Technically the construction industry is in a recession, but many firms continue to report stable activity levels for now, says Michael Hubbard of Aecom

01 / Executive summary

Tender price index ▲

Tender prices increased by 3.1% over the year at Q3 2017. Although slower, the rate of yearly change is still positive but against a backdrop of falling industry output.

��ɫ����TV cost index ▲

��ɫ����TV materials cost inflation is up over the year at 3.7% in Q3 2017. Both labour and materials components of the index continue to increase steadily.

Retail prices index ▲

The annual rate of change was 3% in September 2017. The yearly rate of change continues to increase, putting pressure on disposable incomes.

02 / Trends and forecasts

While “deal or no deal” for Brexit dominates the news, technically, construction entered a recession in Q2 2017 – though it doesn’t feel like it, given the high utilisation or stretched capacity at which most firms are still operating. Last Market Forecast described inconsistency between hard (official statistics and published data) and soft (surveys) industry data series. Mixed stories and messages are still around, but there is now increasing alignment between the respective trends of the soft and hard data.

In contrast to economic news globally and across Europe, UK gross domestic product figures for Q3 2017 are lacklustre. It is unfortunate that this news for the UK comes at a time when global economic activity is expected to pick up. Worryingly, construction contributed -0.7% to

the overall GDP figure for the quarter and was the only UK industrial sector to contribute negative growth. As this was the second successive quarterly contraction for the construction industry, it is this that marks a technical recession.

In spite of this gloomier news, construction market sentiment across the UK has held up so far. This is probably more reflective of the near-term and nowcast surveys. Trade contractors are still bullish on workload out into next year. As many of them are sequenced later in a construction programme, they may not be experiencing the same dynamics just yet that main contractors are seeing. More main contractors are scanning the horizon over the medium term and seeking ways to navigate a more stable route through expected higher turbulence. Furthermore, capacity is beginning to appear, and it might be no coincidence that business development activity is picking up. Still, across informal settings industry participants talk about good activity levels – the phones are still ringing with opportunities. However, client propensity to commit to actual starts has shifted and is lower than recent years.

The news of a construction recession comes as the International Monetary Fund says the global recovery is “stronger and more broadly based” than previously thought. Not only this, but the Fund has raised its global economic growth forecasts for 2017 and next year too. Additionally, McKinsey’s Economic Conditions survey underscored the strengthening fortunes of the respondents’ domestic economies – and also their views on the outlook for the global economy. According to this international survey, it is the first time in six years that a majority of those surveyed report improving conditions in their domestic markets.

Against a backdrop of rolling Brexit speculation, ambiguity is seemingly increasing, which makes business planning more difficult. Market reaction arrived immediately after the referendum result, but how the market and economy responds now will be a clearer gauge to the future direction of industry output. Generally, capital investment intentions for UK firms across all industrial sectors are increasingly stalled or lower, reflecting subdued confidence in expected market conditions. Where then will domestic demand for construction come from?

A lopsided rebound beginning in 2013 has seen private housebuilding push higher and further away from all other sectors. This sector expanded by 80% more than any other sector over the same period. Conversely, all non-housing sectors have ebbed and flowed since mid-2013, never sustaining a continuously upwards course.

But because of such severe capacity constraints over the last four years, all sectors have felt very busy – in spite of national statistics offering a different slant to the story – helping output to reach record levels in the UK.

Margins remain a primary focus for contractors. How long this lasts will be influenced by external events, and by how much construction demand adjusts over the medium term. Increasing pressure from factors outside firms’ control will test this resolve. As contractors work to improve their financial positions, strains are felt through the skills shortages amplified by EU migration flows from the UK. This dynamic adds to cost-push inflationary trends that have contributed to the operational strains of recent years.

Project delivery headaches might be alleviated by falling industry output; however, this is a small crumb of comfort when new orders data looks portentous. Although demand is expected to slip, tight supply-side issues are likely to provide some offset to tender price falls.

