% had work for three to six months (32% in March). The remaining 24% (up from 21%) had work in hand of up to three months.

Over the past quarter the non-residential sector saw a shift to shorter periods of time with work in hand. The share of respondents reporting available work for three to six months rose to 20% (up from 17% three months ago), compensated by a drop in participants reporting activity for more than six months – down to 40% (from 48% in March). The remaining 40% reported having work in hand for less than three months, close to the 39% figure in March.

Civil engineering experienced a similar shift. Half the respondents had work for three to six months (compared with none in March). The rest reported work for less than three months (down from 75%). None said they had work for more than six months (compared with 25% in March).

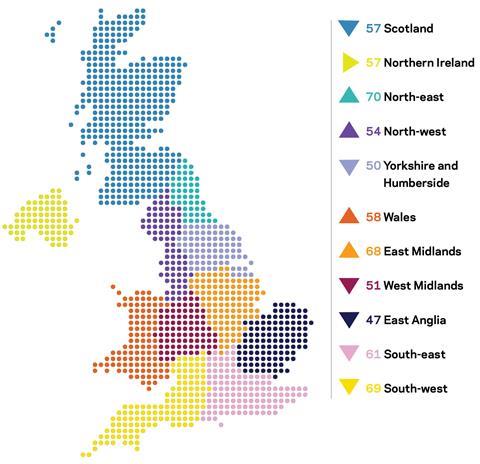

04 / Regional perspectives

Experian’s regional composite indices incorporate current activity levels, the state of order books and the level of tender enquiries received by contractors to provide a measure of the relative strength of each regional industry.

The overall UK composite index fell by a point as the losses in some regions overpowered the favourable developments in others. It stood at 59, down from 60 in May, the second-highest figure for the past six months.

Yorkshire and Humberside experienced the biggest drop, losing 11 points to stand at the no-growth boundary. The East of England retained its last position for a fourth consecutive month, as the region’s index ticked down by a point to 47. The North-east took the lead in June after gaining two points to 70. The South-west followed close behind, with an index of 69, despite losing five points. The South-east and the West Midlands lost six and seven points respectively, to stand at 61 and 51.

The East Midlands saw the biggest rise, with an 11-point gain to 68. Wales also experienced a similar 10-point rise to 58. The North-west index remained positive at 54 after gaining one point.

Northern Ireland and Scotland both registered 57 points, with the first being flat relative to its May level and the second losing a point over the same period.

This an extract from the monthly Focus survey of construction activity undertaken by Experian Economics on behalf of the European commission as part of its suite of harmonised EU business surveys. The full survey results and further information on Experian Economics’ forecasts and services can be obtained by calling 0207-746 8217 or logging on to .

The survey is conducted monthly among 800 firms throughout the UK and the analysis is broken down by size of firm, sector of the industry and region. The results are weighted to reflect the size of respondents. As well as the results published in this extract, all of the monthly topics are available by sector, region and size of firm. In addition, quarterly questions seek information on materials costs, labour costs and work-in-hand.

No comments yet