As we look at the Q2 figures, people are ready to blame Brexit for plunging the UK construction economy into a darker period. But the reality is more complex. Michael Hubbard of Aecom reports

01 / executive summary

Tender price index ▲

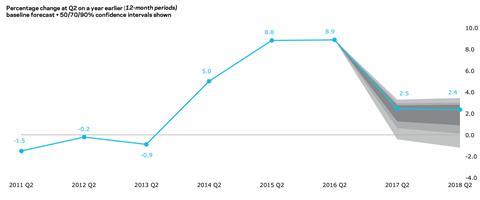

Tender prices increased in Q2 2016 by 8.9% provisionally versus the same time a year earlier. Risks to the outlook are now clearly to the downside through 2017 and into 2018.

��ɫ����TV cost index ▲

��ɫ����TV materials cost inflation is moving marginally higher than previous flat trends, approximately 0.6% over the first half of 2016. Lower sterling exchange rates are cited as a key contributory factor.

Retail prices index ▲

The annual rate of change was 1.5% in Q2 2016. Inflation rates may pick up in future quarters as a result of weaker sterling.

02 / trends and forecasts

Is Brexit the tipping point and catalyst for the UK economy and construction to go into a more ominous period once again? Or will it eventually turn out to be loud thunder but small raindrops? Plenty of current rhetoric appears to suggest that every change to economic indicators and output levels is because of Brexit. Without question, uncertainty has increased since 23 June. The Brexit vote, and the European Union (EU) renegotiations that follow, are an added complication to a weaker, cyclical outlook more generally. However, events in the UK economy and construction that play out over the next couple of years will not be all due to the referendum outcome.

Various data series confirm that weakening economic trends have been evident for an extended period now. Besides, the EU referendum was infrequently mentioned a year ago. Increasingly lacklustre global economic growth and disinflationary trends are undermining the quest for genuinely sustained and balanced growth prospects. Despite this, UK construction did well in the last couple of years, led predominantly by the housing sector.

The UK’s position in the EU has not changed. Brexit-related uncertainty is clearly creating considerable unease, however. This is particularly acute where construction client organisations are searching for meaning in events themselves - and if construction projects are related to this. Some future projects have been put on hold, deferring capital investment until more clarity emerges; some will be cancelled, perhaps those that were more speculative in nature. Many will continue or proceed where the business case delivers tangible operational or investment benefits. Many of these planned projects were already being closely appraised in the face of elevated construction price and cyclical trends. A major concern for property clients is the unknown impact on end-user confidence, in turn affecting demand and potentially reducing rents or signing up pre-lets that help to make developments viable.

Although the Brexit referendum outcome has had minimal immediate impact on construction activity already underway, higher levels of uncertainty will emerge in the supply chain over the near-term. This adds complexity to the market dynamics already at play through 2016, where moderating levels of activity are being seen across almost all construction sectors. These underlying trends were expected to continue later into the year and 2017, irrespective of a Brexit outcome in the referendum.

Some early indications of more anxiety have appeared in sentiment surveys. Many parts of the construction supply chain until recently maintained that workload remains strong though, pipelines are still good and long-standing capacity constraints persist. Confidence in pipeline will now become one of the key determinants of contractor views on market engagement: suitability or acceptance of certain procurement routes, negotiating positions and pricing. Price, after all, is a major signalling mechanism that reveals market sentiment. It will be watched more closely in coming months for signs of higher competition.

Enquiries are reportedly higher for some firms from international clients - probably because of changes to exchange rates. Perhaps more concerning, anecdotal evidence appears to suggest that Brexit is being used as a negotiation tactic to seek pre-contract cost savings. Will this store up problems post-contract if costs are now being removed during pre-contract negotiations that are real and justifiable, and flow primarily from the supply chain?

Supply chain strength has once again been highlighted with the collapse of Dunne Group. Events of this kind reverberate vertically and horizontally around the supply chain, as trade contractors have clients, suppliers and subcontractors. If construction firms’ balance sheets are still impaired after the last recession, this compounds the overall fragility of the supply chain.

