Energy Performance Contracts are increasing in popularity as a way of delivering large-scale energy savings in existing buildings. Chris Spicer of Sweett Group discusses the pros and cons of taking one on

01 / Introduction

If you manage, operate or finance an existing estate, you can probably answer yes to at least one of the following questions:

- Do you have an energy or carbon emission reduction target?

- Do you have backlog maintenance issues?

- Are your capital projects budgets under pressure?

- Could additional investment in your estate improve the internal environment or working conditions?

However, what if there was a solution that could potentially address all these issues, with the option of no capital required up front and a guaranteed return on investment?

Well this is exactly what could be achieved through a well procured, delivered and managed energy performance contract. Energy Performance Contracts (EnPC) are increasing in popularity as a way of delivering large-scale energy savings and improvement in existing buildings. An EnPC involves partnering with an Energy Service Company (ESCo) who will undertake energy saving upgrade works and provide a guarantee on the performance, therefore supporting a robust business case.

Alongside this, an increasing number of sources of finance are available within the private sector, supported by a growing awareness and confidence in the debt markets on the returns available from investment in energy efficiency projects. At a European level, over 70 financial organisations have committed to scale up their investment in energy efficiency projects as we approach COP21 climate talks in Paris, while in the UK the Green Investment Bank has recently earmarked several hundred million pounds to help reduce the NHSÔÇÖs ┬ú500m annual energy spend through energy efficiency projects.

When reviewing the business case for a major energy efficiency retrofit project, the analysis should look beyond just the reduction in energy expenditure and should take consideration of the planned backlog maintenance expenditure.

Within the NHS, the value of backlog maintenance is currently over ┬ú4bn and both the overall backlog, and importantly the value of the overdue maintenance for areas identified as ÔÇťcritical infrastructure riskÔÇŁ, grew between 2012-13 and 2013-14. Overall, the maintenance backlog for public sector estates is ┬ú40bn, nearly double the ┬ú25bn cost of running these estates.

While EnPCs are not a panacea for addressing all forms of maintenance backlogs they do provide a mechanism for investing in improving building services and fabric. So while the guaranteed energy savings are sufficient to repay the cost of the works, this is only one dimension of the overall benefit. Improved quality and control over the internal environment together with the increased reliability and significant maintenance savings that arise from the replacement of life-expired building elements mean that an EnPC can have a dramatic impact on an organisation with a tired and inefficient estate.

02 / Overview of the EnPC process

The EnPC timeline varies depending on the complexity of the project, efficiency of internal governance and interest from the ESCo market. The diagram below outlines the typical process and provides indicative timescales.

| Business planning | Procurement | Detailed design & costings | Installation | Operational service |

|---|---|---|---|---|

| 3-6 months | 3-6 months | 6-12 months | 3 months - 2 years | |

| Define the scope of the EnPC | Choose tender approach and procurement route | Facilitate investment grade audit | Oversee installation of measures by ESCo | Measurement and verification |

| Gather internal support and senior management buy in | Finalise business case | Review ESCo proposals | Arrange and review stage payments | Annual performance reporting |

| Develop business case and review funding options | Arrange funding | Agree design, costings, saving programmes and return on investment | ||

| Appoint ESCo for investment grade audit | Develop contract |

03 / Financing options

When financing an EnPC, organisations typically have three options:

- Self-financed: Organisations raise the capital budgets internally and finance the works as a capital project.

- Energy Services Company (ESCo) financed: The ESCo carrying out the energy upgrade works can finance the works. In this scenario the ESCo would often take on the credit and performance risk. This option may also include ÔÇťoff balance sheet solutionsÔÇŁ, which involve leasing energy saving equipment from the solution provider.

- Third party financed: The client organisation sources finance directly from a third party and uses this to fund the works, with the repayment supported by a guaranteed saving or performance by the ESCo.

The decision to use ESCo or third party finance should be informed by the wider business strategy and current financial situation, but there are a number of contributing factors which should influence the decision, and that can be assessed using business case models:

- Is the capital budget required to support other services?

- What is the potential cost avoided through reduced backlog maintenance?

- What is the impact on the day-to-day operation and maintenance cost?

- What influence will fluctuations in energy prices have on the overall business case?

04 / Advantages and disadvantages of procuring an EnPC

| Advantages | Disadvantages |

|---|---|

| An EnPC has the potential to deliver large and long-term scale energy and cost savings through improved asset efficiency | A large capital outlay is often required to attract an ESCo and/or third party finance to support the scheme (£2m plus) |

| Backlog maintenance and dilapidations can be improved, reducing FM cost budgets, improving reliability and reducing operational risk | There is a requirement for a long-term relationship with the ESCo, which may not align with the estates strategy and will also require investment to achieve a strong working relationship |

| The savings achieved through EnPC are supported by guarantee, which supports the business case and increases confidence in the investment | The ESCo will typically assume all the performance risk and capital costs can reflect this, potentially increasing costs compared with other forms of procurement, for example separate capital projects |

| There is an option to finance the project through a third party, providing a capex-free solution of relieve pressure on budgets | There is the potential for significant legal fees for drawing up the contract |

| Measurement and verification forms the backbone to the EnPC and therefore provides the opportunity to put in place recognised processes to validate the savings, for example IPMVP |

05 / The EnPC business case

Before deciding whether to enter into an EnPC, a detailed modelling exercise should be undertaken to determine which option best meets the requirements of the organisation. A comparison of business as usual, against a traditional capital projects and energy performance contract approach will help identify the best whole-life cost solution.

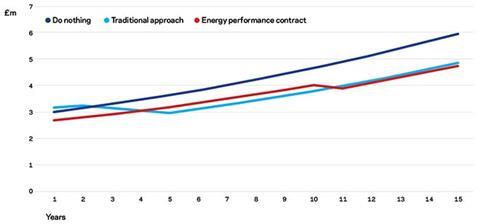

The graph below compares three potential scenarios for a theoretical estate, comparing capital costs, backlog maintenance expenditure and energy costs.

- Do nothing Operate the estate with no investment, with subsequent ongoing reactive maintenance costs

- Traditional approach Invest £1m to relieve pressure on backlog maintenance with focus on energy saving using normal procurement route and capital expenditure process over a period of five years

- Energy Performance Contract approach Include backlog maintenance projects in wider energy retrofit project to maximise energy saving with a capital value of £2.5m, with the project funded by a third party and a repayment term of 10 years.

Whole-life cost solutions for theoretical estate

The main difference in using an energy performance contract is the smoothing out of the cost curve. While the traditional approach would maintain an ongoing pressure on annual estates budgets, with the associated administrative time allocated to this, the EnPC approach funds the cost from the operational budget. In addition, this investment is supported by a guarantee that eliminates any risk of the returns included in the business case from being realised.

06 / Conclusion

The pressure for organisations to reduce energy consumption, improve internal environments and manage costs is increasing. EnPCs are a successful and tested way of meeting these objectives and this dictates that they should frequently be considered as a viable option. This is supported by an increasing presence of funders who realise financial benefits of energy efficiency investment.

However, there are a number of factors to be considered and reviewed to determine whether they are suitable or indeed the best solution when compared with alternative procurement routes.

No comments yet