Will 2018 be the year for construction’s procurement revolution? Two decades on from the Egan report and with a construction sector deal on the way, Simon Rawlinson of Arcadis examines the opportunities and implications of a raft of procurement initiatives that are being driven by private and public sector clients

01 / Introduction

This year is an important time for construction. The construction sector deal will soon be launched, and with the promise of investment from government comes the recognition that industry also must grasp this one-off opportunity for change. One of the most encouraging aspects of recent developments is the launch of a set of related procurement initiatives demonstrating that major clients are determined to use their buying power to drive the transformation of the construction supply chain.

This procurement feature looks at the initiatives launched by clients including central government, Network Rail, Heathrow airport and HS2 that are acting as a co-ordinated effort to drive industry change. We explain what the initiatives are, how they link together and what the implications could be for industry. Although this feature is published before the launch of the construction sector deal, now expected after local elections in May, the elements that have been announced so far – procurement for value, industry-led innovation and skills for the future – are all closely aligned to the thinking behind these change programmes.

02 / The challenge - how do you change a fragmented industry?

Everyone in the industry is familiar with construction’s performance problem – productivity is low, the profitability of many contractors is dismal, and the industry fails to invest in its future – either in its people or in productivity-boosting research and development. Mark Farmer’s 2016 report, Modernise or Die, neatly summarised the challenges of the industry in 10 symptoms.

Part of the industry’s challenge relates to its diversity and fragmentation. This means the interests of various parts of the supply chain are rarely aligned and as a result, there is rarely agreement about what the best solutions to improve performance might be. The absence of the large, dominant lead suppliers seen in other industries such as defence, aerospace and automotive has also led to the industry adopting a piecemeal, project-by-project, client-by-client approach to improvement and innovation.

The continuation of the status quo cannot be assured. The rapid growth of US firm Katerra, a Silicon Valley construction technology start-up that has only taken three years to grow into an end-to-end business with a $3bn (£2.6bn) pipeline, demonstrates that even construction business cannot assume that they are protected from industry disruption.

Most contractors, specialist contractors and consultants can highlight great projects in their portfolios – schemes featuring a challenging brief, great teamwork and innovation excellence. The problem is that these projects tend to be exceptions rather than the norm. Furthermore, no attempt at industry self-improvement, from Constructing the Team (1994) to Never Waste a Good Crisis (2009), has been successful in creating sufficient momentum to break construction out of its negative behaviours.

In 2018, with the Grenfell Tower disaster and the collapse of Carillion both casting long shadows, current business models no longer look sustainable. Procurement models do not protect clients from risk, enable a profitable supply chain or deliver valued outcomes to clients. Left to its own devices, although individual businesses would thrive, it is unlikely that construction could undertake its own step change. Fortunately, clients from infrastructure, the public sector and government are considering how they can use their positions to drive change.

A series of separate but linked initiatives are set to put clients in the driving seat for industry change. Construction’s ability to respond to these initiatives and how far reform can be driven into the supply chain will help to determine whether we can reinvent our industry for the 21st century.

10 symptoms of construction industry failure

- Low productivity

- Low predictability

- Structural fragmentation

- Leadership fragmentation

- Low margins and financial fragility

- Dysfunctional training

- Workforce demographics

- Culture of lack of collaboration

- Lack of investment in innovation

- Poor industry image

03 / The role of clients in a changing construction industry

Business is increasingly customer-centric. Digital firms thrive on building an involving customer experience, which creates more opportunities to build relationships, capture data and sell a wider range of services.

The construction industry’s clients all have customers, and the imperative that they must deliver better services and outcomes to customers is driving many of them to seek to deliver better value by taking a more active role in shaping how projects and programmes are set up.

Three of the most significant reform initiatives that are currently combining to shape the industry reform agenda are:

- Transport infrastructure efficiency strategy (TIES) – sponsored by a consortium of transport clients

- Transforming Infrastructure Performance (TIP) – promoted by the Infrastructure and Projects Authority

- Project 13 – sponsored by the Infrastructure Client Group.

