CarillionÔÇÖs collapse is easy to dismiss as a one-off case of mismanagement. But what it also reveals is how hard it is to keep a healthy balance sheet in an industry with wafer-thin margins. Is it time to blame the system

Hindsight is a wonderful thing. Just over two months ago Bill Hocking, head of Galliford TryÔÇÖs construction arm, was telling ║├╔½¤╚╔·TV he expected CarillionÔÇÖs banks to reach a settlement with the troubled contractor, which was in partnership with his firm on an Aberdeen bypass project. The road scheme known as the Aberdeen Western Peripheral Route was one of three jobs that had forced Carillion to take a ┬ú375m hit. It had set the alarm bells ringing. As it turned out Hocking, like pretty much everyone else, was wrong: the banks didnÔÇÖt do a deal. Nor, when pushed, did HM Government. The rest, as they say, is history.

Rightly or wrongly, the collapsed firm has become a byword for executive incompetence, financial profligacy and, in some quarters, single-handedly tarnishing the reputation of a multibillion-pound industry. ÔÇ£To do a CarillionÔÇØ will doubtless become part of the lexicon of business studies undergraduates for years to come.

Appearing before MPs earlier this month, a few weeks after going into liquidation, members of the firmÔÇÖs senior management were grilled over the way they ran the business. Among a litany of charges, MPs took CarillionÔÇÖs bosses to task over why the firm regularly bid so aggressively for what was effectively unprofitable work. Arguing that its recent strategy had been to exit activities deemed to be unprofitable, CarillionÔÇÖs executive chairman Philip Green nevertheless admitted that negotiations on some contracts had been done ÔÇ£too quicklyÔÇØ and it had learned its lesson, a claim met with derision by some parliamentarians. Pressed on why Carillion had persisted over the years to chase so hard after such low returns, Green answered: ÔÇ£The industry itself is low margin. It is a competitive industry.ÔÇØ

ÔÇ£Hoping that if youÔÇÖve bid lower than you think a job will cost and [will] come out on top by 1%, 2% or 3% is speculative in the extremeÔÇØ

Tony Williams, ║├╔½¤╚╔·TV Value

There are those who see Carillion not as a one-off, but as representing the worst aspects of an industry where large firms play fast and loose with their supply chain while being buffeted relentlessly by the cycles of economic boom and bust. Throw in under-capitalised balance sheets and an approach to corporate governance that many find wanting and things start to look pretty bleak. So what are the chances that CarillionÔÇÖs downfall will change any of this? Here we consider the extent of the problems facing main contractors and the struggle they have to improve their minuscule margins.

| Turnover | Operating profit | Operating profit margin | |

|---|---|---|---|

| Balfour Beatty | ┬ú8.5▓·▓È | ┬ú67│¥ | 0.8% |

| Kier** | ┬ú4.3▓·▓È | ┬ú146│¥ | 3.4% |

| Morgan Sindall | ┬ú2.6▓·▓È | ┬ú49│¥ | 1.9% |

| Keller | ┬ú1.8▓·▓È | ┬ú95│¥ | 5.4% |

| Costain | ┬ú1.7▓·▓È | ┬ú41│¥ | 2.3% |

Average turnover: £3.8bn

Average operating profit: £80m

Average operating profit margin: 2.8%

*year ended 31/12/16 unless stated **year ended 30/06/17

On the margin

Margins have been an issue in the industry for decades. Mark Castle, chair of Build UK and MaceÔÇÖs deputy chief operating officer for construction, recently wrote in ║├╔½¤╚╔·TV that it had been a concern for his entire 37 year-long career. Castle noted that contractors tabled unrealistically low offers which clients were willing to accept, with any resulting downside being passed down to suppliers, leaving them, in his words, ÔÇ£high and dry [ÔǪ] putting thousands of livelihoods at risk and threatening to derail crucial infrastructure projectsÔÇØ.

Operating margins for the top five listed contractors excluding Carillion range widely, from 0.8% for Balfour Beatty through to KellerÔÇÖs impressive 5.4% (see table above). BalfourÔÇÖs boss Leo Quinn has bold goals for his firmÔÇÖs margin performance, just 12 months ago championing the ambition of hitting 5% by 2020.

At the time he was aiming for what he called ÔÇ£industry standardÔÇØ figures of between 2% and 3% by the end of 2017. Others, including Morgan Sindall boss John Morgan and Galliford TryÔÇÖs chief executive Peter Truscott had also been bullish, aiming for 2%.

