Despite the unexpected surge in consumer prices in March, construction inflation is continuing to slow. Peter Fordham of Davis Langdon, an Aecom company, reports

01 / KEY CHANGES

- Construction inflation measures all falling

- Electrical cost inflation zero over the last year

- Consumer price inflation higher than construction price inflation and forecast fall being stubbornly resisted

- Higher oil prices have impacted on trades such as roadbuilding

- Lower metals prices have brought cladding costs down

- Manufacturing industries’ input costs fall sharply

- Plumbers in England and Wales the only trade so far to receive any wage increase in 2012

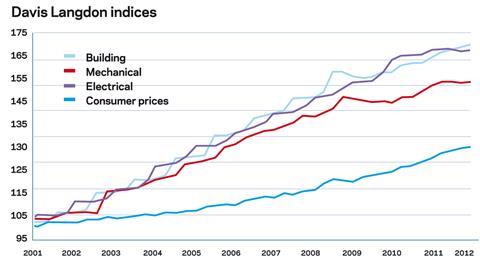

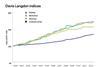

The chart below shows how Davis Langdon’s index series, reflecting cost movements in different sectors of the construction industry, have fared since 2000, with the movement of the Consumer Prices Index for comparison.

��ɫ����TV cost index

Materials price increases ensure that the building cost index shows the highest year on year percentage rise.

Mechanical cost index

Small increase in first quarter but year-on-year increase sharply down.

Electrical cost index

Small increase in first quarter to reverse falls at end of 2011 but zero year-on-year inflation not seen in last 35 years.

Consumer prices index

Inflation down from 5.2% in September 2011 but March saw unexpected uptick.

Guide to data

Davis Langdon’s cost indices track movements in the input costs of construction work in various sectors, incorporating national wage agreements and changes in materials prices as measured by government index series. They provide an underlying indication of price changes and differential movements in the various work sectors but do not reflect changes in market conditions affecting profit and overheads provisions, site wage rates, bonuses or materials price discounts/premiums. Market conditions are recorded in Davis Langdon’s quarterly Market Forecast (last published 20 April).

02 / PRICE ADJUSTMENT FORMULAE FOR CONSTRUCTION CONTRACTS

Price adjustment formulae indices, compiled by the ��ɫ����TV Cost Information Service (previously by the Department for Business, Innovation and Skills), are designed to calculate increased costs on fluctuating or variation of price contracts. They provide guidance on cost changes in various trades and sectors and on the differential movement of work sections in Spon’s Price Books.

Over the last 12 months, between April 2011 and April 2012, the 60 building work categories recorded an average rise of 3.3%, well down from 4.4% three months previously and 5.2% six months ago.

Those works categories showing the highest increases over the last 12 months have been:

| April 2011-April 2012 | % change |

| Pavings: coated macadam and asphalt | 10.7 |

| Boards, fittings & trims: hardwood | 8.4 |

| Finishes: bitumen, resin and rubber latex flooring | 7.9 |

| Sanitary appliances | 7.5 |

| Finishes: carpets | 7.4 |

| Pipes and accessories: aluminium | 7.2 |

| Finishes: flexible tiles and sheet coverings | 6.1 |

| Waterproofing: liquid applied coating | 5.9 |

The effect of the increase in oil prices in spring 2011 and again this spring can be clearly seen in some of the categories above.

Those categories showing the smallest increases or in some cases decreases are:

| Cladding and covering: aluminium | -1.2% |

| Cladding and covering: lead | -0.7% |

| Cladding and covering: fibre cement | 0.4% |

| Softwood carcassing and structural members | 0.5% |

| Cladding and covering: zinc | 0.6% |

The common factor here is the decline in metals prices in the second half of last year.

Materials

The slowdown in inflation is being led by falls in metals and electrical prices

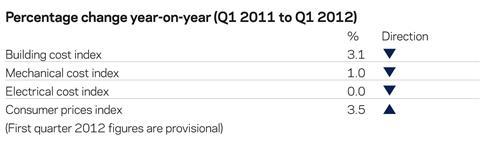

03 / EXECUTIVE SUMMARY

- Consumer price inflation progressively declining but unexpected rise in March

- Industry input costs show sharp decline

- Output prices rose at the beginning of the year but the recent inflationary trend has been downwards

- Metals prices on downward trajectory again

- Construction materials subject to new year price rises but annual inflation trends lower

- Mechanical services material prices see little or no inflation

- Electrical services material prices have fallen over the last year

04 KEY INDICATORS

The rate of inflation was falling steadily from 5.2% last September to 3.4% in February. March saw an unexpected increase back to 3.5% as clothing costs leapt by a record 2.3% and fuel costs jumped by 2.2%. The downward direction of the retail prices index was maintained and was down to 3.6% from 5.6% last September.

