Costing Steelwork is a series from Aecom, BCSA and Steel for Life that provides guidance on costing structural steelwork. This quarter provides a market update and guidance on demonstrating competency

Construction new work output fell by 6.6% in the first half of 2024 but has shown signs of recovery in the second half of the year. The Office for National Statistics has continued to show growth in repair and maintenance output, which recorded a rise of 7.9% in the same period. New construction orders reached their highest level since Q4 2022, a 12% increase when compared with the first half of 2023. Areas of uplift have come by way of the New Prisons Programme, 27% growth in private commercial orders helped by central London office developments and a strong performance in the infrastructure sector.

Business confidence has strengthened in Q2, according to the Institute of Chartered Accountants in England and Wales (ICAEW). Construction sentiment indicators reflect this, and main contractors have a strong pipeline. However, the optimism from the summer forecasts dulled slightly while awaiting the impact of the new government Budget announcements and other global factors. The Bank of England base rate has been further cut to 4.75% when considered against the maintained high of 5.25% at the beginning of the year; this should continue to help restore confidence in the market. This has been a major influence on funding but more specifically on mortgage rates, which has been an impediment to residential development.

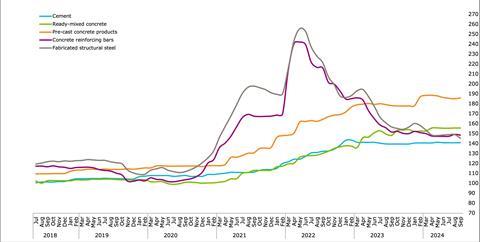

Aecom’s building cost index – a composite measure of materials and labour costs – indicated an annual increase of 1.8% in the third quarter. The Department for Business and Trade’s composite building cost indices suggest that material prices are 2.6% lower than this time last year. However, it is worth noting that manufacturing output price is now marginally less than input cost inflation. This does create, even if it is modest, pressure on inflation with plastic and precast concrete products at the top of the inflationary scale. Shipping costs reduced in August but have remained high, with many shipments between Asia and Europe being rerouted to avoid the Red Sea corridor. Demand from the Chinese market has remained subdued, which has assisted in stabilising material and energy prices. An improvement in the Chinese economy and the impacts of new fiscal measures from the change of US government by way of tariffs will have the potential to add increased pressure on building costs.

It is worth noting that there are 64 government elections in 2024, which impacts 49% of the world’s population and has resulted in geopolitical instability and globally the stalling of construction projects. This combined with continued conflict in Ukraine and the Middle East has the potential to increase uncertainty and fluctuate input prices.

Figure 1: Material price trends

Price indices of construction materials 2015=100. Source: DBEIS

Skills shortages are impacting a number of areas across the industry. Concern over labour shortages was at a record high when surveyed in Q2, with members of the Federation of Master Builders highlighting carpenters, bricklayers and plasterers as particularly difficult to recruit. The changes in the emphasis on types of work with an increase in refurbishment has added further pressure, particularly as these are more labour-intensive. The scale of the problem has grown from the 2023 forecasts, with a projected increase of an additional 5,000 per year reflected in the CITB now estimating the industry needs to attract an additional 50,300 workers per year from now until 2028 in order to meet the anticipated demand.

Overall tender price inflation has started to pick up in the second quarter of 2024. Due in part to the depleted capacity within the industry coupled with an improved outlook, tender price inflation is looking set to increase in Q4 2024 and in the next couple of years (as illustrated in figure 2). A composite measure of building input costs rose by 1.8% in the third quarter, with an expectation of 3.2% in the year to Q4 2024. The consumer prices index fell to 1.7% in the 12 months to September 2024.

Insolvencies have remained as an ever-present risk within the construction industry. The recent insolvency of a major main contractor will have potential impacts on those within its supply chain and could trigger further insolvencies at trade/subcontract levels. This persistent risk of insolvencies will put pressure on costs and is an identifiable risk to both active and future projects.

The industry is anticipating increased demand next year, while the sentiment has been partially subdued due to slow economic growth and concerns around the further reduction of interest rates. The industry as a whole is dependent on how strong the housebuilding recovery will be.

Figure 2: Tender price inflation, Aecom Tender Price Index, 2015=100

| Forecast* | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

|

1 |

120.4 |

120.0 |

131.2 |

145.4 |

145.8 |

150.0 |

154.4 |

|

2 |

121.0 |

122.6 |

134.5 |

146.6 |

147.0 |

151.1 |

156.0 |

|

3 |

119.1 |

125.3 |

138.1 |

146.8 |

148.1 |

152.2 |

157.5 |

|

4 |

119.1 |

127.5 |

142.3 |

145.6 |

149.1 |

153.4 |

159.3 |

Sourcing cost information

Cost information is generally derived from a variety of sources, including similar projects, market testing and benchmarking. Due to the mix of source information it is important to establish relevance, which is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building, with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 3), highlight the existence of different market conditions in different regions.

To use the tables:

1. Identify which frame type most closely relates to the project under consideration

2. Select and add the floor type under consideration

3. Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£169.50 + £112.50 + £30.50 = £312.50

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

Figure 3: Indicative cost ranges based on gross internal floor area

| TYPE | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

||

|

Steel frame to low-rise building |

153-186 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

257-290 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

290-343 |

Steelwork design based on 110kg/m2 |

|

Floors |

||

|

Composite floors, metal decking and lightweight concrete topping |

88-137 |

Two-way spanning deck, typical 3m span with concrete topping up to 150mm |

|

Precast concrete composite floor with concrete topping |

134-188 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

||

|

Fire protection to steel columns and beams (60 minutes resistance) |

24-36 |

Factory applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes resistance) |

30-49 |

Factory applied intumescent coating |

|

Portal frames |

||

|

Large-span single-storey building with low eaves (6-8m) |

111-146 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

135-173 |

Steelwork design based on 45kg/m2 |

Figure 4: BCIS location factors, as at Q4 2023

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

125 |

Nottingham |

101 |

|

Manchester |

103 |

Glasgow |

93 |

|

Birmingham |

98 |

Newcastle |

89 |

|

Liverpool |

98 |

Cardiff |

103 |

|

Leeds |

90 |

Dublin |

90* |

*Aecom index

Steel For Life sponsors

Demonstrating competency

The ��ɫ����TV Safety Act 2022 introduced a requirement for clients, consultants and contractors throughout the supply chain to be able to demonstrate competency, for works on all types of buildings. How can contractors demonstrate competency in structural steelwork to meet these requirements?