But these margin targets are viewed in some quarters as a red herring, with industry watchers pointing instead to other systemic problems. Profitability in contracting ÔÇ£is a total accidentÔÇØ, according to Tony Williams of ║├╔½¤╚╔·TV Value. ÔÇ£The key is to avoid having a howler on the books. Some jobs work, some donÔÇÖt. Hoping that if youÔÇÖve bid lower than you think a job will cost and be able to make up the difference over the course of the project and come out on top by 1%, 2% or 3% is speculative in the extreme.ÔÇØ

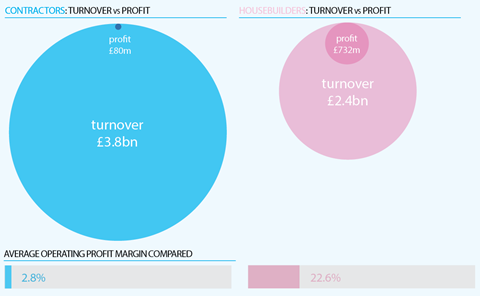

Margins: contractors and housebuilders compared*

While Carillion is being held up as contracting at its worst, sector watchers have been well aware that blood has been on the industryÔÇÖs carpet for some time, with many firms operating on a knife-edge. A glance at ║├╔½¤╚╔·TVÔÇÖs last table of Top 20 contractors, published last July, shows turnover derived from contracting activity in the billions for all but five. However, profit figures paint a grimmer picture, with a number posting pre-tax losses in their most recent full financial year.

Ironically, Carillion recorded a pre-tax profit for its last full year, 2016, albeit that it fell from ┬ú155m to ┬ú147m on turnover of ┬ú5.2bn, up from ┬ú4.6bn. Contrast this situation with housebuilders. The top five housebuilders by turnover in ║├╔½¤╚╔·TVÔÇÖs Top 20 housebuilders posted in the last year operating profit margins of between 17.2% (Barratt) to nearly 28% (Berkeley). Demand has obviously been high, although support for housebuilders in the form of the taxpayer-backed Help to Buy is in a sense a political gamble, one that is to an extent working for those building some of the countryÔÇÖs desperately needed homes. But some observers suggest this is a system which simply aids those who can ill afford it to jump aboard the home ownership carousel.

Martin Hewes, managing director of data specialists Hewes Associates, highlights a near-doubling of housebuilding activity in the last eight years, and believes that Help to Buy has effectively been bailing out operators in the sector since 2013. And in a recent analysis, Hewes forecast potential problems ahead: ÔÇ£The traditional economic drivers ÔÇô real income growth, steady secure employment, the prospect of lower interest rates ÔÇô are lacking. That places emphasis for growth firmly on further government support which, as is now evident, has its limits.ÔÇØ

The numbers game

The question of margins is a misnomer, Cenkos Securities analyst Kevin Cammack believes. ÔÇ£ItÔÇÖs more about cyclicality than anything structural. ItÔÇÖs virtually impossible to maintain 2% or 3% margins throughout all economic cycles and you canÔÇÖt set targets for such things without accounting for where you are at any particular time.ÔÇØ While companies can experience ÔÇ£unforeseeable eventsÔÇØ which either dent or conversely burnish profitability, it makes sense that for a long-term sector the peaks and troughs of a rolling economic cycle will have an impact.

And as Michael Hubbard, an associate at Aecom, wrote in ║├╔½¤╚╔·TV last week, competitive market conditions tend to scotch the ability of principal contractors to pass on higher supply chain prices, ÔÇ£particularly if clients pursue lower or lowest prices in an easing marketÔÇØ.

But Carillion went further than market fluctuations and its downfall has raised fundamental questions about the way large contractors look for revenue. Rudi Klein of the Specialist Engineering Contractors Group (SEC Group) says: ÔÇ£Carillion symbolises all that was wrong about UK construction. It perfected the art of manipulating the cash position of its supply chain. It has no assets to speak of. It was a finance company, basically, using long payment periods to fund itself.ÔÇØ The ┬ú29m that Carillion had in cash balances when it went into liquidation was probably owed to suppliers, he believes. Klein says red flags about the firm had been raised on a number of occasions but were ignored.

