Last week Barbour ABI launched the second of its monthly Economic & Construction Market Reviews. Here are highlights, including sector and regional statistics, with a focus on the commercial and retail sector

Economic context

December recorded a string of positive news stories for the economy and this has continued into 2014. The closely watched Purchasing Managers Index (PMI) indicators dipped slightly in November and December but were still significantly above the level of 50 which indicates expansionary activity.

One of the most important indicators of the UK economy鈥檚 improving performance was the convergence of the Consumer Price Index to its target level of 2% in December, the first time it had reached that level since November 2009.

Unemployment also fell further in the period September to November with the figure now sitting at 7.1%, down from a peak in recent years of 8.4%.

The Office for National Statistics estimates that the economy grew by 0.7% in the final three months of last year which translates to 1.9% growth in 2013. This shows the significant positive change in outlook that occurred during the year, as most analysts were predicting growth of between 0.6% and 1% in the first half of 2013.

There were a number of other positive stories for the economy in the last month which indicate upturns in demand including:

- UK car sales stood at 2.26 million in 2013, the highest level since 2007

- An Ipsos MORI poll of business leaders showed 93% thought the economy would improve in 2014

- Figures from High Fliers Research predict an 8.7% increase in graduate recruitment this year.

With inflation and unemployment falling the Bank of England governor Mark Carney has plenty to cheer at the moment. However, there are still a number of potential headwinds for the economy including low productivity levels, stagnating wages and a persistent trade deficit which will continue to prove a drag on the scale and durability of economic growth.

The downside risks from the Eurozone, while lessening, still remain for the UK but overall things look better now than six months ago. It is Barbour ABI鈥檚 view that the near term outlook for the UK economy has improved but the challenges of addressing the output gap, the trade deficit and encouraging greater business investment will be vital in ensuring sustainable economic growth in 2014 and beyond.

The construction sector鈥檚 performance

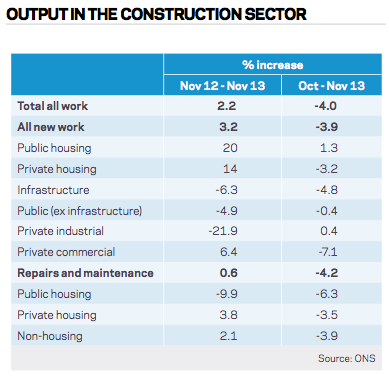

The latest figures from the Office for National Statistics (ONS) showed that the UK construction sector declined by 4.0% between October and November 2013. This decline was unexpected, although the figures had been revised significantly upwards last month which in part may explain this fall. More importantly, output in the sector increased by 2.2% compared to November 2012 and is further evidence of its improving performance in 2013, in line with wider economic growth.

Only public housing and private industrial grew between October and November. However, public housing, private housing and private commercial all showed strong year-on-year growth rates. Private housing increased by 14% and public housing by 20%, demonstrating good performance in the last year. Private commercial grew by 6.4% between November 2012 and November 2013, an encouraging sign for construction鈥檚 largest individual sector.

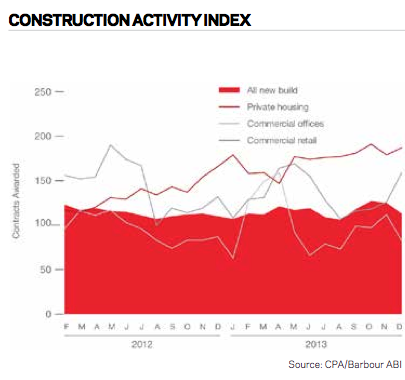

The CPA/Barbour ABI Index, which measures the level of contracts awarded using January 2010 as its base month, recorded a reading of 113 for December. While lower than the months of October and November it is still above its December 2012 levels, supporting the view that activity in the industry remains strong. As well as private housing, the reading for commercial retail continued to rise in December 2013 while commercial offices fell to 82 after a number of months of growth.

The improved statistics and sentiment surrounding the construction industry has led to an upgrading in forecasts for its future performance by the CPA. Growth levels in 2013 are estimated to be 1% for 2013 and the industry is now forecast to grow by 3.4% in 2014 and 5.2% in 2015. While this is welcome news for the industry it is important to note that it will be 2017 before the industry exceeds the levels of activity occurring in 2007 before the recession took hold.

