Reduced costs and the ability to attract finance are critical to the viability of the UK wind industry, and with the government recently withdrawing onshore subsidies, the focus on offshore has never been greater

01 Introduction

The UK鈥檚 energy industry is in the middle of a profound change. With first generation nuclear being phased out, and coal鈥檚 share of the generation market falling, new capacity in nuclear, large-scale offshore wind and gas-fired generation needs to be delivered by private sector providers. The UK鈥檚 energy policy is currently driven by:

鈻� The energy gap The gap between demand and generation capacity is influenced by the closure of fossil fuel and nuclear power stations. The UK lost 4.4GW of electricity capacity out of a total national capacity of 85GW in 2013. At the same time demand is increasing. In 2013, demand increased by 0.8%, which equates to 1.2 million tonnes of oil equivalent.

鈻� The global and EU climate change and low carbon agenda and the UK Climate Change Act 2008, with a commitment to reduce carbon emissions by 20% by 2020 (from 1990 levels) and to provide 20% of energy from renewables.

鈻� Security of supply In the last seven years the UK has shifted from being a net gas exporter to net gas importer, resulting in greater reliance on energy sources that are outside of UK control, which in turn increases exposure to geopolitical and economic risk.

The UK is the windiest country in Europe and has the largest offshore area within its national jurisdiction. As a result, it has by far the greatest potential to get renewable energy through offshore wind farms, both near shore and in deep water, which can be over 50km from the shore.

However, technological innovation, cost and attracting finance continue to challenge the viability of offshore wind developments. When compared to onshore wind farms, offshore wind capital costs are twice as high, due in part to the difficult work environment as well as the challenges associated with assembling the technology and specialist supply chain.

Innovation to reduce the lifetime cost of offshore wind generation, known as the Levelized Cost of Energy (LCOE), is a key aspect of UK government policy, stakeholder activity and supply chain investment.

02 Overview of the market and players

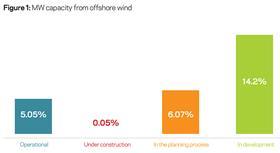

As at June 2015 there were 25 operational offshore wind farms with 5.05GW capacity delivering electricity to the National Grid. The potential for investment is huge. If all offshore wind farms planned or in development are constructed, the industry will provide the UK with over 25GW of capacity. Projects with consent and subsidy awards are worth around 拢20bn in capex. A further 拢16bn worth of projects have consent but are waiting to secure government support through pricing mechanisms before the final investment decision is made.

There are a large number of stakeholders engaged in the development of the UK offshore wind industry.

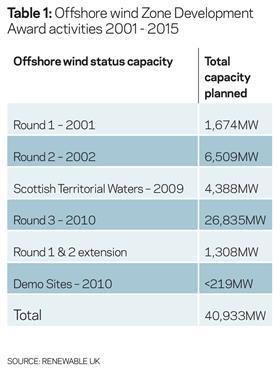

鈻� The Crown Estate owns the UK seabed, is the landlord and controls the release of zones for exploitation through Zone Development Agreements (ZDA), which provide exclusive development rights for the successful bidder. The Crown Estate has had a key role in building the industry, particularly by awarding ZDAs only to organisations (usually consortiums) that are able to demonstrate capability to deliver operational wind farms. There have been three ZDA rounds, providing the theoretical potential of 40GW of energy generation.

鈻� DECC, BIS and UKTI all represent the UK government interest in a viable UK offshore wind market: DECC from the perspective of energy security, consumer costs of electricity and climate change; BIS and UKTI from a competitive supply chain interest. The secretary of state for energy controls the final sign-off for consent, supported by statutory bodies including the Statutory Nature Consultation Body (SNCB).

鈻� Developers. Early projects were developed individually by UK and European utilities companies, including Centrica, RWE, E.on, Scottish Power, SSE, EDPR, Repsol, Statkraft, Statoil, Mainstream Renewables, and EDF. As projects have increased in size, joint ventures or consortiums of utility companies have emerged as the most common development model - with all parties seeking ways to reduce their risk exposure.

鈻� Suppliers. The European offshore market presents significant opportunities for suppliers in the development of technologies, as well as construction and offshore installation, operations and maintenance and decommissioning. The UK workforce is currently 14,000 strong and will see significant growth over the next few years as a shift takes place from the very low UK-sourced content in the country鈥檚 wind farms - in some cases below 20%. Constraints currently affecting the UK industry, for example, include a shortage of installation vessels and a lag in the development of UK-based manufacturing capability.