Procurement routes have seen tension because of the busy market conditions in recent years. Single-stage design and build is oftentimes the preferred procurement choice for many clients, but there is now more willingness by main contractors to entertain this market engagement route. Changing market conditions is one reason; the other reason can arise from “two-stage fatigue” and some unpredictability

in tender outcomes, especially where the market is hot and pricing is known to change quickly. The length of time it can take to conclude the second stage of tendering in this procurement route drains momentum from the pre-contract programme.

03 / Activity indicators

New orders for main contractors dropped notably in Q2 2017. Falls were recorded in both headline measures – quarterly and yearly movements – in the Office for National Statistics (ONS) data. The movement from Q1 2017 to Q2 2017 saw an 8% decline; and Q2 2017 versus the same period a year earlier showed a 12% drop. These recent values are comparable to similar movements seen during the period 2010 to 2013. While this reflects the cyclicality of construction new orders and output, denominator effects do play a part in the size of the negative numbers. In other words, the highest recorded value in the last seven years for new orders for new work was in Q2 2016, and any number divided by this will affect the percentage change outcome.

Viewed in a positive light, all work construction output moved higher by 4.1% in Q2 2017 versus Q2 2016. However, the ONS data release also recorded a fall of 0.5% for all work on a quarterly change basis between Q1 and Q2 2017. Not only are there mixed stories across the industry in respect of workload and sentiment, but industry output data can be interpreted in different ways – with a positive or negative spin. What is evident is a trend to lower overall construction output. But this has to be given vital context in that new work output reached record levels earlier this year. All and any described changes, or future comparisons, are therefore from a record high-water mark. Our sector had managed for some time to outrun the spectre of uncertainty that had descended on other UK industry sectors earlier this year. Nonetheless, it appears that the stable but slower current situation elsewhere in the economy is finally catching up with the construction sector.

Despite all this, the optimism of construction firms shone through at least until the halfway mark of the year. Sales and output expectations among manufacturers, builders and subcontractors were positive in the main, supported by enough enquiries to invoke a feeling of confidence. However, more clouds appeared during the third quarter. Put together, the evidence would suggest that this is very likely to be the inflection point where more rather than fewer firms corroborate the slower activity of the industry. An uptick in the number of construction insolvencies earlier this year is a trend to keep sight of.

Although the construction sentiment surveys held up, economic indicators and business surveys turned down. Some fell below equilibrium levels into negative balances – both the CBI’s and ICAEW’s UK business confidence surveys in Q3 2017, for example. Consumer confidence has taken a hit too as higher domestic inflation and persistent flat wage growth put pressure on disposable incomes.

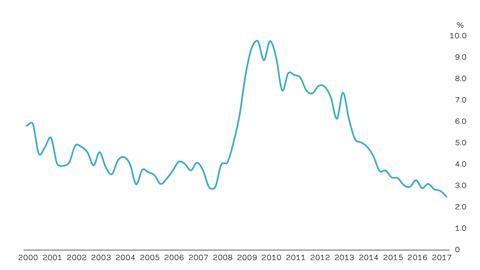

A / Annual rate of change in construction employment

04 / ��ɫ����TV costs and prices

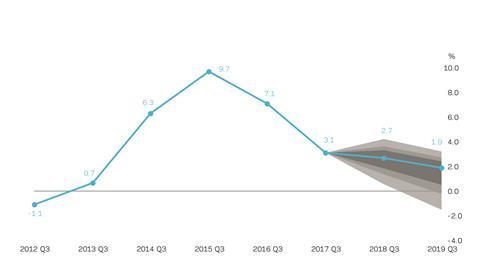

Aecom’s tender price index recorded its 20th consecutive quarter where the index level increased. This run is only surpassed by the period 1984 to 1989 at 23 successive quarters. Despite falling UK construction output, tender prices continued to increase on a yearly basis at Q3 2017 by 3.1%.

