The return to growth of the UK construction market has prompted some envious glances from mainland Europe, so should UK firms steel themselves for an influx of continental rivals? Plus find out this year’s Top 150 European contractors and manufacturers

This may sound a little odd, given that the UK construction industry is still dragging itself off the floor, but do spare a thought for your continental cousins. After all, with a few exceptions, the prospects for construction economies across the channel look rather more bleak than they do domestically.

According to the latest Euroconstruct forecast, published in November, construction output in Europe will grow by just 0.9% this year, from €1,215bn (£1,013bn) to €1,225bn (£1,021bn), compared with a projected increase of 2.4% in the UK. While the European prospects for 2015 are a little better, with forecasted growth of 1.7%, this is still little more than half the 3.1% anticipated in the UK.

Of course, after years of decline, any growth at all on the continent is welcome, but the recovery is pretty anaemic. In the last few years it has been clear that southern European countries such as Spain and Italy - not to mention Greece - have been acting as a drag anchor on the eurozone, holding back the more successful and disciplined northern economies such as Germany. That remains largely the case, but if the Euroconstruct forecasts prove accurate, the next 18 months will see major northern construction economies stagnating - just as southern states start reporting growth for the first time in years.

From a purely domestic perspective, the question is what this continuing stagnation in the rest of Europe means for the UK. As activity levels finally begin to increase at home, is the UK market about to be flooded with continental construction firms?

The Crossrail effect

In part the answer to that question is that the increased interest in the UK has happened already. Because the recessions in countries such as Spain - which saw construction output contract by about 80% between 2007 and 2013 - have been so deep and long-lasting that the push to secure more work abroad began several years ago. To take just one example, two Spanish contractors were awarded major roles on Crossrail.

“I wouldn’t say that I’ve seen it change much in the last six months,” says William Shirley, an analyst at Liberum Capital. “But I think that with Crossrail there were perhaps more Europeans than normal. You definitely saw the Spanish and Irish contractors coming over from 2009, and I think that has been sustained at a high level.”

However, the trend does not apply across the industry as a whole, with European successes largely restricted to major projects, mostly in civil engineering, and for public sector clients. Crossrail is a good example, but so too is Dragados’ win on the refurbishment of Bank tube station in the City of London. As Steve Canadine, managing director of Ramboll UK, puts it: “Certainly it’s rare now for there to be a major civils project without a European company as part of the team.”

The fact that European competition is being most keenly felt on such projects makes sense on several levels. First, it isn’t really worth the investment in UK offices for foreign contractors to bid for work on projects worth less than about £50m. But perhaps more importantly, these projects tend to be for public sector clients that are legally bound to put contracts out to tender at an EU-wide level and are monitored on their procurement processes.

“Those European players coming in would be more inclined to be bidding for bigger types of projects where they feel that there is more of a level playing field because the decisions are taken in a politically correct manner,” says Kevin Cammack, an analyst at Cenkos. “Where you don’t see them is on £10m-30m projects where the decision-making process is more opaque and where you need to have a personal relationship with the client.”

Irish recovery

The European contractors that do bid for work in the UK tend to be major international players already, generally with an established base in the country. While such publicly-listed companies have had to be competitive when it comes to price, it is unlikely that they will have cut prices too far, purely to maintain turnover: their shareholders simply wouldn’t wear it.

But there is an exception: Ireland. “With Ireland, you can see contractors moving quite quickly and competing for cash,” says Howard Seymour, an analyst at Numis Securities. “Certainly for the last couple of years the big contractors have been saying to me that in Scotland a lot of these boys have been competing on a cash basis and that they’ve had to walk away from a lot of contracts.”

However, it looks likely that the downward pressure exerted by Irish contractors will start to ease in the short to medium term. Out of the 19 countries covered by the Euroconstruct forecast, Ireland is the nation expected to see by far and away the highest growth in the next three years, with projections of 10%, 8% and 11% in 2014, 2015 and 2016 respectively.

