Construction output levels saw a further slowdown in Q4 but were still up on the same period last year. Private housing and infrastructure are the bright lights for the year ahead

Economic context

There was continued growth in GDP in Q4 from Q3, but levels remained down on 2014 at 2.2%, compared to 2.9% last year.

The latest GDP figures for the UK economy were released in the last month and they showed that the UK economy had grown by 0.5% in the final quarter of 2015. This was slightly higher than the 0.4% rate of growth experienced in the third quarter and meant that for the full year the economy grew by 2.2%, well below the 2.9% recorded in 2014.

While the total level of output is now comfortably above its pre-recession peak the pattern of growth within the economy is still very much focused towards the dominant service sector. The latest figures show that this sector is now 11.6% higher than its pre-recession peak while construction is currently 4.2% below its pre-recession peak and manufacturing is 6.4% below.

This indicates the scale of the challenge of rebalancing the economy towards manufacturing and construction given the dominance of the service sector.

Putting the UK鈥檚 economic recovery in the context of the other G7 economies suggests that since 2008 the UK has had a middling performance. While the USA and Canada have grown the most since the start of 2008, the UK had more subdued growth from 2010 to 2013 but one of the fastest growing since then.

Other news this month on the UK economy includes:

- The IFS highlighted that slowing wage growth could endanger the chancellor鈥檚 target to eradicate the deficit by 2020

- The latest Inflation Report from the Bank of England forecast that the inflation level would remain below 1% for the whole of 2016

- The composite PMI index, which measures activity across all sectors, rose to a six-month high of 56.0.

The construction sector

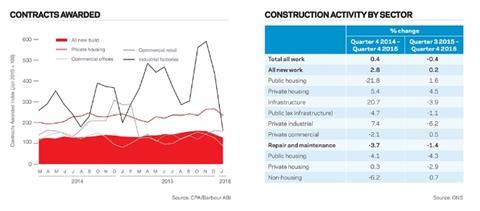

The latest figures from the Office for National Statistics (ONS) show that the construction sector decreased by 0.4% between September Q3 and Q4 2015. Comparing output levels with Q4 last year showed an increase of 0.4%.

Private housing returned to quarter-on-quarter growth, with output levels up 4.5% on Q3 and also up 5.4% on the same quarter last year. Public housing had quarter-on-quarter growth of 1.6% but more significantly was down a considerable 21.8% on Q4 2014.

Infrastructure was down 3.9% on Q3 but remained up 20.7% on the same quarter last year. With some large projects, headed by HS2 and Thames Tideway Tunnel, it鈥檚 hoped that this sector will provide a boost to output levels over the next couple of years.

The CPA/Barbour ABI Index, which measures the level of contracts awarded using January 2010 as its base month, recorded a reading of 128 for October. This is a continued decrease from the previous month. The readings for private housing remain high at 235, although down from a level of 265 for the previous two months.

Commercial offices activity had a marked slowdown with a level of only 87. With plenty of promised work in the pipeline it is hoped that the remainder of 2016 will see a pick up in activity.

The Construction Products Association recently updated its forecasts for 2016 and beyond and the industry is now predicted to grow by 3.6% this year and 3.8% next year on the back of continuing strength in the new build private residential sector and increasing activity in the infrastructure sector.

According to Barbour ABI data on all contract activity, January witnessed a decrease in construction activity levels with the value of new contracts awarded at 拢5.3bn, based on a three-month rolling average. This is an 8.6% decrease from December and a 3.7% decrease on the value recorded in January 2015. The number of construction projects within the UK in January increased by 26.1% on December, but were 18.3% lower than January 2015.

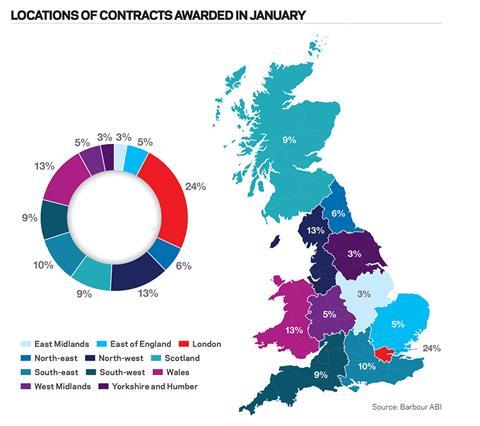

Projects by region

London received the highest proportion of construction contracts by region, accounting for 24% of the UK total. In London, the award of the 22 Bishopsgate contract to Brookfield Multiplex at a value of 拢500m was the largest project in January by construction value.

The North-west had the second highest portion of contract activity by value in January, accounting for 13% of the value awarded.

The contract to develop a new pharmaceutical HQ for GSK in Ulverston, Cumbria was the highest value contract in the region in January with an estimated construction cost of 拢350m. Wales followed closely with the next highest proportion of contracts by value, also with 13% of contract value awarded in January.

The largest project awarded was the Wylfa nuclear power station in Anglesey, which agreed contracts valued at 拢450m for the construction element.

Types of project

Both residential and infrastructure sectors received the highest proportion of contracts awarded by value in January with 23% of the total value of projects awarded. Residential projects such as the Streatham Hill development in South-west London, valued at 拢60m, and the Britannia Music site in Ilford, valued at 拢50m, were the two largest projects awarded.

The Wylfa nuclear power station in Wales was the largest infrastructure project awarded as well as the Port Clarence biomass plant in Cleveland, valued at 拢200m. Commercial and retail accounted for 19% of contract values awarded, with 22 Bishopsgate in the City of London the largest project in January.Residential activity decreased in January 6.1% compared to December and is 14.6% lower than January 2015, indicating that new contract activity for units in the residential sector is lower than last year. The value of projects associated with residential contracts awarded decreased by 32.9% between December and January based on a three-month rolling average, and by 21.4% on January 2015. These statistics suggest a slower start for residential at contract award stage. However, the numbers of housing completions are rising, suggesting building activity in the sector remains strong. Given that the long-term fundamentals that have been driving growth are set to continue, Barbour ABI remains confident of the longer term growth prospects for the sector.

Sector performance

House price indices for January from Halifax showed that average prices are increasing at 9.7% annually in the three months to January, up from 9.5% last month, and 9.0% this time last year. Nationwide reported annual house price rises of 4.4%, compared with 4.5% in December.

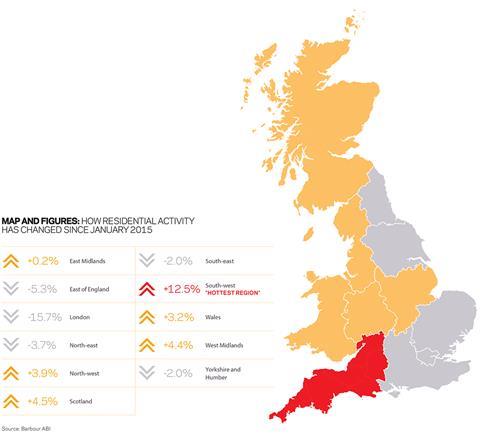

Projects by region

London was the main location of activity in the residential sector this month, accounting for 22.4% of the value of contracts awarded, a decrease of 15.7% in the same month last year. However, in a further sign residential activity is increasing its geographical spread, the South-west accounted for 20% of contract value 鈥� a 12.5% increase from the same month in 2015. The North-west also had a high share, accounting for 15% of the value awarded.

No comments yet