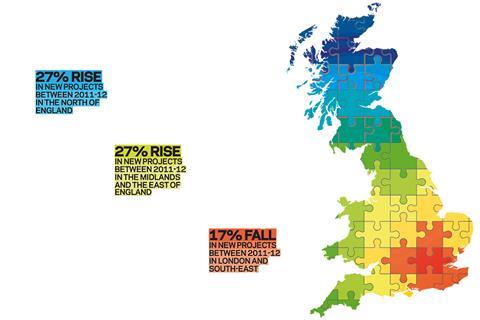

Most peopleÔÇÖs idea of construction activity is of London and the South-east in relatively robust health; the rest of the country dying on its feet. But in this preview of ║├╔ź¤╚╔˙TVÔÇÖs Regional Construction Trends White Paper, we find the true picture is more complex than that

The painful contrast between the tentative signs of recovery in the wider economy, and the national picture for construction was made stark when the UK economy lifted itself out of recession in the third quarter of 2012. That quarter the construction industry shrank 2.2%, according to the Office for National Statistics - and it was the fifth consecutive quarter of shrinking output in the industry. And while the fourth quarter of last year offered some hope as the industry grew 0.9%, it is still far too early for confidence in the market.

But this continuing malaise has not been felt equally in all areas of the country, leaving firms struggling with how to respond to the changing landscape of regional work. In-depth analysis for ║├╔ź¤╚╔˙TVÔÇÖs forthcoming Regional Construction Trends White Paper, to be published this month, paints a picture of an industry that is seeing pockets of activity masked by the gloom - and a picture that is far more complex than the perception that the South-east is the only real place to be. So where are the hidden opportunities, and what trends are emerging from construction businesses in their strategies towards chasing this work?

As you would expect London and the South-east remains the UKÔÇÖs busiest region with 27% more new projects than the second busiest region, the North. But you might be surprised to find out that ║├╔ź¤╚╔˙TVÔÇÖs analysis of data from Barbour ABI for the white paper found that London and the South-east experienced a 35% drop in new projects between the start of 2011 and the end of 2012.

Likewise, while it is understandable that a nationwide survey of over 900 construction professionals conducted for the white paper found that 71% expected 10% or more of their turnover in 2013 to come from the region, a significant number of respondents also expected similar levels of turnover to come from other regions. For instance, 36% of respondents to the survey said the Midlands would account for 10% of turnover.

Gordon Kew, UK director of regional building at contractor Interserve, says the higher education sector is showing a surprising amount of opportunities in the Midlands region despite the overall market in that region being ÔÇťrelatively flatÔÇŁ.

KewÔÇÖs comments are backed up by data from Barbour ABI for the white paper that shows the number of new projects in the education sector in the Midlands and East Anglia increased steadily from 66 in the first quarter of 2011 to 89 in the fourth quarter of 2012.

John Frankiewicz, chief executive of contractor Willmott Dixon, adds that the care home market is another driver of work in the region. He says recently announced government policy to give certainty over how long-term care will be paid for will continue the unlock ÔÇťthe grey poundÔÇŁ. ÔÇťThat market is going to grow,ÔÇŁ he says.

Likewise, research for the white paper demonstrates that the construction market in the North promises far greater opportunities than is generally assumed. Fifty-two per cent of respondents to ║├╔ź¤╚╔˙TVÔÇÖs survey identified either the North-east or the North-west as a source of significant turnover for their business. Indeed, Frankiewicz says the region is setting the pace for Willmott DixonÔÇÖs business. The firm has already secured 80% of its national revenue for the year and orders in the North are playing a key role. Orders in the region are significantly up on where the firm had expected them to be by March 2013.

Kew adds that contractors have other reasons to be optimistic about the region. He says: ÔÇťSome of the Northern Local Enterprise Partnerships [the initiative to drive regional growth which replaced Regional Development Agencies in 2010] are extremely strong and hopefully we will see some projects from that.ÔÇŁ

However, in general, work outside the South-east remains hard to come by and some firms have taken the decision to close regional offices. In October 2012, ║├╔ź¤╚╔˙TV revealed contractor Morgan Sindall had decided to close five offices. The firm said the move was about ÔÇťkeeping its cost base as low as possibleÔÇŁ. Likewise contractor Kier announced this month it would be closing offices as it restructures. Kier said the closures would make the business more efficient and denied that they would weaken the firmÔÇÖs regional presence. The firm will stick to having eight regional arms as part of the restructure. It followed a decision by contractor Balfour Beatty to close 38 of its offices as part of a wide ranging restructure.

These firms are not alone. Sixteen per cent of respondents to ║├╔ź¤╚╔˙TVÔÇÖs survey said they had reduced the number of offices over the last year. This trend was more pronounced for contractors, with 22% of respondents saying they had seen offices close. Conversely, only 11% of architects reported office closures.

But Interserve is bucking this trend. Kew says the firm plans to expand its regional office network. ÔÇťOur coverage UK wide is pretty good but there are one or two gaps we would like to fill. We are looking at opening a satellite office in one or two of those locations,ÔÇŁ he says. He adds that the firm gets more ÔÇťtractionÔÇŁ bidding for work with regional clients when it has a local base and supply chains in place, ensuring spending benefits the local economy.