Cost-push inflationary trends – supply chain, materials and labour – explain much of the recent year-on-year increases. Imported inflation is still in the system from the lower sterling exchange rates being experienced since 2016. While sterling remains weaker against its major currency pairs – particularly the euro and US dollar – higher rates of domestic inflation will continue as a feature of the economic picture over the near term and well into 2018.

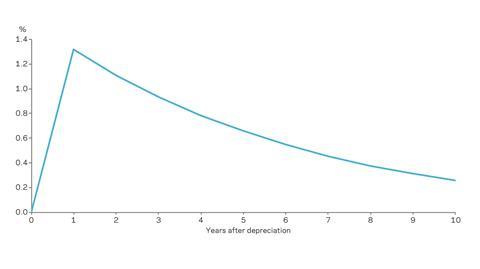

The Bank of England recently attempted to quantify the effect of sterling devaluation and how long resulting domestic inflation stays in the system. The conclusion is that “the effects of exchange rate changes last longer, but build more slowly than commonly assumed” (see chart B, overleaf). Commercial pressure remains then from higher or rising input costs, given that UK construction is a significant net importer of construction materials. Further, the Department for Business, Energy and Industrial Strategy’s All Work construction materials index increased by over 5% at September 2017.

Labour market tightness also remains in evidence. Indeed, surveys among contractors and subcontractors detail the enduring difficulties in securing staff resources. Labour rates still record continued upward movement over the year by more than 3% at Q3 2017 for an aggregate measure of numerous trades. Likewise salaries, where surveys also confirm strong underlying demand for most supervisory, management and professional skills. Although this aggregate measure for site disciplines is positive over the year, a clear majority of trades saw declines in the month-to-month change recently, reflecting an early signal about the softening outlook for construction.

Skills shortages are here to stay, though. The reasons are well documented. Future risks for the industry are that the problems get worse or, at the very least, do not improve. Even with a period of slower overall activity, demand for skills and resources is expected to remain.

This puts contractors across the whole construction supply chain in a quandary: how and where to pitch tender prices and commercial bids when faced with more competition for the available work, but with ongoing cost pressures from the inputs required for their services?

Demand is falling. But context is important. The slowdown is happening after record levels of industry output. Evidently, supply-side factors to tender pricing are beginning to weigh more heavily now.

It is very likely that an inflection point has arrived. However, there is often a lagged effect between tender price adjustments and changes to industry output. If historical guidelines are sought to determine these expected changes, there may be less application now because of exceptionally tight supply-side conditions throughout the industry.

Aecom’s baseline forecasts for tender price inflation are 2.7% from Q3 2017 to Q3 2018, and 1.9% from Q3 2018 to Q3 2019. There is a slight skew towards downside price risks over the coming forecast period, with further downside risks weighing on the outlook through to Q3 2019. Political events are now acting as a drag on the UK economy and construction, with an increase in these issues providing further headwinds over the medium-term horizon.

The price forecasts are based on key assumptions: construction output is relatively sound over the near term but maintains its drift downwards; contractor order books can be filled but with increasing flexibility in the accepted commercial terms; uncertainty (both cyclical and Brexit-related)

begins to introduce genuine turbulence into the UK economy; prevailing trends in government capital expenditure are not substantially changed over the short term and into the medium term; and sterling does not materially adjust from its present lower valuations.

Upside risks to tender price trends over the forecast periods come from the conflation of the supply-side issues described, and a further pick-up in price inflation is seen. This said, mitigation to the size of the risk is possible to some extent if demand continues to fall away and more competition returns to the marketplace. Nevertheless, a period of “stagflation” is now upon us, as prices continue to rise yet industry output slides.

B / Effect on CPI after permanent 20% fall in sterling

C / Tender price inflation (yearly run rate and forecasts)

Percentage change at Q3 on a year earlier (baseline forecasts +50/70/90% probability distributions shown)

No comments yet