All three feature a group of clients that need to be able to get more value from their assets and that can use their influence, enabled by long-term programmes, to shape how projects and programmes are initiated, procured and managed.

The initiatives assume clients must up their game too. Project 13 stresses the role of the project owner rather than the construction client as having a vital role in setting up a project for success, while TIP and TIES both emphasise the set-up stages of a programme.

04 / Transport infrastructure efficiency strategies (TIES)

The transport infrastructure efficiency strategy or TIES is a collaboration between seven major transport clients including HS2, Transport for London (TfL) and Highways England. All TIES members have efficiency programmes. They have joined forces to focus on the main challenges facing the industry, to build necessary capabilities and skills and take opportunities for collaboration and shared learning. TIES members such as Crossrail already have a strong track record of investing in industry improvement initiatives, so by combining forces and aligning initiatives they aim to have wider influence across the supply chain.

TIES has identified seven core strategic

interventions – all of which are backed up by some capability within the client group. Network Rail and TfL, for example, both have well developed digital asset management strategies.

The seven strategies are shown in the table below.

| Strategy | Component parts | Relevance for construction supply chain |

|---|---|---|

|

Strategic decision-making informed by whole-life cost and benefit |

Longer-term decision-making |

Opportunities to deliver greater value using optimised trade-offs |

|

Better project set-up |

Up-front investment in identification of programme objectives |

Greater clarity on scope before the budget and programme are set |

|

Benchmarking forum |

Adoption by clients of more consistent methods of data capture |

Greater transparency on cost, time and performance |

|

Whole-life estimating |

Consistent approach to estimating adopted by transport clients |

Greater certainty in budgets at the start of programmes |

|

Collaborative relationships |

Taking advantage of the scale and duration of capital programmes |

Changing role of main contractor and supply chain |

|

Challenge standards |

Commitment to high standards for safety and asset performance

|

Project teams may have more opportunities to innovate to create value for the client |

|

Digital solutions |

Emphasise digital innovation as a key strategy for improving productivity |

Adoption of the presumption for offsite manufacture by 2019 |

05 / What are the opportunities and implications of TIES?

Many of the innovations proposed by TIES are focused on changing the behaviour of clients, particularly on setting up projects better in the first place. The emphasis of TIES on the adoption of common processes across the sector, such as cost estimating, highlights the need for a foundation of shared standards upon which clients and their suppliers can improve their own performances.

Under the TIES initiative, clients have critical roles in optimising their projects by basing programme selection and specification on a wider consideration of long- and short-term benefits. Combined with an emphasis on better governance, project teams should have greater opportunities to improve their own performance and to deliver a wider range of benefit – perhaps by training more apprentices or by minimising the disruption caused by a project through the wider use of offsite manufacture.

TIES builds on already established initiatives such as IPA’s “programme initiation routemap”and the Crown Commercial Service’s “procuring for growth balanced scorecard”, which is used to award contracts on a wider set of criteria than just the lowest price.

While moving away from cost competition, TIES looks to turn the heat up on design and construction team performance. The emphasis on “design-to-cost” means that not only the objectives and scope of a project need to be properly stated, but also that the design proposals and cost estimates must account for the full range of outcomes right from the start.

Initiatives around benchmarking, performance assessment and performance incentives will also require investment by clients and their teams in data capture and a commitment to greater transparency that comes with the use of performance data.

It could be argued that TIES is a sector-specific initiative and therefore does not have applicability to the wider construction industry. As a result, the co-ordination of the launch of TIES with the Infrastructure and Projects Authority’s Transforming Infrastructure Performance (TIP) strategy is both significant and important. TIP extends much of the thinking of TIES into the wider construction sector, but crucially also thinks about how different programmes interact – for example, linking transport infrastructure with associated opportunities to do with housing, jobs and growth.

06 / Transforming infrastructure performance (TIP)

Transforming Infrastructure Performance or TIP is a 10-year plan to improve the effectiveness of public and private investment in infrastructure. It is intended to address major challenges for industry including improving industry productivity, maximising the benefits of investment and improving the overall performance of project delivery.

