Values in the workplace are changing, which in turn means that what occupiers want from an office building is also evolving rapidly. Here Alinea with Henigan Consulting Group outline the key issues and how the battle for tenants is now being fought by both traditional and flexible providers

01 / The employee experience

As work changes in nature and method, so the design of the workplace is progressing to meet future needs. So often the term ŌĆ£millennialsŌĆØ is sprinkled through discussions about the way modern businesses are responding to the challenges of the new era, but a successful working environment must cater for a fully diverse workforce, which goes beyond a simplified classification by age.

The employee experience is becoming vital as the war for talent intensifies against a backdrop of low unemployment, a more transient labour pool and changing expectations of work.

The average job tenure in the UK has fallen since 2013, with those in the 18-29 age bracket accounting for the highest proportion of workers voluntarily moving from one job to another. The internet has brought about vast networking opportunities and reduced reliance on face-to-face interactions. With the next wave of workplace entrants being classed as ŌĆ£digital nativesŌĆØ this invisible networking will intensify.

| Outdated workstyle | Modern workstyle | |

|---|---|---|

|

Hours |

9-5 office-based |

24/7 and global |

|

Company structure |

Hierarchical |

Flat |

|

Office plan |

Space linked to status |

Connected, diverse, open |

|

Workstation design |

Effective |

Ergonomic |

|

Technology |

A valuable tool |

Symbiotic |

|

Trust |

Built through face-to-face exchanges |

Built in various ways, via various platforms |

|

Communication |

Email, phone |

Spectrum of communication options |

|

Work/life relationship |

Seeking balance |

Integration, supporting ŌĆ£lifeŌĆØ at work |

Brand values and culture are increasingly being used by firms as a means of attracting and retaining talent, and space is a key medium for achieving this. If a workspace fails to reflect culture or brand, a company can run the risk of a disconnected workforce who may vote with their feet.

Gone are the days when work was viewed as a focused activity that took place between 9am and 5pm within a dedicated building. By 2020, 50% of office workers will be either freelance, remote or project-based, according to Forbes. A National Small Business Association report revealed that arrangements for working from home jumped 44% in 2012, and data from the Telework Advisory Group suggests 42% of this mobile population were below the age of 35.

Millennials: unique demands?

Born between the early 1980s and 2000, millennials are characterised by their second-nature familiarity with media and technology. By 2025, they will comprise 75% of the global workforce, progressively making the move from employee to manager, so it is no wonder that their opinions on the workplace are key to current design discussions.

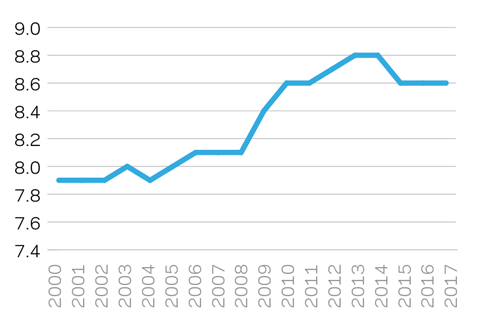

Many suggest that millennials are reshaping the workforce, posing challenges to managers, demanding more, and requiring maximum return for minimum effort. Co-working provider Mindspace claims that 21% of millennials have rejected a job because of uninspiring or poorly designed offices. In the same study, nearly half of millennials showed a preference for co-working spaces in order to network with others, so it is possibly no surprise that such spaces have experienced a boom in recent times, increasing from 1% of take-up across London in 2008 to 20% in 2017.

However, the co-working life is not just for millennials and start-ups. At the end of 2017, co-working and meeting space provider The Clubhouse reported that more than 60% of its members were aged 40 or over.

The Edenred Ipsos Barometer survey, which aimed to identify the qualities of an ideal employer, showed that older and younger workers generally want the same things: rewards for everyoneŌĆÖs efforts, management that cares about people, and opportunities for personal growth. Good working conditions and flexibility were ranked equally by those aged under and over 30.

Technology and structural economic changes have altered workstyles (as outlined in table 1), and therefore how people of all ages occupy and use workplaces has changed.

02 / Productivity

Integration, not balance

Advances in technology and a growing focus on work/life integration rather than balance mean the modern view of work has changed, and the physical workspace has had to adapt to serve it efficiently and enable productivity.

The seamless integration of technology throughout modern life means work can take place anywhere. New graduates are aware of where and how they learn best, having had no need to confine their learning to a library corral. So why should work be confined to a desk?

