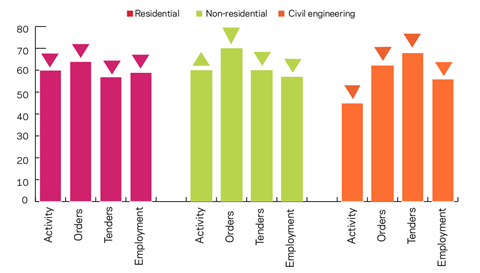

The total activity index indicates growth, and residential and non-residential activity is in positive territory. However, civil engineering has fallen below the no-growth level.

01 / State of play

The total activity index for October continues to indicate growth in the sector, standing at 58 points, down by two points from September.

The R&M index shows a similar development, remaining above the no-growth 50-point level and close to July’s figure at 54 points, six points down on the previous month.

Both residential and non-residential activity remain in positive territory for October, as their indices posted values of 60 points. The residential index fell marginally by two points, while the non-residential activity index increased by the same amount. The activity index for the civil engineering sector points at a notable deterioration in October, falling by 32 points to 45, just below the no-growth level.

Both orders and tender inquiries continued to grow, although their respective indices have changed direction and headed downwards.

The orders index was down by 11 points on September, returning to its July level of 63. The tender enquiries index decreased by four points to 58, the same as June’s figure.

Orders in all main sectors are in positive territory, but the indices suggest a slowdown. The index for non-residential orders saw the largest decrease in October, by 11 to 70 points, followed by the civil engineering index, down by 10 points to 62, and residential orders, down nine points to 64.

The tender (enquiry) indices suggest deceleration in growth for all sectors in October. The largest change was recorded in civil engineering, with the sector’s index falling to 68, down by 18 points since September. The non-residential enquires index ticked down by one point to 60, while the residential index fell by 5 points to 57.

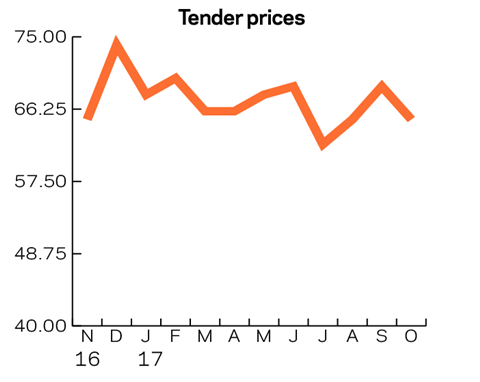

The tender prices index decreased by four points and posted a value of 65. Despite the downward movement, the index remains firmly on the expansionary side, with October marking the 15th month above 60 points.

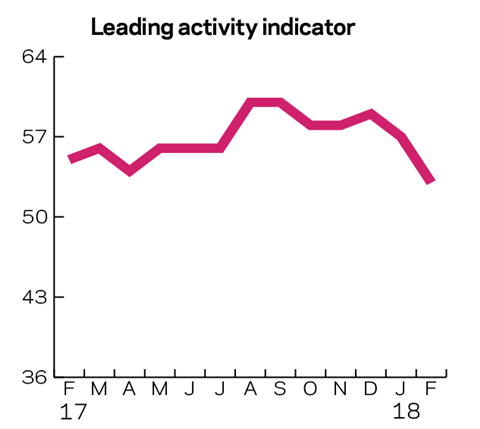

02 / Leading construction activity indicator

The activity index continued to suggest positive developments this month in contractors’ workloads, standing at 58 points. It has gone down by two points relative to the previous month’s figure, but is still the second highest value the index has marked since June 2016. In the next four months the Leading Activity Indicator is expected to initially increase marginally before falling down more notably to just above the no-growth 50-point level.