While it should be remembered that the construction economy in Ireland contracted by about 70% between 2007 and 2013, such growth should begin to see contractors from across the Irish Sea seek more lucrative jobs back home. “I genuinely think that does actually help,” says Seymour. “If they can move back into the Irish market it does remove an element of overcapacity in the UK - not immediately but it doesn’t hurt.”

An attractive pipeline

An Irish retreat would be seen as welcome news for UK contractors, and analysts also say they haven’t seen any great surge in European competition for about the last six months. However, there are reasons to believe that another spike could be on the way. First, the UK government’s infrastructure pipeline is looking more secure and with more and better opportunities than have been seen for years, including huge contracts up for grabs on HS2 and nuclear new-build.

What’s more, when it comes to the big energy contracts, clients are unlikely to be domestic companies and probably haven’t used many UK contractors on previous major jobs. “If you take new nuclear, you could argue that the only advantage that UK contractors have is their geography,” says Cammack. “The ultimate owner of the asset isn’t UK-based and where they’ve developed plants elsewhere they probably haven’t used UK contractors. You’ve got experienced continental players in that sector.”

Then there’s the issue of the sluggish forecasts for the French and German construction markets in particular. With domestic opportunities constrained and other European neighbours continuing to suffer, it looks likely that northern European giants will push hard for major contracts in the UK. “I’m sure that they will target markets where they can see growth, and compared with other major European economies ours doesn’t look like such a bad bet,” says Cammack. “I think that generally the surge that the main German contractors have had eastwards has run its course. They may be redistributing a bit of effort in markets to the west.”

Whether all of this adds up to a problem or an opportunity, of course, depends on your perspective. From a contractor’s point of view, the added competition will be unwelcome. But an influx of experienced foreign firms could also expose the market to different, perhaps more effective, ways of delivering major projects. As Ramboll UK’s Canadine points out: “It’s beneficial to have open borders - it works both ways. It’s good to bring in new ways of working and can make UK firms scratch their heads a bit. The client can end up with a better product.”

The north-south divide

There have been stark differences in the performances of Europe’s largest construction economies over the past few years

Spain

Out of the “big five” - Germany, France, Italy, Spain and the UK - Spain’s construction market was hit hardest by the recession. Following the nation’s misguided real estate boom, in which more houses were built over a decade than in France, Germany and the UK combined, the industry crumbled as the economy collapsed.

In numbers

- Construction output plummeted from €138bn to €110bn between 2010 and 2011, before a crippling 31% drop to €75bn the following year.

- Although slight growth is expected to take place in 2016, the industry must first endure further decline, with the Euroconstruct Construction Overview predicting an approximate output as low as €53bn in 2015.

- In comparison, the UK industry was worth €184bn in 2011, before it fell by 8% in 2012, and is expected to reach €181bn in 2016.

- The total loss of Spain’s construction output between 2007, when the country’s housing bubble peaked, and 2013 is expected to reach 80%.

- Unsurprisingly, even Spain’s strongest firms are suffering huge losses, with industry giant ACS recording a loss of €1.9bn last year.

- The Centre for Economics and Business Research estimates that 4.7 million jobs were lost as a result of Spain’s construction industry collapsing.

Germany

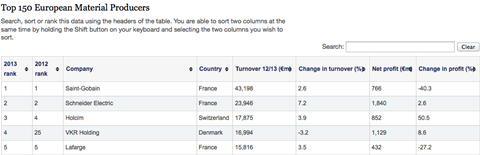

After enjoying one of its highest years of growth since reunification in 2011, the German construction industry’s output fell slightly from €279bn to €276bn in 2012. However, Germany remains Europe’s largest construction economy, with second-place France worth about €211bn.

In numbers

- After a stagnant winter had threatened activity last year, output is now predicted to have grown by 0.3% in 2013.

- Germany’s output between 2013 and 2016 is expected to pick up initially before falling back to 0.3% growth in 2016, when it is expected to stand at €289bn.

- Construction behemoth Hochtief increased turnover last year by 10% to €25.5bn, while net profit rose by 330%.

- Bilfinger, Germany’s second-largest contractor and ranked 10th on the Top 150 list, increased turnover by 4% but saw its net profit fall by 30%.

No comments yet