It’s been a year since BIM became mandatory for all centrally procured public contracts. Tim Clark reports on the latest survey from NBS, which shows that take-up is growing but raises concerns that private clients don’t understand BIM and that the government is failing to enforce its own mandate

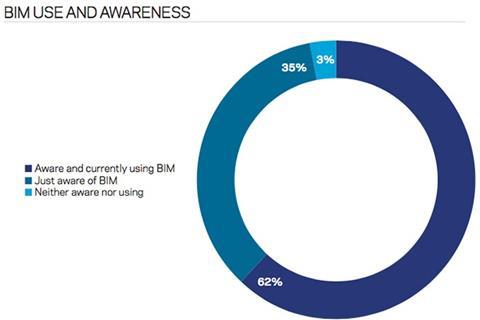

A year after the BIM mandate came into force for all centrally procured public contracts, awareness of the process is near universal in construction, but there are still doubts about whether actual BIM adoption by firms has reached critical mass within the industry.

According to the latest survey findings from construction technical information provider NBS, revealed here by ∫√…´œ»…˙TV, adoption of the practice is growing in the UK, in scale and depth. Introduced in April 2016, the BIM mandate meant any construction firm looking to secure centrally-procured public contracts needed to be BIM level 2 compliant. With the public sector as the biggest single employer of the industry, the implementation of the mandate has undoubtedly spurred interest in the practice and meant that firms can no longer ignore BIM as a requirement for future work.

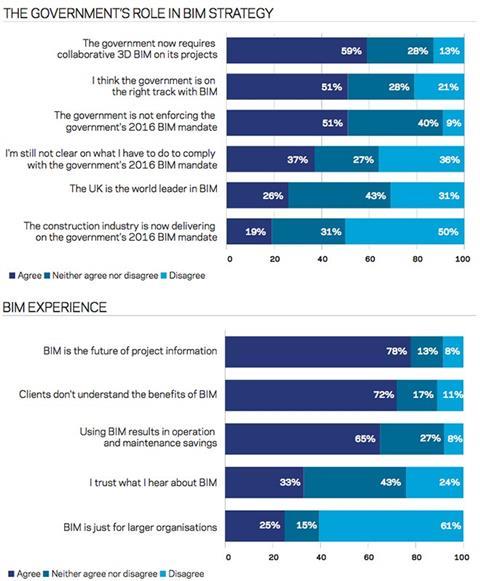

However, looking a little deeper into the latest NBS figures, collated from more than 1,000 respondents, primarily architects, the effects of the mandate have been mixed. Although the mandate has been welcomed as a rare positive move by government to influence private industry, a year on from its launch over half (51%) of respondents say that central government departments are not enforcing the 2016 mandate compared with a mere 9% who believe they are. Moreover, belief in the industry’s own ability to deliver on the mandate is also low, with only 19% of those polled agreeing that construction has taken up the challenge, compared with half who believe it has not.

With little confidence in the government’s ability to enforce the mandate or the construction industry’s ability to deliver it, how is this being translated in the numbers of firms choosing to adopt BIM? And can the government do more to increase the rate of BIM take-up in the future?

The mandate effect

The overall positive message is that BIM uptake is on the rise – according to the NBS report, 62% of respondents now use BIM on some of their projects, up from 54% last year. This 8 percentage point growth over the past 12 months is the biggest jump in BIM usage since 2014, suggesting the 2016 BIM mandate has had some success. It’s also encouraging news that 51% think the government is on the right track with BIM.

However, the data also points to more worrying signs, with less than one third seeing the UK as the world leader on BIM, small practices still less likely to adopt BIM (although 48% have), and more than a third not clear about how to comply with the BIM mandate. One respondent said: “Everyone has their own version of what it means to meet the mandate.”

One concerning trend identified is the belief among respondents that clients – including government departments – are not sufficiently educated to allow the BIM mandate to take full effect. In fact, 72% of respondents said clients do not understand the benefits of BIM, with one saying: “The majority of government departments are still working out what BIM is and often have poor, uncoordinated documentation.”

