Housing and infrastructure are leading the rebound of construction activity, and sentiment is near record highs. Rising demand and tightening supply are driving up both costs and tender prices. But how much of this is just a spike rather than an underlying upward economic trend? Michael Hubbard of Aecom reports

01 / Summary

Tender price index â–²

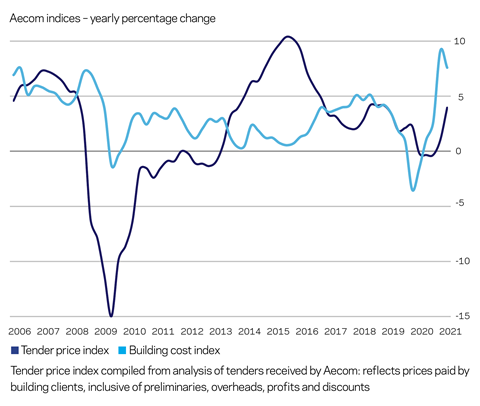

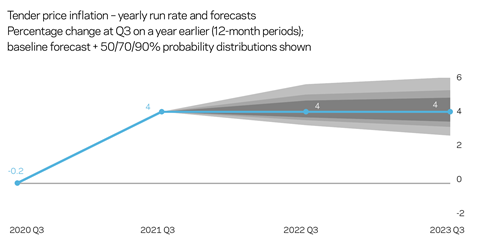

Tender prices increased by 1% over the 12 months to Q2 2021. They are set to further increase over the remainder of 2021 as workload stays busy and input cost pressures remain.

ºÃÉ«ÏÈÉúTV cost index â–²

A composite measure of building input costs increased by 8.5% over the year at Q2 2021. Global and domestic issues and problems combined to push up input cost inflation to its highest yearly rate of change since 2005.

Consumer prices index â–²

The consumer prices index (CPI) rose by 2.5% in the 12 months to July 2021. Consumer price inflation is expected to increase further in 2021.

02 / Output

UK construction output

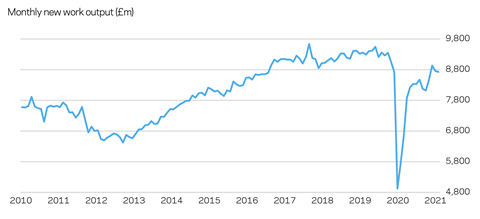

After faltering in early 2021, construction output regained momentum and took another leg up in the second quarter, according to the latest data from the Office for National Statistics (ONS). This has helped push the level of new work output up towards pre-pandemic figures, although at this latest output data release it was still about 5% shy of that milestone. All work construction output declined for the second month in a row; however, both falls were marginal at -0.7% and -0.8% in April and May respectively. It is expected that new work output will maintain a steady course or move up further in subsequent data releases, given the strength of sentiment recorded lately.

Across the UK, the private housing and infrastructure sectors led the way in output rebounds. Infrastructure workload continued its strong growth trend out of 2020 and now clearly surpasses its pre-pandemic levels. Within this sector, electricity, gas and communications utilities work all recorded strong rates of growth over the two-year period from the start of 2019. In a further sign of construction industry durability, the largest sector by volume – private housing – has now recovered a substantial part of the ground lost during 2020. The commercial and private industrial sectors are still some way off returning to pre-pandemic levels.