Cammack says MPs missed a trick in hammering CarillionÔÇÖs executive management over its failed corporate governance. ÔÇ£There were warning signs that both the management and indeed the government should have recognised.ÔÇØ There were many instances where, he argues, ÔÇ£you think someone would have stuck their hand up and asked what was going on.ÔÇØ Instead they hoped things would get better. And they didnÔÇÖt.

Must do better

For many the fall-out from CarillionÔÇÖs demise will be far-reaching and there is already a big debate under way regarding the current state of the industry and more importantly where it is heading. Many believe that the industry will only reform if compelled to do so by legislation. The SEC GroupÔÇÖs Klein, who is part of the task-force set up by the business department looking into the Carillion collapse, says the affair has opened everyoneÔÇÖs eyes to what is going on in parts of the sector, not least abuse of the supply chain. He wants to see ministers take action on retentions, payment terms and project bank accounts (PBA).

CenkosÔÇÖ Cammack says that while strengthening retention legislation ÔÇ£wonÔÇÖt stop firms from going under, it will stop the ripplesÔÇØ. But he wants firms to have stronger balance sheets. ÔÇ£Debt has gone mad, and capitalisation for these businesses is woefully small for the work they are taking on.ÔÇØ

Cammack says Carillion has shown how important it is to carry out rigorous due diligence prior to awarding contracts. Some will have assumed that because of CarillionÔÇÖs size, things couldnÔÇÖt possibly go wrong. It appears the government had few qualms about its position, given that it continued to put multimillion-pound projects CarillionÔÇÖs way up until a few months before its collapse. ÔÇ£Carillion is a reminder that corporate governance across the board needs to be robust. We are talking about a competitive industry which wonÔÇÖt change overnight, but it will hopefully make for better corporate practice. Only those who take a long hard look at themselves will survive,ÔÇØ Cammack says.

Klein agrees, and believes SMEs should play a greater role, particularly on services contracts. ÔÇ£These have to be broken down to into smaller chunks for SMEs to work on. Handing huge projects to big, under-resourced companies has to change. There must also be more due diligence and it has to be of better quality.ÔÇØ

CanÔÇÖt change, wonÔÇÖt change

But not everyone is convinced that the Carillion affair will set things straight any time soon. Tony Williams says: ÔÇ£CarillionÔÇÖs demise has led to a huge lump of capacity and the surviving large firms will probably be secretly pleased, given the work that is coming their way, possibly on better terms. There are privately-owned firms, large and small, that are run properly and in many cases will thrive. But the industry wonÔÇÖt have learned anything [from CarillionÔÇÖs collapse] that it didnÔÇÖt already know.ÔÇØ Under-bidding will persist, Williams believes. Nor does he think the client/contractor relationship will become more ÔÇ£collaborativeÔÇØ, as some have been predicting. ÔÇ£It just wonÔÇÖt happen,ÔÇØ he says.

Meanwhile there are industry watchers who argue that while CarillionÔÇÖs management may have made mistakes, market conditions should not be underestimated when assessing the fall of the company. Was Carillion a financially brittle player in a brutal market? Martin Hewes, managing director of data specialist Hewes Associates, says amid all the furore about its collapse and the inevitable knock-on effect for suppliers, staff and projects now in limbo or being sold off piecemeal to grateful rivals, there has been little discussion of whatÔÇÖs happened to the market in recent years, and how that contributed to CarillionÔÇÖs demise. ÔÇ£Housebuilding is almost double what it was in 2010, but in contracting itÔÇÖs a very different picture. YouÔÇÖve got more public outsourcing, but budgets are getting smaller. In the headier days there were profits to be made, but now the government wants more done for less money. How do you cope with an environment where a clientÔÇÖs spending is down 10%? Look at areas such as education and road-building budgets. TheyÔÇÖve been heavily cut. Yes, you need to manage things better and clearly some companies are run better than others. But if your workload is down you are bound to face problems.ÔÇØ

How clients, not least central government, put work out to tender in future will be a litmus test of whether lessons have been learned from the Carillion crash. Will they revamp framework tenders to avoid them coming to grief? Will large contractors and clients work closer together to see a project through to a conclusion that works for all concerned?

How contracting firms themselves behave both in bidding for such work and managing it once they have secured it will be key in determining whether margins lift above the floor level of 1% and 2%. Some suggest the industry cannot learn from Carillion. Others will argue that following one of the biggest corporate failures the industry has seen in years, it canÔÇÖt afford not to.

No comments yet