An attractive workplace

Interactions and outputs increasingly take place in the virtual world, but the physical place of work still matters. People need to come together to exchange and share ideas and be the cultural epicentre of an organisation.

All of this means that the traditional workplace is changing. The war for talent and a focus on the employee experience has encouraged firms to focus on the wellbeing of staff through provision of gyms, yoga classes and coffee shops. As employers respond to the needs of their employees, so developers are thinking about what is important to their tenants.

One of the City of LondonŌĆÖs newest towers, 22 Bishopsgate, is providing an array of amenities: multiple spaces in which to meet, talk, present, eat, drink, relax, entertain and play. The first new commercial building in the UK to be WELL-standard enabled, its backers are making the most of its scale to provide a healthy, attractive and collaborative environment.

Concentrating on productivity

But when it comes to the workplace itself, it would seem that there is room for improvement. According to a survey by Leesman, only 57% of employees think that their workplace enables them to be productive. This figure only improves to 64% from employees in recently refurbished offices. Key reasons seem to be that workplaces do not support high-value activities, particularly those closely linked to individual tasks requiring high levels of concentration.

These opinions were consistent across all age groups, reinforcing the idea that while the industry has based its change in thinking on the millennial generation, the reality is that there is a wider challenge to be met.

The implication is that rather than focusing on the age profile of employees, employers and space providers would benefit from having a much better understanding of the types of work undertaken and how an employee-centric design ŌĆō across all employees ŌĆō could raise productivity as well as health and happiness.

For most, the working day consists of a variety of activities, including group working, concentrated study and process-driven tasks. A one-size-fits-all approach is not appropriate for all tasks or all working preferences. GenslerŌĆÖs Workplace Performance Tool revealed that the least effectively supported task in the workplace is individual focus. Often meeting rooms are filled with individuals wanting time away from the distractions of the office floor. Cellular offices, on the other hand, inhibit collaboration, wellness and creativity. Overprovision for one mode of work at the expense of another generally creates a domino effect in productivity, as unfocused staff distract others.

Designers are creatively developing a mix of spaces that address this balance while efficiently providing more productive environments.

03 / Company culture

Many organisations invest a lot of time and money into ensuring their offices provide a sense of belonging. Increasingly, corporations will have a design rule-book that enables each office to look part of the family, wherever it is in the world.

Sometimes brands can be so strong that the character of their office space is well known even to industry outsiders ŌĆō Innocent Drinks, Disney or Google, to name but a few ŌĆō but internal culture is at least as important, if not more so.

The chief operating officer and executive vice-president of the Lego Group was quoted as saying that the firmŌĆÖs new London office ŌĆ£encourages collaboration and chance encounters that can spark new ideas and opportunitiesŌĆØ. By taking steps to dissolve traditional physical separations between departments, including the lack of fixed seating, the company has moved towards a whole-office culture embracing the diversity not just of its people but of spaces.

Lego draws allusions to its cross-generational product by calling its workplace a ŌĆ£kit of partsŌĆØ, allowing not only for a multiplicity of zones but also for a variety of body postures, textures, sounds, smells and atmospheres in the office. This refocusing on activity-based working, rather than departmental divisions, comes with a set of guidelines to ensure that the firmŌĆÖs horizontal management structure stays in place and everyone uses the space appropriately.

Named by the British Council for Offices as the UKŌĆÖs best new office (and winner of the Stirling prize), BloombergŌĆÖs new London HQ features a double-height pantry at its core, along with bespoke desking solutions to facilitate collaboration and embody the firmŌĆÖs key values of transparency, communication and innovation.

04 / Flexibility: a gap in the market

Physically embodying the culture of a company in a building can be expensive and is particularly risky in an uncertain market. Rather than compromising staff expectations of a company home, many firms are looking at ways to progress their business plan while avoiding potentially abortive work on short-term offices.

Flexible providers have recognised this obvious need, capitalising on the growing popularity of the sharing economy to create a work environment that provides for a variety of tasks from individual to group work, in both private and open spaces.

A hospitable offering

Traditional landlords have struggled to keep up with the demand for exceptional, representative workplaces with high-quality amenity allowing the blurring of work and leisure, on a flexible timescale or shorter lease. This has left a gap for co-working providers to fill with an offering more akin to hospitality.