03 / Activity indicators

Business sentiment

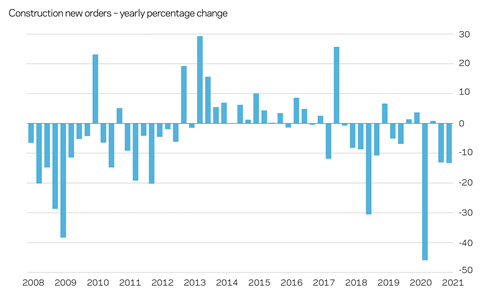

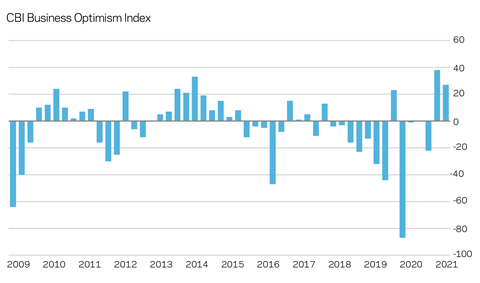

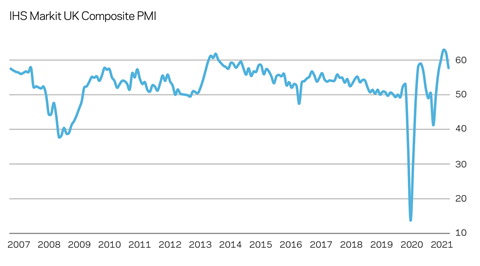

Construction sector sentiment reached near record highs in the last couple of months. While general business sentiment continued to rise as the UK economy reopened more, optimism in the construction sector accelerated slingshot-like at an even greater speed over recent months. Improving workload is powering this optimism. Significant supply-side issues around workforce constraints and materials procurement are muddying the waters with regard to the idea that everything is due to higher output levels across all sectors.

Activity is expected to remain busy in the second half of 2021 as consumer demand returns across a larger number of economic sectors. Business sentiment conditions therefore are likely to remain elevated thanks to a mix of expected and real improved sales and revenue over the remainder of 2021. But real risks remain of further bumps in the road from the pandemic and a potential return of restrictions should the situation deteriorate again. What will become clearer is the proportion of the rebound that is from the short-term cyclical spike and that which is driven by the strength of underlying demand and structural factors propelling economic activity.

Estimates of UK GDP in May suggest a fourth consecutive month of expansion. The services and production sectors continued to expand, but manufacturing and construction both returned marginal contractions in output levels between April and May. For construction, this is the second month in a row where output contracted, albeit marginally. Crucially, this adds further colour to the undulating picture of recorded construction output as the sector moves out of the pandemic.

Housebuilding and public infrastructure underpinned much of the industry’s progress on output, with government policy incentives for housebuilding adding impetus. Housing repair and maintenance workload also increased demand for skills and trades, while pushing stories about materials shortages onto the front pages. Factors combining to create the supply disruptions include higher international logistics costs, returning demand from industry workload, HGV driver shortages, and permanent Brexit non-tariff barriers and their additional administrative processes. There are problems at most links of the UK’s integrated supply chain.

04 / ºÃÉ«ÏÈÉúTV costs

Inputs

Aecom’s composite index for building costs – comprised of materials and labour inputs – rose 8.5% in the 12 months to Q2 2021. This headline figure, aggregating many different materials classifications, masks a wider range of inflation rates for individual items. The largest increases continued to be in metals and timber products, especially for imports. A rolling quarter-to-quarter change for the composite index at June 2021 recorded a movement of 2.6%. The month-on-month change at June for materials only was 0.91%, equivalent to 11% annualised approximately. This underlines the notably elevated rate of input cost inflation currently.

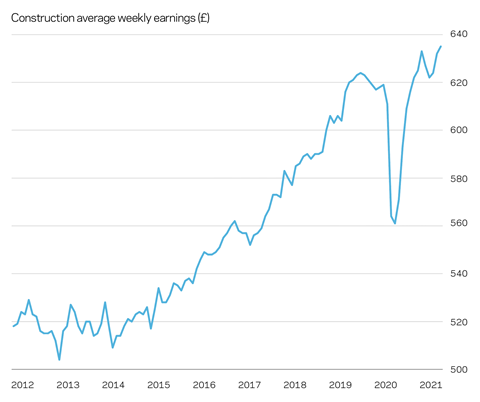

There is evidence that some of the high input cost inflation is easing somewhat on a yearly change basis, but only marginally. Despite this potential short-term relief, input cost inflation is expected to persist at above-average rates for the remainder of 2021 and probably into 2022. Timber is likely to see inflationary trends into Q3 2021, with trade associations warning of expected supply problems from a combination of global and domestic factors. Labour rates are increasing healthily after dipping last year in response to lockdowns and impaired demand for site trades and skills. Year-on-year change of 7% for a mix of site trades is the current headline rate for wage inflation, but this does not convey the broader range of wage inflation for different trades. Steelwork trades and bricklayers are seeing wage inflation of 15%-20% over the year to Q2 2021, although this figure is influenced by the dip in wages at the same time last year. Nevertheless, it highlights the strength of demand for key trades. Mechanical and electrical and joinery trades are also in demand, with corresponding wage inflation of approximately 10% over the year.

