Housebuilder and brownfield developer expects asset write-down to impact agreement with specialist funding vehicle

Troubled housebuilder and brownfield developer Inland Homes has warned it is likely to breach the terms of its loan agreement with subsidiary Inland ZDP PLC.

In a statement to the London Stock Exchange yesterday, the AIM-listed firm said it is currently “considering possible provisions to be made against certain asset values in its accounts” with auditors.

“The amounts of any such provisions, which have not yet been determined, appear likely to trigger a breach of the asset cover covenant applicable to the loan between Inland ZDP PLC and Inland Homes PLC,” it said.

In June, the £181m-turnover firm delayed the publication of annual results for the year to September 2022 for a third time. It has already said it is likely to report a pre-tax loss of more than £90m when it does finally publish its numbers.

Inland ZDP PLC was formed in December 2012 as a specialist funding vehicle to issue zero-dividend preference shares. It is due to be wound up in April next year. According to Inland ZDP’s most recent annual report and accounts, the firm has issued around 18.1m zero-dividend preference shares, raising £22.28m for Inland Homes.

Last month Inland Homes said it had tightened up its corporate procedures after a report by accountant FRP Advisory discovered “significant and repeated failures in board-level corporate governance”.

FRP was called in by the firm in April after the sudden resignation of then chair Simon Bennett and board members Carol Duncomb and Brian Johnson, formerly the boss of housing association Metropolitan.

At the time, Inland said the trio stood down after the rest of the board was not informed of issues that could be treated as “related party transactions” under stock-exchange rules.

FRP discovered that AIM rules were not followed by Inland in its dealing with a company called First Place Nurseries, an education business in which former Inland chief executive Stephen Wicks and the firm’s chief financial officer Nish Malde owned 40% stakes in.

Among the issues discovered by FRP was a 20-year lease granted by Inland to FPN in 2018 to operate at a property and temporary buildings for FPN’s Beaconsfield Nursery on Inland Homes’ Wilton Park development site.

The report also said various Inland employees spent time on FPN projects at its Radlett and Bushey nurseries in 2021 and 2022 and that those costs should have been charged to FPN.

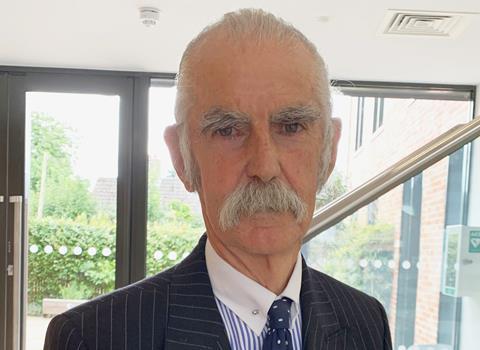

Last month Inland Homes brought in 75-year-old former Gleeson boss Jolyon Harrison as its chief executive and agreed a £4m acquisition of West Yorkshire firm NorthCountry Homes.

Harrison said the firm planned to expand NorthCountry’s “low cost homes” business model in the north of England, taking advantage of lower land values. He said Inland would continue its existing construction commitments in the south and look to develop its brownfield and strategic land business.

“In due course it is proposed to rebrand the business to reflect its focus on housebuilding in the north of England,” Harrison said. “The group will remain headquartered in Beaconsfield, Buckinghamshire for the foreseeable future. I look forward to the Inland team helping me to turn the business round which will take a while, but we are looking forward to a profitable future.”

No comments yet