The more established landlords are catching up, with evolved products. Last year British Land launched its own offering, Storey, which will account for nearly 10% of its ┬Ż9bn office portfolio, while Great Portland Estates and Land Securities are also working on their own flexible solutions. Last year private equity and property firm Blackstone took a majority stake in The Office Group as the flexible working trend gained momentum, saying, ŌĆ£The traditional workspace is being redefined in gateway cities across the globe, as evolving business practices increase demand for flexible office space to suit the needs of the discerning modern occupier.ŌĆØ

ŌĆśRock up and log onŌĆÖ

Some providers have gone so far as to develop a strategy whereby enterprises can replicate their brand. The introduction of propositions such as WeWork HQ, where medium- to longer-term occupiers have the opportunity to customise their space and have a direct input into the finish, could be very attractive to firms with a significant brand.

As one technology provider put it, ŌĆ£this means we can rock up and log onŌĆØ, knowing how the space will look and feel. This approach would allow bespoke solutions where whole or elements of capital fit-out costs can be rentalised over the duration of the lease, reducing the initial upfront cost.

The growth of flexible spaces

In central London 21% of all office leasings were to flexible providers in 2017 ŌĆō a record 2.5 million ft2 of office space and an annual increase of 190%. This massive growth has been enabled not only by the growth of the start-up community or by technology facilitating the casualisation of work but also by the increasing use of flexible space by corporates.

Flexible operators are increasingly offering longer, one- to three-year leases. WeWork provides leases that scale from fully flexible to whole floors or even entire buildings, and its ŌĆ£move-in ready offices or fully tailored spaces that embody your brandŌĆØ already boast global enterprise clients such as Microsoft, BlackRock and Citigroup.

Flexible spaces usually have shared amenities offered as part of the charge. Amenities can include:

- Meeting rooms of varying sizes and configurations

- Food and beverage offering

- Town hall and auditorium space

- Locker space, changing areas and bike stores

- Fitness and wellbeing spaces such as gyms, yoga or spin studios, or contemplation areas

- Outdoor spaces

- Technical rooms and services.

The short-termism of flexible leases means providers need to ensure they are offering what the market wants, as clients can quickly move to another provider.

05 / Why are large businesses considering flexible workspace?

Start-ups and small enterprises with young employees have traditionally been the main client base for providers delivering flexible office space, but as this sub-market has evolved it has also become an aspect of some of the large corporate occupiersŌĆÖ workplace strategies, supplementing their traditional office lettings.

Vicarious learning

According to Mindspace, the recent influx of artificial intelligence and machine learning firms into co-working spaces is a trend that is set to continue. Booking.com and Siemens have recently taken non-traditional offices in order to set up an innovation hub where they can access local talent, saying that ŌĆ£having the right set-up that inspires imagination and experimentation is keyŌĆØ.

The ability to learn and innovate determines a companyŌĆÖs competitive edge. The demographics of a hub can be incredibly valuable to a company looking to evolve its business. A team placed into a co-working space has the ability to overhear, learn from and converse with a diverse range of people, which can encourage innovation. Some traditional landlords report that their tenants claim the most valuable part of their building is the lift lobby or the coffee point, as this is where the majority of exchanges take place.

The financial argument

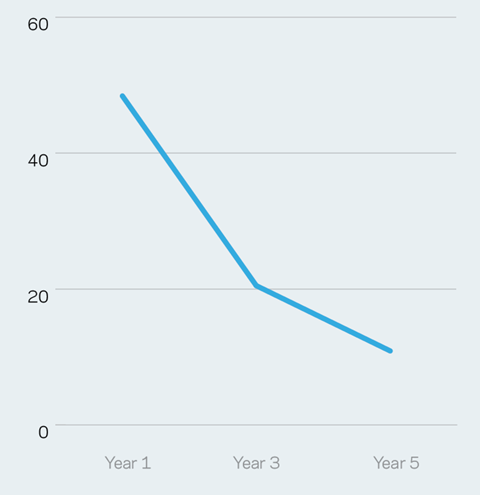

Perceptions vary about the relative occupational costs of traditional leases and flexible workspaces. We have attempted to draw some conclusions by putting numbers to both scenarios, for a space of 100 people over a 15-year period. Such a notional exercise is necessarily high-level and based on some key assumptions (listed right), and the answer will vary as these change. The scales may be tipped by, among other things: different occupational densities; landlord incentives such as rent-free periods; the quality of the fit-out in the traditionally leased space; or the decision by a flexible tenant to brand or personalise its space.

Nevertheless, the overriding conclusion is that while the rent for a flexible desk is more expensive than the cost of the comparable amount of office space rented by the square foot under a traditional lease, the total cost of occupation in a traditional lease is higher, in particular driven by the initial capital outlay for a Category B fit-out.