05 / Tender prices

Resources

An aggregate measure of tender prices increased by 1% in the 12 months to Q2 2021. A denominator calculation effect influences the rate of change as Q2 2020 was when tender prices peaked, Aecom analysis shows. Provisionally, Q3 2021 sees an approximately 4% rise year-on-year. The highest rates of change in key trades were concrete at 16%, reinforcement at 15%, plastering at 11%, and steelwork at 10%. We are seeing clear momentum on price rises after the meandering journey through 2020 and early 2021. There is now urgency to increase prices in response to higher output and demand, and to address the acute pressure to recover higher input cost trends over Q1 and Q2 2021. Overwhelmingly, trades that involve metals saw the steepest price rises in the last quarter. Materials input cost inflation is the largest driver of tender price rises but is also pushed higher by labour rate increases.

Not all of the materials cost inflation is being transferred into tender prices, because of the impact on competitive positioning. Price changes will take longer to secure than the quick changes to input costs over the first half of the year. Prices are built up of numerous components, not just materials. Some of the input cost inflation is absorbed at various stages of the supply chain. Sourcing, buying and inventory mitigations also act to offset input cost pressures. But the high cost inflation adds commercial pressure to the supply chain and is difficult to sustain over an extended period without creating problems for company financial management. Some of the Q1 2021 spike in materials costs is abating a little but the lagged effect into tender prices will see them continuing to rise in H2. This should help the supply chain, who are dealing with acute commercial pressures, but margins will be squeezed.

06 / Outlook

TPI forecast

Materials and components shortages made national headlines in Q2 2021. The fact these issues have impacted private domestic customers made it inevitable that construction would be in the news. Global and domestic issues are combining to create higher prices, as well as longer delivery times. Two immediate problems arise from this situation: delivering current projects on time and budget, and increased stockpiling as real and apparent shortages create the perception of the need to buy more now. The longer that supply-side issues continue, the more likely that future output is affected – either through extended times and delays to complete existing work, or through the effect of greater costs, prices and programme durations which impact funding calculations and decisions on projects in pre-construction stages.

Added to the current problems with materials are workforce constraints, labour shortages, and recruitment difficulties. Public health requirements from pinging by test and trace apps will further complicate workforce planning over the next quarter. Yet there is a need to balance these issues with decisions to increase headcount as a result of expectations of improving business activity, demand and revenues.

Resource issues are from a combination of the rebound in activity and problems that long predated the pandemic. Beneath these shorter-term issues lie acute structural problems for the construction sector. More explicitly, the workforce size is not growing sufficiently to change the underlying make-up of the industry and alleviate capacity constraints. Notable imbalances exist between workforce size and construction output in the South-east, the East of England, London and Scotland.

Ordinarily, capital investment could be expected to rise as the economy picks up speed – to increase capacity, for example. Some current government tax breaks relating to built assets are helpful to encourage capital investment. However, many businesses’ forward plans and investment decisions are now conditional on a number of external factors – returning consumer and business demand, no further restrictions in response to the pandemic or impacts from other major issues confronting the UK. Construction demand will adjust and sector nuances will be evident. This is already happening, in the commercial sector for example, where offices and retail impacts are clear.

Logistics-related sectors will continue to see strong construction demand from port development and associated infrastructure, facilities and warehousing capacity. Trends within sectors will influence associated demand – prime versus non-prime commercial property, and newer versus older properties where environmental requirements may bring additional costs for retrofitting or improvement in line with tenants’ demand and expectations. The repurposing of commercial sector built assets is likely to introduce additional demand for construction services, as firms’ office footprints and requirements for floorspace are reviewed as a result of adjustments to different ways of working.

Aecom’s baseline forecast for tender prices is for a 4% increase from Q3 2021 to Q3 2022, and a 4% rise from Q3 2022 to Q3 2023. Risks are to the upside across the first 12-month period, with upside risks again over the second 12-month forecast period. The baseline forecast scenario sees a continuation of the incomplete economic recovery. Significant inflationary pressures will remain. The pervasive nature of the inflation pressures means it is almost certain that tender prices will rise across more of the supply chain. However, evident market competition in some sectors and locations will limit the extent of price rises to some degree. This does not mean that excessive risk transfer will be accepted, though. There has been a tangible change by the supply chain in what is deemed an acceptable level of risk.

No comments yet