鈻� Transmission owners. Separate ownership of generation and transmission assets has been introduced retrospectively into offshore wind. The offshore transmission regime has created offshore transmission owners (OFTO). On the current pipeline of projects, developers typically develop and construct the whole plant and once commissioned transfer ownership of the transmission part of the plant to an OFTO. The logic behind this is that the developers will assure the delivery of the transmission asset, avoiding the risk of 鈥渟tranding鈥� where there is no infrastructure to export electricity to the Grid.

There is real political will in the UK to support the wider economy through the development of an offshore wind industry, albeit this has to be developed in the context of the wider European market. Government strategy includes a requirement for a DECC-approved Supply Chain Plan as part of the qualifying criteria to secure subsidy. These plans implicitly encourage the investment in UK-sourced content. Recent schemes have demonstrated up to 50% UK content, much higher than the 20% content seen in many early projects completed over the past 2-3 years.

03 Support to the offshore wind industry

In line with governments around the world, the UK has set about supporting the fledgling renewables market until unit costs reduce to the extent that the technology can stand on its own two feet. Given that the UK has a privately owned energy infrastructure, the application of public subsidies has to be sensitive to political and commercial influences including local community concerns, open commercial markets and challenges around state aid. Unfortunately, the renewables industry has had to contend with a lot of tinkering with incentive mechanisms, which reduces confidence among the investment community and which increases risk for developers associated with the ability to access the available support.

Energy strategy is changing, which is having a significant impact on the delivery of new investment. Over the past decade support has been provided through the Renewable Obligation (RO) and the sale of Renewable Obligations Certificates (ROC).

The RO, introduced in 2002, requires energy operators to obtain a proportion of their electricity from renewable sources, creating a market for investors in green energy. Suppliers generating electricity from renewable sources also obtain ROCs: offshore wind receives 2 ROCs per MW. ROCs demonstrate that an operator is meeting its obligation. Suppliers not generating via renewable sources have to buy ROCs to comply with the RO. This second source of income for renewable suppliers has been fundamental in enabling the UK market to develop. The subsidy is effectively paid by consumers, rather than by the government.

However, following on from the Electricity Market Reform (EMR), as set out in the Energy Act 2013, the ROC regime is being closed to new schemes from 2017 and replaced with a new support system, Contracts for Difference (CfD) that applies to all types of renewable energy generation. Index-linked ROCs will remain for operational schemes and some consented projects for up to 20 years.

Under CfDs a 鈥渟trike price鈥� is set for each category of renewable technology. If the market price for electricity is below the strike price, the operator is entitled to a payment to make up the difference. Conversely, if the market price is above the strike price, the operator must pay the difference back. In this way the market pricing risk is very significantly reduced, and there is much more certainty around income from the asset. CfD awards provide 15 years of price protection, and like ROCs, the cost is borne by the consumer. The CfD regime will remain available for new projects until 2020 - no replacement for subsequent development is currently envisaged.

A limit on support up to 拢7.6bn has been set up to 2020 to enable the achievement of UK renewable and low-carbon objectives. This Levy Control Framework (LCF) captures all the various support mechanisms and progressively allocates the budget on an annual basis to different technologies. As a result, there is a finite amount of support available via CfDs for offshore wind. If the annual allowance is oversubscribed, then the strike price is determined by auction. This has already occurred, and two offshore wind farms secured CfDs in early 2015 through auction at prices that represent a substantial reduction on costs of early schemes. The 714MW EA 1 wind farm by Scottish Power Renewables (UK) Limited secured CfD at a strike price of 拢119.89/MWh with phase 1 delivery expected in 2017/18, while the 414MW Neart na Gaoithe scheme, developed by Mainstream secured a strike price of 拢114.39/MWh, with delivery expected in 2018/19.

Other projects which applied for the CfD in 2015/16 lost out in the auction. They are faced with either applying in the next allocation round, currently planned for October 2015, or accelerating delivery to meet the deadline for the RO regime before the scheme closes. This demonstrates that the new subsidy environment involves significant allocation risks. These risks are likely to increase as developers resubmit schemes in subsequent support rounds. Investors incur significant costs with no guarantee that a CfD can be obtained. Some developers have attempted to accelerate their consent processes to secure deals under the old ROC arrangement, but most operators will have to adapt to the new regime, which places far more emphasis on lifetime risks associated with technology adoption, supply chain readiness and access to finance.