According to Barbour ABI data on all contract activity, December witnessed a slight fall in construction levels with the value of new contracts awarded 拢6bn, based on a three month rolling average. This is a decrease of 1.4% from November but a 67.1% increase on the value recorded in December 2012, an indication of a significant upturn in construction activity in the UK in 2013. The number of construction projects within the UK in December was down 27.7% on November, but levels were 17.5% higher than December 2012.

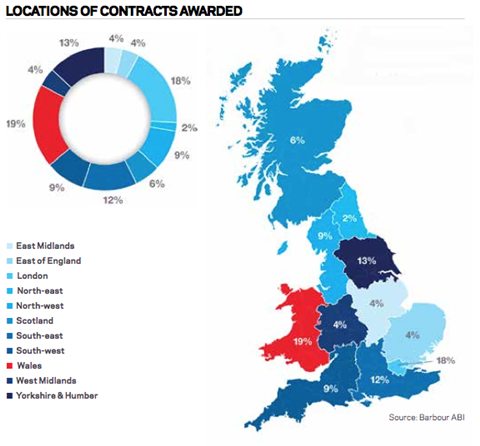

The majority of the contracts awarded in November by value were in Wales, which accounted for 19% of the UK total. This was largely attributable to an 拢800m waste treatment project announced in Clwyd. London was the next most prominent location with 18% of the contract award value, with major residential project The Glebe and the Heathrow Tunnels Refurbishment Project awarded this month. Yorkshire & the Humber and South-east were the next highest accounting for 13% and 12%of the total respectively.

Infrastructure had the highest proportion of contracts awarded by value in December with 36% of the total. This is largely attributable to the waste treatment project in Clwyd and a carbon capture project at Drax Power Station in Selby. Contracts awarded in the residential sector remain high accounting for 32% of the contracts awarded in December. Of the remaining sectors education (12%) was the most significant.

Construction performance by sector

Spotlight on the commercial sector

The value of contracts awarded in the commercial & retail market was 拢618m in December based on a three month rolling average. This is a 19.9% decrease from November but a 31% rise

from the December 2012 figure. In the three months to November the value of contracts was 18% above the previous three months and 48.6% higher than the same period in 2012. This suggests a much stronger finish to 2013 in the sector than the previous year.

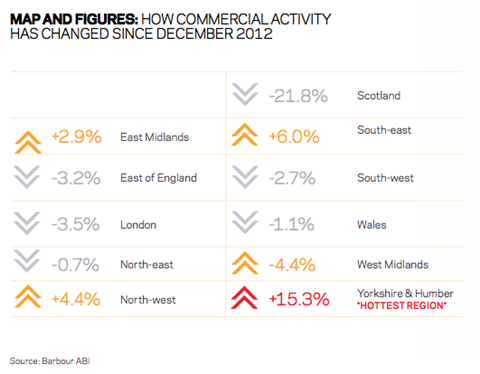

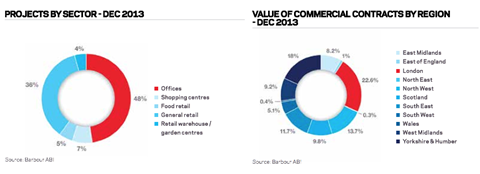

The South-east was the main location of activity in the sector this month with 22.6% of the value of all contracts awarded, a 3.5% decrease from December 2012. The projects contributing to this increase were the commercial led redevelopment of St Giles Circus in Oxford Street which has a value of 拢30m. Yorkshire & the Humber was the next most significant location of activity accounting for 18% of contract value, a 15.3% increase from the corresponding month last year. The North-west and the South-east were the two other regions of note and were the locations for 13.7% and 11.7% of the value of contracts awarded in November respectively.

Offices were the dominant type of project in the sector accounting for 48% of the value of contracts awarded in December 2013, though this was a 28% decrease on December 2012. General retailing is the other significant sector with 36% of contract award value, 18% higher than November 2012.

The CPA forecasts for the sector show that after a solid year in 2013, where output is estimated to increase by 2.7%, a similar level of growth is forecast for 2014. As the levels of investment in the offices and retail sector increase this is forecast to have a positive impact on the levels of output in 2015

and beyond.

No comments yet