03 / Labour costs

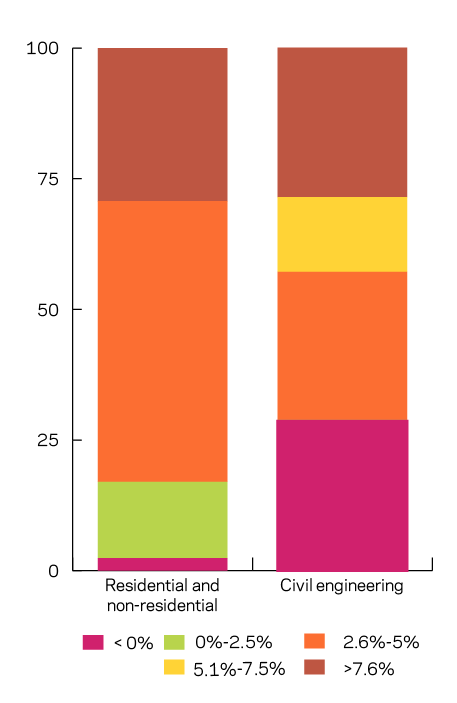

As UK inflation reached a five-year high in the past two months, the increase in labour costs was renewed. In October, 53.7% of the respondents reported labour cost increases between 2.6% and 5%, while 29.3% estimated the growth to be above 7.6%. The share of respondents who have pointed out a decrease relative to July has shrunk to 2.4%, while the share of respondents reporting increases up to 2.5% has expanded to 14.6%.

Developments in labour cost changes in the civil engineering sector are also apparent. Relative to July, the share of respondents reporting increases in labour costs in October has shrunk from 100% to 71.4%, with the remaining 28.6% reporting a decrease. The same share of respondents (28.6%) report labour cost increases of above 7.6% and another 28.6% – increases ranging between 2.6% and 5%. The remaining 15.3% have experienced an increase in labour costs between 5.1% and 7.5%.

04 / Regional perspectives

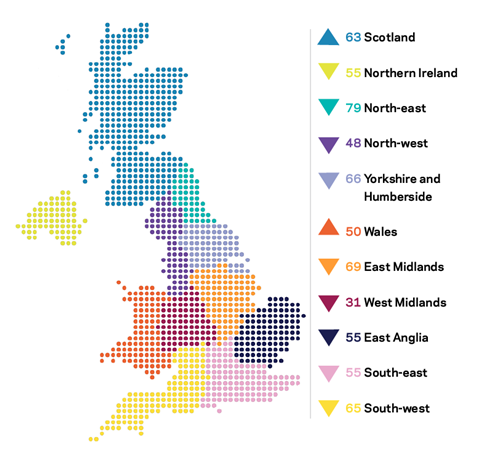

Experian’s regional composite indices incorporate current activity levels, the state of order books and the level of tender enquiries received by contractors to provide a measure of the relative strength of each regional industry.

In October, the general trend was a decrease in the composite index. Only two regions enjoyed an increase in their respective indices.

The index for West Midlands was down by four points to 31 in October, making this the fourth consecutive month in negative territory. The North-west was also below the no-growth limit in October after its index dropped eight points to 48. The Yorkshire and Humberside index also recorded an eight-point decrease on September figures and was estimated at 66 in October.

The two regions which saw positive changes were Wales and Scotland. Wales’ index grew two points to put it in neutral territory at 50 points. Scotland posted a three-point increase and reached 63.

The North-east kept its leading position followed by East Midlands with indices of 79 and 69, respectively, down by five and three points.

The UK composite index was estimated at 68 – three points down from September. Despite that, the index is at its second highest position since March 2016.

This an extract from the monthly Focus survey of construction activity undertaken by Experian Economics on behalf of the European Commission as part of its suite of harmonised EU business surveys.

The full survey results and further information on Experian Economics’ forecasts and services can be obtained by calling 0207-746 8217 or logging on to

The survey is conducted monthly among 800 firms throughout the UK and the analysis is broken down by size of firm, sector of the industry and region. The results are weighted to reflect the size of respondents. As well as the results published in this extract, all of the monthly topics are available by sector, region and size of firm. In addition, quarterly questions seek information on materials costs, labour costs and work-in-hand.

No comments yet