04 Developing a project

Offshore wind projects are complex undertakings. In addition to the huge turbines that are now being developed to increase generating capacity, projects also include a complex network of inter-array cables, sub-stations and export cables. All of this technology needs extensive onshore support, not only associated with the capital-intensive construction phase, but also in connection with crew transfer and maintenance for the operational life of the asset.

The journey of a wind-farm investment from concept to commissioned operational plant is in principle the same as for any generation asset - but with some added complexities associated with emerging technologies and supply chains and the funding mechanisms.

Development partners are required to make significant at-risk investments in the initial development of offshore wind farm projects. While the CfD regime has made a significant contribution to mitigating the market pricing risks associated with offshore wind, the competition for subsidy means that developers will want to be increasingly confident that their schemes are well placed to deliver competitively priced energy. Sites in more marginal locations may not be brought forward as a result of the increased focus of developers on allocation risk.

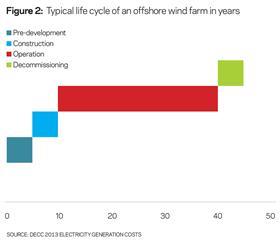

Once developed an offshore wind farm typically has a 25-30 year operation, as shown in Fig 2.

05 Cost reduction 鈥� meeting the challenge of affordable renewable energy

As the industry evolves, two factors are dominating the journey: cost reduction and finance. Cost reduction concerns the LCOE - including development and construction costs, finance, operation and maintenance and decommissioning. The large scale and complexity of these projects creates significant financing and project governance challenges.

The CfD has introduced significant pressure to reduce costs to be competitive. Evidence from the first auction is that the CfD process has increased the element of competition in the supply chain. The result was that both successful projects delivered a strike price that is 25% below the initial benchmark of 拢155/MWh. These schemes are now challenged with delivering the business plan, while ensuring their stakeholders receive the expected rate of return.

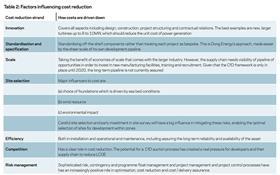

Reducing the LCOE is an industry challenge that affects all activities including technological innovation, procurement, creation of economies of scale, increased efficiency and risk reduction. Continuing progress is needed, given the diminishing value of the Levy Control Framework (LCF) and the ultimate aim of a non-supported industry.

There has been a great deal of industry collaboration around cost reduction. The Crown Estate published its Cost Reduction Pathway in 2012, setting out the route towards LCOE at 拢100/MWh. The industry set up and published the Cost Reduction Task Force report and its recommendations have been implemented. These include establishing the Offshore Wind Programme Board (OWPB) around 12 areas of activity to reduce LCOE, which include initiatives including the Offshore Wind Supply Chain Growth Programme and an Offshore Wind Investment Organisation to help deliver inward investment into the UK.

Renewable UK hosts events at which 鈥渓essons learnt鈥� is a major theme, and it has various working groups which aim to reduce LCOE. In addition, the Carbon Trust has implemented a programme of accelerator projects around various technical solutions and there are a number of demonstrator sites aiming to prove new technology aimed at cost reduction. Ironically, since implementation of the CfD process and the associated competition there has been less openness and sharing between industry players, especially between developers.

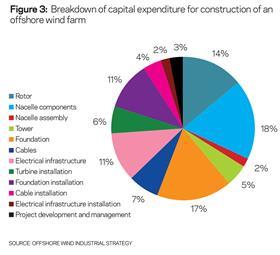

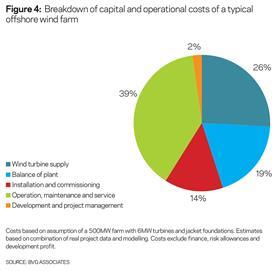

The bulk of initial construction costs for the offshore wind are turbine related as shown in Figure 3, demonstrating that the Original Equipment Manufacturers have a critical role in ensuring the long-term viability of the offshore wind industry.