Another participant went as far as suggesting that government departments “have used loopholes in contract form[s] to get out of mandated BIM requirements”.

Adrian Malleson, head of research, analysis and forecasting at NBS, admits the figures were a shock. He says: “Some of the things which were said surprised me. About half [of respondents] say the government is not enforcing the mandate.”

In addition, when asked for comments, some respondents expressed disappointment that not all local authorities have followed central government’s lead and requested BIM in their contracts. Malleson points out that there is no mandate for them to do so but it seems this lack of consistency between what’s expected by central and local government is causing some confusion for the industry.

Mark Bew, chair of Digital Built Britain, a government-backed programme launched last year, and chairman of engineering consultancy PCSG, argues that the direction of travel is broadly promising even if the journey might appear to be a bumpy one. He says: “The fact that the results [of BIM uptake] are so good means that everyone is making a fantastic effort and we should celebrate that. Clearly the supply chain and clients are on a common learning curve and everyone is learning together.”

In his introduction to the NBS report, Bew acknowledges the industry needs to work harder to make BIM level 2 “business as usual”. He states: “This is where industry needs to lead the transition to BIM level 2 and spread it across the market, not just centrally-procured public sector projects but local authorities and the private sector.”

Clients need to get on board

James Pellatt, head of projects at London developer Great Portland Estates (GPE), says that until private clients truly back BIM, the process will not fully penetrate the market.

He says: “The pinch points are that private sector clients just don’t get it. Apart from us [GPE] and Argent, I don’t see people taking a lead in this, and I don’t see people completing projects on time either.”

Pellatt‚Äôs thoughts are echoed by Colin Harding, former Chartered Institute of ∫√…´œ»…˙TV president, who says that only firms close to public procurement are getting the BIM message: ‚ÄúThose involved in the industry may know what BIM is, but 90% of clients have no idea as they have no industry involvement. It is quite a big step for people who aren‚Äôt computer literate and see BIM as a complication.

“The general public think you either ring up a builder or contact an architect; they don’t understand the complexities of the modern design process.”

Another issue holding back BIM adoption is the initial investment, which still puts off smaller tier 2 or 3 suppliers. In an industry built on small margins, SMEs need to see a clear return on their investment and with only 41% of BIM users in the latest survey agreeing that the practice increased profitability many may need convincing.

Paul Newby, executive engineering services director at SES Engineering Services, says the investment needs to be justified: “Buy-in and uptake of BIM by tier 2 and 3 suppliers of all disciplines continues to be a real problem. Is it realistic to expect smaller businesses to invest between 1-2% of turnover in BIM technology, over and above their basic IT needs when not all the projects they will work on require it?”

The adopters

Of the firms that have taken the plunge, the story is very different. The NBS survey found that of the respondents that have adopted BIM, 75% are at or beyond the stipulations of the mandate.

Most respondents seem convinced of the benefits of BIM, 70% saying that BIM will help bring cost reduction in the construction and whole-life costs of buildings, while 60% saying BIM will help bring time efficiencies on projects.

Even more encouraging is the finding that once BIM is adopted, it is most often the design practice of choice: two-thirds who are using BIM do so on the majority of projects. And for the first time, a majority describe themselves as confident in their own knowledge and skills in using BIM. Fifty-five per cent are confident and 23% are not. Back in 2012, only 35% described themselves as confident in BIM, and 40% not confident.

The NBS survey also found that, of the respondents that have adopted BIM, 69% believed clients will increasingly insist on adopting BIM, while 64% of BIM users said contractors will insist on adoption.

The figures are familiar to contractors such as Kier, which, according to group director of BIM Andy Radley, has reaped the rewards of being an early adopter of the practice. “We’ve seen a 90% increase in demand for level 2 projects over the past 18 months, across both public and private sectors. There has also been significant engagement from our supply chain around either reviewing their BIM offering or challenging them to respond to our mandate.”

Kier pioneered its in-house BIMXtra platform in 2013 and since its launch has rolled BIM-orientated design across its highways, property and workplace services businesses. The aim is to join up as many disparate areas of the group as possible from construction through to property investment and facilities management.