Since the introduction of the ��ɫ����TV Safety Act 2022, building owners, clients and all parties throughout the supply chain have a new awareness of their responsibilities for safety. The act applies to all buildings and introduces specific requirements for higher-risk buildings including establishing the ��ɫ����TV Safety Regulator and the Office for Product Standards and Safety (OPSS). These are driving the main changes, as well as the introduction of competence and capability requirements for all those involved in building.

How can steelwork contractors demonstrate competence before site works?

Competency and compliance include having the right skilled people undertaking different aspects of a project, and the provision of certified products accompanied by the correct documentation at each stage of the project.

Products

Any fabricated steelwork provided for a project must be CE/UKCA marked, which is a legal requirement. For a fabricator to be able to provide this, they must have a factory production control (FPC) certificate from either a notified body in the case of CE marking or an approved body in the case of UKCA marking. The FPC certificate demonstrates that the fabrication systems comply with the requirements of BS EN 1090-1 supported by BS EN 1090-2 and are capable for producing fabricated products to the specified execution class. An FPC certification requires the company to have its factory production control system audited by an independent third party, which in most cases includes an audit of the company’s welding processes to BS EN ISO 3834.

Specifications

A robust specification should be provided to the steelwork contractor, stipulating all the requirements: steel grade, tolerances, types of connections etc for fabrication purposes. The most widely used specification for buildings is the National Structural Steelwork Specification for ��ɫ����TVs, which also requires a steelwork contractor to be certified to the Register of Qualified Steelwork Contractors (RQSC).

People

It is imperative that companies have the right staff, trained to the right level, to manage and sign off different elements of the work being carried out. In terms of a steelwork fabrication company, you would expect for them to have trained, skilled, knowledgeable and competent people in each of the following roles:

- Responsible welding co-ordinator

- Responsible bolting co-ordinator

- Responsible painting/coating co-ordinator

- Erection methods manager

- Designated individual for temporary works

- The company’s technical/design manager.

If a steelwork contractor undertakes a project that falls within the scope of the high-risker buildings rules, then it should be able to demonstrate that it has an appointed person for each of the above roles, who has the correct and up-to-date training.

Demonstrating competence and capabilities on site

The competency requirements are not just focused on the supply chain, such as the steelwork contractors, but also on those in control of the sites (usually the principal contractors). Members of the BCSA are encouraged to operate and use safe site handover certificates (SSHC) to help identify which responsibilities lie with the principal contractor and ensure these are in place before the steelwork contractor starts work on the site and during the period of on-site operations.

Safety during steelwork erection is a key focus of the BCSA and its member companies; issues such as safety when working at height, personal protective equipment and preventing falls are afforded high priority. Equally, the provision of proper site conditions, access and hardstandings is of fundamental importance, which is why the use of the SSHCs is used by the steelwork contractors, as this gives the principal contractor the means of informing them that the site conditions are safe to start work on, for the efficient and safe erection of constructional steelwork.

By implementing the use of these, there is a consistent approach to safe site conditions. They also assist clients, principal contractors and steelwork contractors alike to meet their respective responsibilities under health and safety regulations such as the Construction (Design and Management) Regulations and the ��ɫ����TV Safety Act.

Which steelwork contractors meet these requirements?

To ensure that the constructional steelwork industry is ready to meet this challenge, the BCSA has improved the access to its Register of Qualified Steelwork Contractors (RQSC) for both buildings and bridges. The revised schemes are based around the Common Assessment Standard (CAS) and include requirements for assessing the competence and capability of steelwork contractors. The RQSC (��ɫ����TVs) also meets the requirements for the execution of buildings given in the National Structural Steelwork Specification (NSSS), 7th edition, 1st revision.

The companies that hold this badge or seal of approval have been assessed to prove their competence, giving clients an assured way of choosing a steelwork contractor that has the capabilities and experience to work under the new building safety regime.

The RQSC is open to all steelwork contractors, and those steelwork contractors who have been assessed as complying with the scheme will receive an RQSC certificate and are allowed to use the RQSC logo on their marketing and promotional literature. The RQSC logo is a mark of competence and shows that the company meets and, in many cases, exceeds the requirements of the ��ɫ����TV Safety Act 2022. By choosing an RQSC qualified steelwork contractor, clients and insurance companies can be confident that the company has the right competence and capability credentials to safely complete the project.

Want to find out more about competencies in structural steelwork to meet the ��ɫ����TV Safety Act?

The BCSA is hosting a webinar on this subject, presented by Mr Pete Walker on 21 January 2025 from 12pm to 1pm.

The ��ɫ����TV Safety Act 2022 applies to all buildings and introduces specific requirements for higher-risk buildings (HRB) and requires organisational and individual competencies to be identified and established for those working on HRBs.

The webinar will talk about what the steelwork contractors have in place or available to them to demonstrate they are compliant.

To register your attendance, scan the QR code.

This Costing Steelwork article produced by Patrick McNamara (director) of Aecom is available at .

The data and rates contained in this article have been produced for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the article content.

No comments yet