Taking rent, rates, service charges and fit-out costs into consideration, our analysis shows that a flexible lease potentially offers a 50% saving over the first year of occupation, which reduces to a 10% saving after five years. Given the variables (rent-free periods in particular will narrow or close the gap), we could surmise that there is not much in it from a cost perspective after five years. In other words ŌĆō perhaps unsurprisingly ŌĆō a traditional occupier needs to commit to a location for at least five years in order to achieve a payback on the initial investment in its fit-out.

Of course, considerations must extend beyond the pure numbers, and it is more than just a matter of whether it is worth a company paying a premium for its own front door. Factors such as the working environment, strength of the brand, size of business, administrative time and risk/uncertainty ŌĆō and more ŌĆō are all important. Overleaf, we attempt to bring all of these determinants together in a summary of the pros and cons of a flexible option, in our conclusions and summary table.

Key assumptions

- Both scenarios provide space for 100 people for 15 years

- Rent, rates and service charges are reflected accordingly

- Traditional tenant undertakes an initial fit-out (costing ┬Ż90/ft2)

- Flexible tenant spends no extra on branding its space.

- Traditional lease has a rent of ┬Ż60/ft2/year

- Flexible lease has a rent of ┬Ż750/desk/month

- Traditional landlord provides 10,000ft2 of lettable space

- Flexible landlord provides 8,000ft2 of desk space (at the same density as the traditional arrangement), plus another 2,000ft2 of accessible common space

- Traditional lease does not factor in any rent-free periods or other incentives

06 / Conclusions

In a world of growing competition for skills, the workplace has become a battleground as firms fight to attract and retain good people. Some commentators would have us believe that it is all about senior management trying to get to grips with the millennial group, but the truth is workspaces are improving to cater for new ways of working and a greater overlap between work, leisure and home ŌĆō the effects of which affect the full spectrum of a workforce that is diverse in many ways. Workspaces also need to reflect developing business dynamics, from a focus on the power of the brand (for customers and employees alike) to the need for flexibility in uncertain times.

Flexible workspace providers such as WeWork and The Office Group have appeared on the scene to satisfy this need, and to provide hassle-free accommodation to start-ups and SMEs ŌĆō as well as corporates. Whatever the lease arrangements, companies everywhere are trying to create fun, attractive offices that encourage interaction and offer a variety of spaces, yet the need for modern businesses to address a whole series of fast-changing dynamics has encouraged the more traditional commercial developers to enter the flexible workspace scene ŌĆō using sub-brands (such as British LandŌĆÖs Storey) or purchases (such as BlackstoneŌĆÖs acquisition of The Office Group this year) to compete with the likes of WeWork, Regus and Impact Hub.

Our notional financial appraisal suggests that over time there is little difference in the bottom line. The key commercial advantage of flexible space is avoiding a cash-hungry fit-out in year one, backed by a choice of lease lengths and simpler paperwork. A decision between a traditional lease and flexible workspace would have to be made using a wider set of factors; these are summarised in table 2 (below).

Some firms seek the best of both worlds, supplementing their core headquarters with shorter-term spaces that they can flex up or down as the business environment demands. In an age of prevailing uncertainty and rapid change, a mixed portfolio that provides a secure home as well as flexible turnkey, rentalised arrangements could be increasingly attractive. Both traditional developers and market disruptors will develop their products as they compete for the same tenants.

The success of providers such as WeWork has meant the amount of flexible office space in London has almost trebled over the last decade (most of the growth being in the last five years). Against this success is an element of nervousness, prompted by a model that involves signing long-term leases but charging members on a short-term basis. Should a downturn cause the users of these spaces to close or move, the providers will be left with large amounts of unlet space (which would in turn impact their landlords too).

It is clear that the workspace is changing, with providers and employers using imaginative designers to create exciting, collaborative, healthy and productive environments. The way these spaces are being offered to the market by a range of competing providers is changing in equal measure, and it will be fascinating to see how all this plays out over the next few years, as the business environment itself changes, and technological progress adds further spice to the mix.

| Benefits of a flexible space | Points to consider |

|---|---|

|

Entry into new location |

Security |

|

Total flexibility |

Business operations |

|

The office environment |

Organisational culture |

|

Office refresh or exit strategy? |

Company image |

|

The economy |

|

|

Capital cost outlay |

|

|

Control of cost in use |

Iain Parker of Alinea will speak on working with millennials at ║├╔½Ž╚╔·TV Live, just one of the topics on this yearŌĆÖs extensive programme with speakers from all sectors of the industry. Book now at

No comments yet