Frankiewicz, who has also avoided office closures, agrees that having close links with local suppliers helps Willmott Dixon win work. He says: ÔÇťUp to 50p in the pound can be spent locally within an hour of our sites. ThatÔÇÖs very attractive. That appeals to local authorities.ÔÇŁ

Kew adds that supply chain members, many of which are regionally based, tend to bring new ideas to Interserve first if they have long-standing and stable relationships, in turn improving the main contractorÔÇÖs service to its clients. He points to the firmÔÇÖs M&E subcontractor on its Leighton hospital extension project. It recently designed a modular way to build the plant rooms for the scheme making the programme much more manageable and causing less disruption to ongoing running of the hospital.

Meanwhile, architects and engineers who have seen fees squeezed in the downturn have chosen to manage the changing picture of regional income in other ways.

Mike Walters, regional lead and managing director of the London office at architect Aedas, says the firm uses its international work to help keep its regional bases alive. ÔÇť[Other architects] are looking internationally to stimulate the London business,ÔÇŁ he says. ÔÇťWe are slightly different because we already have international offices and we look to use that work to stimulate the work in the regions in the UK.ÔÇŁ

He adds that some of the firmÔÇÖs regional offices have built-up specialist skills in various sectors, which can be applied to projects across the globe. For instance, he says the firmÔÇÖs Leeds office has built expertise in healthcare and the Manchester office is a source of expertise on education design.

Like Aedas engineer Ramboll will send work to offices where there is staff capacity but it also moves staff to where there is work. This ensures staff are productive across its regional offices. ÔÇťWe see a lot of our engineers being quite mobile at the moment,ÔÇŁ says Steve Bentley, head of building services at Ramboll. ÔÇťWeÔÇÖve got a lot of our engineers from our Bristol office working in Glasgow and Southampton and weÔÇÖve got guys from Manchester working in London.ÔÇŁ

║├╔ź¤╚╔˙TVÔÇÖs white paper analysis shows that the commonly held assumptions about the best sources for work in the UK market are not always accurate but opportunities exist in all regions if you know where to find them.

Figuring out how to adjust their business to cope with the changing regional markets will be crucial for construction firms as they wait for widespread growth to return to the country.

North of England

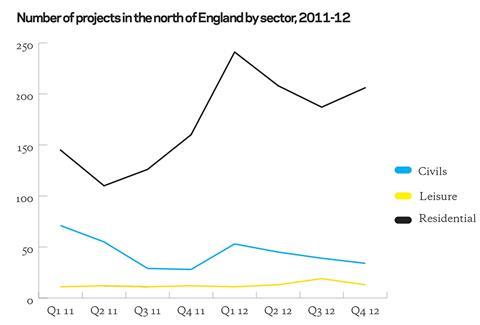

The north of England has had an uncertain couple of years but remains the second busiest region in the UK and so is not somewhere firms can afford to ignore. According to the data from Barbour ABI, activity over the course of 2011 was largely flat, going from 546 projects in Q1 to 530 projects in Q4. But work appeared to pick up in the first half of 2012, with the number of projects rising to 750 in the second quarter. However, this activity has since declined sharply to 603 projects in the fourth quarter of 2012.

Despite this market uncertainty, the number of residential projects in the region has risen dramatically from 541 projects in 2011 to 842 for the whole of 2012. The value of new residential orders has also grown from ┬ú4.7bn in 2011 to ┬ú7.5bn in 2012 according to data from Barbour ABI. This all comes despite a continued stagnation of house prices in the region. The Land RegistryÔÇÖs House Price Index shows the price of houses in the North-east rose only 0.3% between December 2011 and December 2012. Prices in Yorkshire and Humber fell 0.7% over the period and prices in the North-west plummeted 3.5%.

Meanwhile, the civils sector continues to be the second biggest in the region. It was boosted by contracts for the multibillion-pound Hornsea wind farm in the first quarter of 2011 pushing new orders to a total of £15.6bn in the quarter. This was then followed by a further £7.8bn of work across the sector over the next seven quarters.

The leisure sector also continues to be a major source of work in the North. The region has the second biggest leisure sector in the country, not far behind London and the South-east. The region saw £657m of new orders over the last two years compared with £758m in and around the capital. Together the two regions accounted for 77% of all leisure works contracts in the UK.

The North also has the second largest value from education contracts, after London and the South-east, partly driven by the fresh investment under the priority schools programme. It is also the second largest region for the hotel sector racking up contract awards valued at £1.1bn over the last two years.

Regional Construction White Paper

║├╔ź¤╚╔˙TVÔÇÖs Regional Construction White Paper is based on data from Barbour ABI, a survey of over 950 construction professionals and construction clients. It includes:

- Detailed analysis of regional and sector trends across Great BritainÔÇÖs six regions, including analysis of contract awards over the past two years provided by Barbour ABI

- Analysis of trends in construction firmsÔÇÖ regional business strategies, focusing on contractors, consultants and architects, from a survey of more than 900 professionals

- Interviews with construction firms Balfour Beatty, Aedas, Aecom on their approach to regional markets

- Interviews with construction clients The Co-Op, John Lewis and Prologis

- Analysis of what both regional and national clients are looking for from construction firms based on feedback from more than 50 leading national and regional clients

- Exclusive regional contract award rankings showing which contractors, architects and consultants have won the most work in each region over the past year

To pre-order a copy of the Regional Construction Trends White Paper go to

No comments yet