UK construction will experience impacts over the medium-term from this potent mix of headwinds - further complicated by negotiations to leave the EU. For now, the UK is still a member of the EU. UK and pan-European political uncertainty and inertia is also a near-term threat, denting investment confidence for some domestic and international organisations.

Where there is a threat, there is often an opportunity. Many large property clients were already anticipating a slowdown before the referendum. Consequent adjustments to their pipelines were made, further questioned by elevated construction cost trends. Some organisations are therefore in a good or stable position to capitalise on future opportunities.

Those who hold their nerve could get a better market deal versus those who value engineer now but take time doing so. Looking through the current near-term picture in order to see the longer-term story and outlook may therefore pay off.

Paradoxically, a weaker pound makes the UK more attractive purely in money terms. Possible opportunities from foreign investment from a fall in sterling then become realistic propositions, although this may be simply purchasing real estate assets rather than actual development activity.

A / AECOM INDICES

03 / activity indicators

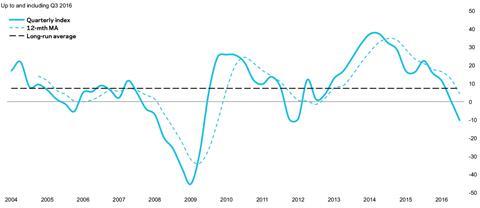

Adding to the apparent gloom, the UK construction industry entered a technical recession, according to the latest Office for National Statistics (ONS) data release. Construction output across the UK was estimated to have fallen by approximately 2% in the year to May 2016. Month-on-month and quarter-on-quarter movements also recorded negative changes of a similar magnitude. All new work saw a larger drop in the year at -2.7% in May. Even applying a quarterly average to remove data noise doesn’t necessarily improve the outcome.

A sector breakdown shows that of the all new work classifications only private housing and commercial posted increases in the most recent three months compared with the same period a year earlier. Newer monthly changes saw both these sectors drop into negative territory to join the others. Infrastructure was the exception, which notched a 0.6% increase in the latest month-on-month change.

ONS data for new orders is only available up to Q1 2016 presently. This provides evidence that the industry was still expanding overall at this point, as all new work was holding up at 1.2% higher than a year earlier in Q1 2015. Only in September, with the next ONS new orders data release, will we know what newer official data trends look like.

Sentiment surveys from a range of providers for construction and the UK economy are now moving into line with each other: the general synopsis is that the industry was doing well until recently but there is now more disquiet and deterioration in the outlook. Nevertheless, we should not be surprised by these data releases and output figures. Weaker rates of overall construction industry growth is not a new trend, having been clearly evident since last year. The momentum currently being experienced in the industry will determine the level of anxiety over coming months.

B / ICAEW Uk business confidence index

An expected near-term slowdown in future construction output can be offset by government policies relating to infrastructure and public sector capital spending. The new chancellor recently signalled possible major changes to fiscal policy. Prevailing fiscal approaches since 2010 have not always helped UK construction output volumes. The new chancellor talked of “resetting the government’s fiscal policy” and saying he’s ready to “borrow and invest”. As always, the proof will be in the pudding, and this year’s Autumn Statement will be eagerly anticipated to see whether UK construction benefits and helps to remove increasing industry anxiety. Higher competition for infrastructure work is expected if Hinkley gets the green light, but as the other “Hs” - HS2, housing and Heathrow - all come under review, further delays could occur as value engineering is required.

These changes to construction output are happening in tandem with revised forecasts for economic growth, both in the UK and globally. Although UK GDP surprised to the upside in Q2 2016, posting 0.6% quarterly growth, the economic outlook is beginning to look markedly weaker. In fact, the National Institute of Economic and Social Research suggests that the Q2 figures hide a more nuanced story - that growth slowed notably at the end of the quarter and most of the action happened in April.