TIP has been developed by the Infrastructure and Projects Authority, which acts as the government’s centre for expertise on major programme delivery. TIP is seen as an essential change to enable the UK to deliver its £600bn infrastructure programme against a backdrop of the capacity limitations and low investment in change.

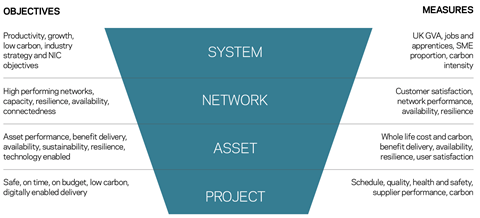

A big innovation in TIP is the introduction of systems thinking for infrastructure, as shown in the diagram (below). This approach requires project sponsors to stop thinking in silos and to look beyond the immediate scope of their programme to consider how it will affect other investments and the total benefits obtained from them. This complements the emphasis on setting up projects properly in TIES.

The TIP plan has four elements, which will be developed over a 10-year time horizon to create the conditions for much improved industry performance.

The four elements of the TIP are listed in the table below.

| Element | Component parts | Relevance for construction supply chain |

|---|---|---|

|

Benchmarking for better performance |

Future programmes selected and planned using benchmark data |

New skills and data tools needed to capture data |

|

Alignment and integration |

Better planning of investments to deliver the desired outcomes |

Supply chain needs to think outside of project silos |

|

Procurement for growth |

10-year programme to develop smarter commercial arrangements |

Benefits of standardised pre-qualification questionnaire and fewer bespoke contracts |

|

Smarter infrastructure |

Embedding technology so infrastructure operates more effectively |

Certainty associated with pipeline enables construction supply chains to invest in smart technologies |

07 / What are the opportunities and implications of TIP?

The ambition of TIP highlights the scale of the opportunity and challenge facing clients and suppliers involved in the delivery of the UK’s future infrastructure programmes. The adoption of a systems thinking approach is especially radical, contrasted with previous stop-start approaches to project funding adopted by UK public sector clients.

Many of the themes taken up by TIP – benchmarking, better project definition, collaborative delivery and more investment in innovation – are closely aligned to TIES and Project 13, helping to make sure the initiatives are part of a larger, self-reinforcing programme.

Clients also have a particularly significant role under TIP. Government will define and collect the benchmarks use to define performance. It is the client’s role to define how programmes support one another and, through procurement, it is the project owner that will set the rules by which suppliers collaborate and create opportunities to co-invest in innovation and capacity creation.

The changes envisaged through the 10-year TIP programme are significant and will take time to become embedded, like the extended period during which the government BIM mandate was introduced. Initial priorities being pursued by the Infrastructure and Projects Authority (IPA) and public-sector clients include:

- The establishment of benchmarking capability in the public sector client body

- The wider adoption of the CCS “procuring for growth balanced scorecard”

- Support for the government presumption for offsite manufacture

- Support for the construction sector deal.

The IPA’s membership of the i3P consortium ahead of the launch of the sector deal is an early indication of the IPA’s intention to participate fully in the innovation elements of the industry’s reform agenda.

The challenge for construction businesses will be the need to keep up with the requirements of potentially fast-moving clients who will want to see their construction investments deliver better value – not just through increased productivity, but also through wider benefits such as the sequencing of the site activities or through the involvement of a wider supply chain. Heathrow airport’s proposal to use construction hubs dotted around the UK to deliver the third runway programme is a good indication of how TIP might influence programme delivery.

A further challenge raised by TIP is the need for all members of the supply chain to participate in innovation rather than simply the tier one contractors and programme integrators. The practicalities of how participants in a fragmented industry will come together to share innovation and rewards through bids, research and development and project delivery is a level of detail that has yet to be explored in much detail.

However, while TIP looks at the improvement of performance at the system-level of multiple programmes, Project 13 perhaps has a perspective that is closer to the industry’s focus on individual teams or projects. It is also a client-led initiative that is focused more on the practicalities of delivering infrastructure investment.