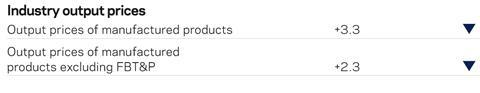

Manufacturing input costs fell 1.5% in April, bringing the annual rate of inflation down to 1.2% from 5.6% in March and 17.9% in April 2011. The most recent fall was due to drops in the price of crude oil and imported metals, parts and equipment. The narrower measure, for manufacturing industry excluding FBT&P, fell by a lower 0.4%. The annual inflation figure has dropped to 2.5% from 4.2% in March and 13.3% last September.

The annual rate of inflation for output prices declined to 3.3% in April, down from 6.3% in September last year but prices rose by 2.3% in the first four months of this year, the fastest rate of inflation since the same period of 2011. However it is common for manufacturers to raise prices early in a calendar year.

Products in the narrower band rose 2.3% over the year, down from 3.7% in September, and rose 1.5% in the first four months of 2012.

Increases over the last 12 months include:

| Wood and wood products | +4.2% |

| Rubber and plastic products | +1.6% |

| Fabricated metal products | +2.2% |

Metals prices’ recovery in late 2011 and early 2012 peaked in March, since when prices have once again been in decline as the eurozone went into recession.

Construction industry

Materials price increases for the construction industry over the last year (to March 2012) are detailed below:

Overall, construction materials rose by 4.5% over the year to March. Prices rose in the first three months of the year, particularly for non-housing new work materials (following the normal seasonal pattern) but annual percentage increases are declining.

Mechanical services materials have seen some small increases in price at the beginning of this year but there has been a rapid decrease in the rate of annual inflation, for housing down to zero from 9.1% in February 2011 and for non-housing down from 8.0% last February to 1.0% this March.

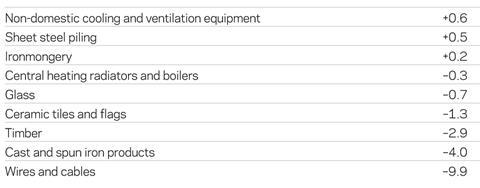

The pattern for electrical services materials has been very similar but even more extreme, down from +10.8% in February last year to -1.5% in March this year.

Construction materials showing the biggest increases over the past year are:

Those showing decreases or only minimal increases include:

Labour

Earnings remain largely frozen, but employment was marginally up at the end of the year

- In March 2012, average weekly earnings in construction were £549, up 0.4% over the year

- Average earnings throughout the whole economy rose by 0.6% over the year to March

- The number of people employed in construction rose in the second half of last year - in December it was 34,000 higher than in June, an increase of 1.7%

- 22,000 people were made redundant in the construction industry in the first quarter this year, the highest figure since the same quarter of 2010.

06 / WAGE AGREEMENTS

2012 looks like being a bleak year for operatives working in the construction industry. Plumbers in England and Wales received a 3% wage increase at the beginning of January. This followed a 3% award from January 2011, which had been negotiated down from the 5% increase in RPI that was contained in the previous agreement.

All other trades rates remain frozen at this point in time. Plumbers in Scotland and Northern Ireland were expecting revised wages from 4 June but the parties have failed to reach agreement and the rates of wages and allowances that have been in place since June 2011 are continuing until further notice.

��ɫ����TV and civil engineering operatives under the Construction Industry Joint Council received a 1.5% wage award last September. Any further increase from their normal anniversary date of the end of June looks unlikely to be achieved but talks have begun.

Operatives employed under the BATJIC agreement are in a similar position. Their normal anniversary date of June was revised to September in 2010 and 2011 and talks have not yet begun for any 2012 revision.

Rates of pay for electricians (last revised January 2010) and heating and ventilating operatives (October 2010) remain frozen.

Wages are also frozen at January 2011 rates for operatives under the National Joint Council for the Engineering Industry, such as steel erectors, although some increases have been agreed on accommodation and travelling allowances. Discussions are already under way regarding a 2013 wage review.

Please see attached for PDF showing wage rates and agreements

Downloads

Wage agreements

PDF, Size 0 kb

No comments yet