C / Aecom tender price inflation - Yearly run rate and forecasts

04 / ��ɫ����TV costs and prices

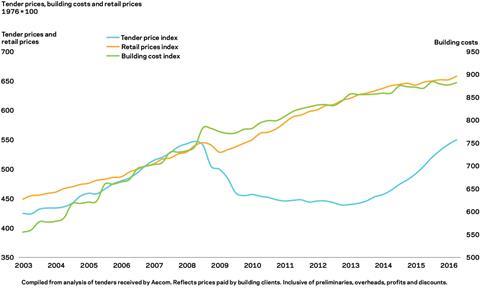

Aecom’s tender price index recorded an 8.9% change in the year at Q2 2016. This strong performance follows the preceding three quarters when annual increases in the run rate of tender price inflation were stronger still, at or in excess of 10%. Significantly, the index level is now above its last peak in Q2 2008.

Moderating market conditions are expected to result in lower rates of change in tender price inflation moving towards the end of 2016 and into 2017. Higher industry-wide uncertainty also adds to the changing complexion of market pricing.

The degree of output moderation - or slowdown - will influence the magnitude of commensurate tender pricing changes. The forecasts are based on a number of assumptions: that output slows in an orderly fashion; that the EU referendum result is not another “Lehman moment”; that order books do not collapse immediately as a result of this coming uncertainty; that prevailing trends in government capital expenditure are not substantially changed; and that most material adjustments to sterling are now priced in.

Main and trade contractor preliminaries levels have risen strongly and these will likely change in response to higher levels of competition. So too other on-costs such as risk allowances. But any reductions in this area of supply chain pricing compounds industry fragility once more. Balance sheet strength remains an issue for many firms across the industry.

Despite increasing industry ambiguity, contractors had, until recently, indicated order books are good, with many suggesting that they are still able to pick and choose projects. Extended lead times are reported, and some trade contractors expect further increases over the near-term. These pressures support the narrative of a stretched industry. The reality might be different if some pipeline dominoes fall or, at the very least, are dislodged.

The disinflationary interplay between output, changes to future pipeline, higher competition and tender pricing could be offset by rising input costs though - primarily materials. Materials costs have shown signs of life lately, rising 0.6% between June and July on an aggregate basis. Until then, materials prices overall were flat through the first half of 2016 posting only a 0.5% increase.

These recent changes are likely to result from a combination of two factors: general supply and demand dynamics, and early effects of movements in foreign exchange rates, principally weaker sterling. Domestic inflation is also a near-term contributory risk to pricing.

Cost and price escalation from foreign exchange rate changes will create underlying inflationary pressures for the construction supply chain over the medium-term, just as tender pricing trends cool off. Profit levels could then be squeezed, should there be limited headroom or an inability to secure higher tender prices over the next 12-24 months.

Higher volatility in sterling and its major currency pairs has been experienced in the last two months. Cost expenditure on non-UK denominated materials and equipment is expected to increase should sterling remain lower for an extended period. Cost planning needs to take account of these higher currency-related risks, either through hedging strategies or robust quantitative risk allowance approaches. Design and specifications might therefore need to give additional consideration to domestic materials and equipment,

in the event of further changes in the relative positions of currencies.

Cladding packages are often cited as being subject to changes in foreign exchange rates. Other major materials categories that are heavily imported, such as tiling, stone and timber have seen some increases in costs. Further, input cost changes arising from lower sterling will impact the supply chain where mitigation strategies are not in place.

Difficulties in receiving fixed prices for certain construction elements may emerge in coming months too. In addition to these early input cost movements already seen, there is increased talk of suppliers wanting to raise their material prices following Brexit. Again, direct links to a lower sterling, particularly against the US dollar, are cited as the key factor.

Aecom’s baseline forecasts for tender price inflation are 2.5% from Q2 2016 to Q2 2017, and 2.4% from Q2 2017 to Q2 2018. This tells only part of the story though - specifically in the changing and evolving marketplace set for the remainder of 2016 and early 2017. These baseline forecasts should not be appraised in isolation.

There are clear downside risks to price forecasts and associated confidence intervals over both 12-month periods, many of which were expected but are complicated by Brexit uncertainty. Moderate positive yearly change is the most likely scenario, given earlier assumptions, but there remains a possibility of some negative annual price changes over the forecast periods.

No comments yet