Radley does admit, though, that educating clients is key. He adds: “There’s still a preconception that contractors and design teams reap the benefits of BIM. It’s important to dispel that myth, so we are capturing some narrative around the benefits of the BIM process and technology for all project stakeholders.”

Does BIM still need government backing?

Another debate is how committed the government will be to BIM in the future, especially with BIM level 3 on the horizon. BIM forms a key tenet of the government’s construction strategy 2016-2020, which aims to embed and increase the use of digital technology, deploy collaborative procurement techniques to enable early contractor and supply chain involvement, and develop and drive a whole-life approach to cost as well as carbon reduction across construction.

Development of BIM level 3 is also being worked on by the government-backed Digital Built Britain programme, chaired by Mark Bew, with a remit to push for the next phase of digitisation in construction by defining standards, creating commercial models and identifying the right technologies.

Simon Rawlinson, head of strategic research and insight at Arcadis UK, believes that, if anything, the government will become more involved in the coming years. He says: “I can see the commitment [by the government] intensifying. The private sector were never going to be included in the mandate, but when it comes to new capability, there’s more of a role for industry working with what is being developed, including public sector, private sector and the supply chain.”

Rawlinson’s view is given weight by research published by McKinsey Global Institute in February, which highlighted tax relief for R&D within construction, along with the BIM mandate, as an essential part of the UK’s investment in productivity for the sector, especially post-Brexit.

Despite the progress with BIM, low productivity has remained a concern for successive governments. The McKinsey research noted that the UK’s annual construction productivity growth was 0.49% per year between 1995 and 2015 which, though better than the US (which recorded a negative level of -1.04%), trails other industrialised countries such as Australia (2.05%) and Singapore (1.37%).

According to Harding, however, the government may no longer need to play such an important role: “I think the government will take their foot off the pedal and BIM will coast along, the industry is modernising and digitising its systems anyway.”

Jason Ruddle, chief operating officer of software development group Elecosoft, which develops 5D BIM construction software, also believes government backing for BIM may have run its course: “[BIM] is already part of the future built environment and infrastructure of the country. It is no longer really a question of government commitment, but that of the sector’s willingness to embrace digital business and building change – and that is non-negotiable if it hopes to compete in the global construction marketplace.”

If the government is to stay involved, then it may be the UK’s export potential for BIM that proves key. Jamie Wood, partner at architecture practice Sheppard Robson, says: “The mandate has also had an accelerative effect on the BIM skill-base in England. The mandate has focused the industry to be the world leader, which five years ago – before the mandate – would have perhaps been Australia.”

The NBS survey, however, found that only a third of respondents felt that BIM could help reduce the trade gap between exports and imports for construction products and materials and only 26% of respondents agreed that the UK was the world leader in BIM.

Kier’s Radley, however, is bullish on the UK’s prospects globally: “We are still seen as a mature market for BIM and a centre for the nurturing of talent,” he says.

Whether Radley’s optimism is justified is hard to tell as the country goes through the political and economic uncertainty of Brexit. However, what is without doubt is that as the rate of technological change continues to accelerate, those individual construction and design companies that invest in BIM will be best placed to exploit whatever opportunities present themselves.

This webinar will reveal the top highlights of the report, with a panel of industry experts to help dissect what these trends mean for the industry, and how you can best position your company and career to meet the demands of the changing landscape. The 2017 report is the seventh annual study using a consistent set of core questions, allowing NBS to present a unique year-on-year comparison drawing on the insight of over 1000 construction industry professionals.

Date: Friday 19 May

Time: 11.00 - 12.00 BST

Featured speakers: Chair: Chlo√´ McCulloch, Managing editor, ∫√…´œ»…˙TV; Adrian Malleson, Head of Research, Analysis & Forecasting, NBS; Simon Gillis, Technical Specialists Manager, Autodesk; Richard Waterhouse, Chief Executive, NBS; Aaron Perry, BIM Manager, Allford Hall Monaghan Morris.

No comments yet