08 / Project 13

Project 13 is an initiative led by the Infrastructure Client Group to develop better ways of delivering infrastructure, which encourage innovation, deliver better outcomes and reduce waste. It will be formally launched on 1 May, following the initial publication of the report From Transactions to Enterprises in March 2017.

Project 13 is at the vanguard of the client-led reform agenda and should drive many of the initial changes needed to bring TIP and TIES to life.

The starting point for Project 13 is analysis of the weaknesses of conventional delivery of infrastructure projects.

The initiative highlights, for example, that clients pay twice for risk – first for the supply chain’s costs of risk management and later for the actual costs when the planned risk transfer proves impossible.

The Project 13 approach is more focused on the delivery of specific investments than either TIES or TIP but still requires significant change by client and delivery team. Accordingly, the initiative has been structured by three levels of maturity, enabling clients and their suppliers to map out a progressive move towards greater integration. This level of detail is essential for the plans of TIP and TIES to be brought to reality.

The five key features of the approach are shown in the table below.

| Feature | Component parts | Relevance for construction supply chain |

|---|---|---|

|

Governance |

Owner’s definition of value to be delivered by the investment |

Based on a whole-life approach and long-term investment horizons |

|

Organisation |

Coalitions of suppliers ready to be engaged as part of the project team |

Competitive bidding is not used so need to find other ways of identifying and sharing savings |

|

Integration |

Teamwork facilitated by the new leadership role of integrator |

Opportunities for many organisations to undertake integrator role |

|

Capable owner |

The owner is central to the success of the delivery of programmes |

Places the client at the centre of the creation of a successful programme team |

|

Digital transformation |

Needs to be focused on digital business models as well as technologies

|

Solutions will be driven by user needs rather than by the team’s technologies Digital transformation will involve a much wider range of suppliers |

09 / Project 13 - moving to a collaborative approach

The scale of the shift from the current transactional model to a collaborative approach is indicative of the size of the industry’s challenge and the complexity of the changes that are required. Even for infrastructure owners represented by the Infrastructure Client Group, the changes envisaged represent a challenge that will rely on effective change management and aligned objectives as they seek to deliver challenging programmes in markets that are affected by Brexit, resource constraint and other sources of uncertainty.

For clients that do not have a programme of work or an experienced capable owner to provide the necessary leadership, they will rely on the raised performance of the wider industry to deliver improved value – the benefits of Project 13 must be encouraged to trickle down to the lower tiers of industry.

10 / Summary and next steps for industry

The co-ordinated launch of these three change programmes and the forthcoming construction sector deal provides clear evidence of a desire within the sector and its clients to reverse long-established trends around transactional project working that have wider impacts on employment, investment and profitability within the industry.

The proposals set out in TIP, TIES and Project 13 represent major change programmes for clients, as well as the construction industry as a whole, so it is important that the supply side recognises its role and supports clients as they commence pilot projects, train their employees and develop new ways of working.

As the detail of the construction sector deal is published, further opportunities for supply chain businesses to participate in industry transformation will become available.

Initially, it is likely that changes to business practice will take place on the largest programmes with the most experienced clients. This has happened in the past, for example, with innovative practice being transferred from Heathrow Terminal 5, to London 2012, to Crossrail. The challenge with these three programmes is to

share best practice much more widely. With the range of clients engaged through TIP, TIES and Project 13, there is a growing likelihood that a much wider set of projects will be influenced by these initiatives.

The key next steps for industry are threefold:

- Recognise that changes proposed on a project are part of a wider programme – encourage them through participation rather than delaying them through lack of engagement.

- Identify routes to value – clients are investing in new approaches to identify how they can get projects to deliver better outcomes and the supply-side needs to do the same.

- Deliver better value – better returns for constructors will come from improved performance, not higher prices.

In conclusion, this year is critical for UK construction. It is the year when organisations that represent a large share of UK construction spend declare how they will act as owners and clients and what their expectations are for sector performance. It is time for industry to respond in the same spirit of challenge, ambition and collaboration.

No comments yet