However, when LCOE is considered, operations and maintenance becomes a more significant element, at 39%, with the turbine and balance of plant accounting for 33% of lifetime costs.

06 Finance, procurement and project assurance

Early UK offshore wind projects were developed by utility companies, which were able to use their large balance sheets as a source of funding. They had an obligation under the RO, wanted to operate the generation plant and to take the electricity generated for their customers.

In response to the twin challenges of cost reduction and risk transfer, project sponsors a range of collaborative approaches to secure the best outcomes:

鈻� Projects are exploring a collaborative approach, which aims to capture engineering efficiencies, ease of installation and operation, and ultimately lower risk and cost.

鈻� Projects are looking at incentive arrangements aimed at aligning objectives of the parties and changing behaviour, encouraging decisions that are best for the project rather than simply best for a single supplier.

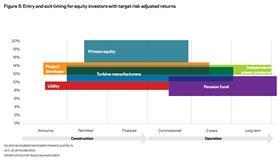

However, over the past five years, the industry has changed. Projects and the associated capex are now very much larger. The obligation under the RO is disappearing but utilities still want to operate generation plant and take the offtake. These circumstances have led to a change towards a different profile of JV ownership and associated funding. Increasingly, projects involve investors with appetite for the risk and return available at different stages of the process. This has had an impact on both the sourcing of finance and funding, and also on procurement strategy.

鈻� Joint venturing utilities tend to be involved early as they are to some extent able to influence the early stage risk.

鈻� Private equity tends to be more risk averse but is prepared to take construction risk, subject to the involvement of the right construction phase partners.

鈻� Pension funds typically invest in operational assets once the development and construction risk has gone. Some funds are prepared to be involved at earlier stages in developments.

鈻� Supply chain partners have also invested. Siemens, for example, has taken equity shares in several projects, as have Fluor and others.

The shift away from balance-sheet funding on a number of major projects and the increased scale of projects has resulted in a growing need for developer JVs to secure debt finance for the capex, often at a ratio of around 35% equity and 70% debt. Debt is conventionally provided on a non-recourse basis, meaning that the lender does not have an underlying guarantee from the project company鈥檚 shareholding companies. Typically, debt providers will thoroughly investigate all avenues of risk affecting project cash flow. Banks鈥� lending criteria also have a significant impact on the procurement strategy, which can cut across other initiatives aimed at improving performance or reducing cost.

These include:

鈻� Passing as much risk as possible to the supply chain, including risks to project cashflows such as delay

鈻� Minimising the number of interfaces between suppliers as much as possible, to reduce interface and coordination risks.

These characteristics have driven a move on debt-financed projects towards EPC/turnkey contracting with as few as two suppliers (a turbine supplier and a balance of plant supplier). This reduces the degree of collaboration on a project but provides absolute clarity with respect to risk allocation.

The change from sole developers, funding on balance sheet to JV arrangements and debt finance has had an impact on the development and construction process. This impact is accentuated by the risk that comes with scale and complexity of larger Round 3 projects. Previously, sole developers had to comply only with their own governance arrangements. However, with JV partners, projects now have to be more transparent and accountable in respect of expenditure, risk and investment returns.

Project assurance is a discipline that is being introduced from other parts of the infrastructure industry into offshore wind. Project assurance processes provide the transparency that JV partners increasingly require and help to manage the scale of risk associated with large-scale, debt-funded infrastructure projects.

鈻� Increased confidence is delivered through project controls processes involving the integration of cost, risk and scheduling functions on projects, often with change management and financial reporting.

鈻� Effective risk analysis and resolution involving running scenarios during optimisation, which can be used to reduce cost.

鈻� Decision making is more robust and is more transparent, facilitating more effective design and change management and the avoidance of any delay to very costly installation processes.

鈻� JV partners, investors and banks can be given access to project controls dashboards providing robust accurate information necessary to give confidence that the project is on track, as well as giving early warning of problems.

The market for investment in offshore wind, and the offshore wind supply chain, have both changed significantly as the scale of the industry has grown. As the scale and complexity of projects grow, investors of the supply chain will benefit from the increased experience and confidence in the management of delivery that effective project assurance brings. Offshore wind will also continue to be challenged with respect to the cost of electricity. The ability of the industry to maintain a downward trajectory on costs will need continuous innovation together with a focus on all aspects of the economics of the wind farm lifecycle.

No comments yet